Ice Cream Market Analysis and Opportunities by 2031

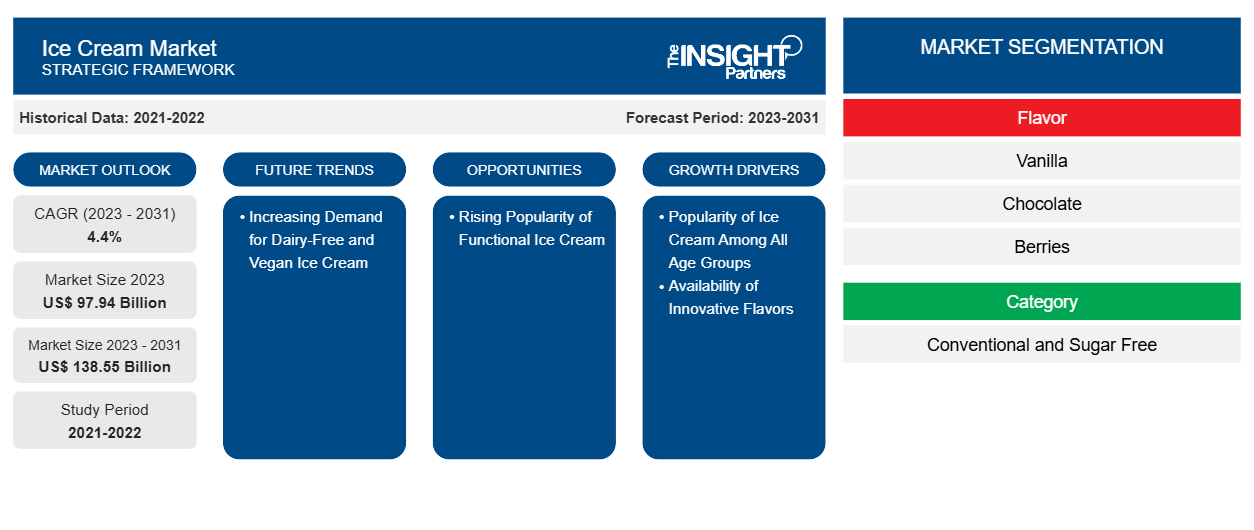

Ice Cream Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Flavor (Vanilla, Chocolate, Berries, Matcha, and Others), Category (Conventional and Sugar Free), Form (Cups and Tubs, Bars and Sticks, and Others), Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Retail, and Others), and Geography

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2023-2031- Status : Published

- Report Code : TIPRE00006113

- Category : Food and Beverages

- No. of Pages : 348

- Available Report Formats :

The ice cream market size is projected to reach US$ 138.55 billion by 2031 from US$ 97.94 billion in 2023. The market is expected to register a CAGR of 4.4% during 2023–2031. The increasing demand for dairy-free and vegan ice cream is likely to act as a key trend in the market.

Ice Cream Market Analysis

The increase in demand for premium ice creams, availability of various flavors, and rise in preference for non-preservatives and natural ingredients are among the factors driving the ice cream market growth. The demand for low-fat, natural ice creams with high taste and indulgence is increasing in Europe. The growing preference for frozen desserts as a digestive aid after meals boosts the demand for these treats. The increasing interest of ice cream manufacturers in fortification and the addition of functional ingredients may influence the consumer's decision to select a healthy alternative. Beyond basic nutrition, functional food provides advantages that can help lower or prevent the risk of certain diseases. Furthermore, sugar-free, low-fat functional ice creams are gaining huge popularity due to their health benefits.

Ice Cream Market Overview

Ice cream is a popular dessert and is available in various flavors. The growth of the ice cream market is driven by the availability of various flavored ice creams, especially seasonal fruit flavors, and the increase in flavor innovations by manufacturers. Recently, functional ice cream has become popular among health-conscious consumers as it contains high-quality ingredients and fulfills consumers' nutritional requirements more than regular ice cream. So, the increasing interest of ice cream manufacturers in fortification and the addition of functional ingredients may influence the consumer's decision to select a healthy alternative. Moreover, sugar-free, low-fat functional ice creams are gaining huge popularity due to their health benefits. The key players in the ice cream market include Blue Bell Creameries, Unilever Plc, Nestle SA, General Mills Inc, Mars Inc, Wells Enterprises, Turkey Hill Dairy, Dairy Farmers of America Inc, Cold Stone Creamery, Morinaga Milk Industry Co Ltd, Kwality Foods LLC, Baskin-Robbins, David Chapman's Ice Cream Limited, Lotus Bakeries NV, and IMURAYA GROUP CO., LTD.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONIce Cream Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Ice Cream Market Drivers and Opportunities

Availability of Innovative Flavors

The global ice cream industry is undergoing a dynamic transformation as manufacturers respond to evolving consumer preferences, health consciousness, and demand for unique sensory experiences. To maintain competitive differentiation and enhance consumer engagement, ice cream producers are increasingly focusing on product innovation through the incorporation of functional ingredients, exotic flavors, and novel formulations. One of the most prominent trends in the industry is the development of ice cream products enriched with nutritional components and organic or herbal additives. Companies are introducing ingredients such as probiotics, plant-based proteins, adaptogens, and botanical infusions to appeal to health-aware consumers who seek indulgent yet functional treats. This strategy not only enhances the perceived value of products but also aligns with the broader clean-label and wellness movement that continues to influence food and beverage purchasing behavior. Flavor innovation is another key driver in the market. Manufacturers are expanding their portfolios with exotic and unconventional flavor profiles, including coconut, lemon, passionfruit, mango, and other tropical fruits. This diversification aims to cater to adventurous palates and global culinary trends, especially among younger demographics seeking premium, artisanal, or culturally inspired products.

