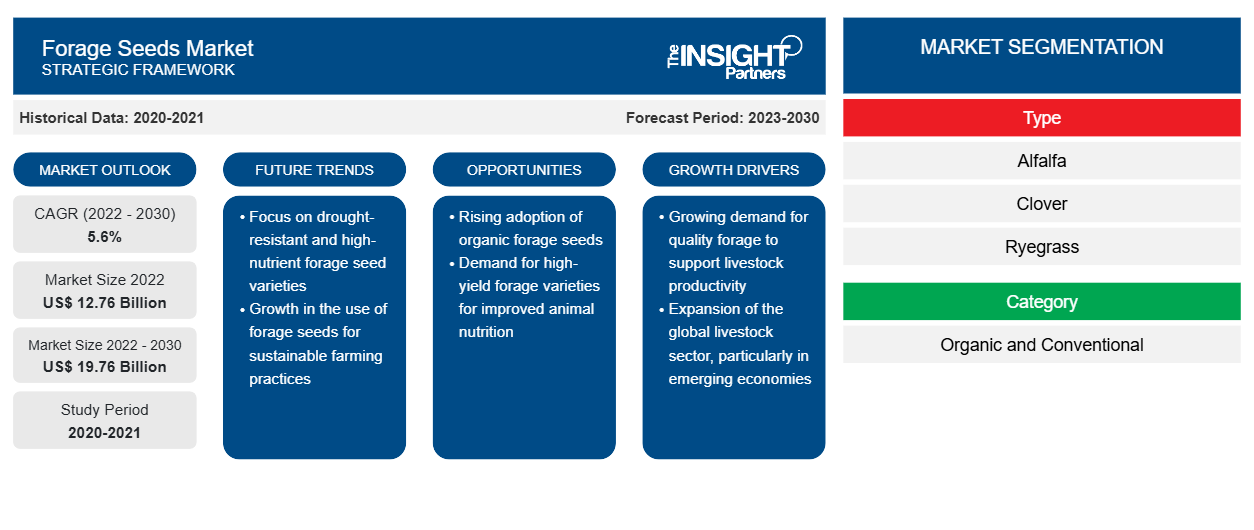

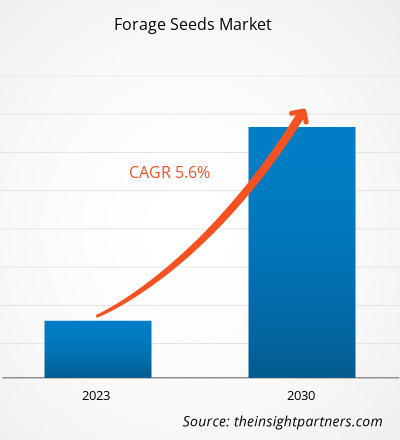

[Research Report] The market is expected to grow from US$ 12,757.00 million in 2022 to US$ 19,755.46 million by 2030; it is expected to record a CAGR of 5.6% from 2022 to 2030.

Market Insights and Analyst View:

Conventional feed often contains high amounts of chemicals that hamper meat quality when consumed by animals. In the long term, the consumption of such meat results in various health disorders. To overcome this issue, manufacturers are developing organic feed that contains no chemical additives. Animals feeding on such feed offer meat that has high nutritional value. Thus, consumers often find organic and natural products as healthier alternatives to conventional products. Consumers are mainly inclined toward organic products, which has encouraged manufacturers to invest heavily in products produced with organic constituents. Furthermore, the more accessible access to infinite information with the help of the internet has made consumers increasingly aware of their health needs, leading to the increasing demand for organic feed. Thus, a rising preference for organic feed is expected to become a significant trend in the forage seeds market during the forecast period.

Growth Drivers and Challenges:

Technological improvements in seed genetics offer an opportunity for the global forage seeds market growth. The seed manufacturers have developed different varieties or traits of seeds, such as hybrid, GMO, non-GMO, and organic seeds, with technological developments. The farmer's preference for these transgenic varieties is slowly rising in various forage-growing regions to minimize crop losses by weeds and diseases and enhance the quality of seeds. The hybrid seeds are developed by the special, carefully controlled cross-pollination of two different parent plants of the same species to produce new traits that cannot be created by the inbreeding of two of the same plants. Usually, the hybrid seeds are cross-pollinated by hand.

