Hot Tub Chemicals for Residential Application Market Size, Growth & Demand by 2034

Hot Tub Chemicals for Residential Application Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Balancers, Oxidizers, Sanitizers, and Others) and Geography

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Apr 2026

- Report Code : TIPRE00019853

- Category : Chemicals and Materials

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

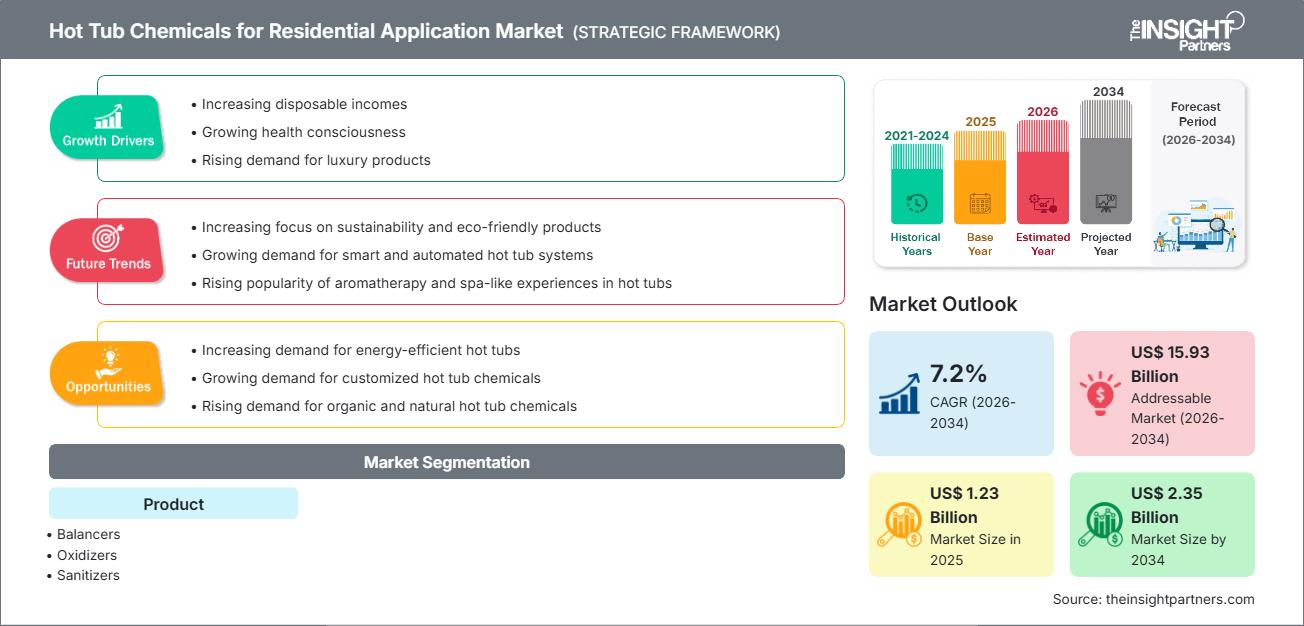

The global hot tub chemicals for residential application market size is projected to reach US$ 2.35 billion by 2034 from US$ 1.23 billion in 2025. The market is anticipated to register a CAGR of 7.2% during the forecast period 2026–2034. Key market dynamics include rising homeownership of hot tubs and spas, growing emphasis on water, sanitation, and skin-friendly formulations, and a shift toward eco-conscious, low-chlorine alternatives. Additionally, the market is expected to benefit from e-commerce expansion for DIY maintenance kits, premiumization in smart-home spa integrations, and increasing demand in wellness-focused suburbs.

Hot Tub Chemicals for Residential Application Market Analysis

The hot tub chemicals for residential application market indicates a shift toward products that are easier to use and more multifunctional, with homeowners placing a high priority on ease of use, safety, and the use of environmentally safe products. For procurement trends, the HTC Product market is bifurcating into Traditional Chlorine/Bromine Kits versus High Growth Enzyme-Based or Mineral Systems. As the market continues to expand, additional strategic opportunities exist in Smart Dispensing Devices (automated dosing) and Hypoallergenic Lines for users with sensitive skin. The future growth of the HTC Market will depend on the establishment of stable supply chains for the two key actives in the HTC Market, Dichlor (Dichloroisocyanuric Acid) and Potassium Monopersulfate (Potassium Permanganate), as well as the introduction of Recyclable Packaging for HTC Products. Competitive advantage can be achieved through branding emphasizing odorless, quick-dissolving tablets and traceability to Purely-Sourced Ingredients.

