Hospital Bed Market Growth Opportunities and Forecast by 2028

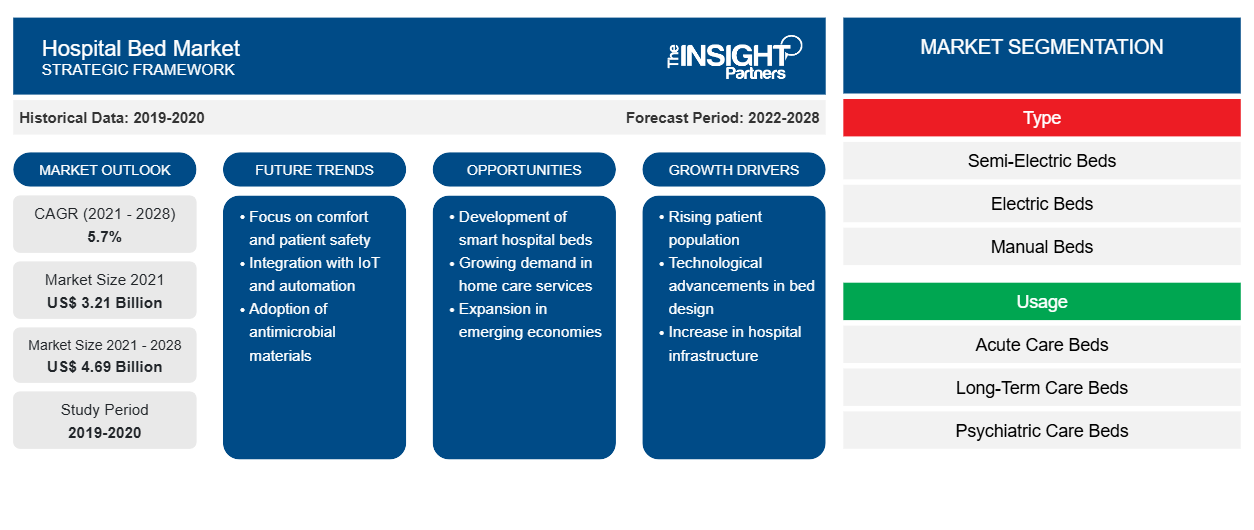

Hospital Bed Market Forecast to 2028 - Analysis By Type (Semi-Electric Beds, Electric Beds, and Manual Beds), Usage (Acute Care Beds, Long-Term Care Beds, Psychiatric Care Beds, and Others), Application (Non-Intensive Care Beds and Intensive Care Beds), and End User (Hospitals & Clinics, Elderly Care Facilities, Ambulatory Surgical Centers, and Home Care Settings)

Historic Data: 2019-2020 | Base Year: 2021 | Forecast Period: 2022-2028- Report Date : Aug 2022

- Report Code : TIPRE00029326

- Category : Consumer Goods

- Status : Published

- Available Report Formats :

- No. of Pages : 201

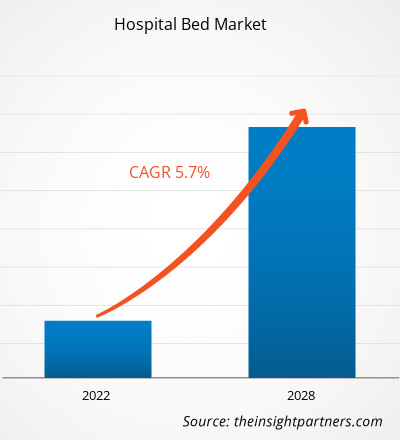

The hospital bed market is expected to grow from US$ 3,214.96 million in 2021 to US$ 4,688.96 million by 2028; it is estimated to grow at a CAGR of 5.7% from 2022 to 2028.

The rising prevalence of chronic diseases and growing preference for highly equipped hospital beds with innovative features are driving the overall market growth. Further, home healthcare services for the geriatric population and postoperative care provide lucrative opportunities to the market players.

According to the National Health Council report, ~40 million Americans face constraints in their routine activities as they suffer from one or more chronic health conditions. Incurable chronic diseases affect ~133 million Americans, representing more than 40% of the total population as per the published report in 2019. Many people are living with one or more chronic illnesses, such as diabetes, heart disease, or depression, but with two or more conditions. Such a high prevalence of chronic diseases may result in a greater requirement for hospitalization, which drives the demand for hospital beds. According to the estimates presented in a report by the Department of Health & Children, ~80% of the general practitioners’ (GP) consultations and 60% of hospital bed requirements are related to chronic disease cases with associated complications. As per a report by the Data and Digital Health Unit, acute care hospital beds are available for curative care, accounting for 100,000 beds per population in Europe. Patients are accommodated on these beds for managing labor (obstetrics), curing nonmental illness or providing definitive treatments to injuries, performing surgeries, and relieving symptoms of nonmental illnesses, among others. ~75% of the healthcare expenditure is allocated to managing chronic diseases every year in the US. According to estimates provided in the Department of Health & Children report, ~8 of the top 11 causes of hospitalizations in the UK are associated with chronic diseases, and 5% of the inpatients are aligned with long-term conditions, occupying ~42% of hospital beds.

