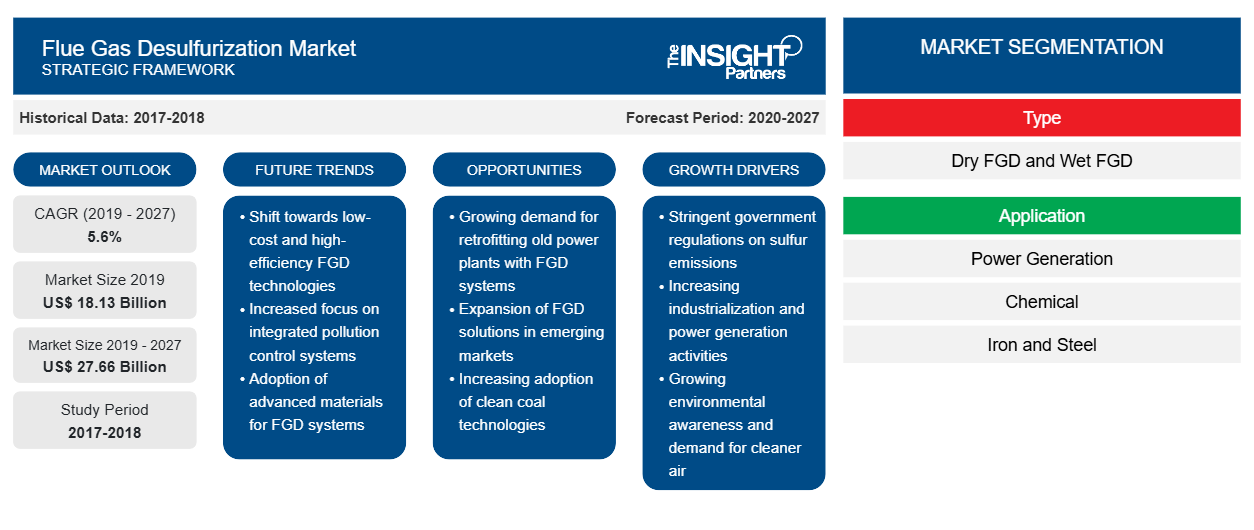

Flue Gas Desulfurization Market Dynamics and Trends by 2027

Flue Gas Desulfurization Market Forecast to 2027 - Analysis By Type (Dry FGD and Wet FGD) and Application (Power Generation, Chemical, Iron and Steel, Cement Manufacturing, and Others)

Historic Data: 2017-2018 | Base Year: 2019 | Forecast Period: 2020-2027- Report Date : Jan 2021

- Report Code : TIPRE00016430

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 152

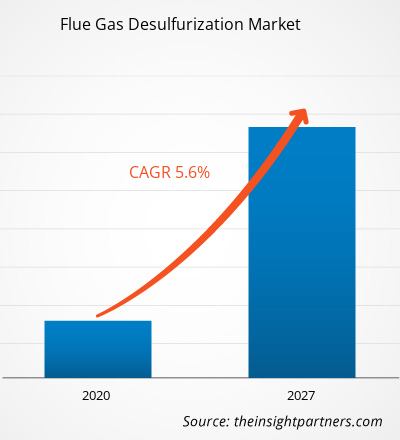

The flue gas desulfurization market was valued at US$ 18,128.01 million in 2019 and is projected to reach US$ 27,655.04 million by 2027; it is expected to grow at a CAGR of 5.6% from 2020 to 2027.

Flue gas desulfurization is a system that has a set of technologies used to remove sulfur dioxide (SO2) from the flue gases, which are emitted from power plants. The stringent environmental regulations mostly focusing on controlling the excessive SO2 emissions are likely to increase the demand for flue gas desulfurization systems. The demand for flue gas desulfurization is rising across diversified end-use industries. Further, rapid industrialization and strategic initiatives taken by the manufacturers are expected to proliferate the growth of the market. Additionally, technological advancements in the designing of FGD systems are expected to provide ample opportunities for market growth.

In 2019, APAC held the largest share of the global flue gas desulfurization market. The growth of the market in this region is primarily attributed to the increasing demand from the power generation industry and stringent regulations in the region. The power generation industry accounts for the highest consumption of FGD in APAC. Cement and chemicals industries in APAC are exhibiting tremendous developments which is expected to promote the demand for flue gas desulfurization systems during the forecast period.

As of December 2020, the US, India, Brazil, Russia, France, UK, Italy, Spain, Argentina, Colombia, Germany, and Mexico are among the worst-affected countries in terms confirmed COVID-19 cases and reported deaths. The COVID-19 pandemic has been affecting economies and industries in various countries due to lockdowns, travel bans, and business shutdowns. The chemicals & materials industry is one of the major industries facing serious disruptions such as office and factory shutdown, and supply chain breaks; as a result of this outbreak, the growth of the flue gas desulfurization market is being negatively impacted.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONFlue Gas Desulfurization Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Increasing Demand from Power & Energy Sector

Power facilities are the most extensive generators of SO2, which may cause acid rain. Sulfur is one well-known element found in coal. When combusted, the sulfur in coal converts into sulfur dioxide. When sulfur dioxide combines with moisture in clouds, it forms acid rain. Adding sodium-based exhaust gases lessens SO2 emissions by 98%. In the FGD systems, reductions of the discharges by the amount of 98% have become the most common type of technology used in bituminous and coal-fired power plants.