Hot Tub Chemicals for Residential Application Market Overview

Hot tub chemicals for residential applications are evolving from basic sanitizers to comprehensive wellness kits. Chlorine granules and Bromine tabs as sanitizers have always been used to control bacteria in spa and pool water, but today their use has expanded to include pH balancers, clarifiers, shock treatments and natural enzyme formulations. Both small-batch formulators and large multinational companies are using bio-based oxidisers to market themselves as environmentally friendly. As consumers in North America and Europe become more aware of health issues related to water quality, they tend to prefer low-irritant synthetic chemicals over traditional pool sanitising chemicals. The North American market has the largest penetration of units across the globe, while urbanisation is causing an incredible increase in market size travel significantly larger than current hot tub ownership levels in the Asia Pacific region.

For instance, the North America market is the largest globally, driven by widespread use of residential hot tubs, disposable income levels, and strong cultural associations with wellness, all contributing to this title. As the demand for skin-friendly, low-maintenance product formulations and mineral and enzyme-based systems continues to grow, the use of smart dispensers and subscription services that deliver sanitising products to consumers’ doorsteps is increasing. Despite the demand for smart dispensers and subscription services, sanitising products remain the largest category of product sales.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONHot Tub Chemicals for Residential Application Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Hot Tub Chemicals for Residential Application Market Drivers and Opportunities

Market Drivers:

- Ease of Use and Home Wellness Boom: Compact tablets and liquid kits simplify maintenance for 8+ million US hot tubs, driven by post-pandemic backyard escapes and remote work lifestyles.

- Regulatory Push for Safer Formulations: Stricter EPA guidelines on VOC emissions boost demand for bromine and biguanide systems over high-chlorine alternatives.

- E-commerce and Subscription Models: Direct-to-consumer platforms like Amazon enable recurring deliveries of customized kits, accelerating adoption in suburban markets.

Market Opportunities:

- Smart Tech Integration: Pairing chemicals with app-controlled dispensers for real-time pH/ORP monitoring targets tech-savvy millennials.

- Eco-Friendly Expansion in APAC: Partnerships with Asian spa brands can unlock demand for phosphate-free and biodegradable options in humid climates.

- Specialty Certifications: Organic and dermatologist-tested labels open doors to allergy-prone segments, as seen in recent US retail successes.

Hot Tub Chemicals for Residential Application Market Report Segmentation Analysis

The Hot Tub Chemicals for Residential Application Market share is analyzed across various segments to provide a clearer understanding of its structure, growth potential, and emerging trends. Below is the standard segmentation approach used in most industry reports:

By Product:

- Balancers: Fast-growing niche for pH, alkalinity, and stabilizer control, preferred by users seeking precise water chemistry to prevent corrosion or scaling.

- Oxidizers: High-demand for non-chlorine shocks like MPS, clearing organics, and boosting sanitizer efficiency in frequent-use residential tubs.

- Sanitizers: Dominant volume leader (chlorine/bromine), essential for daily bacterial control due to cost-effectiveness and proven reliability.

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

The regional trends influencing the Hot Tub Chemicals for Residential Application Market have been analyzed across key geographies.

Hot Tub Chemicals for Residential Application Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 1.23 Billion |

| Market Size by 2034 | US$ 2.35 Billion |

| Global CAGR (2026 - 2034) | 7.2% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Hot Tub Chemicals for Residential Application Market Players Density: Understanding Its Impact on Business Dynamics

The Hot Tub Chemicals for Residential Application Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Hot Tub Chemicals for Residential Application Market Share Analysis by Geography

Asia-Pacific is expected to grow fastest in the coming years. Emerging markets in South & Central America, the Middle East, and Africa also hold untapped potential for affordable sanitizer kits and portable spas.

