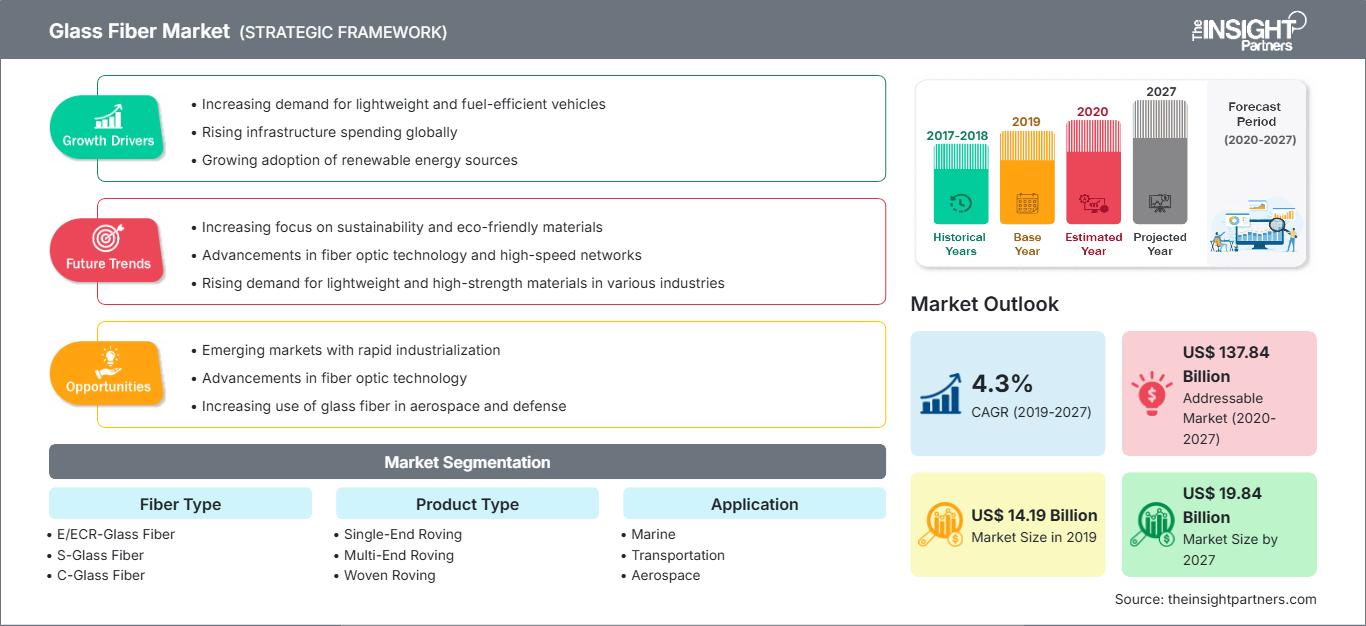

Glass Fiber Market Drivers and Forecasts by 2027

Glass Fiber Market Forecast to 2027 - Analysis By Fiber Type (E/ECR-Glass Fiber, S-Glass Fiber, C-Glass Fiber , and Others), Product Type (Single-End Roving, Multi-End Roving, Woven Roving, and Others ), Application (Marine, Transportation, Aerospace, Construction, Electrical and Electronics, Consumer Goods, and Others ), and Manufacturing Process (Hand Lay Up, Spray Up, Prepreg Lay Up, Injection Molding, Compression Molding, Resin Infusion, and Others)

Historic Data: 2017-2018 | Base Year: 2019 | Forecast Period: 2020-2027- Report Code : TIPRE00012669

- Category : Chemicals and Materials

- No. of Pages : 194

- Available Report Formats :

The glass fiber market was valued at US$ 14,193.55 million in 2019 and is projected to be worth US$ 19,837.62 million by 2027, growing at a CAGR of 4.3% from 2020 to 2027.

Glass fiber is a material consisting of extremely fine filaments of glass that are combined in yarn and woven into fabrics. It is made by blending and melting silica (SiO2), limestone, and soda ash in a three-stage furnace, extruding the molten glass through a bushing in the bottom of the forehearth and then cooling the filaments with water. Glass fibers possess excellent corrosion resistance, higher stiffness and strength, and high tensile strength along with high-temperature tolerance and durability. These fibers find their application in end-use industries such as automotive, construction, marine, wind energy, and aerospace & defense. However, the challenges of the production process, cost-intensive nature of new technologies and low profit margins of glass fiber are limiting the market growth.

