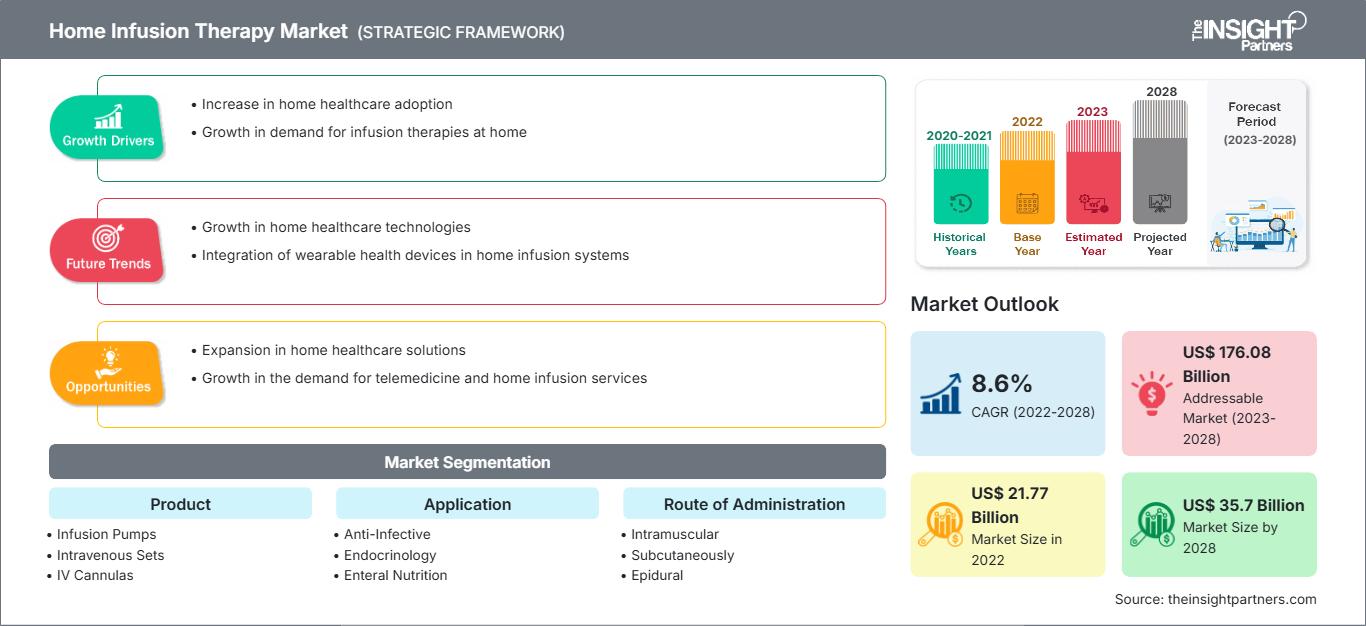

Home Infusion Therapy Market Drivers and Forecasts by 2028

Home Infusion Therapy Market Forecast to 2028 - Analysis By Product (Infusion Pumps, Intravenous Sets, IV Cannulas, and Needleless Connectors), Application (Anti-Infective, Endocrinology, Enteral Nutrition, Hydration Therapy, Chemotherapy, Specialty Pharmaceuticals, and Others), and Route of Administration (Intramuscular, Subcutaneously, and Epidural)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2028- Report Date : Feb 2023

- Report Code : TIPRE00004189

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 221

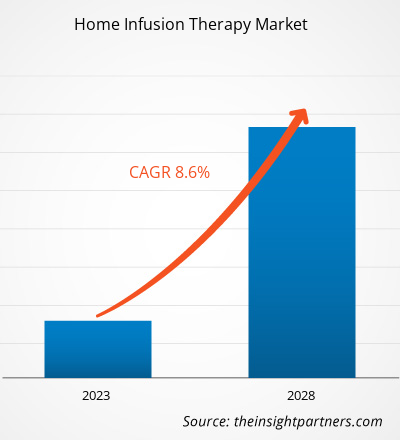

[Research Report] The home infusion therapy market is expected to grow from US$ 21,765.95 million in 2022 to US$ 35,696.05 million by 2028; it is estimated to record a CAGR of 8.6% from 2022 to 2028.

Market Insights and Analyst View:

Home infusion therapy involves the intravenous or subcutaneous administration of drugs or biologicals to an individual at home. The components needed to perform home infusion include the drug (antivirals, immune globulin), equipment (a pump), and supplies (tubing and catheters). The home infusion process typically requires coordination among multiple entities, including patients, physicians, hospital discharge planners, health plans, home infusion pharmacies, and, if applicable, home health agencies. The increasing incidences of chronic disorders and rising geriatric population are boosting the home infusion therapy market growth.

