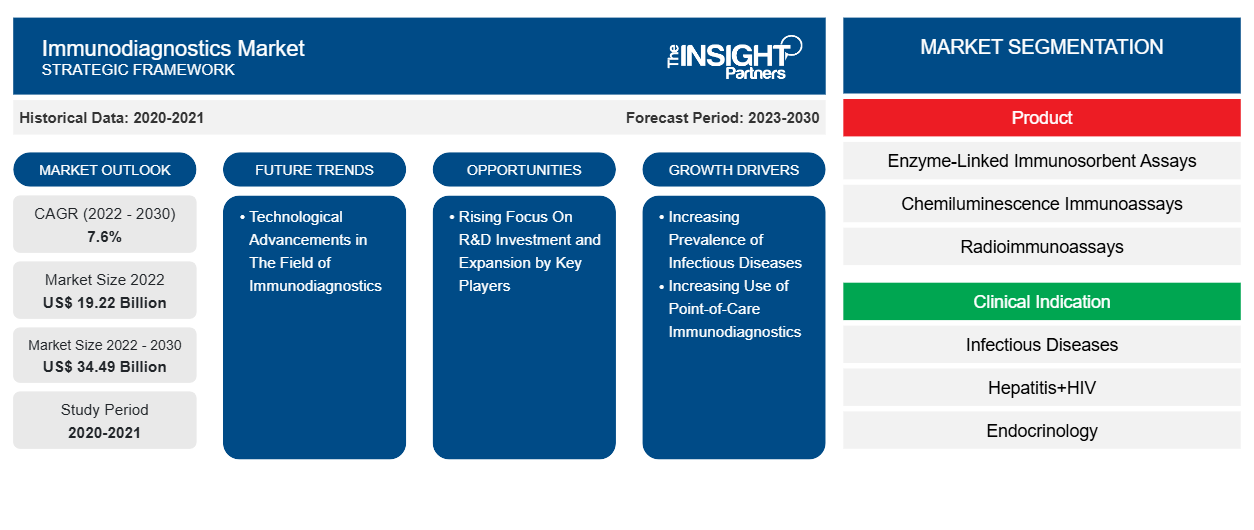

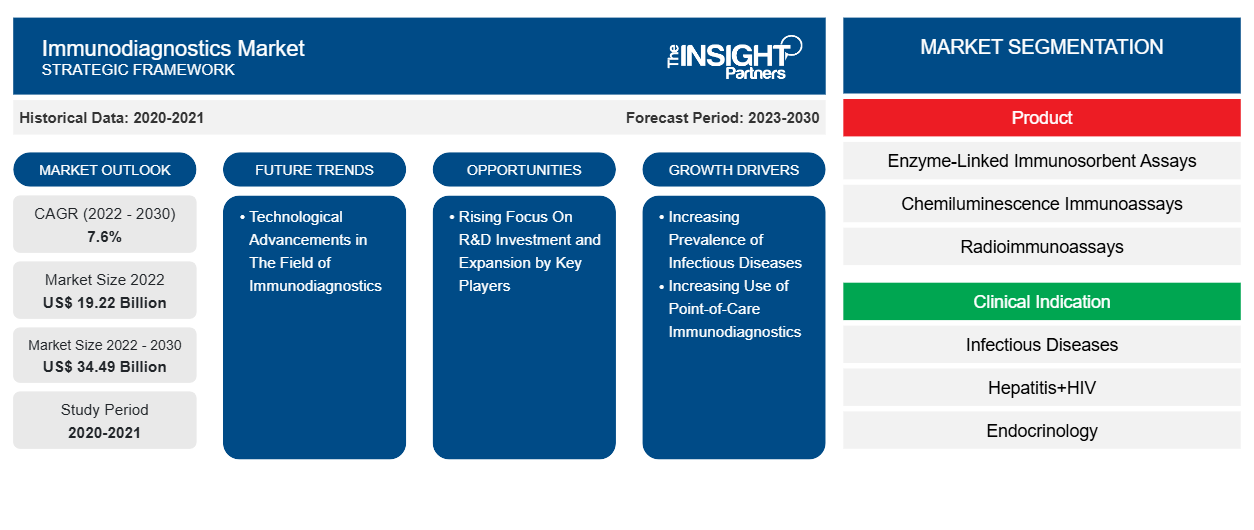

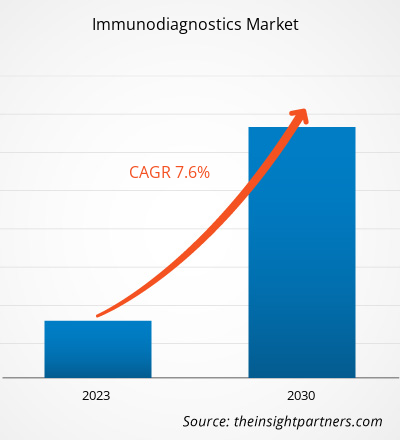

[Research Report] The immunodiagnostics market size is expected to grow to US$ 34,487.80 million by 2030 from US$ 19,218.89 million in 2022; the immunodiagnostics market is estimated to register a CAGR of 7.6% from 2022 to 2030.