In response to growing interest in functional and experiential consumption, brands are also exploring niche segments. For example, Ben & Jerry's made headlines by launching a CBD-infused ice cream, targeting consumers interested in wellness and relaxation benefits. Meanwhile, alcoholic ice cream products are gaining significant traction in the US, driven by the novelty and indulgence they offer. These products typically contain less than 0.5% alcohol, allowing them to be sold through conventional retail channels such as grocery stores and specialty outlets. High-profile brands are also capitalizing on the liquor-infused trend. In September 2021, Häagen-Dazs introduced a spirits line featuring traditional pints blended with alcoholic flavors, including Irish cream, bourbon, rum, and stout. Similarly, in November 2023, LiQ partnered with Baileys to launch liquor-infused ice cream pralines, merging the indulgence of dessert with the sophistication of premium liqueurs.

These innovations reflect a broader shift in the ice cream market toward personalization, premiumization, and experiential indulgence. As consumer preferences continue to evolve, particularly around health, sustainability, and flavor exploration, the market is expected to witness continued growth in the development of hybrid, function-forward, and limited-edition offerings that cater to niche yet growing demand segments.

Rising Popularity of Functional Ice Cream

The popularity of functional ice cream is majorly driven by product innovations, especially in terms of taste profile and nutritional value. In August 2022, California's cult ice cream brand and celebrity favorite Coolhaus made its debut in Singapore with six flavors. These launches of functional products help consumers follow and maintain their health goals and enjoy a good meal simultaneously, as health became a priority for consumers during the COVID-19 crisis. Since people have started focusing on convenience food products while maintaining the nutritional balance in their diets, manufacturers are launching nutritionally enriched ice creams. Such product innovations help them extend their reach and gain a competitive edge in regional markets. Thus, the rising demand for functional ice creams is expected to create lucrative opportunities for the ice cream market in the coming years.

Ice Cream Market Report Segmentation Analysis

Key segments that contributed to the derivation of the ice cream market analysis are flavor, category, form, and distribution channel.

- Based on flavor, the ice cream market is segmented into vanilla, chocolate, berries, matcha, and others. The chocolate segment held the largest market share in 2023.

- By category, the market is bifurcated into conventional and sugar free. The conventional segment held a larger share of the market in 2023.

- In terms of form, the market is segmented into cups and tubs, bars and sticks, and others. The cups and tubs segment dominated the market in 2023.

- Based on distribution channel, the ice cream market is segmented into supermarkets and hypermarkets, specialty stores, online retail, and others. The supermarkets and hypermarkets segment held the largest market share in 2023.

Ice Cream Market Share Analysis by Geography

The geographic scope of the ice cream market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

In 2023, Asia Pacific held the largest share of the ice cream market. The availability of various flavored ice creams, especially seasonal fruit flavors, and flavor innovations by manufacturers drive the ice cream market in Asia Pacific. In addition, consumer inclination toward plant-based products due to the increasing adoption of healthier products is expected to create new plant-based and vegan ice cream trends in the Asia Pacific ice cream market during the forecast period. The increasing demand for vegan ice creams has resulted in the innovation and the launch of plant-based ice creams in the region. For instance, in November 2023, OATSIDE, a Singaporean oat milk maker, introduced a line of vegan ice creams in three flavors available at major retailers nationwide. Rising disposable income, rapid urbanization, and increasing living standards also propel the ice cream market growth. Consumers are also seeking healthier and more nutritious food items, leading to increased demand for ice creams with probiotics, prebiotics, and functional ingredients.

Ice Cream Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 97.94 Billion |

| Market Size by 2031 | US$ 138.55 Billion |

| Global CAGR (2023 - 2031) | 4.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Flavor

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Ice Cream Market Players Density: Understanding Its Impact on Business Dynamics

The Ice Cream Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Ice Cream Market News and Recent Developments

The ice cream market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the ice cream market are listed below:

- Blue Bell Creameries expanded its distribution area to include St. Louis and surrounding cities starting in March 2024. A 16,000 sq. ft. distribution facility is being built at 11400 Spencer Road in St. Peters, Missouri. No products will be made on-site, but there will be a cold storage room for the frozen treats. Blue Bell uses direct store delivery, ensuring that only their employees handle the product from production to store shelves. (Source: Blue Bell Creameries, Company Website, November 2023)

- Magnum launched a mini-sized multi-pack of vegan ice cream and a new and improved recipe for its vegan core range. (Source: Unilever Plc, Press Release, January 2023)

Ice Cream Market Report Coverage and Deliverables

The "Ice Cream Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Ice cream market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Ice cream market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces and SWOT analysis

- Ice cream market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the ice cream market

- Detailed company profiles

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For