In 2019, Asia Pacific contributed to the largest share in the global glass fiber market APAC is expected to be the fastest-growing market for glass fibers in the coming years. With the growth of transportation, construction, electrical & electronics, aerospace, and other industries, the demand for glass fiber has substantially gone up in the region. Construction industry is among the major consumers of glass fibers. Rapid infrastructural development in emerging markets such as India and China is driving the demand for advanced glass fibers. For instance, Indian government has made tremendous efforts to improve residential and transport infrastructure. According to Department for Promotion of Industry and Internal Trade (DPIIT), Foreign Direct Investment (FDI) in in the construction development sector and infrastructure activities stood at US$ 25.78 billion and US$ 17.22 billion, between April 2000 and September 2020, respectively. Continuous investments in the infrastructure development are going to largely boost the consumption of glass fiber. In addition, Glass fibers are also used in marine, wing energy, and consumer goods industry, these industries are also experiencing high investment from government and thus supporting the growth of glass fibers market in region.

COVID-19 first began in Wuhan (China) during December 2019 and since then it has spread at a fast pace across the globe. As of March 2021, the US, India, Brazil, Russia, France, the UK, Turkey, Italy, and Spain are some of the worst affected countries in terms confirmed cases and reported deaths. The COVID-19 pandemic has been affecting economies and industries in various countries due to lockdowns, travel bans, and business shutdowns. In addition to this, the global travel bans imposed by countries in Europe, Asia, and North America are affecting the business collaborations and partnerships opportunities. All these factors are anticipated to affect the chemicals and materials industry in a negative manner, thus act as restraining factor for the growth of glass fiber market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONGlass Fiber Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Growing Demand for Glass Fibers from Construction Industry

Glass fibers are used for insulation, surface coating, cladding, and roofing raw material in the construction sector. They are inexpensive and possess mechanical properties such as stiffness, flexibility, transparency, resistance to chemical outbreak and inertness approximately equal to other fibers, including polymers and carbon fibers. Glass fibers are used in glass fiber reinforced concrete, which is utilized in the construction of walls, fireplace surrounds, foundations, cladding, vanity tops, and concrete countertops. It is mainly used in exterior building facade wall panels and as architectural precast concrete. Glass fibers act as the main carrier providing high tensile strength and making the concrete flexible and resistant to cracking. Alkali-resistant glass fibers (ARGF) are widely used in construction materials. ARGFs significantly improve the tensile strength, flexural toughness, modulus of rupture, and wearing resistance of concrete. Such concrete is used for crack prevention, thus, finds wide applications in the construction sector.

Rapid development of the global construction industry is expected to increase the demand for glass fibers. New construction of residential buildings in developed countries such as the US is supporting the demand for glass fibers. For instance, according to the US Census Bureau, in March 2020, the total residential housing units in the US authorized by building permits were at an annual rate of 1,353,000 representing 5% growth over March 2019. Apart from this, strong economic growth of emerging markets, such as China and India, is resulting into robust infrastructural development. These countries are experiencing an increase in construction of new buildings; maintenance and repairs, remodeling, or renovating of existing structures; on-site assembly of precut; construction of temporary buildings; and installation of specialized building utilities such as elevators and escalators. All these factors are anticipated to create consistent demand for glass fibers in the construction industry.

Fiber Type Insights

Based on fiber type, global glass fiber market is segmented intoE/ECR-Glass Fiber, S-Glass Fiber, C-Glass Fiber, and Others. The E/ECR-Glass Fiber segment led the glass fiber market with the highest market share in 2019. E-glass is an electronic glass and is one of the leading types of glass fibers with properties such as high-strength, good insulation, water-resistance, and corrosion resistance. E-glass fibers are the most extensively used of all fibrous reinforcements and fiber-reinforced composites due to their reasonable cost, low elastic moduli and early development than other glass fibers. On the other hand, ECR glass is like E-glass but without fluorine and boron. ECR glass fibers are environmentally friendly, excellent acid-resistance, water-resistance, temperature resistance, and alkali-resistance. Besides, ECR Glass fiber has excellent dielectric strength, lower electrical leakage, and greater surface resistance. ECR glass fiber, which is manufactured under ASTM-D578-1999 standard since January 2005, is suitable for all e-glass applications, apart from transparent FRP(Fibre-Reinforced Plastic) panel applications. The extensive use of E/ECR glass fiber in cars, electronics, and electronic appliances is expected to drive the segment growth during the forecast period.

