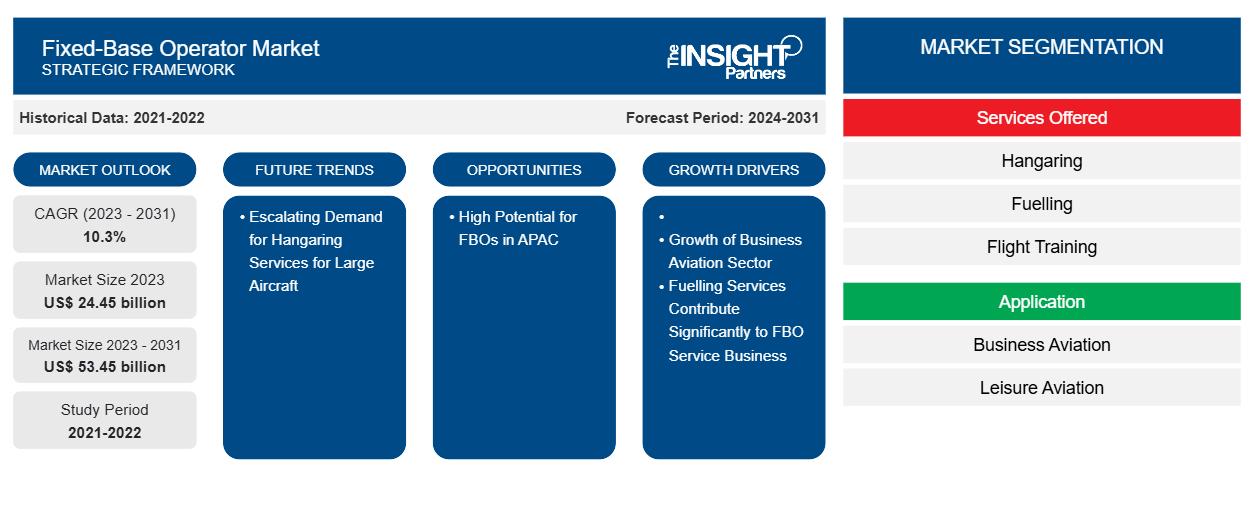

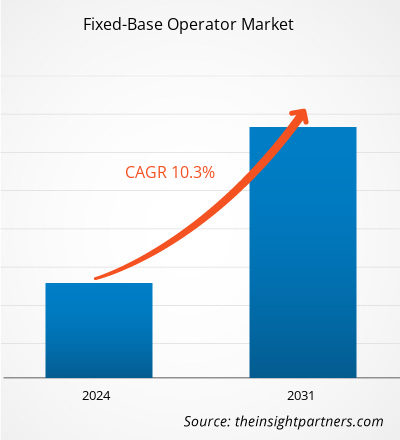

The fixed-base operator market size is projected to reach US$ 41.49 billion by 2031 from US$ 25.55 billion in 2024. The market is expected to register a CAGR of 7.6% during 2025–2031. The soaring demand for hangaring services for large aircraft is likely to bring new trends in the market in the coming years.

Fixed-Base Operator Market Analysis

The increase in business aviation and leisure aviation is supporting the demand for FBOs to offer various services to travelers and enhance their traveling experience. The ongoing decline in the global aviation market because of the pandemic has led many FBOs to reduce their costs and lay off workers. In order to sustain through the pandemic, the FBO service providers have implemented initiatives including business expansion and partnering with other FBOs or ground handling companies. Such initiatives facilitate market players to continue their business. The growth in the number of airports across different regions is adding up new flight routes worldwide, leading to an increase in demand for new FBO operators across the new airports. The construction of new Greenfield airports is expected to propel the demand for new FBO operators across different regions. Also, the ongoing construction of Cukurova Airport in Turkey is expected to generate new opportunities for FBO market vendors during the forecast period.

Some of the major factors driving the growth of the FBO market worldwide are growing worldwide commercial aircraft fleet, rising air passenger traffic, and increasing number of airports worldwide. According to the Insight Partners analysis, the global commercial aircraft fleet stood at around 29,000 aircraft in January 2025, which is likely to reach around 38,300 aircraft by the end of 2035. Similarly, the global air passenger traffic stood at around 9.5 billion passengers in 2024, witnessing an increase of around 10% compared to the global air passenger traffic of 2023. Moreover, the air passenger traffic of 2024 was equivalent to 104% of the 2019 levels which shows a full recovery of pre-pandemic levels as well.

