Green Carbon Fiber Market Analysis and Opportunities by 2028

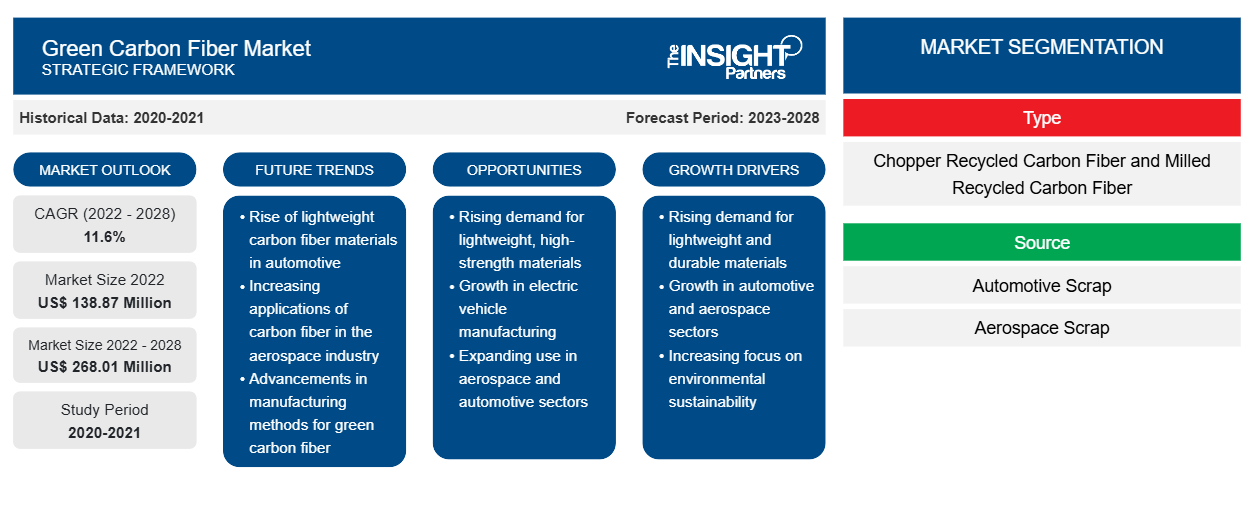

Green Carbon Fiber Market Forecast to 2028 - Global Analysis By Type (Chopper Recycled Carbon Fiber and Milled Recycled Carbon Fiber), Source (Automotive Scrap, Aerospace Scrap, and Others), and Application (Aerospace, Automotive, Wind Energy, Sporting Goods, and Others)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2028- Report Date : Apr 2023

- Report Code : TIPRE00029863

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 193

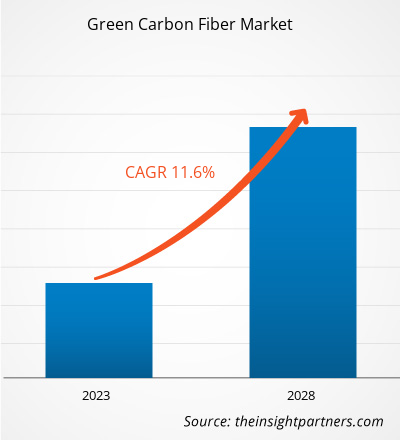

[Research Report] The green carbon fiber market was valued at US$ 138.87 million in 2022 and is projected to reach US$ 268.01 million by 2028; it is expected to register a CAGR of 11.6% from 2022 to 2028.

Green carbon fiber is a recycled carbon fiber. Carbon fiber recycling is a reclamation of fibers from carbon fiber-reinforced composites (CFRC). There are two types of carbon fiber waste. The first type of waste is virgin carbon fiber—offcuts of the product generated from dry fiber and the non-used expired material, which are also called scrap. Green or recycled carbon fiber is used to manufacture new, high-performance parts in various end-use sectors. The benefits of green carbon fiber, along with increasing demand for cost-effective, lightweight materials from various end-use industries such as automotive, aerospace, wind energy, sporting goods, etc., are bolstering the green carbon fibers market growth.

In 2022, Asia Pacific held the largest share of the global green carbon fiber market, and Europe is estimated to register the highest CAGR during the forecast period. The Asia Pacific green carbon fiber market is segmented into China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific. The aerospace & defense industry in Asia Pacific has been growing significantly over the past few years. In Asia Pacific, China is one of the largest aircraft manufacturers and one of the largest markets for domestic air passengers.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONGreen Carbon Fiber Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Green Carbon Fiber Market

Countries in Asia Pacific, such as China, India, and Japan, faced significant challenges due to the shutdown of manufacturing units, disruption of supply chains, and shortage of raw materials during the COVID-19 pandemic; this resulted in a huge slump in product manufacturing and distribution. Nonetheless, the pandemic also brought a few lucrative opportunities for key players operating in the green carbon fiber market in Asia Pacific. Many companies in the green carbon fiber market started implementing government protocols and norms to sell their product during or after the second wave of COVID-19 to grab this opportunity and increase sales. Hence, endorsements by the governments tends to increase the demand for the sustainable carbon fibers, surging the green carbon fiber market growth.