GMO seeds are produced by genetic engineering, altering the genetic material of an organism. GMO seeds are grown in the laboratory using modern biotechnology techniques. On the other hand, non-GMO seeds are grown by pollination. Organic seeds are considered as non-GMO seeds. Organic seeds are produced naturally without the aid of pesticides, fertilizers, or any other chemical substance. These seeds are disease-resilient and have enhanced capabilities to thrive in adverse conditions.

These breeding techniques allow the development of new seed varieties with desired traits by modifying the DNA of the seeds and plant cells. These technological improvements are helping address the challenges farmers face during the cultivation of forage seeds. Thus, the constant technological improvements are expected to create lucrative opportunities in the forage seeds market in the coming years.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Forage Seeds Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Forage Seeds Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The "Global Forage Seeds Market" is segmented on the basis of type, category, livestock, and geography. Based on type, the forage seeds market is segmented into [alfalfa, clover (white, red, hybrid, and others), ryegrass (annual ryegrass, perennial ryegrass, Italian ryegrass, and hybrid ryegrass), timothy, sorghum, brome, birdsfoot trefoil, cowpea, meadow fescue, and others]. Based on category, the market is segmented into organic and conventional. Based on livestock, the forage seeds market is segmented into ruminants, poultry, swine, and others. The forage seeds market, based on geography, is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Chile, and the Rest of South & Central America).

Segmental Analysis:

Based on livestock, the forage seeds market is segmented into ruminants, poultry, swine, and others. The ruminant segment held the largest share of the forage seeds market in 2022 and is expected to register a significant growth rate during the forecast period. Ruminants include cattle, sheep, goats, and buffalo. Forage is the primary source of protein, fiber, and energy for ruminants. Leguminous forages such as alfalfa and clover provide 75% of the crude protein to ruminants. Forage grasses provide high amounts of fiber to the ruminants. Forage also reduces the overall cost of rumen feed. Therefore, livestock breeders usually use forage along with animal feeds. The rising awareness of specific nutrition for ruminants, especially dairy cows, goats and sheep, and beef cattle, is driving the demand for forage, thereby propelling the growth of the forage seeds market.

Regional Analysis:

