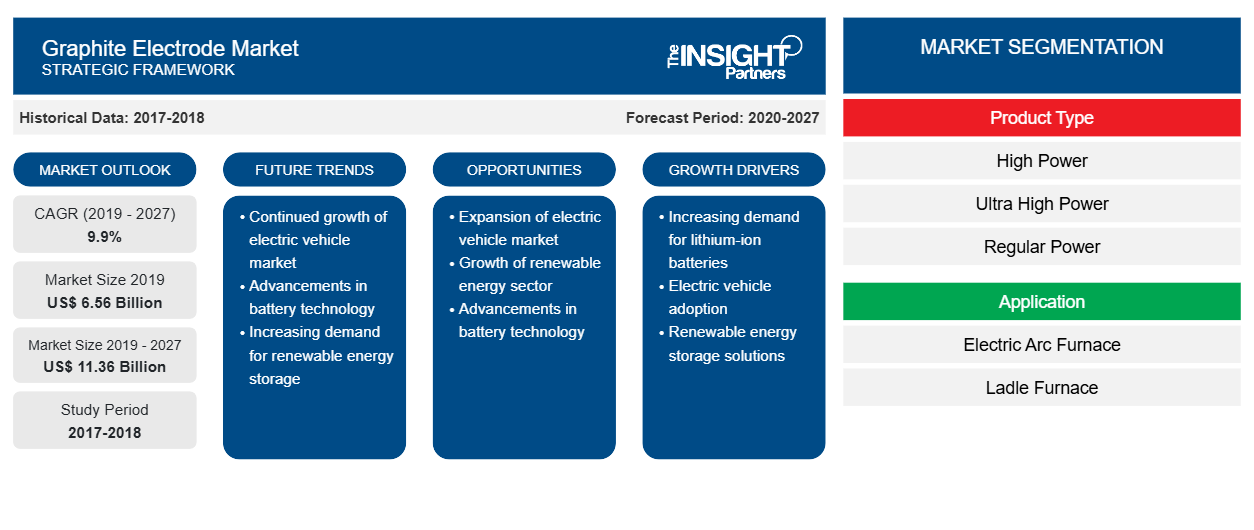

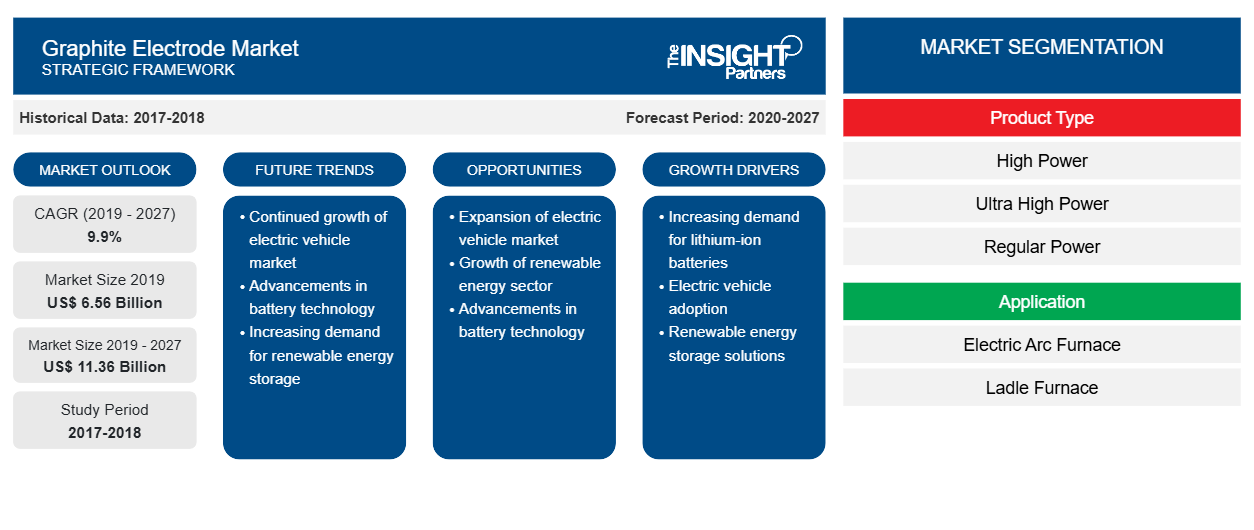

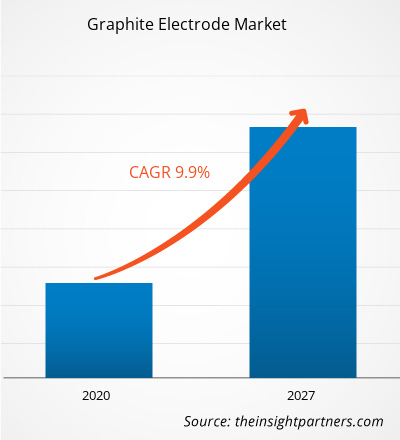

[Research Report] In terms of revenue, the graphite electrode market was valued at US$ 6,564.2 million in 2019 and is expected to reach US$ 11,356.4 million by 2027 with a CAGR of 9.9% from 2020 to 2027.

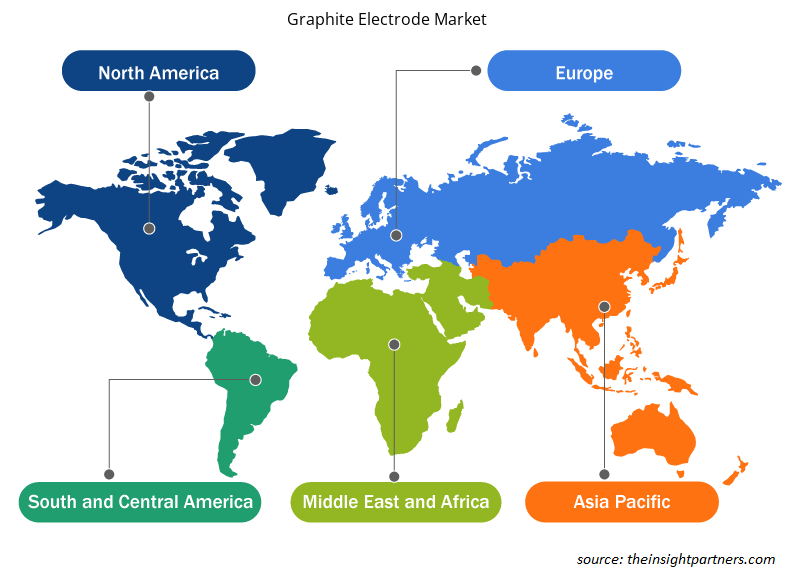

The global graphite electrode market is dominated by the Asia Pacific region accounting for ~58% of the global graphite electrode market collectively. The high demand for graphite electrodes from these countries is attributed to the steep rise in crude steel production. As per the World Steel Association, in 2018, China and Japan produced 928.3 and 104.3 million tonnes of crude steel respectively. In APAC, electric arc furnaces have a significant demand due to rising steel scrap and increase in electrical energy supply in China. The growing market strategies by various companies in APAC is encouraging the growth in the graphite electrode market in the region. For instance, Tokai Carbon Co., Ltd., a Japanese company, has acquired the graphite electrodes business of SGL GE Holding GmbH (SGL GE), at the cost of US$ 150 million.

Governments of major European countries have been taking various initiatives to advance their manufacturing and electronics & semiconductor sectors, among others. Europe has significantly upgraded its industrial solutions through the Industry 4.0 initiatives. The European Commission is focusing on increasing funding for R&D to strengthen the competitiveness of the manufacturing and others sectors of the region in the world. The demand for graphite electrodes is directly linked to the production of steel in electric arc furnaces, and the region is one of the crucial steel producers in the world, with Russia being largest producers.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Graphite Electrode Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Graphite Electrode Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Graphite Electrode Market

According to the latest situation report from the World Health Organization (WHO), the US, India, Spain, Italy, France, Germany, the UK, Russia, Turkey, Brazil, Iran, and China are among the worst affected countries due to COVID-19 outbreak. The outbreak first began in Wuhan (China) during December 2019, and since then, it has spread at a fast pace across the globe. The COVID-19 crisis is affecting the industries worldwide, and the global economy is anticipated to take the worst hit in the year 2020 and likely in 2021. The outbreak has created significant disruptions in the steel industry. The sharp decline in the international trade is negatively affecting the growth of the graphite electrode. The production shutdowns, restrictions on supply chain, procurement management, labor scarcity, and border lockdowns to combat and contain the outbreak have adversely affected the construction sector. The production slowdown in the construction industry is directly affecting the adoption of various steel products, thus impacting the graphite electrode market.