Market Insights

Increase in Use of Green Carbon Fiber in Wind Energy Industry Drives Green Carbon Fiber Market

The demand for wind turbines is increasing rapidly as various countries across the globe are shifting from climate-damaging, nonrenewable fossil fuels to clean, renewable energy sources. Also, the rising electricity rate is pushing the need for renewable energy sources. The wind energy market is growing as governments of various countries such as the US, Germany, Saudi Arabia, and China are taking initiatives to produce renewable energy. An increase in demand for renewable energy sources, especially wind energy, and efforts to reduce the dependence on fossil fuel-based power generation are significant factors for the growth of the wind energy segment, eventually fuels the green carbon fiber market growth.

Polymers reinforced with virgin carbon fibers (VCF) are being used to make spar caps of wind turbine blades, and polymers with glass fibers are used to make skins of the blade components. However, green carbon fiber is now widely used in wind turbines as recycled carbon fiber-hybrid blades offer 12–89% better environmental performance. The energy and carbon payback times for the recycled carbon fiber-hybrid blades were 5–13% lower than those of the market incumbents. Using recycled carbon fibers for wind turbine blade parts can be mechanically feasible and offer significant environmental benefits over glass fibers. These characteristic properties of carbon fiber have helped in producing better wind blade turbines and higher energy production. Therefore, the increasing use of green carbon fibers in the wind energy industry is propelling the market growth.

Type-Based Insights

Based on type, the green carbon fiber market is bifurcated into chopper recycled carbon fiber and milled recycled carbon fiber. The milled recycled carbon fiber segment held a larger share of the market in 2022. Milled recycled carbon fiber is made by grinding chopped fiber into a powder (milled) form. The usual length of milled recycled carbon fiber is 80–100 micrometers. These fibers offer electrostatic dissipation and strength.

Source-Based Insights

Based on source, the green carbon fiber market is segmented into automotive scrap, aerospace scrap, and others The automotive scrap segment is expected to register the highest CAGR during the forecast period. Recycled carbon fibers can be obtained from ~40–60% scrap volume from manufacturing automotive carbon fiber-reinforced plastic (CFRP). Using recycled carbon fiber can help automotive manufacturers achieve more mileage from the vehicle.

Application-Based Insights

Based on application, the green carbon fiber market is segmented into aerospace, automotive, wind energy, sporting goods, and others. The automotive segment accounted for the largest market share in 2022. The automotive industry frequently uses recycled carbon fibers to make chassis panels, floors, roof panels, spare wheel wells, and boot or bonnet inners.

The company uses a closed-loop process for recycling dry carbon fibers. The production cost of automobiles using recycled carbon fiber is comparatively less than the production cost of steel. Also, recycled carbon fiber can be shaped and molded into different shapes, which is not the case in steel. These properties of recycled carbon fiber are bolstering its demand in the automotive sector.

The major players operating in the green carbon fiber market include Procotex Corp SA, Vartega Inc, Sigmatex (UK) Ltd, Shocker Composites LLC, Carbon Conversions Co, SGL Carbon SE, Toray Industries Inc, Gen 2 Carbon Ltd, Catack-H Co Ltd, and Innovative Recycling. These companies are focusing on new product launches and geographical expansions to meet the growing consumer demand worldwide. They have a widespread global presence, which provides them to serve a large set of customers and subsequently increases their market share. These market players focus heavily on new product launches and regional expansions to increase their product range in specialty portfolios.

Green Carbon Fiber Market Regional InsightsThe regional trends and factors influencing the Green Carbon Fiber Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Green Carbon Fiber Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Green Carbon Fiber Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 138.87 Million |

| Market Size by 2028 | US$ 268.01 Million |

| Global CAGR (2022 - 2028) | 11.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Green Carbon Fiber Market Players Density: Understanding Its Impact on Business Dynamics

The Green Carbon Fiber Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Green Carbon Fiber Market top key players overview

Report Spotlights

- Progressive industry trends in the green carbon fiber market to help companies develop effective long-term strategies

- Business growth strategies adopted by the market players in developed and developing countries

- Quantitative analysis of the market from 2022 to 2028

- Estimation of global demand for green carbon fiber

- Porter’s Five Forces analysis to illustrate the efficacy of buyers and suppliers in the green carbon fiber market

- Recent developments to understand the competitive market scenario

- Market trends and outlook, and growth drivers and restraints in the green carbon fiber market

- Assistance in the decision-making process by highlighting market strategies that underpin commercial interest

- Size of the green carbon fiber market at various nodes

- A detailed overview and green carbon fiber industry dynamics

- Size of the green carbon fiber market in various regions with promising growth opportunities

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For