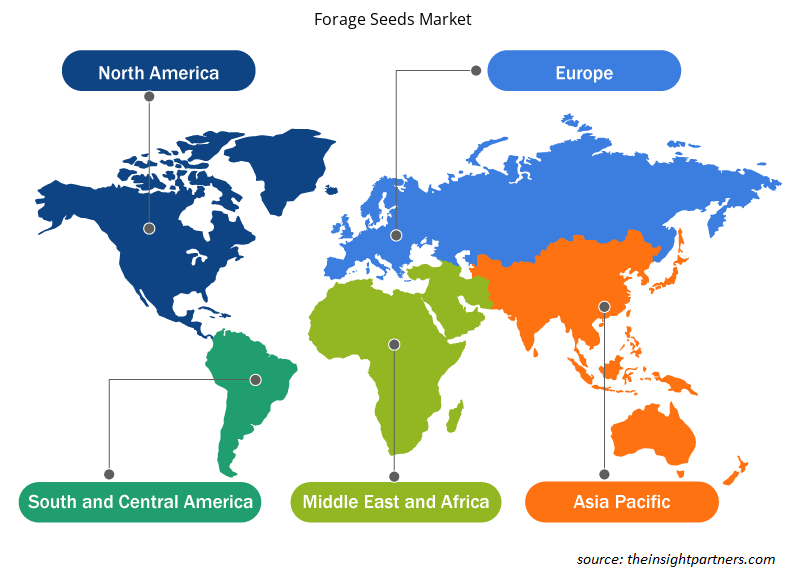

Based on geography, the forage seeds market is segmented into five key regions—North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. The global forage seeds market was dominated by North America and was estimated to be ~US$ 5,000 million in 2022. North America is one of the significant markets for forage seeds due to the increased demand for forage as feed, meat consumption, and weather conditions, as well as rising consumption of livestock products despite the rising prices, well-established animal feed, and agriculture industry. An increasing number of individuals opting for protein-rich and healthier products, growing disposable income, lifestyle changes, and eating patterns contribute to a surge in demand for protein-rich meat in the US, Canada, and Mexico. Thus, with the rising consumption of meat products, the demand for animal feed increases and further drives the market for forage seeds. The region accounts for one of the largest animal feed producers across the region. As per the report of Alltech Global, in 2020, the region produced more than 254 million metric ton of animal feed products. The mass production of animal feed in North America and the rising food safety concerns, especially about meat and dairy products, have led to the increased consumption of nutritional animal feed such as forages in the region.

The significant rise in cattle farming in North America is also expected to drive the demand for animal feed, such as forages, during the forecast period. For instance, according to the Foothills Forage & Grazing Association, the Canadian cattle inventories were at 12.29 million head on July 1, 2021, 0.2% higher than July 1, 2020. The increase is attributed to the rising demand for fresh meat products, which has soared the import of cattle stock. Further, as per the report of the United States Department of Agriculture (UDSA), in 2021, North America recorded over 114 million cattle stock and over 109 million hog stock in the region. Thus, increasing cattle stock and rising demand for healthy animal feed drive the demand for forage seeds across the region.

Industry Developments and Future Opportunities:

Various initiatives taken by the key players operating in the forage seeds market are listed below:

- In November 2022, UPL Ltd., a global provider of sustainable agricultural solutions, announced that its company, Advanta Seeds UK, and Bunge had signed an agreement to acquire a 20% stake each in SEEDCORP|HO. This intended investment is part of UPL Group's OpenAg purpose to drive collaboration to offer a complete package of solutions for farmers.

- In October 2022, KKR, a global investment firm, and UPL Limited, a global agriculture solutions provider, announced the signing of definitive agreements under which KKR will invest US$ 300 million for a 13.33% stake in Advanta Enterprises Limited, a subsidiary of Ltd.

COVID-19 Impact:

The COVID-19 pandemic affected economies and industries in various countries. Travel bans, lockdowns, and business shutdowns in leading countries in North America, Europe, Asia Pacific (APAC), South & Central America (SAM), and the Middle East & Africa (MEA) negatively affected the growth of various industries, including the agriculture and animal feed industry. The shutdown of manufacturing units disturbed global supply chains, delivery schedules, manufacturing activities, and sales of various essential and nonessential products. Various companies announced possible delays in product deliveries and a slump in future sales of their products in 2020. In addition, the bans imposed by various governments in Europe, Asia, and North America on international travel forced the companies to put their collaboration and partnership plans on a temporary hold. All these factors hampered the animal feed industry in 2020 and early 2021, thereby restraining the growth of the forage seeds market.

Forage Seeds Market Regional Insights

The regional trends and factors influencing the Forage Seeds Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Forage Seeds Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Forage Seeds Market

Forage Seeds Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 12.76 Billion |

| Market Size by 2030 | US$ 19.76 Billion |

| Global CAGR (2022 - 2030) | 5.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Forage Seeds Market Players Density: Understanding Its Impact on Business Dynamics

The Forage Seeds Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Forage Seeds Market are:

- UPL Ltd

- DLF Seeds AS

- Corteva Inc

- Limagrain UK Ltd

- S&W Seed Co

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Forage Seeds Market top key players overview

Competitive Landscape and Key Companies:

UPL Ltd, DLF Seeds AS, Corteva Inc, Limagrain UK Ltd, S&W Seed Co, Deutsche Saatveredelung AG, Cerience, Allied Seed LLC, MAS Seeds SA, and Syngenta AG are among the prominent players operating in the global forage seeds market. These forage seed manufacturers offer cutting-edge seed solutions with innovative features to deliver a superior experience to farmers and their livestock.