Market Insights

Transition in Chinese steel industry is supporting the growth of graphite electrode market

In 2016 and 2017, China's steel industry scene was shaped by policy-driven dismissal of IF potential as the government endeavored to inscribe a domestic supply oversupply. As per worldsteel.org, consumption of scrap steel in EAF and basic oxygen furnace (BOF) steel mills touched a record of higher than 200 million metric tons per year. In the meantime, China's EAF capacity relinquished a new zenith of 130 million metric tons per year as government regulations restrict generation by integrated mills in key areas and promote their vigorous replacement by EAF capacity. This has given rise to the production of EAF steel, thus abetting the growth of graphite electrodes market.

Product Type-Based Insights

In terms of product type, the ultra-high power segment captured the largest share of the global graphite electrode market in 2019. Ultra-high power graphite electrode is utilized for recycling steel in the electric arc furnace (EAF) industry. Its main constituent is high-value needle coke, which is produced from either petroleum or coal tar. Graphite electrodes are perfected with a cylinder shape and manufactured with threaded areas at each end. In this way, the graphite electrodes can be assembled into an electrode column using electrode nipples. To suffice the requirement of lower cost and higher work efficiency, the large capacity ultra-high power arc furnaces are becoming more popular. Thus ultra-high power graphite electrodes are expected to hold the major share of the graphite electrode market. Also, the segment is expected to witness the highest CAGR growth in the graphite electrode market.

Application-Based Insights

Based on application, the graphite electrode market is segmented into electric arc furnace, ladle furnace, and others. The electric arc furnace segment is estimated to grow at the highest CAGR during the forecast period. Graphite electrode is an indispensable component of steel production via the Electric Arc Furnace (EAF) method and ladle furnace steel purification. Graphite electrodes are also used for the production of the non-steel ferrous metal, ferroalloy, silicon metal, and yellow phosphorus. Graphite Electrode is an indispensable consumable in EAF steel production, but is needed in very small quantities; one ton of steel production needs just ~1.7kg of graphite electrode. The segment holds over 80% share of the total graphite electrode market.

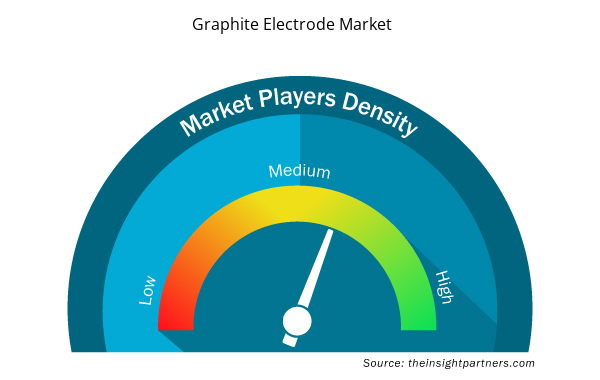

The graphite electrode market is highly consolidated with only a certain number of players dominating the graphite electrode market. A few of the recent developments in the graphite electrode market are listed below:

2020:Tokai Carbon and Tokai COBEX completed the acquisition of Carbone Savoie International SAS, a Carbon and Graphite Manufacturer.

2020:The Board of Directors of GrafTech International Ltd. approved the repurchase of up to $100 million of the company’s common stock in open market purchases

2019:Showa Denko (SDK) completed the acquisition of all shares in SGL GE Holding GmbH, a graphite electrode production company. After the acquisition, the name of the company changed to SHOWA DENKO CARBON Holding GmbH.

