GPS Anti-Jamming Market Share and Forecast by 2031

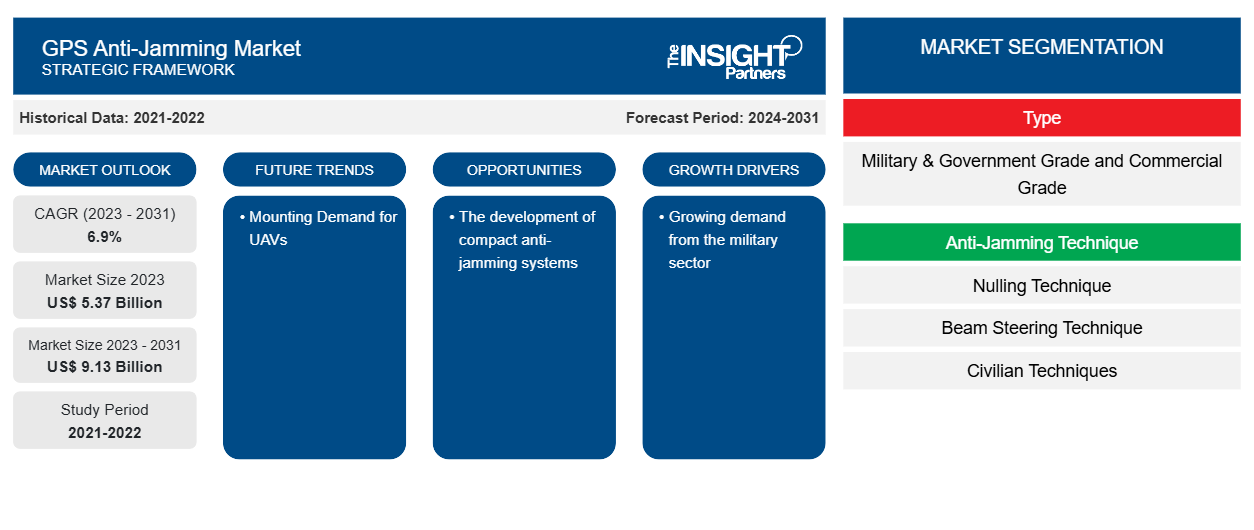

GPS Anti-Jamming Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Receiver Type (Military & Government Grade and Commercial Grade), Anti-Jamming Technique (Nulling Technique, Beam Steering Technique, and Civilian Techniques), Application (Flight Control, Surveillance & Reconnaissance, Position Navigation & Timing, Targeting, and Casualty Evacuation), and End User (Military and Civilian), and Geography

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Report Date : Mar 2026

- Report Code : TIPRE00013796

- Category : Electronics and Semiconductor

- Status : Data Released

- Available Report Formats :

- No. of Pages : 150

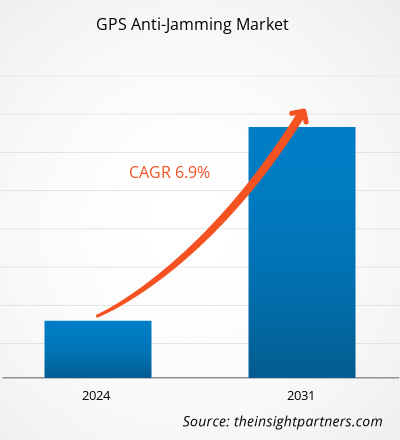

The GPS anti-jamming market size is projected to reach US$ 9.13 billion by 2031 from US$ 5.37 billion in 2023. The market is expected to register a CAGR of 6.9% in 2023–2031. The rise in military expenditure and the growing UAV market are likely to remain key GPS anti-jamming market trends.

GPS Anti-Jamming Market Analysis

The rise in demand for GPS technology in military applications and the rise in military expenditure are some of the prominent factors fueling the GPS anti-jamming market. The development of low-cost GPS anti-jamming solutions is expected to foster market growth in the coming years. The growing demand for unmanned vehicles further bolsters the market growth.

GPS Anti-Jamming Market Overview

GPS anti-jamming safeguards GPS receivers against interference and deliberate jamming. By the time the GPS signal reaches the Earth's surface, it is weak and vulnerable to being overwhelmed by higher-power Radio Frequency (RF) energy. Even a small 10-watt jammer can disrupt an unprotected C/A Code receiver for up to 30 kilometers (line of sight). GPS Anti-Jamming uses power minimization to reduce the effects of interference and jamming, allowing the GPS receiver to continue to function properly. Military organizations consistently depend on satellite technology for accurate positioning, timing, and communications, whereas GPS technology is used to revolutionize modern warfare. A simple low-power jammer, readily available via the World Wide Web, can overpower GPS signals within a large area, denying a position solution and timing.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONGPS Anti-Jamming Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

GPS Anti-Jamming Market Drivers and Opportunities

Growing demand from the military sector to Favor Market

With the changing warfare activities, the demand for GPS anti-jamming technology is gaining traction in the military sector. Military operations require accurate positioning, navigation, and timing, and focus to strengthen their GPS systems against jamming and spoofing. Therefore, the military sector gives contracts to the market players to procure anti-jamming technologies, which fosters the GPS anti-jamming market growth. For example, in December 2021, the Pentagon placed another US$ 315 million order with BAE Systems for GPS modules that use a new anti-jamming signal. This was in addition to the US$ 325 million contract the US Defense Logistics Agency awarded to the company in May of the same year, bringing the total deal value to US$ 640 million.