Frequently Asked Questions

What are the key drivers for the growth of the global forage seeds market?

The forage seeds manufacturers across the globe are investing significantly in strategic development initiatives such as product innovation, mergers and acquisitions, and expansion of their businesses to attract many consumers and enhance their market position. To maintain their strategic position in the market, key players are investing significantly in quality enhancement of forage seeds. For instance, DLF Seeds, the world's leading grass seed breeder, invested US$ 4.6 million in new state-of-the-art mixing and distribution facilities in 2021. The company has invested in transforming its current production facilities of Offshore Patrol Vessels (OPVs) and the hybrid seed of forage and bringing much-needed additional capacity and efficiency to cope with the increasing market demands by consumers and environmental stewardship in the forage seed market. Such strategic development initiatives by key players help to create a strong foothold in the market.

Based on the livestock, which segment is projected to grow at the fastest CAGR over the forecast period?

Based on the livestock, ruminants segment is projected to grow at the fastest CAGR over the forecast period. Ruminants include cattle, sheep, goats, and buffalo. Forage is the primary source of protein, fiber, and energy for ruminants. Leguminous forages such as alfalfa and clover provide 75% of the crude protein to ruminants. Forage grasses provide high amounts of fiber to the ruminants.

What is the largest region of the global forage seeds market?

North America accounted for the largest share of the global forage seeds market. The growth in region is attributed to the increased demand for forage as feed, meat consumption, and weather conditions, as well as rising consumption of livestock products despite the rising prices, well-established animal feed, and agriculture industry. An increasing number of individuals opting for protein-rich and healthier products, growing disposable income, lifestyle changes, and eating patterns contribute to a surge in demand for protein-rich meat in the US, Canada, and Mexico. Thus, with the rising consumption of meat products, the demand for animal feed increases and further drives the market for forage seeds. The region accounts for one of the largest animal feed producers across the region. As per the report of Alltech Global, in 2020, the region produced more than 254 million metric tons of animal feed products. The mass production of animal feed in North America and the rising food safety concerns, especially about meat and dairy products, have led to the increased consumption of nutritional animal feed such as forages in the region.

Based on the category, why is the conventional segment have the largest revenue share?

Based on category, conventional segment mainly has the largest revenue share. Conventional forage seeds are grown using chemical fertilizers, genetically modified organisms (GMOs), and chemical pesticides. Conventional forage seeds provide higher yields than organic ones due to the use of GMOs and chemical fertilizers. Moreover, conventional forage seeds are highly affordable and readily available.

Can you list some of the major players operating in the global forage seeds market?

The major players operating in the global forage seeds market are UPL Ltd, DLF Seeds AS, Corteva Inc, Limagrain UK Ltd, S&W Seed Co, Deutsche Saatveredelung AG, Cerience, Allied Seed LLC, MAS Seeds SA, and Syngenta AG.

What are the opportunities for forage seeds in the global market?

The seed manufacturers have developed different varieties or traits of seeds, such as hybrid, GMO, non-GMO, and organic seeds, with technological developments. The farmer's preference for these transgenic varieties is slowly rising in various forage-growing regions to minimize crop losses by weeds and diseases and enhance the quality of seeds. The hybrid seeds are developed by the special, carefully controlled cross-pollination of two different parent plants of the same species to produce new traits that cannot be created by the inbreeding of two of the same plants. Usually, the hybrid seeds are cross-pollinated by hand.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

I wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA, MANAGING DIRECTOR, PineCrest Healthcare Ltd.The Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

Yukihiko Adachi CEO, Deep Blue, LLC.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Strategic Planning

- Investment Justification

- Identifying Emerging Markets

- Enhancing Marketing Strategies

- Boosting Operational Efficiency

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Forage Seeds Market

- UPL Ltd

- DLF Seeds AS

- Corteva Inc

- Limagrain UK Ltd

- S&W Seed Co

- Deutsche Saatveredelung AG

- Cerience

- Allied Seed LLC

- MAS Seeds SA

- Syngenta AG

Get Free Sample For

Get Free Sample For