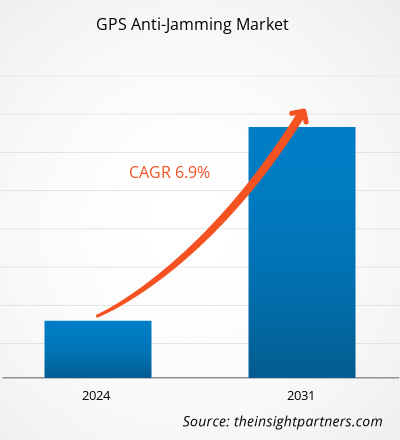

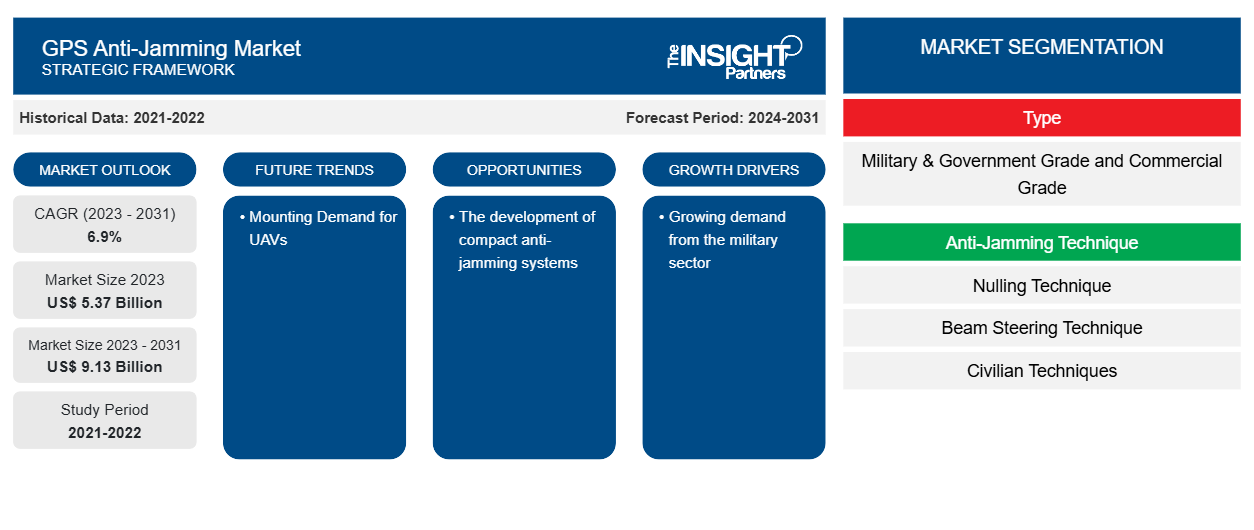

Le marché de l'antibrouillage GPS devrait atteindre 9,13 milliards USD d'ici 2031, contre 5,37 milliards USD en 2023. Le marché devrait enregistrer un TCAC de 6,9 % en 2023-2031. L'augmentation des dépenses militaires et la croissance du marché des drones devraient rester les principales tendances du marché de l'antibrouillage GPS.

Analyse du marché des systèmes anti-brouillage GPS

La demande croissante de technologie GPS dans les applications militaires et l'augmentation des dépenses militaires sont quelques-uns des principaux facteurs qui alimentent le marché de l'antibrouillage GPS. Le développement de solutions antibrouillage GPS à faible coût devrait favoriser la croissance du marché dans les années à venir. La demande croissante de véhicules sans pilote renforce encore davantage la croissance du marché.

Aperçu du marché de l'antibrouillage GPS

L'antibrouillage GPS protège les récepteurs GPS contre les interférences et le brouillage délibéré. Lorsque le signal GPS atteint la surface de la Terre, il est faible et vulnérable à une énergie de radiofréquence (RF) de plus grande puissance. Même un petit brouilleur de 10 watts peut perturber un récepteur C/A Code non protégé jusqu'à 30 kilomètres (ligne de visée). L'antibrouillage GPS utilise la minimisation de la puissance pour réduire les effets des interférences et du brouillage, permettant au récepteur GPS de continuer à fonctionner correctement. Les organisations militaires dépendent constamment de la technologie satellite pour un positionnement, une synchronisation et des communications précis, tandis que la technologie GPS est utilisée pour révolutionner la guerre moderne. Un simple brouilleur de faible puissance, facilement disponible via le World Wide Web, peut surcharger les signaux GPS dans une grande zone, empêchant ainsi une solution de positionnement et de synchronisation.

