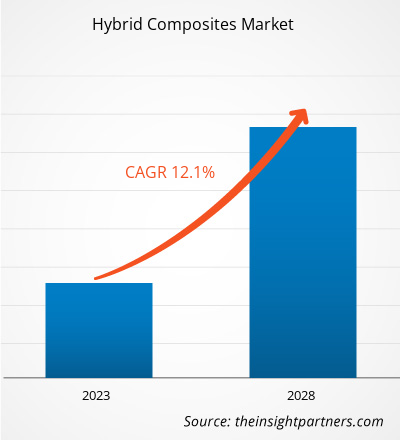

[Research Report] The hybrid composites market size is expected to grow from US$ 856.02 million in 2022 to US$ 1,678.47 million by 2028; it is estimated to register a CAGR of 12.1% from 2023 to 2028.

MARKET ANALYSIS

Hybrid composites consist of two or more fiber types embedded in a single polymer matrix. Hybrid composites are highly used in many engineering applications, offering various enhanced properties and advantages over traditional composite materials. The composites are used to combine the properties of different types of fibers. The commonly used hybrid composites are carbon-aramid reinforced epoxy, which combines strength and impact resistance, and glass-carbon reinforced epoxy, which gives a strong material. They are used in automotive, aerospace, wind energy, marine, sporting goods, and other industries. The global hybrid composites market is segmented on the basis of fiber type, resin, application, and geography.

GROWTH DRIVERS AND CHALLENGES

Hybrid composites are crucial for the safety and efficient performance of modern aircraft. The rising need for lightweight materials to construct aviation components and parts has significantly increased the demand for hybrid composites. Aircraft manufacturers are making efforts to develop huge primary thermoplastic structures in business jets and commercial aircraft. They were the early adopters of long fiber-reinforced thermoplastics. Materials such as composites and polymers are significantly lighter than steel, brass, alloys, iron, etc. The use of these materials allows manufacturers to lower the weight of airplane parts, subsequently facilitating fuel cost reductions. Thus, the growing demand for lightweight materials in the aerospace & defense industry is driving the hybrid composites market growth. However, the raw material required for manufacturing hybrid composite is expensive, making sequential component production challenging and expensive. The manufacturing cost of hybrid composite parts is significantly influenced by the cycle time, which is strongly related to the time required for filling and curing. Tailoring the properties of hybrid composites requires accurate and precise material placement through composite manufacturing processes such as hand layup or automated processes. Hence, a skilled workforce is required, which can be expensive in some cases. Thus, the high cost of these composites is restricting the hybrid composites market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Hybrid Composites Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Hybrid Composites Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

REPORT SEGMENTATION AND SCOPE

The "Global Hybrid Composites Market Forecast to 2030" is a specialized and in-depth study with a major focus on the global hybrid composites market trends and growth opportunities. The report aims to provide an overview of the global hybrid composites market with detailed market segmentation on the basis of fiber type, resin, application, and geography. The report provides key statistics on the consumption of hybrid composites worldwide along with their demand in major regions and countries. In addition, it provides a qualitative assessment of various factors affecting the hybrid composites market performance in major regions and countries. The report also includes a comprehensive analysis of the leading players in the hybrid composites market and their key strategic developments. Several analyses on the market dynamics are also included to help identify the key driving factors, market trends, and lucrative hybrid composites market opportunities that would, in turn, aid in identifying the major revenue pockets.

Further, ecosystem analysis and Porter’s five forces analysis provide a 360-degree view of the global hybrid composites market, which helps understand the entire supply chain and various factors affecting the market growth.

SEGMENTAL ANALYSIS

The global hybrid composites market is segmented on the basis of fiber type, resin, and application. Based on fiber type, the market is segmented into carbon/aramid, carbon/glass, high-modulus polypropylene (HMPP)/carbon, ultra high molecular weight polyethylene (UHMWPE)/carbon, and others. Based on resin, the hybrid composites market is bifurcated into thermoset and thermoplastic. Based on application, the hybrid composites market is segmented into automotive, aerospace, marine, wind energy, sporting goods, and others.

