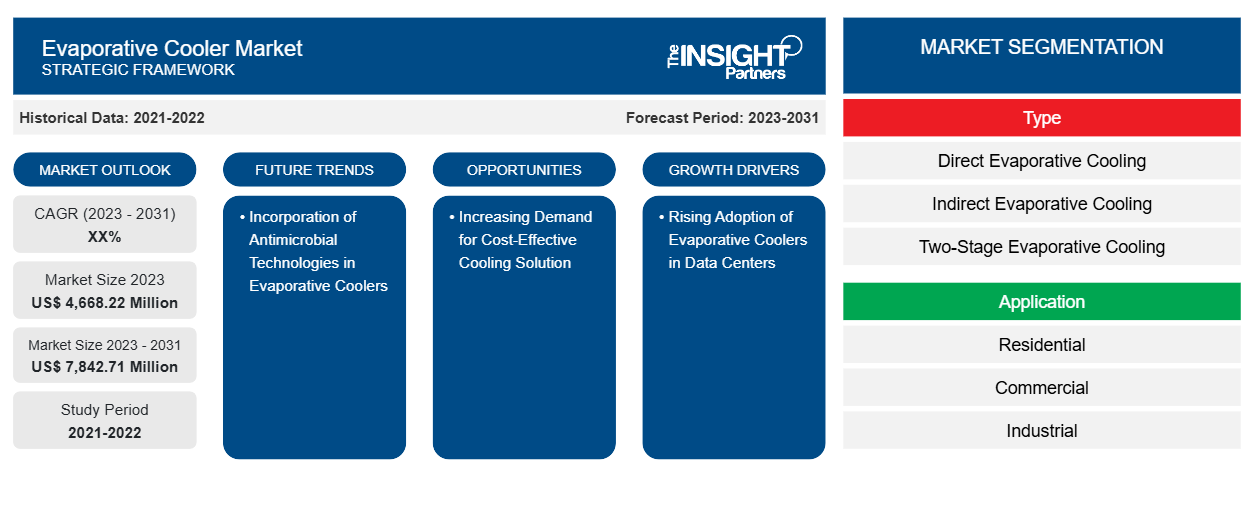

Evaporative Cooler Market Growth and Forecast by 2031

Evaporative Cooler Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Direct Evaporative Cooling, Indirect Evaporative Cooling, and Two-Stage Evaporative Cooling) and Application (Residential, Commercial, Industrial, and Confinement Farming), and Geography

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2023-2031- Report Date : Apr 2026

- Report Code : TIPRE00029819

- Category : Manufacturing and Construction

- Status : Data Released

- Available Report Formats :

- No. of Pages : 150

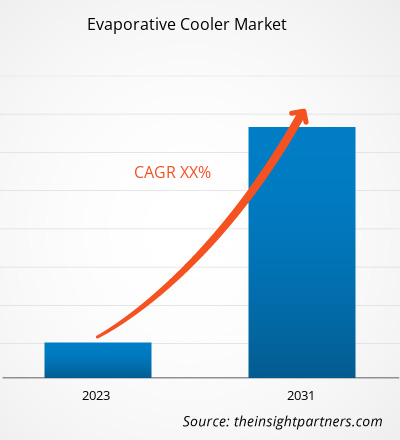

The evaporative cooler market size is projected to reach US$ 7,842.71 million by 2031 from US$ 4,668.22 million in 2023. Evaporative coolers are one of the most cost-effective and energy-efficient area cooling solutions. Hence, their adoption at data centers is increasing tremendously. For instance, in September 2021, Huawei launched an Indirect Evaporative Cooling solution at HUAWEI CONNECT 2021. The company developed this next-generation solution to upgrade air handling units (AHU) to environment handling units (EHU), which can further help reduce data center power usage effectiveness (PUE) and embrace carbon neutrality. Moreover, as evaporative coolers are the most viable and economical, their demand in the residential sector is increasing. Various market players are developing advanced evaporative coolers to cater to the rising residential demand.

Evaporative Cooler Market Analysis

The key stakeholder in the evaporative cooler market includes component & raw material supplier, evaporative cooler manufacturers, indirect customers, and direct customers. In recent years, the demand for evaporative coolers has been proliferating due to the rising global temperature and growing focus on energy conservation. The component & raw material suppliers offer various different materials for the manufacture of evaporative coolers. Raw materials include metal sheets, coatings, electronic components, fans, and copper wires among others.