Personnalisez ce rapport en fonction de vos besoins

Vous bénéficierez d'une personnalisation gratuite de n'importe quel rapport, y compris de certaines parties de ce rapport, d'une analyse au niveau des pays, d'un pack de données Excel, ainsi que de superbes offres et réductions pour les start-ups et les universités.

-

Obtenez les principales tendances clés du marché de ce rapport.Cet échantillon GRATUIT comprendra une analyse de données, allant des tendances du marché aux estimations et prévisions.

Moteurs et opportunités du marché de l'antibrouillage GPS

La demande croissante du secteur militaire pour Favor Market

Avec l'évolution des activités de guerre, la demande de technologie antibrouillage GPS gagne du terrain dans le secteur militaire. Les opérations militaires nécessitent un positionnement, une navigation et un timing précis, ainsi qu'une concentration pour renforcer leurs systèmes GPS contre le brouillage et l'usurpation d'identité. Par conséquent, le secteur militaire attribue des contrats aux acteurs du marché pour l'acquisition de technologies antibrouillage, ce qui favorise la croissance du marché de l'antibrouillage GPS. Par exemple, en décembre 2021, le Pentagone a passé une autre commande de 315 millions de dollars auprès de BAE Systems pour des modules GPS qui utilisent un nouveau signal antibrouillage. Cela s'ajoute au contrat de 325 millions de dollars que l'Agence de logistique de défense américaine a attribué à l'entreprise en mai de la même année, portant la valeur totale de la transaction à 640 millions de dollars.BAE Systems for GPS modules that use a new anti-jamming signal. This was in addition to the US$ 325 million contract the US Defense Logistics Agency awarded to the company in May of the same year, bringing the total deal value to US$ 640 million.

La demande croissante de drones – une opportunité sur le marché de l’antibrouillage GPSUAVs – An Opportunity in the GPS Anti-Jamming Market

Les drones sont de plus en plus utilisés dans le secteur de la défense et de la sécurité pour de nombreuses applications, notamment les opérations de combat, le transport, l'arpentage, la cartographie et la surveillance dans les années à venir. En raison de ses nombreuses applications, les autorités gouvernementales investissent dans la technologie des drones pour renforcer son secteur militaire, ce qui génère l'utilisation de systèmes anti-brouillage GPS pour minimiser le risque d'interférence et de brouillage, ce qui devrait encore alimenter le marché de l'anti-brouillage GPS. En outre, les pays en développement comme l'Inde aspirent à devenir les leaders mondiaux des drones d'ici 2030, pour lesquels ils ont investi pour maximiser la production nationale de technologie de drone et soutenir le fabricant de drones.

Analyse de segmentation du rapport sur le marché des systèmes antibrouillage GPS

Les segments clés qui ont contribué à l’élaboration de l’analyse du marché anti-brouillage GPS sont le type de récepteur, la technique anti-brouillage, l’application et l’utilisateur final.

- En fonction du type de récepteur, le marché est segmenté en catégorie militaire et gouvernementale et en catégorie commerciale. Le segment de qualité militaire et gouvernementale détenait une part de marché plus importante en 2023.

- En termes de techniques anti-brouillage, le marché est segmenté en techniques d'annulation, techniques de direction de faisceau et techniques civiles. Le segment des techniques d'annulation détenait la plus grande part du marché en 2023.

- En termes d'application, le marché est segmenté en contrôle de vol, surveillance et reconnaissance, navigation et synchronisation de position, ciblage et évacuation des blessés. Le segment de la surveillance et de la reconnaissance détenait la plus grande part du marché en 2023.