Fixed-Base Operator Market Overview

The global aviation industry is witnessing a sharp rise in the demand for hangaring services for large aircraft, driven by expanding fleet sizes, increased private jet ownership, and growing reliance on business aviation. The general aviation aircraft OEMs are developing new-generation aircraft with reduced fuel consumption, large size, and low noise and carbon emissions. The design of aircraft hangars is accordingly upgraded to suit the changing aircraft sizes and technologies. Modern aircraft hangars are being equipped with temperature control and security devices.

The Asia-Pacific (APAC) region is experiencing substantial growth in aircraft hangar infrastructure and Fixed Base Operator (FBO) services, supported by the expansion of commercial and private aviation. In 2024, Asia Digital Engineering (ADE), a subsidiary of Capital A, inaugurated a 380,000 square foot L-shaped maintenance hangar at Kuala Lumpur International Airport in Malaysia. The facility is designed to accommodate 14 narrow-body aircraft simultaneously, making it the largest aircraft maintenance hangar in Malaysia. ADE has announced plans for further development, including the construction of additional hangars in the vicinity and the evaluation of potential new sites to address increasing maintenance needs. Further, significant hangar infrastructure projects are underway or planned in cities such as Shanghai (China), Bali (Indonesia), and Sydney (Australia), highlighting continued investment in aviation support facilities across Asia Pacific.

The ban on Russian flights from European countries' airspace and vice-versa due to the ongoing war between Russia and Ukraine has reduced airline operations across the Russian airspace and other countries across Europe. This reduction is leading to a decline in the demand for FBO services and hampering the market growth across the region. Other regions have also been facing several geopolitical tensions, which is hampering aviation operations worldwide. For instance, the rift between China-Taiwan, India-Pakistan, China-India, India-Bangladesh, and Israel-Gaza has been acting as one of the major challenges for aviation operations worldwide.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Fixed-Base Operator Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Fixed-Base Operator Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Fixed-Base Operator Market Drivers and Opportunities

Expansion of Business Aviation Sector

Fixed-base operators (FBO) play a crucial role in handling aircraft and passengers, offering services such as fueling, maintenance, and flight planning. They are a vital part of the business aviation sector, providing essential ground services to private, corporate, and charter aviation. With the growth of the business aviation sector, FBOs are investing in technology and improving infrastructure to meet the evolving needs of the industry. A rising number of high-net-worth individuals, business leaders, and entrepreneurs across countries in North America, Europe, and Asia Pacific increasingly seek flexible and time-saving business aviation services. FBOs provide a seamless and efficient experience for business aviation users, allowing them to focus on their business goals. Private aviation offers quicker travel between cities, direct flights to smaller airports closer to destinations, and avoids commercial airline delays, saving hours on trips. It also permits flexible schedules to make the most of the time. As per the data published by the General Aviation Manufacturers Association (GAMA) in 2023, the business jet deliveries increased from 712 in 2022 to 730 in 2023. Further, the overall value of airplane deliveries in 2023 reached US$ 23.4 billion. Thus, the expansion of the business aviation sector due to the increasing demand for business jets bolsters the market growth.

High Potential for FBOs in Asia Pacific

Asia Pacific (APAC) presents a high growth opportunity for FBOs owing to flourishing business aviation and improving aviation infrastructure in the region. FBOs are witnessing significant momentum in Indonesia, Singapore, and Macau to address the increasing need for premium ground services. Currently, there are a total of 71 FBOs operating in APAC countries; of these, more than 20 are operating in Australia, whereas Mainland China has 15 FBOs. This number is anticipated to grow as high-net-worth individuals and corporations across APAC countries turn to private aviation for greater flexibility, efficiency, and connectivity. Thus, the need for premium ground services is becoming increasingly evident, leading to increased demand for fixed-base operators. Many new airports and upgrades to secondary airports to accommodate general aviation create opportunities for both international and local FBO operators to enter or expand in the market. As per the data published by the Association of Asia Pacific Airlines in February 2025, the region has witnessed strong growth in the international air passenger and cargo market. Asia Pacific Airlines carried ~365.0 million international passengers in 2024, a 30.5% rise from 2023. As per the data published by Airbus in 2024, Asia Pacific is expected to add approximately 10,000 new aircraft between 2024 and 2043. Therefore, increased airline traffic in APAC is likely to generate lucrative opportunities for the market.