Mounting Demand for UAVs – An Opportunity in the GPS Anti-Jamming Market

There is surging use of unmanned aerial vehicles (UAVs) in the defense and security industry for numerous applications which includes combat operations, transportation, surveying, mapping, and monitoring in the coming years. Due to its numerous applications, the government authorities are investing in UAV technology to strengthen its military sector, which generates the use of GPS anti-jamming systems to minimize the risk of interference and jamming, which is further expected to fuel the GPS anti-jamming market. In addition, developing countries such as India aspire to be global drone leaders by 2030, for which they have been investing to maximize the domestic production of drone technology and support the UAV manufacturer.

GPS Anti-Jamming Market Report Segmentation Analysis

Key segments that contributed to the derivation of GPS anti-jamming market analysis are receiver type, anti-jamming technique, application, and end user.

- Based on receiver type, the market is segmented into military & government grade and commercial grade. The military & government grade segment held a larger market share in 2023.

- By anti-jamming technique, the market is segmented into nulling technique, beam steering technique, and civilian techniques. The nulling technique segment held the largest share of the market in 2023.

- By application, the market is segmented into flight control, surveillance & reconnaissance, position navigation & timing, targeting, and casualty evacuation. The surveillance & reconnaissance segment held the largest share of the market in 2023.

- By end user, the market is segmented into military and civilian. The military segment held the largest share of the market in 2023.

GPS Anti-Jamming Market Share Analysis by Geography

The geographic scope of the GPS anti-jamming market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

In terms of revenue, North America accounted for the largest GPS anti-jamming market share in 2023. The region homes to the majority of the GPS anti-jamming market players, which fuels the GPS anti-jamming market share of North America. In addition, market players expand their presence in the region, which further fuels its market growth. For instance, in April 2024, infiniDome, the leading provider of GPS protection and resilient navigation solutions, announced the further expansion of its operations with the establishment of infiniDome USA, a new subsidiary designed to enhance service to the US defense industry and market in general. This strategic move not only underscores infiniDome commitment to providing cutting-edge GPS protection solutions to a growing global clientele but also builds upon its existing presence and success within the US market, where they already serve a significant and expanding customer base.

GPS Anti-Jamming Market Regional InsightsThe regional trends and factors influencing the GPS Anti-Jamming Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses GPS Anti-Jamming Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

GPS Anti-Jamming Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 5.37 Billion |

| Market Size by 2031 | US$ 9.13 Billion |

| Global CAGR (2023 - 2031) | 6.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

GPS Anti-Jamming Market Players Density: Understanding Its Impact on Business Dynamics

The GPS Anti-Jamming Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the GPS Anti-Jamming Market top key players overview

GPS Anti-Jamming Market News and Recent Developments

The GPS Anti-Jamming Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market:

- In November 2021, EDGE, an advanced technology company for defense and beyond, announced the launch of GPS-Protect, an anti-jam system that covers air, land, and sea applications. Developed by SIGN4L, a leading developer of electronic warfare and intelligence solutions (EW&I) and entity within EDGE Group, the UAE-made system provides significant immunity to jamming, thereby protecting mission-critical systems that require assured position, navigation, and timing information from GPS. (Source: EDGE, Press Release, 2021)

- In May 2021, with the increase of interference and jamming in marine environments worldwide, Hexagon | NovAtel announced the release of GAJT-410MS, the latest addition to their proven GPS Anti-Jam Technology (GAJT), into the commercial and defense marine markets. This low size, weight, and power (SWaP) variant protects civil and military operations from interference and jamming, with jammer direction-finding capabilities for enhanced situation awareness in the marine environment. (Source: NovAtel, Press Release, 2021)

- In December 2023, Israel Aerospace Industries (IAI) announced that it signed a contract with Korea Aerospace Industries (KAI) to provide its ADA system for Light Armed Helicopter (LAH) 2nd Phase Production during the Seoul ADEX 2023 exhibition. Under the contract, IAI will provide its ADA system, a GPS Anti-Jamming solution capable of suppressing interferences from multiple jammers from various directions, for serial installation on LAH platforms. (Source: Israel Aerospace Industries (IAI), Press Release, 2023)

GPS Anti-Jamming Market Report Coverage and Deliverables

The “GPS Anti-Jamming Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For