Fuel Cell Vehicle Market Developments and Forecast by 2028

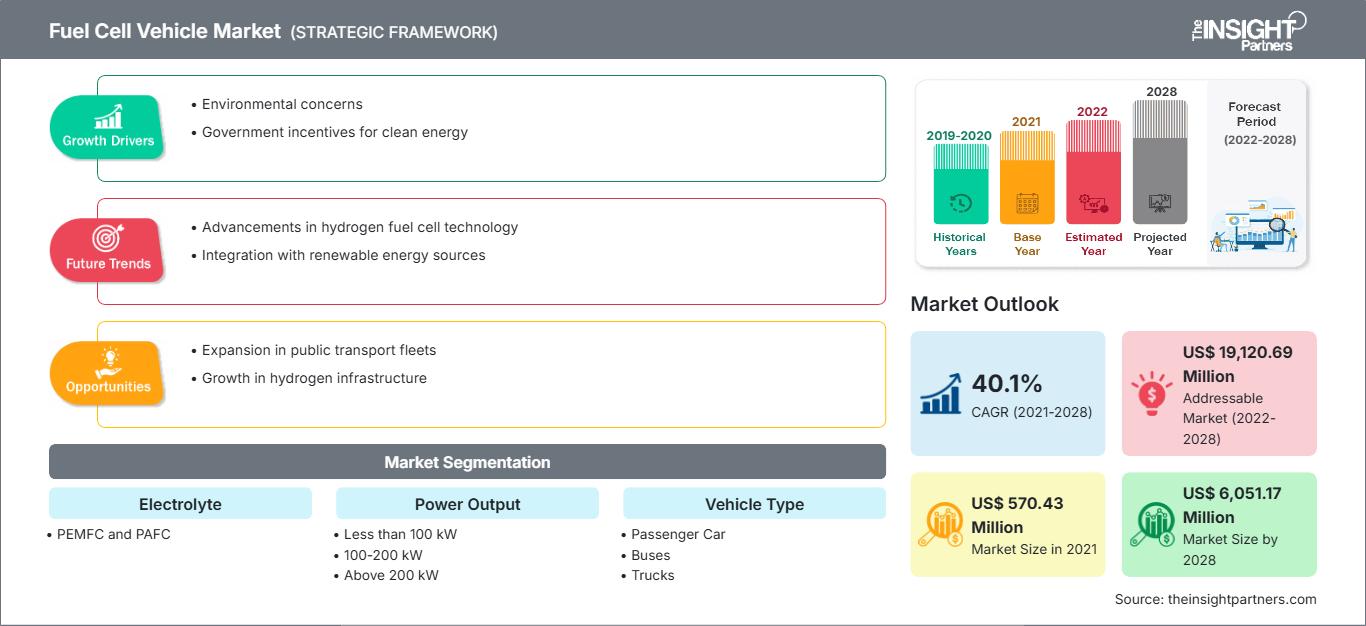

Fuel Cell Vehicle Market Forecast to 2028 - Analysis By Electrolyte (PEMFC and PAFC), Power Output (Less than 100 kW, 100-200 kW, and Above 200 kW), and Vehicle Type (Passenger Car, Buses, Trucks, and Light Commercial Vehicles)

Historic Data: 2019-2020 | Base Year: 2021 | Forecast Period: 2022-2028- Report Date : Jan 2022

- Report Code : TIPAT00002640

- Category : Automotive and Transportation

- Status : Published

- Available Report Formats :

- No. of Pages : 148

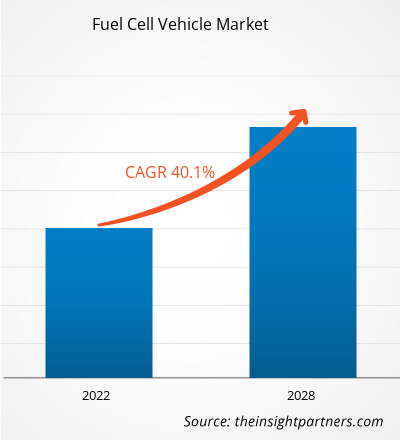

[Research Report] The fuel cell vehicle market is projected to reach US$ 6,051.17 million by 2028 from US$ 570.43 million in 2021; it is estimated to register a CAGR of 40.1% during 2021–2028.

