Home Healthcare Market Analysis and Forecast by Size, Share, Growth, Trends 2031

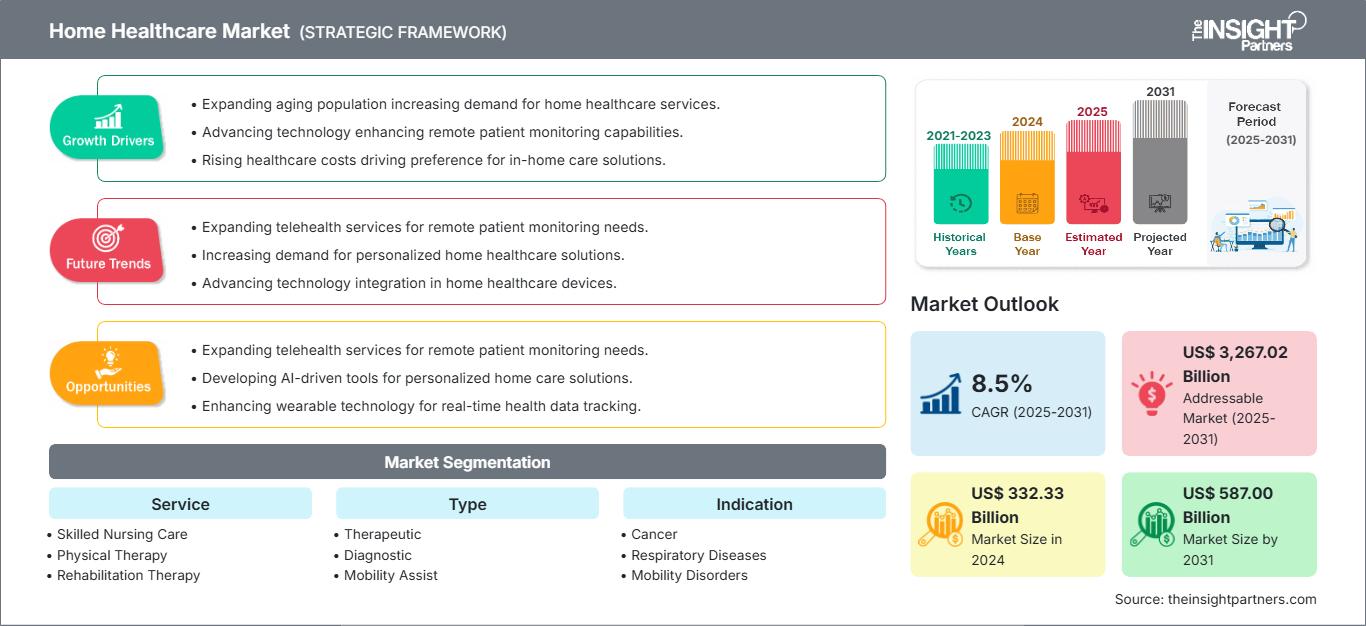

Home Healthcare Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Service (Skilled Nursing Care, Physical Therapy, Rehabilitation Therapy, Speech Therapy, and Others), Type (Therapeutic, Diagnostic, and Mobility Assist), Indication (Cancer, Respiratory Diseases, Mobility Disorders, Cardiovascular Disorders, Wound Care, Diabetes, and Other), and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Mar 2025

- Report Code : TIPHE100000858

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 171

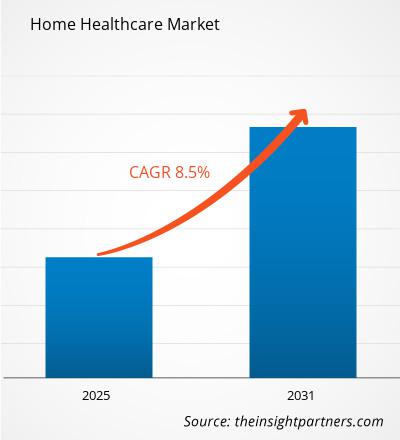

The home healthcare market size is projected to reach US$ 587.00 billion by 2031 from US$ 332.33 billion in 2024. The market is expected to register a CAGR of 8.5% during 2025–2031. The adoption of advanced technologies in homecare settings is likely to bring in new market trends during the forecast period.