Growth Drivers and Challenges:

Chronic disorders such as cardiovascular, nutritional, and gastrointestinal disorders, rheumatoid arthritis, and neurological disorders affect the overall quality of life. According to the World Health Organization (WHO), over 50% of the global population is estimated to suffer from at least one chronic disease. The Centers for Disease Control and Prevention (CDC) stated that 6 out of 10 people in the US suffered from at least one chronic disease in 2019. According to the “Worldwide Prevalence and Burden of Functional Gastrointestinal Disorders, Results of Rome Foundation Global Study,” a large-scale multinational study published in 2021, ~40% of 73,076 adults surveyed from 33 countries in the world were suffering from a functional gastrointestinal disorder (GFID). Age-related gastrointestinal problems are more common in the elderly population, aged 64 and above. Per the study titled “Gastrointestinal problem among Indian adults: Evidence from Longitudinal Aging Study in India”, published in 2022, self-reported gastrointestinal disorders prevalence was reported at ~18%. The study also mentions that varying rates of gastrointestinal problems have been observed across the world, ranging from 14% in Iran to 54% in some western countries.

Cardiovascular diseases (CVDs), especially the cases associated with hectic lifestyles, are a significant cause of mortality globally. According to the International Diabetes Federation (IDF), 537 million people worldwide, aged 20–79, had diabetes in 2021, and the number is estimated to rise to 783 million by 2045. Additionally, diabetes was the cause of 6.7 million deaths worldwide in 2021. According to the Neurological Alliance, ~14.7 million neurological cases were registered in 2019, with at least 1 in 6 people suffering from 1 or more neurological conditions.

Aging can cause a consistent loss of physiological integrity, resulting in a reduction in functionality and an increased risk of mortality. The degradation of body function is a key risk factor for contracting the majority of chronic diseases, including diabetes, CVD, and neurological diseases, among elderly patients. According to the Global Ageing Survey 2019, the frequency of a person aged 65 or above is likely to increase from 1 in every 11 inhabitants in 2019 to 1 in every 6 inhabitants by 2025. As per the US Census Bureau, the number of Americans with age 65 and above is anticipated to double from 46 million in 2016 to over 98 million by 2060, and the share of the elderly population in the global population will increase from 15% to ~24% in the same period. Moreover, except in Africa, the pace of aging will be high in all regions, having nearly a quarter or more of their population aged 60 and above by 2050. Thus, the rising incidence of chronic conditions, coupled with the growing geriatric population, drives the growth of the home infusion therapy market.

However, In the last few years, medical agencies have received many reports of adverse events involving infusion pumps which led to product recalls. The main reason for infusion pump product recalls are software-related problems, user interface issues, and mechanical and electrical failures. For instance, In April 2022, Smiths Medical recalled more than 118,000 Medfusion syringe infusion pumps (model-3500 and 4000) due to software malfunction, causing serious patient harm or death because of under or over-infusion, or delayed delivery of critical medications to patients. It caused about seven serious injuries and one death. Similarly, In December 2020, the FDA announced the Class 1 recall of more than half a million Baxter Sigma infusion pumps due to a defective alarm that caused 3 patient deaths and 51 serious injuries. Thus, the safety concerns associated with home infusion procedures and recalls of infusion pumps hinder the growth of the home infusion therapy market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONHome Infusion Therapy Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The global home infusion therapy market is segmented based on product, application, end user, and geography. Based on product, the home infusion therapy market is segmented into infusion pumps, intravenous sets, IV cannulas, and needleless connectors. The infusion pumps segment is sub-segmented into insulin pumps, elastomeric pumps, and syringe pumps. Based on Application, the home infusion therapy market is segmented into anti-infective, endocrinology, enteral nutrition, specialty pharmaceuticals, hydration therapy, chemotherapy, and others. Based on route of administration, the home infusion therapy market is segmented into intramuscular, subcutaneously, and epidural.

The global home infusion therapy market based on geography is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Spain, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America)

Segmental Analysis of the Global Home Infusion Therapy Market:

Based on product, the home infusion therapy market is segmented into infusion pumps, intravenous sets, IV cannulas, and needleless connectors. In 2022, the infusion pumps segment accounted for the largest market share. Also, the same segment is anticipated to register the highest CAGR during the forecast period as infusion pumps are widely used to provide nutrition and administer medications to patients, including high-risk medications. The market for the infusion pumps segment is sub-segmented into insulin pumps, elastomeric pumps, and syringe pumps. In 2022, the insulin pumps segment accounted for the largest market share.

Based on application, the home infusion therapy market is segmented into anti-infective, endocrinology, enteral nutrition, specialty pharmaceuticals, hydration therapy, chemotherapy, and others. The anti-infective segment held the largest share of the market in 2022. The endocrinology segment is expected to grow at the highest CAGR.

Based on route of administration, the home infusion therapy market is segmented into intramuscular, subcutaneously, and epidural. In 2022, the intramuscular segment held the largest share of the home infusion therapy market, and it is also expected to register the highest CAGR. Factors such as rapid onset of the action of the medication with no gastric problems fuels the intramuscular segment growth.