Graphite Electrode Market Regional Insights

The regional trends and factors influencing the Graphite Electrode Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Graphite Electrode Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Graphite Electrode Market

Graphite Electrode Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 6.56 Billion |

| Market Size by 2027 | US$ 11.36 Billion |

| Global CAGR (2019 - 2027) | 9.9% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Graphite Electrode Market Players Density: Understanding Its Impact on Business Dynamics

The Graphite Electrode Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Graphite Electrode Market are:

- EPM Group

- GRAFTECH INTERNATIONAL LTD

- Graphite India Limited

- HEG Limited

- Kaifeng Carbon Co., Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Graphite Electrode Market top key players overview

Market Segmentation

Graphite Electrode Market – By Product Type

- High Power

- Ultra-High Power

- Regular Power

Graphite Electrode Market – By Application

- Electric Arc Furnace

- Ladle Furnace

- Others

Graphite Electrode Market by Region

North America

- US

- Canada

- Mexico

Europe

- France

- Germany

- Italy

- UK

- Russia

- Rest of Europe

Asia Pacific (APAC)

- China

- India

- South Korea

- Japan

- Australia

- Rest of APAC

Middle East and Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

South America (SAM)

- Brazil

- Argentina

- Rest of SAM

Companies Profiled in Graphite Electrode Market are as Follows:

- EPM Group

- GrafTech International Ltd

- Graphite India Limited

- HEG Ltd

- Kaifeng Carbon Co., Ltd, Zhongping Energy & Chemical Group (KFCC)

- Nantong Yangzi Carbon Co., Ltd.

- Nippon Carbon Co Ltd.

- Sangraf International

- SHOWA DENKO K.K.

- Tokai Carbon Co., Ltd.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type ; Application , and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Which product type is likely to hold the major share of the global Graphite Electrode market?

Ultra-high power graphite electrode is utilized for recycling steel in the electric arc furnace (EAF) industry. Its main constituent is high-value needle coke, which is produced from either petroleum or coal tar. Graphite electrodes are perfected with a cylinder shape and manufactured with threaded areas at each end. In this way, the graphite electrodes can be assembled into an electrode column using electrode nipples. To suffice the requirement of lower total cost and higher work efficiency and, large capacity ultra-high power arc furnaces are growing and becoming more popular. Thus ultra-high power graphite electrodes are expected to hold the lion's market share.

What are the factors behind the growth of Graphite Electrode market?

China’s steel industry is on the transition of a new era. Over the next decade, steel will frequently be made by recycling domestic scrap in electric arc furnace mini-mills as the government interests with the policy-driven exclusion of conventional induction furnaces (IF)/blast furnaces (BF) and the replacement of combined steel capacity. This monument change, which incorporates environmental and economic benefits, will transmute the industry and demand major modifications in the steelmaking business model at the company level. To favorably adapt to this new ecosystem, steel companies and other industry stakeholders should concede the context and motivating factors behind the transition.

Which region led the Graphite Electrode market in 2019?

Presently, APAC holds the largest share of the global Graphite Electrode. The graphite electrode market players in APAC are experiencing significant demand for their products from various industries. China and Japan are the leading countries in the APAC graphite electrode market. The high demand from these countries is attributed to the steep rise in crude steel production. As per the World Steel Association, in 2018, China and Japan produced 928.3 and 104.3 million tonnes of crude steel respectively. In APAC, electric arc furnaces have a promising growth due to the rising steel scrap and increase in electrical energy supply in China. Many countries in APAC are economically developing, and they are focusing majorly on the rising environmental issue. For instance, in China, the heavily polluting basic oxygen furnaces (BOF) have been forced to shut down due to strict environmental regulations. Thus, the induction furnaces were replaced by electric arc furnaces, which utilize graphite electrodes to melt steel scrap. In 2017, China reported the consumption of ~353,600 metric ton of graphite electrodes, with an increase of 3.06% on the consumption in 2016.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Graphite Electrode Market

- EPM Group

- GRAFTECH INTERNATIONAL LTD

- Graphite India Limited

- HEG Limited

- Kaifeng Carbon Co., Ltd

- Nantong Yangzi Carbon Co., Ltd

- Nippon Carbon Co Ltd.

- SANGRAF Intl.

- SHOWA DENKO K.K.

- Tokai Carbon Co., Ltd.

Get Free Sample For

Get Free Sample For