- En fonction de l'utilisateur final, le marché est segmenté en militaire et civil. Le segment militaire détenait la plus grande part du marché en 2023.

Analyse des parts de marché des systèmes anti-brouillage GPS par zone géographique

La portée géographique du rapport sur le marché de l’anti-brouillage GPS est principalement divisée en cinq régions : Amérique du Nord, Asie-Pacifique, Europe, Moyen-Orient et Afrique, et Amérique du Sud/Amérique du Sud et centrale.

En termes de chiffre d'affaires, l'Amérique du Nord représentait la plus grande part de marché de l'antibrouillage GPS en 2023. La région abrite la majorité des acteurs du marché de l'antibrouillage GPS, ce qui alimente la part de marché de l'antibrouillage GPS en Amérique du Nord. En outre, les acteurs du marché étendent leur présence dans la région, ce qui alimente davantage la croissance de son marché. Par exemple, en avril 2024, infiniDome, le principal fournisseur de solutions de protection GPS et de navigation résiliente, a annoncé la poursuite de l'expansion de ses opérations avec la création d'infiniDome USA, une nouvelle filiale conçue pour améliorer le service à l'industrie de la défense américaine et au marché en général. Cette décision stratégique souligne non seulement l'engagement d'infiniDome à fournir des solutions de protection GPS de pointe à une clientèle mondiale croissante, mais s'appuie également sur sa présence et son succès existants sur le marché américain, où il sert déjà une clientèle importante et en expansion.infiniDome, the leading provider of GPS protection and resilient navigation solutions, announced the further expansion of its operations with the establishment of infiniDome USA, a new subsidiary designed to enhance service to the US defense industry and market in general. This strategic move not only underscores infiniDome commitment to providing cutting-edge GPS protection solutions to a growing global clientele but also builds upon its existing presence and success within the US market, where they already serve a significant and expanding customer base.

Aperçu régional du marché de l'antibrouillage GPS

Les tendances régionales et les facteurs influençant le marché de l’antibrouillage GPS tout au long de la période de prévision ont été expliqués en détail par les analystes d’Insight Partners. Cette section traite également des segments et de la géographie du marché de l’antibrouillage GPS en Amérique du Nord, en Europe, en Asie-Pacifique, au Moyen-Orient et en Afrique, ainsi qu’en Amérique du Sud et en Amérique centrale.

- Obtenez les données régionales spécifiques au marché de l'antibrouillage GPS

Portée du rapport sur le marché des systèmes antibrouillage GPS

| Attribut de rapport | Détails |

|---|---|

| Taille du marché en 2023 | 5,37 milliards de dollars américains |

| Taille du marché d'ici 2031 | 9,13 milliards de dollars américains |

| Taux de croissance annuel composé mondial (2023-2031) | 6,9% |

| Données historiques | 2021-2022 |

| Période de prévision | 2024-2031 |

| Segments couverts |

Par type

|

| Régions et pays couverts |

Amérique du Nord

|

| Leaders du marché et profils d'entreprises clés |

|

Densité des acteurs du marché de l'antibrouillage GPS : comprendre son impact sur la dynamique commerciale

Le marché de l'antibrouillage GPS connaît une croissance rapide, tirée par la demande croissante des utilisateurs finaux en raison de facteurs tels que l'évolution des préférences des consommateurs, les avancées technologiques et une plus grande sensibilisation aux avantages du produit. À mesure que la demande augmente, les entreprises élargissent leurs offres, innovent pour répondre aux besoins des consommateurs et capitalisent sur les tendances émergentes, ce qui alimente davantage la croissance du marché.

La densité des acteurs du marché fait référence à la répartition des entreprises ou des sociétés opérant sur un marché ou un secteur particulier. Elle indique le nombre de concurrents (acteurs du marché) présents sur un marché donné par rapport à sa taille ou à sa valeur marchande totale.

Les principales entreprises opérant sur le marché de l'antibrouillage GPS sont :

- Systèmes BAE

- Chelton Limitée

- FURUNO ÉLECTRIQUE SOCIÉTÉ, LTD.

- infiniDome Ltd.

- L3Harris Technologies, Inc.