The hot tub chemicals for residential application market are transforming from commodity inputs to essential wellness accessories. Growth stems from surging residential hot tub installs (up 20% globally since 2022), demand for odorless/low-maintenance options, and eco-regulations. Below is a summary of market share and trends by region:

North America

- Market Share: Largest globally, propelled by 7M+ US hot tubs and premium backyard trends.

- Key Drivers:

- High disposable incomes fund automated chemical feeders.

- Retail giants like Home Depot are stocking multifunctional kits.

- Wellness culture emphasizing skin-safe, non-drying formulas.

- Trends: Rise of mineral-based systems (e.g., MPS + silver ions) and subscription services for winterized spas.

Europe

- Market Share: Strong second, led by UK/Germany's compact spa adoption.

- Key Drivers:

- EU REACH compliance favors low-phosphate products.

- Energy-efficient hot tubs need precise chemical balances.

- Popularity of bromine for indoor/outdoor versatility.

- Trends: Shift to biodegradable enzymes and refill stations to cut plastic waste.

Asia-Pacific

- Market Share: Fastest-growing, driven by urban spas in China/Japan.

- Key Drivers:

- Rapid middle-class expansion and balcony hot tub sales.

- E-commerce boom for imported kits.

- Humid climates demand anti-algae oxidizers.

- Trends: B2C platforms pushing natural plant-based sanitizers for beauty spas.

South and Central America

- Market Share: Emerging, with Brazil and Chile leading residential installs.

- Key Drivers:

- Tropical weather spurring shock treatment demand.

- Affordable chlorine imports fueling mass adoption.

- Wellness tourism influencing home use.

- Trends: Local brands offering value kits with natural clarifiers.

Middle East and Africa

- Market Share: Nascent but rising, tied to luxury villa spas.

- Key Drivers:

- Harsh climates need stabilized sanitizers.

- Expat-driven premium imports.

- Water scarcity is pushing efficient dosing.

- Trends: Solar-powered dispensers paired with salt systems.

High Market Density and Competition

Competition intensifies with leaders like Arch Chemicals (Lonza), BioGuard, and Leisure Time. Niche innovators such as Natural Chemistry and SpaPure, plus regional players like CMP and Robarb, diversify the landscape.

This environment drives differentiation via:

- Premiumization branding low-odor, fast-acting formulas superior to pool chemicals for skin/respiratory health.

- Product diversification into enzyme cleaners, natural shocks, and test-strip bundles, with sanitizers, balancers, and oxidizers.

- Vertically integrated supply from raw synthesis to tablet pressing, ensuring purity and ethical sourcing.

- Tech like foam-free polymers and UV-stabilized actives for long-life powders.

Opportunities and Strategic Moves

- Partner with e-tailers and smart-home brands to capture DIY demand in North America/Asia-Pacific.

- Adopt sustainable packaging and plant-derived actives to attract eco-buyers.

Major Companies operating in the Hot Tub Chemicals for Residential Application Market are:

- Leisurechem

- Online Pool Chemicals

- Clever Company

- Splash Perfect

- Phoenix Products Co.

- Canadian Spa Company

Disclaimer: The companies listed above are not ranked in any particular order.

Hot Tub Chemicals for Residential Application Market News and Recent Developments

- In January 2026, Aiper announced its participation with the Pool & Hot Tub Alliance (PHTA) at The Pool & Spa Show 2026. The partnership represents a major milestone for Aiper, enhancing its ties with the professional community while reaffirming its commitment to innovation, education, and professional growth in the pool and spa industry, as well as residential applications.

- In June 2025, Solenis and NCH Corporation announced they had entered into a definitive agreement to merge the NCH business with Solenis. Under the terms of the agreement, Solenis will acquire 100% of NCH stock, creating a more diversified, customer-centric provider of water and hygiene solutions, which includes sanitizers and other residential applications.

Hot Tub Chemicals for Residential Application Market Report Coverage and Deliverables

The "Hot Tub Chemicals for Residential Application Market Size and Forecast (2021–2034)" report provides a detailed analysis of the market covering below areas:

- Hot Tub Chemicals for Residential Application Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Hot Tub Chemicals for Residential Application Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Hot Tub Chemicals for Residential Application Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Hot Tub Chemicals for Residential Application Market.

- Detailed company profiles

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For