Symphony, Munters, Baltimore Aircoil, and CoolBoss are some of the most prominent evaporative cooler manufacturers around the globe. Players from Asia Pacific and North America have been dominating the market, while European manufacturers are gaining traction fast. The evaporative cooler manufacturers primarily sell their products to two types of customers – direct customers and indirect customers. Indirect customers include dealers, sales agencies, wholesalers, and volume retailers who purchase the evaporative coolers from the manufacturer and supplies to individual, commercial establishments, and industries. When the latter is supplied by the manufacturer directly, they become direct customers of the manufacturers.

Evaporative Cooler Market Overview

An evaporative cooler is a type of air conditioner that harnesses the power of evaporation to cool air temperature. It generally consists of a fan, a water reservoir, a heat exchange material/thick pads, a pump for water distribution, and additional controls for fine-tuning. The evaporative cooler works by cooling the air through evaporating water; this process is called adiabatic cooling. The direct-type coolers contain a fan that draws warm outside air into the unit and cools it by passing it over water-soaked pads, which causes the water to evaporate. The evaporative cooler can bring down the air temperature by 15°F to 40°F of the space to be cooled. Some air coolers also have different parts, such as air filters and pads, which can improve air quality by minimizing mildew growth and reducing allergens.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONEvaporative Cooler Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Evaporative Cooler Market Drivers and Opportunities

Rising Adoption of Evaporative Coolers in Data Centers

Earlier, data centers were constructed in cooler environmental regions. However, with the rising need to reduce latency and construct the data center infrastructure closer to the customers, the demand for data centers in Southeast Asian countries is increasing significantly. In Southeast Asia, Singapore is considered a hotbed for global data center construction because of its robust infrastructure, stable internet connectivity, and talented workforce. The rising demand for data centers in the country is pushing them to build a Green Data Centre Technology Roadmap. Through this, the country is taking the initiative for a more sustainable data center industry. This plan covers both physical IT and software, and it will help reduce carbon emissions that are caused due to data centers. The evaporative cooling technologies that can be used by the country are passive cooling, direct liquid cooling, and free cooling.

Moreover, the adoption of liquid cooling systems for data centers is increasing in the US. According to the survey done by Informa Engage in association with Dell Technologies, in 2020, ~37% of respondents already adopted evaporative cooling over conventional computer room air conditioner (CRAC)/computer room air handler (CRAH), an increase of 6% from 2017. Amazon Web Services, in its efforts to build a sustainable business, have been deploying direct evaporative cooling across several of its data centers during summer times since past 5 years. Therefore, the growing adoption of evaporative coolers for data centers globally is fueling the growth of the evaporative cooler market.

Increasing Demand for Cost-Effective Cooling Solution

Evaporative coolers use less energy which makes them a more affordable cooling solution. Also, evaporative coolers consist of fewer parts when compared with air conditioning systems, which include a fan, pump, and water. This lowers the ownership costs of the evaporative cooling systems, making them a more cost-effective solution.

According to the Canstar Blue report, the average reverse cycle split system air conditioner costs ~US$ 0.60 per hour, whereas an evaporative cooling system cost around US$ 0.10 per hour and another US$ 0.02 for water. It is also seen that ducted evaporative cooling, which is powered by inverter technology, has an annual running cost of US$ 65. In addition, ducted refrigerated air conditioning, with a 3.5-star energy rating, has annual costs of US$ 150. This price can further rise if the refrigerant ducted system is used for more than one room. Moreover, evaporative coolers only use water and no artificial refrigerants, because of which they do not exhaust the ozone layer. Thus, the evaporative cooler will help save up to 55% on energy costs and ~70 % on running costs compared to the refrigerated air conditioner. In addition, it is also seen that in Europe, due to the Russia-Ukraine conflict, the energy cost has increased tremendously. The people in the region are moving toward more energy-efficient and cost-efficient solutions. This will further create an opportunity for the growth of the evaporative cooler market.

Evaporative Cooler Market Report Segmentation Analysis

Key segments that contributed to the derivation of the evaporative cooler market analysis are type, and application.

