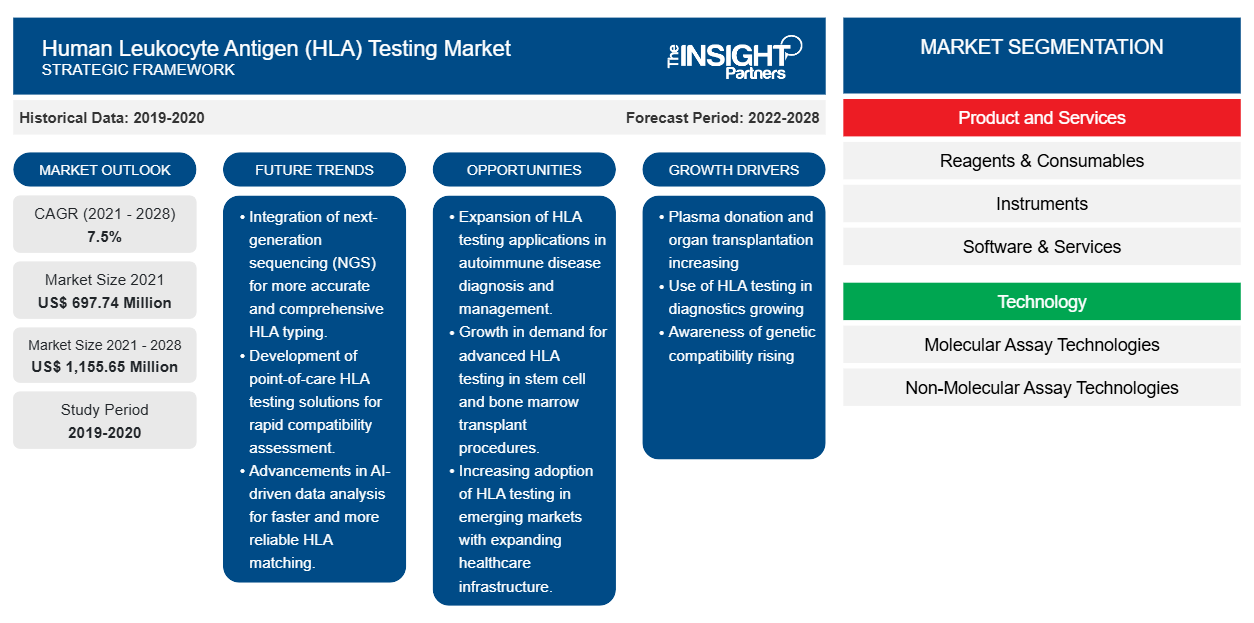

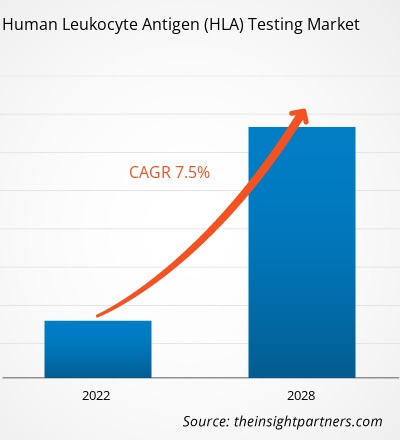

The human leukocyte antigen (HLA) testing market is projected to reach US$ 1,155.65 million by 2028 from US$ 697.74 million in 2021; it is expected to register a CAGR of 7.5% from 2022 to 2028.

Human leukocyte antigens play an essential part in the body's immune response to external substances. The principal use for HLA testing is to match organ and tissue transplant recipients with compatible donors. The HLA testing also involves screening transplant recipients for the presence of antibodies that might target the donated tissue or organ as part of an immune response.

The report offers insights and in-depth analysis of the human leukocyte antigen (HLA) testing market emphasizing market trends, technological advancements, and market dynamics, among others. It also provides the competitive landscape analysis of the globally leading market players. Furthermore, it includes the impact of the COVID-19 pandemic on the market across all the major regions. The COVID-19 pandemic created both a public health crisis and an economic crisis worldwide. Before the pandemic, the human leukocyte antigen (HLA) testing market was growing continuously owing to the regularity in the assessment of organ donors, consolations, and treatments. The first wave of COVID-19 disrupted the consultations, follow-ups, and screenings related to diseases other than COVID-19. Several companies experienced severe losses in the last quarter of 2019; the pandemic particularly had adverse effects on the global market in the first and second quarters of 2020. Businesses worldwide were hampered due to disruption in supply chains, and increased demand for healthcare products and services. To reduce COVID-19 infection in hospitals and clinics, healthcare practitioners and patients adopted and preferred treating their patients remotely. These unforeseeable circumstances also hampered organ transplantation procedures. Many surgical treatments and non-urgent consultations were canceled or postponed, and elective surgeries were suspended in many institutions to limit the spread of SARS-CoV-2 as well as to reserve and reallocate resources, including healthcare personnel (nurses and anesthesiologists), medical equipment (personal protective equipment and ventilators), and beds. The "stay at home" recommendation resulted in a significant reduction in organ donation and organ transplantation surgeries. These conditions restrained the growth of the human leukocyte antigen (HLA) testing market worldwide in 2020.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Human Leukocyte Antigen (HLA) Testing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Human Leukocyte Antigen (HLA) Testing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Increasing Number of Plasma Donation and Organ Transplantation Procedures Drive Market Growth