Diabetes and heart diseases, among other chronic conditions, are the leading causes of death and disability in the US. For example, in 2019, obesity and high blood pressure were the most common chronic conditions in California, which affected more than one in four adults in the state. Moreover, hospital admission rates were high among people suffering from chronic conditions, accounting for 700 hospitalizations per 100,000 people in California. Thus, the growing prevalence of chronic conditions is favoring the overall growth of the global hospital bed market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONHospital Bed Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

The bedsores or pressure sores associated with hospital bed act as a major restraint for the hospital bed market. According to an NIH report, decubitus ulcer is a common and serious problem among inpatients lying on hospital beds for long durations. For example, if a patient is in sleep mode for a long time and the pressure of their body weight crosses a certain point, it results in bruises and ultimately incurable wounds. Therefore, hospital staff has to rotate these patients on their beds regularly to prevent ulcer formation. Bedsores rank third among the costliest disorders, after cancer and cardiovascular disease globally. For instance, according to estimates provided in the NIH report, bedsore wounds affect more than 3 million adults globally. Furthermore, acute care and longer-term rehabilitation facilities struggle with risks associated with bedsores among in-patient admissions. For example, as stated in the NursingHomeAbuseGuide.org report, not less than 150,000 patients or residents in the US would experience pressure sores (some stages) in the coming years.

Regional Overview

Europe holds the largest share of the global hospital bed market. Among the EU Member States, Germany records the highest number of hospital beds, with considerable revenue and growth. Recent OECD 2020 data confirms that Germany has the highest number of ICU beds. Before the onset of the pandemic, Germany had 28,000 intensive care beds, i.e., more than most of its neighboring countries. During the first SARS-CoV-2 pandemic wave (as of April 18, 2020), 12,336 ICU beds (or 41% of the available ICU beds capacity) were still vacant in the country. To manage this health crisis, the German government emphasized primary and secondary prevention, and adding beds to existing ICU capacity was undertaken as a tertiary prevention measure. The German government added ~7,000 beds as of April 27, 2020. The hospital bed market in the UK is expected to grow with the rising number of surgeries, including cardiac, orthopedic, and trauma surgeries.

Type-Based Insights

Based on type, the global hospital bed market is segmented into semi-electric, electric, and manual. The electric bed segment is estimated to register the highest CAGR from 2022 to 2028. Electric Beds are gaining high traction in the market. These beds also feature an optional therapeutic massage function for bed-bound patients managed by remote control, which aids in circulation and helps prevent bedsores and joint pain. The function is enabled as an inbuilt feature in the mattress. Moreover, caregivers and patients don’t need to make frequent adjustments or worry about losing support during the night. In August 2022, Hāwera Hospital purchased 20 new beds from the M9 range of Howard Wright, which is a Taranaki-based medical bed designer and manufacturer. With the help of these beds, hospital staff could make patients feel more comfortable, eliminating the need for lifting them. The M9 beds provide full electric controls for their adjustments to various heights and positions. Zenith9100, Invacare Full-Electric Homecare Bed, and DELTA 4 range are among other electric hospital beds available in the market.

Companies operating in the global hospital bed market adopt the product innovation strategy to meet the evolving customer demands across the world, which also permits them to maintain their brand name in the market.

Hospital Bed Market Regional InsightsThe regional trends and factors influencing the Hospital Bed Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Hospital Bed Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Hospital Bed Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 3.21 Billion |

| Market Size by 2028 | US$ 4.69 Billion |

| Global CAGR (2021 - 2028) | 5.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Hospital Bed Market Players Density: Understanding Its Impact on Business Dynamics

The Hospital Bed Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Hospital Bed Market top key players overview

Global Hospital Bed Market – Segmentation

Based on type, the global hospital bed market is segmented into semi-electric beds, electric beds, and manual beds. The semi-electric beds segment accounted for the largest market share in 2021. However, the electric beds segment accounts for registering the highest CAGR from 2022 to 2028. Based on usage, the global hospital bed market is segregated into acute care beds, long-term care beds, psychiatric care beds, and others. The acute care beds segment led the market in 2021 and is expected to retain its dominance during the forecast period. Based on application, the global hospital bed market is bifurcated into non-intensive care beds and intensive care beds. The non-intensive care beds segment led the market in 2021 and is expected to retain its dominance during the forecast period. Based on end user, the market is segregated into hospitals & clinics, elderly care facilities, ambulatory surgical centers, and home care settings. Based on geography, the global hospital bed market is primarily segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America.

Company Profiles

- Hill-Rom Holdings, Inc. (Baxter)

- Stryker

- Arjo

- Invacare Corporation

- PARAMOUNT BED CO., LTD.

- GF Health Products, Inc.

- Malvestio SpA

- Span America (Savaria Corporation)

- Savion Industries

- Stiegelmever GmbH & Co. KG.

- Medstrom

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For