Regional Analysis:

Based on geography, the global home infusion therapy market is segmented into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. In 2022, North America held the largest share of the global home infusion therapy market size, and Asia Pacific is estimated to register the highest CAGR during the forecast period. In North America, the U.S. is the largest market for home infusion therapy.

Asia Pacific is expected to account for the fastest growth in the global home infusion therapy market. China held the largest market share in 2022, and India is expected to register a significant CAGR in the market. The market growth in these countries is attributed to the increasing prevalence of chronic diseases, the rising geriatric population, the growing presence of home infusion therapy providers, and the rising number of government initiatives. For instance, the Chinese government has adopted Healthy China 2030 to facilitate healthcare services within the nation while delivering great benefits worldwide. The population in the country is more prone to infectious, chronic, and acute diseases. China faces a high burden of lung cancer, colorectal cancer, esophageal cancer, heart disease, and diabetes. Healthcare providers often recommend IV-based therapies and drug administration for the treatment of cancer, infections, and other diseases, thus driving the home infusion therapy market growth.

As per the World Health Organization (WHO), China has a high prevalence rate of diabetes, as more than 10% of the total population in China is suffering from diabetes. Also, as per the WHO, by 2040, ~402 million people (28% of the total population) will be over the age of 60. Thus, the rising geriatric population and the growing prevalence of metabolic risk factors are increasing the burden of CVDs and diabetes across the country. This is generating requirements for the application of home infusion therapies for drug administration and IV therapies in China. Further, the growing presence of local key players is boosting the growth of the home infusion therapy market in China. Manufacturers are focusing on expanding their strategic global presence and specialized expertise with exclusive technological capabilities, leading to the expansion of the home infusion therapy market in China. Hence, the rise in the prevalence of diabetes and chronic diseases, the increase in the geriatric population, and the surge in the number of regional players are expected to propel the growth of the home infusion therapy market in China during the forecast period.

Home Infusion Therapy Market Regional InsightsThe regional trends and factors influencing the Home Infusion Therapy Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Home Infusion Therapy Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Home Infusion Therapy Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 21.77 Billion |

| Market Size by 2028 | US$ 35.7 Billion |

| Global CAGR (2022 - 2028) | 8.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Home Infusion Therapy Market Players Density: Understanding Its Impact on Business Dynamics

The Home Infusion Therapy Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Home Infusion Therapy Market top key players overview

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global home infusion therapy market are listed below:

- In January 2023, Eitan Medical announced the opening of its new manufacturing facility at the company’s headquarters. On-site manufacturing will support Eitan Medical’s production scale of its Pharmaceutical Solutions division. The facility will manufacture the Sorrel wearable drug delivery platform across multiple device configurations, including Sorrel vial- and cartridge-based wearable injectors, pre-filled and pre-loaded in primary containers up to 50ml, as well as small volume on-body injectors.

- In May 2022, Fresenius Kabi completed the acquisition of Ivenix, a manufacturer of infusion systems. Fresenius Kabi now offers health care professionals in the United States a broad and expanding portfolio of advanced infusion pumps and solutions to meet needs across the continuum of care.

- In January 2022, ICU Medical Inc announced that it has completed its acquisition of Smiths Medical from Smiths Group plc. The Smiths Medical business includes syringe and ambulatory infusion devices, vascular access, and vital care products. When combined with ICU Medical’s existing businesses, the combined companies create a leading infusion therapy company with estimated pro forma combined revenues of approximately $2.5 billion.

- In June 2021, Micrel Medical Devices announced the expansion of their global presence with the announcement of a new distribution partnership with Baxter in Australia and New Zealand for the Rythmic PN+, ambulatory Infusion pump for Home Parenteral Nutrition.

- In June 2021, Micrel Medical and Baxter Healthcare (Baxter) announced an agreement for the distribution of the Micrel Mini Rythmic PN+ infusion pump for Parenteral Nutrition (PN). Micrel Mini Rythmic PN+ is an ambulatory infusion pump supporting patients with Hospital-in-the-Home Parenteral Nutrition. As part of the agreement, Baxter Healthcare will be the sole distributor of the Micrel Mini Rythmic PN+ infusion pump and its accessories across ANZ.

Competitive Landscape and Key Companies:

There are various prominent players operating in the global home infusion therapy market. Some top home infusion companies are B. Braun Melsungen AG, Micrel Medical Devices SA, Baxter International Inc, Nipro Corp, Becton Dickinson and Co, Fresenius Kabi AG, ICU Medical Inc, JMS Co Ltd, Eitan Medical Ltd, and Terumo Corp, among others. These companies focus on various new product developments and geographical expansions. This helps them to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. They have a widespread global presence which allows them to serve a large set of customers. Also, it offers opportunity to increase their market share.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For