Fixed-Base Operator Market Report Segmentation Analysis

The key segments contributing to the derivation of the fixed-base operator market analysis are services offered and application. Based on services offered, the fixed-base operator market is segmented into hangaring, fueling, flight instruction, aircraft maintenance, and aircraft rental. The fuelling segment held the largest market share in 2024. By application, the fixed-base operator market is segmented into business aviation and leisure aviation. The business aviation segment held a larger market share in 2024.

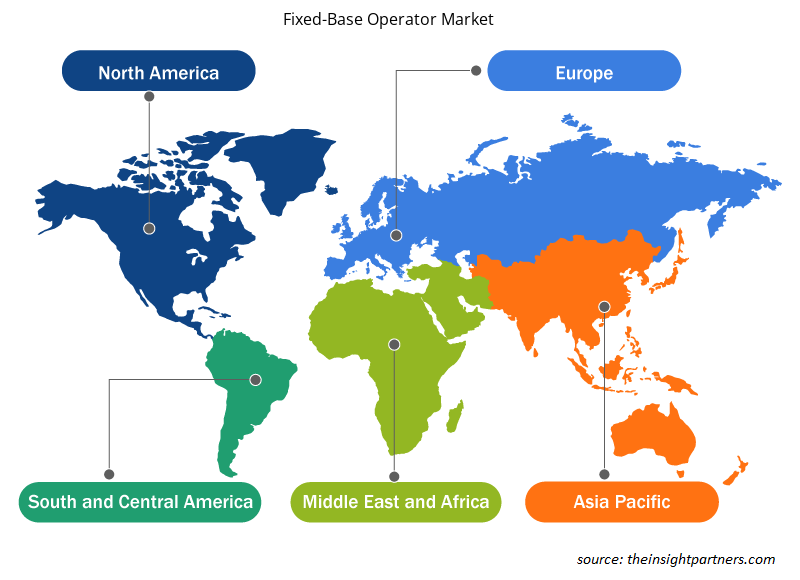

Fixed-Base Operator Market Share Analysis by Geography

The geographical scope of the fixed-base operator market report is divided into five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America accounted for the largest market share of 35.1% in 2024 and is projected to register a CAGR of 6.9% during the forecast period. High demand among customers and the widespread presence of fixed-base operator service providers in North America, especially in the US, boost the growth of the fixed-base operator market. APAC is projected to showcase tremendous demand for FBOs in the upcoming years, thus registering the highest CAGR during the forecast period; this is due to the significant growth in the general aviation segment, particularly in Australia, China, and Southeast Asian countries.

North America comprises the largest network of fixed-base operators worldwide. In recent years, there has been consistent growth in corporate flying and charter activity in the region, which is creating demand for general aviation services such as fixed-base operator services. Additionally, the US and Canada houses a number of general aviation airports, which enables a higher number of FBOs to operate across these countries. For instance, Teterboro Airport, Centennial Airport, and Van Nuys Airports are key airports with high concentration of FBOs. Also, the US consists of globally recognized FBOs such as Signature Aviation, Universal Aviation, Presidential Aviation, and Pentastar Aviation. The global recognition of these companies enables them to attract customers from different nations, thereby catalyzing their revenues year-on-year.

According to data released by Airlines for America, in 2023, commercial aviation accounted for 5% of the US GDP, i.e., US$ 1.37 trillion. In addition, the rising air passenger traffic and government initiatives to increase aircraft fleets in commercial aviation sectors fuel the demand for flight management solutions such as flight planning software.

Europe holds the second-largest share in the global fixed-base operator market. The presence of top players, such as Gama Aviation Plc., Lufthansa Technik FBO, and Luxaviation, is a key factor driving the market growth in Europe. Further, the constant growth of general aviation in the region is increasing the traveler's footprint on business jets/private jets for enhanced travel experience. General aviation comprises aircraft ranging from gliders to complex business jets with a complete range of high-value services, such as FBOs and business door-to-door transportation. The trends in Europe are shifting toward the need to carry out innovation and research to reduce environmental impacts.