Home Healthcare Market Analysis

Elderly individuals are more likely to suffer from chronic health issues, including heart disease, diabetes, hypertension, arthritis, and respiratory ailments. Home healthcare is essential for managing such chronic diseases by offering skilled nursing care, patient education, and training. For example, nurses can educate patients living with hypertension on how to monitor their blood pressure levels or help diabetic patients learn to use blood glucose meters. Home healthcare is more cost-effective than hospital care and minimizes the risk of healthcare-associated infections. It also promotes aging in place and fosters independence, which are crucial for ensuring a good quality of life for older adults.

With the global population aging, governments across the globe are acknowledging the significance of delivering comprehensive healthcare services to senior citizens, which includes care within the home. This awareness is leading to various initiatives and programs focused on enhancing the quality of life for older adults and encouraging healthy aging. For instance, in September 2024, the Centers for Medicare & Medicaid Services (CMS) published a report detailing the agency's analysis of the Acute Hospital Treatment at Home (AHCAH) program, which permits some Medicare-certified hospitals to provide inpatient-level treatment to patients at their homes. The Consolidated Appropriations Act (CAA), 2023, extended the waivers and flexibilities related to the AHCAH project until December 31, 2024, although the program was started under the COVID-19 public health emergency (PHE). Such initiatives benefit the well-being of seniors and increase the demand for home healthcare services.

Home Healthcare Market Overview

The growth of the market in the Asia Pacific region is owing to the growing prevalence of chronic disorders, increasing product approvals, increasing number of market players, developing healthcare infrastructure, and rising investments to bolster healthcare facilities. Increasing consumption of alcohol, obesity, lack of physical activity, and excess saturated fats in the diet are contributing to the growing prevalence of noncommunicable diseases (NCDs) such as heart disease, stroke, diabetes, cancers, and chronic respiratory diseases. As per the Centers for Disease Control and Prevention (CDC), approximately 82% of China’s disease burden is due to NCDs. In China, there are high levels of salt intake and tobacco use, which greatly increase the risk of heart attacks and stroke. In China, in 2020, there were 3.4 million new cases, 17.8 million prevalent cases, and 2.3 million deaths due to stroke. As per the Globocan 2022 report, lung cancer is the most common cancer in China. There were 1,060,584 cases of lung cancer in China in 2022. Thus, the growing prevalence of chronic diseases is likely to increase the demand for home healthcare services in China.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONHome Healthcare Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Home Healthcare Market Drivers and Opportunities

Cost-effectiveness of Home Healthcare Fuels Market Growth

Home healthcare is a more affordable option than standard inpatient facilities such as nursing homes and hospitals. According to Partnership for Quality Home Healthcare, a 30-day stay in a skilled nursing facility costs nearly US$ 16,500, while home healthcare costs ~US$ 2,010 for the same duration. Reduced rates of emergency room (ER) visits, readmissions, and hospital hospitalizations among patients receiving home-based care further increase these savings by preventing expensive and preventable accidents. As per the Partnership for Quality Home Healthcare, through its Home Health Value-Based Purchasing (HHVBP) Model, Medicare has saved nearly US$ 1.38 billion over six years in just nine states in the US. According to the Commonwealth Funds, when compared to typical hospital care, "hospital at home" programs have shown comparable outcomes and fewer problems at a cost of at least 30% less. Such programs are well established in countries such as England, Canada, and Israel, where payment policies encourage the provision of health care services in less costly venues. Thus, the cost-effectiveness of home healthcare services, coupled with increasing developments by the market players, contributes to the growing demand for these services.