Based on fiber type, the carbon/aramid segment accounted for a significant hybrid composites market share in 2022. Carbon/aramid hybrid composites are advanced materials that combine the desirable properties of carbon fiber and aramid fiber to create a unique and high-performance material. Carbon fibers are known for their exceptional strength, stiffness, and low weight, making them ideal for applications that require high-performance and lightweight structures. Aramid fibers, such as Kevlar, possess outstanding impact resistance, excellent energy absorption, and remarkable durability.

Based on resin, the thermoset segment accounted for a significant hybrid composites market share. Thermoset resins are utilized to make most hybrid composites. They are converted from liquid to solid state through polymerization or cross-linking. When used to produce finished goods, thermoset resins are cured by using a catalyst, heat, or a combination of the two.

By application, the automotive segment accounted for a significant hybrid composites market share. Hybrid composites such as carbon and glass, and carbon and aramid are used in car manufacturing to reduce vehicle weight and meet mileage standards. Hybrid composites are often utilized for producing body panels and preparing car frames, rims, springs, and truck bedliners. The composites are also widely utilized by vehicle manufacturers to increase fuel efficiency and improve performance to carry larger payloads.

REGIONAL ANALYSIS

The report provides a detailed overview of the global hybrid composites market with respect to five major regions—North America, Europe, Asia-Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. Asia Pacific accounted for the largest hybrid composites market share in 2022. In Asia Pacific, China and India are among the world’s top five countries with installed wind power. Hybrid composite is increasingly utilized for wind energy applications. Asia Pacific is home to significant global semiconductor and automobile players, including Samsung Electronics Co., Ltd.; Sony Group Corporation; SK Hynix Inc.; Toyota Motor Corporation; Tata Motors Ltd.; Hyundai Motor Company; Nissan Motor Co., Ltd.; and Honda Motor Co., Ltd. These companies are focused on expansion, research and development, and product innovation. Thus, prominent semiconductors and automobile players in the region have increased the demand for hybrid composites. Europe accounted for a significant share of the market and valued at more than US$ 250 million in 2022. The automotive industry is growing significantly across various countries in Europe. According to the report by European Commission, turnover generated by the automotive industry in Europe represents 7% of the region’s total GDP. Additionally, the presence of prominent automotive players, including Volkswagen AG, Stellantis NV, Mercedes-Benz Group AG, Bayerische Motoren Werke AG, and Renault SA, significantly contributes to the demand for hybrid composites in Europe.

INDUSTRY DEVELOPMENTS AND FUTURE OPPORTUNITIES

Partnerships, acquisitions, and new product launches are among the major strategies adopted by the players operating in the global hybrid composites market.

- In 2022, Lanxess AG launched sustainable product variants to its Tepex brand composite range.

- In 2022, Avient Corporation acquired DSM Protective Materials (Dyneema brand) and also announced its plan to explore sale options for its Avient Distribution business.

- In 2021, Solvay SA completed the installation of its new thermoplastic composites (TPC) manufacturing facility.

Hybrid Composites Market Regional Insights

The regional trends and factors influencing the Hybrid Composites Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Hybrid Composites Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Hybrid Composites Market

Hybrid Composites Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 856.02 Million |

| Market Size by 2028 | US$ 1,678.47 Million |

| Global CAGR (2022 - 2028) | 12.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Fiber Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

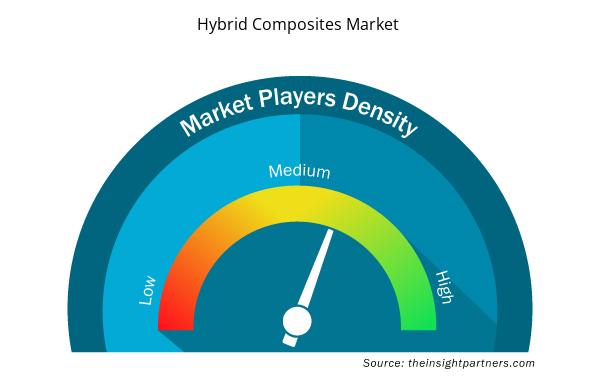

Hybrid Composites Market Players Density: Understanding Its Impact on Business Dynamics