Product Type Insights

Based on product type, global glass fiber market is segmented intosingle-end roving, multi-end roving, woven roving, and others. The others segment led the global glass fiber market in 2019. The others segment includes Fabrics, CSM, CFM, DUCS, CS, OptiSpray Roving, Cem-FILRoving.Direct Roving, and others. OptiSpray Roving represents a compelling solution for fabricators, which want to save time and resin while enhancing product performance. Cem-FIL Roving is an alkali resistant glass fiber assembled roving produced for use in manufacturing glass fiber reinforced concrete composites by the simultaneous spray method. Cem-FILRoving offers advantages such as alkali resistant glass, good unwinding, easy chopping, and high split efficiency, perfect for use with complex profiles and great mechanical performance. Manufacturers such as Owens Corning offer OptiSpray F Roving, Cem-FILRoving 5325, Cem-FILRoving 62.4, Cem-FIL Roving 62/70. Saint-Gobain Vetrotex offers Direct Roving, which is a splice-free single-end roving made of E-Glass and suitable for multiple textile technologies.

Application Insights

Based on application, global glass fiber market is segmented intomarine, transportation, aerospace, construction, electrical and electronics, consumer goods, and others

The Transportation segment led the global glass fiber market in 2019. The glass fiber is used in the transportation industry, such as roof panels, doors, windows, cooling ventilators, luggage bins, seats, and headrest back panels. The glass fiber has a higher strength-to-weight ratio, which is an essential factor in manufacturing automobiles. These factors are anticipated to propel the growth of the glass fiber market in the transportation industry during the forecast period.Manufacturing Process Insights

Based on manufacturing process, global glass fiber market is segmented into hand lay up, spray up, prepreg lay up, injection molding, compression molding, resin infusion, and others. The Others segment led the global glass fiber market in 2019. Others segment includes pultrusion, centrifugal casting, hybrid injection-molding/thermoforming, and others. Pultrusion is a low-cost, simple, continuous process, which has been used for decades with glass fiber and polyester resins. Still, in recent times the process also has found application in advanced composites applications. Pultrusion produces smooth finished parts that usually do not require post-processing. In the centrifugal casting method, epoxy or vinyl ester resin is infused into a 150G centrifugally spinning mold, penetrating the woven fabric wrapped around the mold’s interior surface.

Johns Manville; Jushi Co., Ltd.; Chongqing Polycomp International Corp. (CPIC); Goa Glass Fiber Ltd; Nippon Electric Glass Co. Ltd; Saint-Gobain Vetrotex; Sichuan Weibo New Material Group Co., Ltd.; Taishan Fiberglass Inc; Taiwan Glass Group; and Owens Corning are among the major market players operating in the glass fiber market. These companies offer their products worldwide, which helps them in catering to a wider customer base. These major players in the market are highly focused on the development of high quality and innovative products to fulfill the customer’s requirements. Over the past few years, the companies operating in the market have realized the immense potential pertaining to the glass fiber market and were highly involved in strategies such as mergers & acquisition and product launch. For instance, For Instance, in 2020, Jushi launched E9 ultra-high-modulus glass fiber for the promotion of the development of lightweight wind turbine blades.

Glass Fiber Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 14.19 Billion |

| Market Size by 2027 | US$ 19.84 Billion |

| Global CAGR (2019 - 2027) | 4.3% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Fiber Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Glass Fiber Market Players Density: Understanding Its Impact on Business Dynamics

The Glass Fiber Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Report Spotlights

- Progressive industry trends in the global glass fiber market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the global glass fiber market from 2017 to 2027

- Estimation of the demand for glass fiber across various industries

- PEST analysis to illustrate the efficacy of buyers and suppliers operating in the industry to predict market growth

- Recent developments to understand the competitive market scenario and the demand for glass fiber

- Market trends and outlook coupled with factors driving and restraining the growth of the glass fiber market

- Decision-making process by understanding strategies that underpin commercial interest with regard to global glass fiber market growth

- Glass fiber market size at various nodes of market

- Detailed overview and segmentation of the global glass fiber market as well as its dynamics in the industry

- Glass fiber market size in various regions with promising growth opportunities

Global Glass Fiber Market, by Fiber Type

- E/ECR-Glass Fiber

- S-Glass Fiber

- C-Glass Fiber

- Others

Global Glass Fiber Market, by Product Type

- Single-End Roving

- Multi-End Roving

- Woven Roving

- Others

Global Glass Fiber Market, by Application

- Marine

- Transportation

- Aerospace

- Construction

- Electrical and Electronics

- Consumer Goods

- Others

Global Glass Fiber Market, by Manufacturing Process

- Hand Lay Up

- Spray Up

- Prepreg Lay Up

- Injection Molding

- Compression Molding

- Resin Infusion

- Others

Company Profiles

- Chongqing Polycomp International Corp. (CPIC)

- Johns Manville

- China Jushi Co., Ltd.

- Nippon Electric Glass Co.,Ltd.

- Owens Corning

- SAINT GOBAIN S.A.

- Sichuan Weibo New Material Group Co., Ltd.

- Taishan Fiberglass Inc.(CTG)

- Taiwan Glass Group

- Goa Glass Fibre Limited

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For