Growing Government Support for Home Healthcare to Create Lucrative Opportunities in the Market

Government initiatives such as "National Programme for the Health Care of Elderly" (NPHCE) since 2010 prioritize the provision of primary, secondary, and tertiary healthcare facilities for people over 60. The scope of this program has been extended to geriatric primary and secondary care services, such as lab, physiotherapy, IPD, and OPD, across 713 health districts in India. Such initiatives benefit the well-being of seniors and increase the demand for home healthcare services. Government support also extends to financial assistance and insurance coverage for home healthcare services. In the United States, Medicaid and Medicare provide federal coverage for these services, while state-specific coverage varies. These government-funded initiatives increase the accessibility and affordability of home healthcare, which encourages older people and those with long-term illnesses to use it. Governments are also enforcing laws and quality control procedures to guarantee the efficacy and safety of home healthcare services. Better, intelligent, and healthier healthcare delivery is the main goal of the US Centers for Medicare & Medicaid Services' (CMS) Quality Strategy. Therefore, government initiatives to encourage the adoption of home healthcare services are expected to create opportunities for the service providers to expand their offerings and gain market share during the forecast period.

Home Healthcare Market Report Segmentation Analysis

Key segments that contributed to the derivation of the home healthcare market analysis are type, service, and indication.

- Based on the service, the home healthcare market is segmented into skilled nursing care, physical therapy, rehabilitation therapy, speech therapy, and others. The skilled nursing care segment held the largest share in the home healthcare market in 2024.

- By type, the home healthcare market is segmented into therapeutic, diagnostic, and mobility assistance. The therapeutic segment dominated the home healthcare market in 2024.

- According to indication, the home healthcare market is segmented into cancer, respiratory diseases, mobility disorders, cardiovascular disorders, wound care, diabetes, and others. The respiratory diseases segment dominated the home healthcare market in 2024.

Home Healthcare Market Share Analysis by Geography

The geographical scope of the home healthcare market report mainly focuses on five regions: North America, Asia Pacific, Europe, South & Central America, and the Middle East & Africa. In terms of revenue, North America dominated the global market in 2024 and is expected to continue its dominance during the forecast period. The US is the largest market for home healthcare in the world. The growth of the home healthcare market in the US is driven by the increasing adoption of advanced medical device technologies, growing digitalization of medical devices, increasing emphasis on improving treatment outcomes, and increasing prevalence of chronic diseases. Chronic diseases such as heart disease, cancer, and diabetes are the leading causes of death and disability in the US. As per the US Department of Health and Human Services, an estimated 129 million people in the US have at least one major chronic disease. As per the Centers for Disease Control and Prevention (CDC) 2024, chronic and mental diseases cost US$ 4.5 trillion in annual health care costs. Also, the increasing penetration of home healthcare services across the country is driving its adoption. For instance, in November 2024, Internal Healthcare Group, a new senior referral service, launched a virtual service to help connect seniors and families with quality care providers. Serving the US and Australia, they specialize in finding home health agencies, assisted living, independent living, and senior day centers that fit individual needs and budgets. In April 2024, the Food and Drug Administration (FDA) announced the launch of the Home as a Health Care Hub, a new initiative created to advance healthcare-at-home in the US and improve health equity.

Home Healthcare Market Regional Insights

The regional trends and factors influencing the Home Healthcare Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Home Healthcare Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Home Healthcare Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 332.33 Billion |

| Market Size by 2031 | US$ 587.00 Billion |

| Global CAGR (2025 - 2031) | 8.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Service

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Home Healthcare Market Players Density: Understanding Its Impact on Business Dynamics

The Home Healthcare Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Home Healthcare Market top key players overview

Home Healthcare Market News and Recent Developments

The home healthcare market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. Below are a few of the key developments witnessed in the home healthcare market:

- Enhabit, Inc., a leading provider of home health and hospice services, announced its acquisition of the home health agency from Southwest Florida Home Care, Inc., located in Fort Myers, Florida. This acquisition extended Enhabit's presence in Florida, bringing the total number of their home health locations in the state to 22. The new Fort Myers location enhanced Enhabit's capacity to serve the communities in southwest Florida. (Source: Enhabit Home Health & Hospice, December 2022)

- LHC Group, the Lafayette, Louisiana-based home health, hospice, and personal care services provider, announced it has signed a definitive agreement to form a new JV with University Health Care System, one of the largest, most comprehensive health care organizations in Georgia. (Source: LHC Group, Press Release, August 2020)

Home Healthcare Market Report Coverage and Deliverables

The "Home Healthcare Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Home healthcare market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Home healthcare market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Home healthcare market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the home healthcare market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For