The Hybrid Composites Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Hybrid Composites Market are:

- Hexcel Corp

- Lanxess AG

- SGL Carbon SE

- Gurit Holding AG

- Avient Corp

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Hybrid Composites Market top key players overview

IMPACT OF COVID-19 PANDEMIC/IMPACT OF GEOPOLITICAL SCENARIO/IMPACT OF RECESSION

The COVID-19 pandemic led to a decline in the progress of many industries across the world. Shutdown of manufacturing plants and restricted trade across the globe led to supply chain constraints for global manufacturers. The automotive, aerospace, marine, wind energy, sporting goods, and other industries have been major contributors to the demand for hybrid composites. In 2020, these industries had to slow down their operations due to disruptions in the value chain caused by the restrictions on national and international boundaries. The labor shortage resulted in the deceleration of hybrid composite production. Disruptions in the global supply chain and the shutdown of hybrid composite production facilities had negatively impacted the hybrid composites market growth. The automotive industry is one of the major end users of hybrid composites. During the pandemic, the industry reported reduced demand, supply interruptions, financial pressure, and labor shortage.

In 2021, the global marketplace began recovering from the losses incurred in 2020 as governments of different countries announced relaxation in social restrictions. Manufacturers were permitted to operate at full capacities, which helped them overcome the demand–supply gap. Moreover, the rising vaccination rates led to conducive environments for industrial progress. This has resulted in the increasing demand for hybrid composites from different industries.

COMPETITIVE LANDSCAPE AND KEY COMPANIES

Hexcel Corp, Lanxess AG, SGL Carbon SE, Gurit Holding AG, Avient Corp, Teijin Ltd, Solvay SA, PGTEX China Co Ltd, Toray Industries Inc, and Mitsubishi Chemical Holdings Corp are among the key players operating in the hybrid composites market.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Fiber Type, Resin, Application, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Can you list some of the major players operating in the global hybrid composites market?

The key players operating in the global hybrid composites market include Hexcel Corp, Lanxess AG, SGL Carbon SE, Gurit Holding AG, Avient Corp, Teijin Ltd, Solvay SA, PGTEX China Co Ltd, Toray Industries Inc, and Mitsubishi Chemical Holdings Corp.

What are the key factors influencing market growth?

The projected growth of the market is attributed to the growing demand for lightweight materials in aerospace & defense industry and rising use of hybrid composites in wind energy and automotive industries.

Based on resin, which segment is leading the global hybrid composites market during the forecast period?

The thermoset segment held the largest share of the global hybrid composites market in 2022. Thermoset resins are utilized to make most hybrid composites. Thermoset hybrid composites are easy to produce as the liquid resin is easy to handle.

Which region held the fastest CAGR in the global hybrid composites market?

Ans. Europe is estimated to register the fastest CAGR in the global hybrid composites market over the forecast period. The increasing installed wind capacity and growing automotive, aerospace & defense industries in the region are driving the market growth.

Which region held the largest share of the global hybrid composites market?

In 2022, Asia Pacific held the largest share of the global hybrid composites market. In Asia Pacific, China and India are among the world’s top five countries with installed wind power. Hybrid composite is increasingly utilized for wind energy applications. Asia Pacific is home to significant automobile players across the world. The strong presence of the automotive industry in countries such as China, India, Japan, and South Korea is fueling the hybrid composites market growth in the region.

Based on fiber type, which segment is leading the global hybrid composites market during the forecast period?

The carbon/aramid segment held the largest share in the global hybrid composites market in 2022. Carbon/aramid hybrid composites are advanced materials that combine the desirable properties of carbon fiber and aramid fiber to create a unique and high-performance material.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Hybrid Composites Market

- Hexcel Corp

- Lanxess AG

- SGL Carbon SE

- Gurit Holding AG

- Avient Corp

- Teijin Ltd

- Solvay SA

- PGTEX China Co Ltd

- Toray Industries Inc

- Mitsubishi Chemical Holdings Corp

Get Free Sample For

Get Free Sample For