FGD Gypsum Market Key Players and Opportunities by 2030

FGD Gypsum Market Forecast to 2030 - Industry Analysis by Application (Wallboard/Drywall, Cement, Agriculture, Water Treatment, and Others)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Code : TIPRE00029985

- Category : Chemicals and Materials

- No. of Pages : 153

- Available Report Formats :

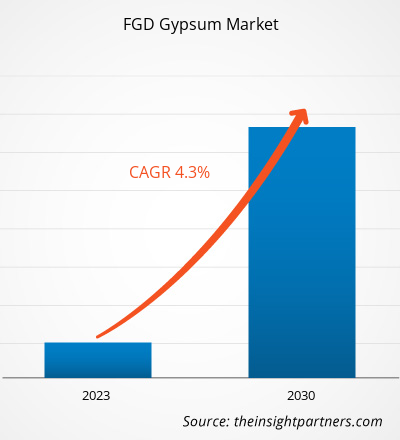

[Research Report] The FGD gypsum market size is expected to grow from US$ 2,298.56 million in 2022 to US$ 3,207.00 million by 2030; it is estimated to register a CAGR of 4.3% from 2022 to 2030.

Market Insights and Analyst View:

FGD gypsum is a by-product generated from the fuel gas desulfurization (FGD) process in coal-fired power plants. This process is used to remove sulfur dioxide (SO2) emission from the fuel gases to comply with environmental regulations. FGD gypsum is a valuable material as it can be used as a substitute for natural gypsum in various applications. The construction sector, in particular, is a major consumer of FGD gypsum as it is used in plasterboard and cement production. Stringent environment regulations and emission standards have led power plants to adopt FGD systems, resulting in a higher FGD gypsum production.

Growth Drivers and Challenges:

Gypsum is used in the construction industry as a filler for cement and plasters to increase their strength while reducing the setting time of concrete. FGD gypsum, a synthetic gypsum, is highly preferred due to its lower life cycle impact compared to natural gypsum. It is also used to make decorative panels, drywall panels, wallboard, and gypsum board. The rising demand for these panels in the construction industry bolsters the demand for gypsum. Furthermore, a gypsum board, also known as a drywall panel, is preferred over plaster since it is easier to install and repair, less expensive, and more durable. It takes less time to mount and is also widely available. Fire-resistant properties and feasibility of utilization are common factors increasing the use of gypsum in residential and nonresidential construction activities. Gypsum boards are widely used as a substitute for wooden panels and concrete walls in modern buildings and interiors, as they can be installed easily and quickly. However, natural gypsum and synthetic gypsum such as citrogypsum, fluorogypsum, phosphogypsum, and titanogypsum are alternative materials to FGD gypsum. The cost-effectiveness of natural gypsum due to high production in the largest gypsum-producing regions can negatively impact the preference for FGD gypsum for drywall applications. This factor reduces FGD gypsum consumption.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONFGD Gypsum Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “Global FGD Gypsum Market” is segmented on the basis of application. Based on application, the market is segmented into wallboard/drywall, cement, agriculture, water treatment, and others. The FGD gypsum market, by geography, is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America)

Segmental Analysis:

Based on application, the FGD gypsum market is segmented into wallboard/drywall, cement, agriculture, water treatment, and others. The wallboard/drywall segment held the largest share in 2022. Wallboard or drywall is a building material used as an alternative to conventional brick/stone walls. FGD gypsum is widely used in the form of wallboards and drywalls in the construction industry. It is used as a core ingredient for gypsum-based drywall panels. The core of drywall provides structural strength, whereas it is also lightweight. FGD gypsum contains trace amount of calcium sulfate hemihydrate, which contributes to the fire-retardant properties. FGD gypsum is known for consistent quality and purity, which is advantageous for drywall manufacturing. Wallboard and drywall manufacturers have increased the utilization of synthetic gypsum such as FGD gypsum as an effective alternative to natural gypsum. All these factors are boosting the global FGD gypsum market.

Regional Analysis:

Based on geography, the FGD gypsum market is segmented into five key regions—North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. Asia Pacific dominated the global FGD gypsum market, and the regional market accounted for over US$ 1.3 billion in 2022. Asia Pacific is a major contributor to the global market. South & Central America is expected to register the highest CAGR of over 7% during the forecast period. The FGD gypsum market in South & Central America is segmented into Brazil, Argentina, and the Rest of South & Central America. One of the major factors bolstering the market growth in this region is the increasing construction activities. According to the US and the Brazilian Green Building Councils, Brazil accounted for more than 1.2 million square meters of certified buildings, thereby ranking seventh in Leadership in Energy and Environmental Design (LEED) registrations worldwide in 2021. According to the International Trade Administration, the Argentine government focuses on infrastructure projects in the range of US$ 20 million. Thus, the increase in construction activities is expected to boost the FGD gypsum market expansion in the coming years. North America is also expected to witness considerable growth, reaching over US$ 500 million by 2030.

Industry Developments and Future Opportunities:

Various initiatives taken by the key players operating in the FGD gypsum market are listed below:

- In 2022, Georgia-Pacific LLC invested ∼ US $300 million in the gypsum wallboard facility in Sweetwater East, Texas. The company aimed to strengthen its capacity to meet the growing needs of the residential, commercial, and industrial construction sectors in Texas.

- In 2022, Adaptavate Ltd launched drywall made from agricultural waste and a lime-based binding agent that absorbs carbon dioxide. The approach eliminated the need for gypsum, an emissions-intensive material. The company raised US$ $2.9 million for the development of a pilot line in Bristol, England, aimed to produce these industry-standard plasterboards.

FGD Gypsum Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2.3 Billion |

| Market Size by 2030 | US$ 3.21 Billion |

| Global CAGR (2022 - 2030) | 4.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Application

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

FGD Gypsum Market Players Density: Understanding Its Impact on Business Dynamics

The FGD Gypsum Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

COVID-19 Impact:

The COVID-19 pandemic adversely affected almost all industries in various countries. Lockdowns, travel restrictions, and business shutdowns in North America, Europe, Asia Pacific (APAC), South & Central America (SAM), and the Middle East & Africa (MEA) hampered the growth of several industries, including the chemicals & materials industry. The shutdown of manufacturing units disturbed global supply chains, manufacturing activities, delivery schedules, and essential and nonessential product sales. Various companies reported delays in product deliveries and a slump in their product sales in 2020. Due to the pandemic-induced economic recession, consumers became cautious and selective in purchasing decisions. Nonessential purchases were significantly reduced by consumers due to lower incomes and uncertain earning prospects, especially in developing regions. Many manufacturers of FGD gypsum reported decline in profits due to reduced consumer demand during the initial phase of the pandemic. However, by the end of 2021, many countries were fully vaccinated, and governments announced relaxation in certain regulations such as lockdowns and travel bans. People started to travel to different places, which increased the demand for FGD gypsum. All these factors had a positive impact on the growth of the FGD gypsum market across different regions.

Competitive Landscape and Key Companies:

Georgia-Pacific LLC, Cez Energeticke Produkty SRO, EP Power Minerals GmbH, CASEA GmbH, Holcim Ltd, Knauf Gips KG, Travancore Titanium Products Ltd, Compagnie de Saint-Gobain SA, American Gypsum Co LLC, and National Gypsum Co are among the prominent players operating in the global FGD gypsum market. The players offer high-quality FGD gypsum and cater to many consumers in the global market.

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For