According to the International Energy Agency, the coal-fired power plants produce about 37% of the globe's electricity, making them the largest single electricity generation source worldwide. However, such plants are bound to release pollutants, especially sulfur, which deteriorates the quality of environment. SO2 is usually formed by combusting fossil fuels and by the smelting of mineral ores that contain sulfur. Acid rain can cause deforestation, corrode building materials and paints, and acidify waterways to harm aquatic life. Therefore, the government has proposed stringent policies to control emissions of particulate matter (PM), SO2, nitrogen oxides, and mercury by coal-based thermal power plants. The new rules are expected to cut SO2 emissions by 90%, PM emissions by 25%, nitrogen oxides by 70%, and mercury by 75% from new thermal plants. The growing focus toward reducing the pollutants arising from power generation sector has significantly driven the demand for setting up flue gas desulfurization systems.

Type-Based Insights

Based on type, the flue gas desulfurization market is categorized into dry FGD and wet FGD. The wet FGD segment dominated the flue gas desulfurization market in 2019. Wet flue gas desulfurization processes are mostly based on the concept of absorbing sulfur dioxide in absorption liquor or caustic suspension. The wet FGD is in demand has it provides higher efficiency in the removal of SOx than the dry FGD. The wet FGD also provides lower operating cost and more fuel flexibility. Besides, the wet FGD systems use limestone as a reagent, and the by-product is gypsum, which can be marketed to cement and wallboard manufacturers and the fertilizer industry.

Application-Based Insights

Based on application, the flue gas desulfurization market is segmented into power generation, chemical, iron and steel, cement manufacturing, and others. The power generation segment led the flue gas desulfurization market in 2019. Across the world, over 75% of electricity is being produced from the thermal power plant. Coal comprises sulfur in the range of 0.3% to 1% that differs depending upon the origin of location. Sulfur present in the coal after reaction forms sulfur dioxide (SO2), which is toxic to the atmosphere. To save the environment from such toxins, several countries in Europe as well as the US have implemented strict policies regarding reducing sulfur dioxide discharge. Consequently, power plants are installing flue gas desulfurization (FGD) plants or units mainly to lower the sulfur dioxide in the environment. Flue gas desulfurization refers to the process of removing sulfur oxides from the flue. The coal-fired power plants are the largest source of power generation globally and account for nearly 37% of the world’s electricity, as per the International Energy Agency. They are implementing strict measures by installing FGD systems in the plants to prevent the emission of harmful gases. Therefore, the factors such as stringent rules and regulations set by multiple federal governments, improving FGD technologies to increase absorption efficiency, high demand for electricity, and growing number of coal-fired power plants in emerging nations are expected to boost the growth of the flue gas desulfurization market.

Chiyoda Corporation; Ducon; General Electric; S.A Hamon; Mitsubishi Heavy Industries, Ltd.; Rafako S.A; Valmet; Doosan Lentjes; Babcock and Wilcox Enterprises, Inc.; and Marsulex Environmental Technologies are among the key players operating in the flue gas desulfurization market. Major players in this market focus on strategies such as mergers and acquisitions, and product launches to increase their geographic presence and consumer base. For instance, in December 2016, MET and Sanders Lead Company Inc. entered into a contract for the supply of MET’s proprietary ammonium sulfate flue gas desulfurization (AS-FGD) system at Troy, Alabama, a lead smelter and battery reclamation facility. In January 2016, Valmet signed a contract with CIECH Soda Polska S.A for the supply of FGD to Soda Polska’s Janikowo combined heat and power plant in Poland.

Flue Gas Desulfurization Market Regional InsightsThe regional trends and factors influencing the Flue Gas Desulfurization Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Flue Gas Desulfurization Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Flue Gas Desulfurization Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 18.13 Billion |

| Market Size by 2027 | US$ 27.66 Billion |

| Global CAGR (2019 - 2027) | 5.6% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Flue Gas Desulfurization Market Players Density: Understanding Its Impact on Business Dynamics

The Flue Gas Desulfurization Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Flue Gas Desulfurization Market top key players overview

Report Spotlights

- Progressive industry trends in the global flue gas desulfurization market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the global flue gas desulfurization market from 2017 to 2027

- Estimation of the demand for flue gas desulfurization across various industries

- PEST analysis to illustrate the efficacy of buyers and suppliers operating in the industry to predict market growth

- Recent developments to understand the competitive market scenario and the demand for flue gas desulfurization

- Market trends and outlook coupled with factors driving and restraining the growth of the flue gas desulfurization market

- Decision-making process by understanding strategies that underpin commercial interest with regard to global flue gas desulfurization market growth

- Flue gas desulfurization market size at various nodes of market

- Detailed overview and segmentation of the global flue gas desulfurization market as well as its dynamics in the industry

- Flue gas desulfurization market size in various regions with promising growth opportunities

Global Flue Gas Desulfurization Market, By Type

- Dry FGD

- Wet FGD

Global Flue Gas Desulfurization Market, By Application

- Power Generation

- Chemical

- Iron and Steel

- Cement Manufacturing

- Others

Company Profiles

- Chiyoda Corporation

- Ducon

- General Electric

- S.A Hamon

- Mitsubishi Heavy Industries, Ltd.

- Rafako S.A

- Valmet

- Doosan Lentjes

- Babcock and Wilcox Enterprises, Inc.

- Marsulex Environmental Technologies

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For