In APAC, the fixed-base operator market is dominated by Australia and countries in Southeast Asia. By 2039, the Sydney airport is expected to manage more than 65 million passengers—over 408,000 airport movements—and 1 million tons of freight in the year. The government allocated US$ 8.4 billion from 2022 to 2026 for the development of Western Sydney Airport. Sustainability remains a focal point, with airports incorporating eco-friendly practices and renewable energy sources into their infrastructure. The rising demand for business aviation, along with increasing disposable income, is creating growth avenues for the companies operating in the market in these countries. In Southeast Asia, there is a strong presence of fixed-base operator networks, and demand for business and leisure aviation is also high in countries such as Singapore, Indonesia, the Philippines, and Malaysia. With the growing demand for business aviation services for enhanced travel experience in these countries, the adoption of FBOs is increasing. In Asia Pacific, the market growth has been primarily attributed to the rise in the expansion of aircraft fleets and airport infrastructure development. The International Air Transport Association predicted that 2.1 billion travelers are likely to travel by 2036, particularly in China. The increasing number of passengers is expected to fuel the demand for fixed-base operator services. This factor is expected to create growth opportunities for the key players operating in the market during the forecast period.

Fixed-Base Operator Market Regional Insights

The regional trends and factors influencing the Fixed-Base Operator Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Fixed-Base Operator Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Fixed-Base Operator Market

Fixed-Base Operator Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 25.55 Billion |

| Market Size by 2031 | US$ 41.49 Billion |

| Global CAGR (2025 - 2031) | 7.6% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Services Offered

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Fixed-Base Operator Market Players Density: Understanding Its Impact on Business Dynamics

The Fixed-Base Operator Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Fixed-Base Operator Market are:

- Avemex SA De CV

- DEER JET CO. LTD.

- dnata

- General Dynamics Corp

- Jetex

- Luxaviation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Fixed-Base Operator Market top key players overview

Fixed-Base Operator Market News and Recent Developments

The fixed-base operator market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the fixed-base operator market are listed below:

- Atlantic Aviation announced it had acquired Ferrovial Vertiports from Ferrovial, a leading global infrastructure company. (Atlantic Aviation, Press Release, 2025)

- The Air Charter Safety Foundation (ACSF) is proud to announce that Avemex S.A. de C.V. has successfully renewed its Industry Audit Standard (IAS) registration, solidifying its commitment to the highest level of safety in aviation. (The Air Charter Safety Foundation, Press Release, 2024)

Fixed-Base Operator Market Report Coverage and Deliverables

The "Fixed-Base Operator Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Fixed-base operator market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Fixed-base operator market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter’s Five Forces and SWOT analysis

- Fixed-base operator market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, market share analysis of prominent players, and recent developments for the fixed-base operator market

- Detailed company profiles

Frequently Asked Questions

What are the future trends of the fixed-base operator market?

1. Soaring Demand for Hangaring Services for Large Aircraft

2. Adoption of Advanced Technologies in Aviation Industry

What are the driving factors impacting the fixed-base operator market?

1. Expansion of Business Aviation Sector

2. Contribution of Fuelling Services to FBO Service Business

Which are the leading players operating in the fixed-base operator market?

The key players operating in the fixed-base operator market include Avemex SA De CV; DEER JET CO. LTD.; dnata; General Dynamics Corp; Jetex; Luxaviation; Signature Aviation Limited; Swissport; Abilene Aero, ExecuJet; Atlantic Aviation FBO Inc.; ExecuJet Aviation Group AG; and Universal Weather and Aviation, Inc.

What will the fixed-base operator market size be by 2031?

The fixed-base operator market is expected to reach US$ 41,494.15 million by 2031.

What is the estimated global market size for the fixed-base operator market in 2024?

The fixed-base operator market was valued at US$ 25,552.94 million in 2024; it is expected to register a CAGR of 7.6 % during 2025–2031.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Aircraft MRO Market

- Helicopter Hoists Winches and Hooks Market

- Aerospace Fasteners Market

- Aerospace Stainless Steel And Superalloy Fasteners Market

- Aircraft Floor Panel Market

- Military Optronics Surveillance and Sighting Systems Market

- Smoke Grenade Market

- Airport Runway FOD Detection Systems Market

- Artillery Systems Market

- Aircraft Brackets Market

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Fixed-Base Operator Market

- Avemex SA De CV

- DEER JET CO. LTD.

- Dnata

- General Dynamics Corp

- Jetex

- Luxaviation

- Signature Aviation Limited

- Swissport AG

- Abilene Aero

- Atlantic Aviation FBO Inc.

- ExecuJet Aviation Group AG

- Universal Weather and Aviation, Inc.

Get Free Sample For

Get Free Sample For