Analyst Perspective:

In recent years, the fuel cell vehicle market has gained significant attention and momentum as a promising alternative to conventional gasoline-powered vehicles. Fuel cell vehicles (FCVs) are powered by hydrogen fuel cells, which induce electricity through a chemical reaction between hydrogen and oxygen, producing water vapor as the only emission. One of the main advantages of FCVs is their environmental friendliness. Since they emit only water vapor, they contribute to reducing greenhouse gas emissions and air pollution, addressing the global concerns of climate change and urban pollution. This characteristic has led to increased government support and incentives for adopting and developing fuel cell technology. Regarding market growth, the fuel cell vehicle market has witnessed steady progress.

Automakers and technology companies have been investing heavily in research and development to improve fuel cell vehicles' efficiency, performance, and affordability. As a result, the range of FCVs has significantly increased, addressing one of the initial concerns related to the limited driving range. Although the fuel cell vehicle market is still relatively small compared to traditional internal combustion engines and electric vehicles, it is expected to experience substantial growth in the coming years. The increased demand for sustainable transportation solutions, coupled with advancements in fuel cell technology and infrastructure development, will likely drive the expansion of the market. Additionally, partnerships and collaborations between automakers, energy companies, and governments are fostering the growth of the fuel cell vehicle market. These alliances aim to accelerate the deployment of fuel cell vehicles and promote research and development.

Market Overview:

The fuel cell vehicle market focuses on vehicles powered by fuel cell technology, which utilizes hydrogen as a fuel source to generate electricity. The market has seen notable growth due to increasing environmental concerns and the need for sustainable transportation options. Government regulations and incentives have played a crucial role in promoting the adoption of fuel cell vehicles. Advancements in fuel cell technology, collaborations among industry stakeholders, and ongoing research and development efforts have further propelled the market's expansion. Challenges such as high costs and limited infrastructure remain, but the market holds significant potential for future growth as technology improves and demand for cleaner transportation solutions continues to rise.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONFuel Cell Vehicle Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Increase in Environmental Concern to Drive Growth of Fuel Cell Vehicle Market

The increasing environmental concern has emerged as a significant driver in the market growth of fuel cell vehicles. As people become more aware of the detrimental effects of traditional gasoline-powered vehicles on the environment, there is a growing demand for cleaner and greener transportation alternatives. This heightened environmental consciousness has created a favorable market environment for fuel cell vehicles. Fuel cell vehicles utilize hydrogen as a fuel source, which is an abundant and clean energy carrier. When hydrogen is mixed with oxygen in a fuel cell, it produces electricity, with water vapor as the only byproduct. This emission-free operation is a key factor in attracting environmentally conscious consumers. The rising awareness about air pollution and greenhouse gas emissions has resulted in stricter environmental regulations imposed by governments and regulatory bodies. Many countries and regions have set ambitious targets to reduce carbon emissions and encourage sustainable transportation. In response, automakers are increasingly focusing on developing fuel cell vehicles as a part of their portfolio to meet these regulations and appeal to the environmentally conscious customer base.

Furthermore, the advancements in fuel cell technology have led to significant improvements in the performance and efficiency of fuel cell vehicles. These vehicles now offer longer driving ranges and faster refueling times, making them more practical for everyday use. The growing infrastructure for hydrogen refueling stations is also supporting the market growth of fuel cell vehicles by addressing one of the major challenges associated with their adoption. Moreover, the increasing investments and research efforts in fuel cell technology by automotive manufacturers, energy companies, and governments have accelerated the development and commercialization of fuel cell vehicles. These investments have not only improved the technological capabilities of fuel cells but have also contributed to reducing their production costs, making them more competitive in the market.

Segmental Analysis:

Based on vehicle type, the fuel cell vehicle market is segmented into passenger cars, buses, trucks, and light commercial vehicles. The passenger cars segment held the largest share of the market in 2020, and is estimated to register the highest CAGR in the market during the forecast period. The passenger cars segment has emerged as the largest share of the fuel cell vehicles market due to various factors. Growing global focus on reducing carbon emissions and transitioning to sustainable transportation has increased the demand for fuel cell vehicles. Automakers have invested in developing and commercializing fuel-cell passenger cars, improving their efficiency, range, and affordability.