Analyst Perspective:

The immunodiagnostics market is expected to flourish due to the significant rise in the developments in the diagnostic sector. The immunodiagnostics market growth was boosted during the COVID-19 pandemic. Various companies received emergency authorizations for their products that helped them commercialize into the market. In addition, the growth of the market was majorly attributed to the increased investments in research and development of faster diagnostics techniques. Companies made various strategic decisions to expand their product portfolio and geographic presence. In addition, the improved life expectancy has led to a significant rise in geriatric population, contributing to increased demand for immunodiagnostics. Moreover, the increasing awareness among people and changing health standards have increased the demand for early diagnosis, which has propelled the demand for various devices for diagnosis. Also, the awareness about the developments in immunodiagnostics and its benefits has increased the usage of immunodiagnostic techniques.

Market Overview:

Immunodiagnostics is referred to as a diagnostic methodology that primarily uses antigen-antibody reaction as its primary means of detection. Antibodies specific to a desired antigen can be conjugated with a radiolabel, fluorescent label, or color-forming enzyme and are used as a probe to detect it. The speed, accuracy, and simplicity of such tests have led to the development of rapid techniques for the diagnosis of diseases, microbes, and even illegal drugs in vivo. The key factors that are driving the rising prevalence of infectious diseases and the growing use of point-of-care propel immunodiagnostics market growth. However, inadequate reimbursements hinder market growth. Geographically, North America is the largest market and followed by Europe. In North America, the US holds the maximum market share of the immunodiagnostics market. Asia Pacific is the fastest-growing region in the global immunodiagnostics market. In Asia Pacific, China is the largest market for immunodiagnostics and is expected to retain its dominance during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Immunodiagnostics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Immunodiagnostics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Increasing Prevalence of Infectious Diseases

The diagnosis and management of several ever-growing infectious diseases caused by infectious agents such as viruses, fungi, bacteria, parasites, or their toxic products are surging number of prescriptions for immunodiagnostic tests, e.g., complement fixation, precipitation tests, agglutination tests, line blot assays, Western blot assays, enzyme immunoassays (EIA), and immunofluorescence tests.

Human immunodeficiency virus (HIV) continues to be a major public health issue worldwide. In 2021, there were ~38.4 million people worldwide with HIV, as per the Joint United Nations Programme on HIV/AIDS (UNAIDS). Besides, hepatitis is another major factor driving the immunodiagnostics market. According to the World Health Organization (WHO), nearly 58 million people worldwide suffer from chronic hepatitis C infection, with 1.5 million new conditions occurring yearly. Furthermore, about 3.2 million adolescents and children have hepatitis C infection. Approved by all member states, the global hepatitis WHO strategy aims to reduce new hepatitis infections by 90% and mortalities by 65% during 2016–2030. Such global initiatives are fueling the demand for immunodiagnostic products.

Further, tuberculosis (TB), COVID-19, and other hospital-acquired infections (HAIs) require immunodiagnostic tests.

- TB has been the 13th leading cause of death and the second-leading infectious killer after COVID-19. In 2020, 1.5 million people died from TB and affected an estimated 10 million people, comprising 5.6 million males, 3.3 million females, and 1.1 million children globally.

- In 2021, a total of 7,860 TB cases were reported to CDC's National Tuberculosis Surveillance System (NTSS) by the 50 states of America and the District of Columbia (DC).

- According to Worldometer, millions of deaths were reported worldwide due to the COVID-19 pandemic. It strained healthcare systems and increased the need for immunodiagnostic tests.

Diagnostics play a vital role in determining suitable medical treatments. Immunodiagnostics help diagnose diseases that severely impact the immune system. Thus, the rising prevalence of infectious diseases leads to the surging demand for immunodiagnostic products.