- Société Lockheed Martin

Avis de non-responsabilité : les sociétés répertoriées ci-dessus ne sont pas classées dans un ordre particulier.

- Obtenez un aperçu des principaux acteurs du marché de l'antibrouillage GPS

Actualités et développements récents du marché de l'antibrouillage GPS

Le marché de l'antibrouillage GPS est évalué en collectant des données qualitatives et quantitatives après des recherches primaires et secondaires, qui comprennent d'importantes publications d'entreprise, des données d'association et des bases de données. Voici une liste des évolutions du marché :

- En novembre 2021, EDGE, une société de technologie avancée pour la défense et au-delà, a annoncé le lancement de GPS-Protect, un système anti-brouillage qui couvre les applications aériennes, terrestres et maritimes. Développé par SIGN4L, un développeur leader de solutions de guerre électronique et de renseignement (EW&I) et entité au sein du groupe EDGE, le système fabriqué aux Émirats arabes unis offre une immunité significative au brouillage, protégeant ainsi les systèmes critiques pour la mission qui nécessitent des informations de position, de navigation et de synchronisation garanties par le GPS. (Source : EDGE, communiqué de presse, 2021)

- En mai 2021, face à l'augmentation des interférences et du brouillage dans les environnements marins du monde entier, Hexagon | NovAtel a annoncé la sortie du GAJT-410MS, le dernier ajout à sa technologie éprouvée antibrouillage GPS (GAJT), sur les marchés maritimes commerciaux et de défense. Cette variante de faible taille, poids et puissance (SWaP) protège les opérations civiles et militaires contre les interférences et le brouillage, avec des capacités de radiogoniométrie du brouilleur pour une meilleure connaissance de la situation dans l'environnement marin. (Source : NovAtel, communiqué de presse, 2021)

- En décembre 2023, Israel Aerospace Industries (IAI) a annoncé avoir signé un contrat avec Korea Aerospace Industries (KAI) pour fournir son système ADA pour la deuxième phase de production d'hélicoptères légers armés (LAH) lors de l'exposition ADEX 2023 de Séoul. Dans le cadre de ce contrat, IAI fournira son système ADA, une solution anti-brouillage GPS capable de supprimer les interférences de plusieurs brouilleurs provenant de différentes directions, pour une installation en série sur les plates-formes LAH. (Source : Israel Aerospace Industries (IAI), communiqué de presse, 2023)

Rapport sur le marché de l'antibrouillage GPS et livrables

Le rapport « Taille et prévisions du marché de l’antibrouillage GPS (2021-2031) » fournit une analyse détaillée du marché couvrant les domaines ci-dessous :

- Taille du marché et prévisions aux niveaux mondial, régional et national pour tous les segments de marché clés couverts par le périmètre

- Dynamique du marché, comme les facteurs moteurs, les contraintes et les opportunités clés

- Principales tendances futures

- Analyse détaillée des cinq forces de PEST/Porter et SWOT

- Analyse du marché mondial et régional couvrant les principales tendances du marché, les principaux acteurs, les réglementations et les développements récents du marché

- Analyse du paysage industriel et de la concurrence couvrant la concentration du marché, l'analyse de la carte thermique, les principaux acteurs et les développements récents

- Profils d'entreprise détaillés

- Analyse historique (2 ans), année de base, prévision (7 ans) avec TCAC

- Analyse PEST et SWOT

- Taille du marché Valeur / Volume - Mondial, Régional, Pays

- Industrie et paysage concurrentiel

- Ensemble de données Excel

Rapports récents

Témoignages

Raison d'acheter

- Prise de décision éclairée

- Compréhension de la dynamique du marché

- Analyse concurrentielle

- Connaissances clients

- Prévisions de marché

- Atténuation des risques

- Planification stratégique

- Justification des investissements

- Identification des marchés émergents

- Amélioration des stratégies marketing

- Amélioration de l'efficacité opérationnelle

- Alignement sur les tendances réglementaires

Obtenez un échantillon gratuit pour - Marché de l'antibrouillage GPS

Obtenez un échantillon gratuit pour - Marché de l'antibrouillage GPS