The availability of a wide range of fuel-cell passenger car models, advancements in hydrogen infrastructure, and the advantages of fuel-cell technology, such as long driving ranges and shorter refueling times, have contributed to the segment's success. Overall, the passenger cars segment reflects fuel cell technology's increasing acceptance and viability in the automotive industry.

Regional Analysis:

The Asia Pacific fuel cell vehicle market was valued at US$ 301.69 million in 2021 and is projected to reach US$ 4,113.9 million by 2028; it is expected to grow at a CAGR of 45.2% during the forecast period. The Asia Pacific region has emerged as the dominant force in the fuel cell vehicle market. With its vast population, rapid urbanization, and growing concerns over pollution and climate change, the region has actively embraced cleaner and more sustainable transportation alternatives. One of the key factors contributing to the region's dominance is the strong government support and policies promoting the adoption of fuel cell vehicles. Countries like Japan, South Korea, and China have implemented favorable regulations, tax incentives, and subsidies to encourage the use of fuel cell vehicles. These measures have created a conducive environment for manufacturers, investors, and consumers alike, fostering market growth. Japan, in particular, has been at the forefront of fuel cell vehicle development and deployment. The Japanese government has set ambitious targets for hydrogen infrastructure development, aiming to establish a network of hydrogen refueling stations nationwide.

Additionally, major Japanese automakers, such as Toyota and Honda, have invested significantly in fuel cell vehicle research and development, leading to commercializing models like the Toyota Mirai and Honda Clarity. South Korea has also made remarkable progress in the fuel cell vehicle market. The government has prioritized the development of hydrogen infrastructure and actively supporting the deployment of fuel cell buses and commercial vehicles. Companies like Hyundai and Kia, both based in South Korea, have been instrumental in driving the adoption of fuel cell vehicles through their innovative models like the Hyundai Nexo and Kia Niro. With its massive population and growing concern for air pollution, China has also recognized the potential of fuel cell vehicles. The Chinese government has introduced generous subsidies and targets for fuel cell vehicle production to establish the country as a global leader in hydrogen technologies. Several Chinese automakers, including BYD, BAIC, and Geely, have invested heavily in fuel cell vehicle development, contributing to the region's overall market dominance. Furthermore, the Asia Pacific region benefits from its strong manufacturing capabilities and technological expertise. The presence of established automotive manufacturers, as well as a robust supply chain, has facilitated the production and commercialization of fuel cell vehicles. Additionally, the region boasts advanced research and development centers, academic institutions, and partnerships between industry and academia, driving technological advancements in fuel cell technology.

Key Player Analysis:

The fuel cell vehicle market analysis consists of the players such as Hyundai Motor Company; Toyota Motor Corporation; Cummins Inc; General Motors; AB Volvo; Honda Motors Co., Ltd.; Riversimple; Hyzon Motors; Daimler AG; and Ballard Power Systems Inc. Among the players in the fuel cell vehicle Cummins Inc and Hyundai Motor Company are the top key players owing to the diversified product portfolio offered.

Fuel Cell Vehicle

Fuel Cell Vehicle Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 570.43 Million |

| Market Size by 2028 | US$ 6,051.17 Million |

| Global CAGR (2021 - 2028) | 40.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Electrolyte

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Fuel Cell Vehicle Market Players Density: Understanding Its Impact on Business Dynamics

The Fuel Cell Vehicle Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the fuel cell vehicle market. A few recent key market developments are listed below:

- In April 2021, SAFRA Materiel Transport Public and Symbio (a subsidiary of Michelin and Faurecia) signed an agreement to manufacture 1500 hydrogen buses.

- In December 2020, Toyota launched its new vehicle Mirai. The vehicle runs on a fuel cell powered by hydrogen as fuel. Toyota Mirai gets a 142.2-liter fuel tank, and the fuel cell offers a max power of 171hp and 221Nm of peak torque.

Frequently Asked Questions

Declining Cost of Green Hydrogen

The fuel cell vehicle market is expected to witness steady growth during the forecast period from 2021 to 2028, owing to the rising demand from passenger car segment.

The region includes major nations such as India, China, Japan, South Korea, and Australia. South Korea and China are the fastest-growing manufacturing markets in APAC.

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For