- By type, the evaporative cooler market is segmented into direct evaporative cooling, indirect evaporative cooling, and two-stage evaporative cooling. The direct evaporative cooling segment accounted for a larger market share in 2023.

- By application, the evaporative cooler market is segmented into residential, commercial, industrial, and confinement farming. The residential segment accounted for a larger market share in 2023.

Evaporative Cooler Market Share Analysis by Geography

The global evaporative cooler market is broadly segmented into North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and South America (SAM). The evaporative cooler market in North America is segmented into the US, Canada, and Mexico. Global warming has resulted in a rise in temperature across North American countries, which is creating a demand for eco-friendly cooling solutions. As refrigerant air cooler is one of the causes of increasing global warming, people are adopting evaporative coolers as an eco-friendly alternative.

In addition, the increasing construction activities, such as building residential and commercial spaces, are creating the demand for evaporative coolers across North America. Also, these coolers provide eco-friendly cooling, which is increasing its demand in North America. The number of single-family homes and privately‐owned housing under construction increased to the highest level in North America since 2010. According to the US Census Bureau and the US Department of Housing and Urban Development's new residential construction statistics, privately‐owned housing completions recorded an annual rate of 1,309,000 in February 2022, an increase of 5.9% from the January estimate of 1,236,000. Furthermore, in February 2022, single‐family housing completions recorded a rate of 1,034,000; 12.1% higher than that of January 2022 at 922,000. Similarly, according to Jonas Construction Software Inc, the construction sector in Canada is expected to be worth more than US $ 430 billion and is expected to grow at 8.5% by 2024. Thus, the growing residential construction activities in the region are expected to fuel the evaporative cooler market growth during the forecast period.

Evaporative Cooler Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 4,668.22 Million |

| Market Size by 2031 | US$ 7,842.71 Million |

| Global CAGR (2023 - 2031) | XX% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Evaporative Cooler Market Players Density: Understanding Its Impact on Business Dynamics

The Evaporative Cooler Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Evaporative Cooler Market News and Recent Developments

The evaporative cooler market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for innovations, business expansion, and strategies:

- In February 2022, Baltimore Aircoil Co TrilliumSeries Cooler is that it captures and reuses water, unlike once-through systems, and is optimized for adiabatic operation, a form of heat rejection that is more efficient than dry coolers and uses less water than evaporative cooling. This cooler can operate at a high dry switch point and offers up to 20% energy savings versus alternatives in the marketplace, thanks to its smart water management system comprised of high-efficiency pre-cooler pads, a dual pump recirculating system, and intelligent controls. (Source: Baltimore Aircoil Co, Press Release)

- In June 2022, New Cool Boss features a micro-computer programmed control panel with LCD and remote control. A built-in timer allows the unit to be programmed to turn on or off at pre-selected times. One large 30-inch diameter fan operates at three selectable speeds, and a thick cooling pad ensures even water distribution and reliable heat absorption. (Source: New Cool Boss, Press Release)

Evaporative Cooler Market Report Coverage and Deliverables

The “Evaporative Cooler Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering the following areas:

- Evaporative cooler market size and forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities

Evaporative cooler market trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

Evaporative cooler market analysis covering key market trends, Global and regional framework, major players, regulations, and recent market developments

- Evaporative cooler market landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments.

- Detailed company profiles

Nivedita is an accomplished research professional with over 9 years of experience in Market Research and Business Consulting. Currently serving as a Project Manager in the ICT domain at The Insight Partners, she brings deep expertise in managing and executing Syndicated, Custom, Subscription-based, and Consulting research assignments across diverse technology sectors.

With a proven track record of delivering data-driven analysis and actionable insights, Nivedita has been a key contributor to several critical projects. Her work involves end-to-end project execution—right from understanding client objectives, analyzing market trends, to deriving strategic recommendations. She has collaborated extensively with leading ICT companies, helping them identify market opportunities and navigate industry shifts.

Nivedita holds an MBA in Management from IMS, Dehradun. Prior to joining The Insight Partners, she gained valuable experience at MarketsandMarkets and Future Market Insights in Pune, where she held various research roles and built a strong foundation in industry analysis and client engagement.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For