Human leukocyte antigens (HLAs) are the specialized proteins present on all cell surfaces of the human body, except red blood cells. HLA testing has significant application in organ transplantation, which can be recommended as a part of the treatment of kidney failure, chronic liver cirrhosis, and chronic heart disease, among other medical issues. The growing prevalence of chronic diseases and organ failure leads to high demand for organ transplant procedures, as well as HLA testing. Before transplantation, HLA testing is performed to check tissue compatibility between patients and donors to avoid graft rejection. In recent years, transplantation has become a successful practice worldwide. According to data published in Global Observatory on Donation and Transplantation (GODT), in 2020, 129,681 organ transplants were recorded in total. Of these, 31.7% were living kidney transplants and 20.40% were living liver transplants.

Governments of various countries are taking initiatives to spread awareness about the need for organ donation and the benefits of organ transplantation in certain treatment procedures. For Instance, the Organ Procurement and Transplantation Network (OPTN) has implemented a few strategies to improve the number of organ transplantation procedures in the US. These strategies focus on increasing the number of organ and tissue transplants among patients with end-stage organ disease, altering the current organ distribution, and modifying organ transplantation waitlist by redistributing the existing organ soppy. Furthermore, the OPTN has used out-of-box strategies to improve organ transplantation. These innovative strategies include the optimized use of organs obtained from deceased patients [e.g., donation after cardiac death (DCD) or brain-dead donors], reducing discards of organs, promoting living donation, and improving the rate of potential organ donation authorization.

Thus, the growing demand for organ transplantation leads to the requirement of a more substantial number of HLA testing kits and consumables, which drives the growth of the HLA testing market.

Product and Services-Based Insights

Based on product and services, the human leukocyte antigen (HLA) testing market is segmented into reagents and consumables, instruments, and software and services. In 2021, the reagents and consumables segment held the largest share of the market, and it is expected to register the fastest CAGR of 7.5% during the forecast period.

Technology-Based Insights

Based on technology, the human leukocyte antigen (HLA) testing market is segmented into molecular assay technologies and non-molecular assay technologies. In 2021, the molecular assay technologies segment held a largest share of the market, and it is expected to record a higher CAGR of 7.7% during 2022–2028.

End User-Based Insights

Based on end user, the human leukocyte antigen (HLA) testing market is segmented into independent reference laboratories, hospitals and transplant centers, and others. In 2021, the independent reference laboratories segment held the largest share of the market. However, hospitals and transplant centers segment is expected to report the highest CAGR of 7.9% during 2022–2028

The human leukocyte antigen (HLA) testing market players adopt organic strategies such as product launch and expansion to expand their footprint and product portfolio worldwide, along with meeting the growing product demands.

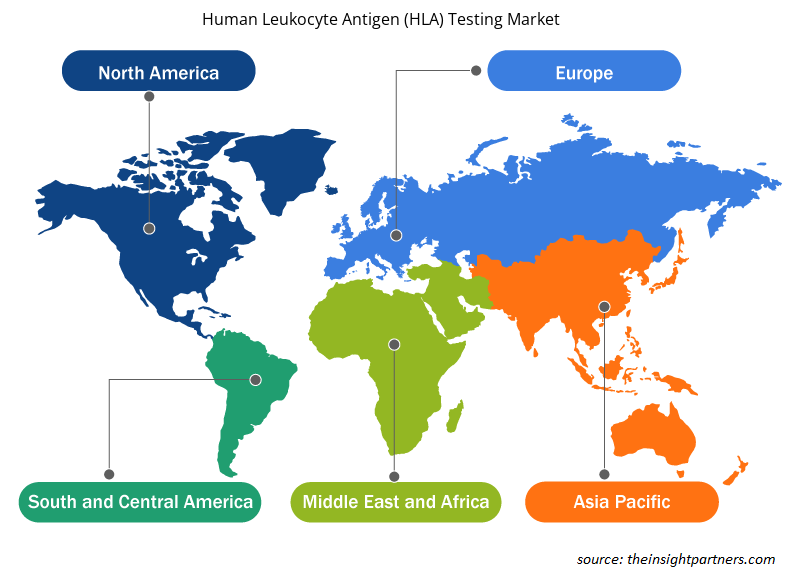

By Geography

Based on geography, the human leukocyte antigen (HLA) testing market is segmented into North America (US, Canada, and Mexico), Europe (UK, Germany, France, Italy, Spain, and the Rest of Europe), Asia Pacific (China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (the UAE, Saudi Arabia, South Africa, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Human Leukocyte Antigen Testing Human Leukocyte Antigen (HLA) Testing Market Regional Insights

The regional trends and factors influencing the Human Leukocyte Antigen (HLA) Testing Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Human Leukocyte Antigen (HLA) Testing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Human Leukocyte Antigen (HLA) Testing Market

Human Leukocyte Antigen (HLA) Testing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 697.74 Million |

| Market Size by 2028 | US$ 1,155.65 Million |

| Global CAGR (2021 - 2028) | 7.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product and Services

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Human Leukocyte Antigen (HLA) Testing Market Players Density: Understanding Its Impact on Business Dynamics

The Human Leukocyte Antigen (HLA) Testing Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Human Leukocyte Antigen (HLA) Testing Market are:

- Thermo Fisher Scientific Inc.

- CareDx

- Qiagen

- Illumina Inc.

- Bio-Rad Laboratories, Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Human Leukocyte Antigen (HLA) Testing Market top key players overview

Company Profiles

- Thermo Fisher Scientific Inc.

- CareDx

- Qiagen

- Illumina Inc.

- Bio-Rad Laboratories, Inc.

- TBG Diagnostics Limited

- F.Hoffmann-La Roche Ltd.

- Takara Bio Inc.

- Luminex Corporation

- Omixon Inc.

- The Sequencing Center

- Protrans

- HistoGenetics LLC.

- CD Genomics

- Qunitara Biosciences

- CeGat GmbH

- Creative Biolabs Inc.

Frequently Asked Questions

What is the regional market scenario of the human leukocyte antigen (HLA) testing market?

Global human leukocyte antigen (HLA) testing market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. In North America, the U.S. is the largest market for human leukocyte antigen (HLA) testing market. The US is estimated to hold the largest share in the human leukocyte antigen (HLA) testing market during the forecast period. The presence of top players and favorable regulations related to product approvals coupled with commercializing new products are the contributing factors for the regional growth. Additionally, the increasing number of technological advancements is the key factor responsible for the Asia-Pacific regional growth for human leukocyte antigen (HLA) testing accounting fastest growth of the region during the coming years.

Who are the key players in the human leukocyte antigen (HLA) testing market?

Thermo Fisher Scientific, Inc., CareDx, Inc., Qiagen N.V., Illumina, Bio-Rad Laboratories, Inc., TGB Diagnostics Ltd., F. Hoffman La-Roche Ltd., Takara Bio, Luminex Corporation, Oximon, The Sequencing Center, Protrans, HistoGenetics LLC, CD Genomics, Quintara Biosciences, CeGaT GmbH, Creative Biolabs, Inc., are among the leading companies operating in the global human leukocyte antigen (HLA) testing market

Which technology segment held the largest revenue (US$ Mn) in the human leukocyte antigen (HLA) testing market?

The molecular assay technologies segment dominated the global human leukocyte antigen (HLA) testing market and is likely to account for the revenue of US$ 626.86 million in 2022.

What is meant by the human leukocyte antigen (HLA) testing market?

Human leukocyte antigens play an essential part in the body's immune response to external substances. The principal use for human leukocyte antigen (HLA) testing is to match organ and tissue transplant recipients with compatible donors. HLA testing also involves screening transplant recipients for the presence of antibodies that might target the donated tissue or organ as part of an immune response.

What are the driving factors for the human leukocyte antigen (HLA) testing market across the globe?

Increasing plasma donation and organ transplants procedures is one of the most significant factors responsible for the overall market growth.

Which segment led the human leukocyte antigen (HLA) testing market?

Based on product and service type, reagent and consumables took the forefront leaders in the worldwide market by accounting largest share in 2021 and is expected to continue to do so till the forecast period.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Human Leukocyte Antigen (HLA) Market

- Thermo Fisher Scientific Inc.

- CareDx

- Qiagen

- Illumina Inc.

- Bio-Rad Laboratories, Inc.

- TBG Diagnostics Limited

- F.Hoffmann-La Roche Ltd.

- Takara Bio Inc.

- Luminex Corporation

- Omixon Inc.

- The Sequencing Center

- Protrans

- HistoGenetics LLC.

- CD Genomics

- Qunitara Biosciences

- CeGat GmbH

- Creative Biolabs Inc.

Get Free Sample For

Get Free Sample For