Segment Analysis:

The global immunodiagnostics market is segmented into product, clinical indication, and end user. Based on product, the market is segmented into enzyme-linked immunosorbent assays (ELISA), chemiluminescence immunoassays (CLIA), radioimmunoassays (RIA), and others. The enzyme-linked immunosorbent assays (ELISA) segment held the largest market share of the market by product. Infectious diseases are caused by harmful pathogens such as bacteria, viruses, parasites, and fungi entering the body. They are commonly spread through contaminated food or water and bug bites. Contagious diseases cover a significant section of the immunodiagnostics market. Immunodiagnostics tests are performed to complement the results of molecular assays in infectious disease studies. Several immunodiagnostic tests are employed to diagnose infectious diseases, detect endocrine and neoplastic disorders, and measure blood drug concentrations. Enzyme-based immunoassays use antibodies to detect antigens and quantify antibodies. A Western blot test involves detecting antibodies in patients’ samples such as serum or different body fluids based on reactions between antibodies and target antigens (viral components) immobilized into a membrane by blotting.

The chemiluminescence immunoassays (CLIA) segment is anticipated to register the highest CAGR during the forecast period. The CLIA segment is further segmented into vitamin D assay, HIV detection, HIV AG/AB combo assay, and others.

Based on clinical indication, the market is segmented into infectious diseases, hepatitis+hiv, endocrinology, gastrointestinal, metabolic, and others. Infectious diseases acquired the highest market value in 2022and is expected to register the highest CAGR during the forecast period. The infectious disease segment is further segmented into COVID-19, tuberculosis, Lyme, infection management, Zika, treponema, TORCH, measles and mumps, VZV, and EBV. Similarly, the endocrinology segment is further classified into hypertension, growth, diabetes, thyroid, and reproductive endocrinology.

Based on end user, the immunodiagnostics market is classified into hospitals, clinics, diagnostics laboratories, academic and research institutes, and others. The hospitals segment held the largest share of the market in 2022. The clinics segment is anticipated to register the highest CAGR during the forecast period.

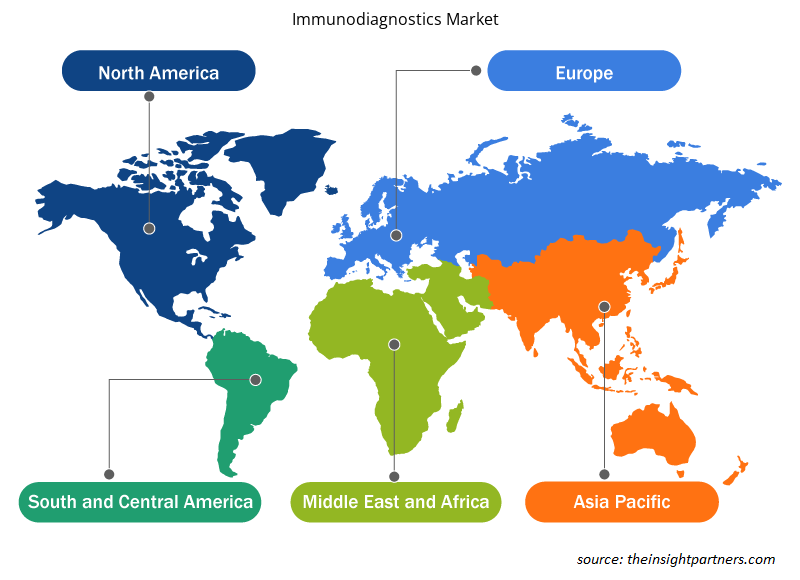

Regional Analysis:

North America held the largest market share of the global immunodiagnostics market, which was valued at US$ 9,772.80 million in 2022, with a CAGR of 7.5%. North America is the largest market for immunodiagnostics, with the US, Canada, and Mexico being the major contributors to this regional market. The growing government support for adopting advanced diagnostics, increasing R&D efforts, and initiatives such as strategic collaborations by market players contribute to significant immunodiagnostics market growth. In addition, technological advancements by the players operating in the diagnosis industry will likely be a major growth stimulator for the immunodiagnostics market in North America over the coming years. At the same time, Asia Pacific is the fastest-growing region in the global immunodiagnostics market. The US is the largest market, and the immunodiagnostics growth is driven by the increasing prevalence of cancer that demands diagnosis and growing developments in the field of immunodiagnostics.

The Asia Pacific immunodiagnostics market is segmented into China, India, Japan, South Korea, Australia, and the Rest of APAC. The increasing frequency of chronic illnesses in APAC resulted in high demand for diagnostic tests that provide essential details of medical care with detection, diagnostics, and therapy related to the diseases. In addition, the investment of domestic players to develop immunodiagnostics products and technologies is likely to propel the immunodiagnostics market growth during the forecast period.

Immunodiagnostics Market Regional Insights

The regional trends and factors influencing the Immunodiagnostics Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Immunodiagnostics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Immunodiagnostics Market

Immunodiagnostics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 19.22 Billion |

| Market Size by 2030 | US$ 34.49 Billion |

| Global CAGR (2022 - 2030) | 7.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

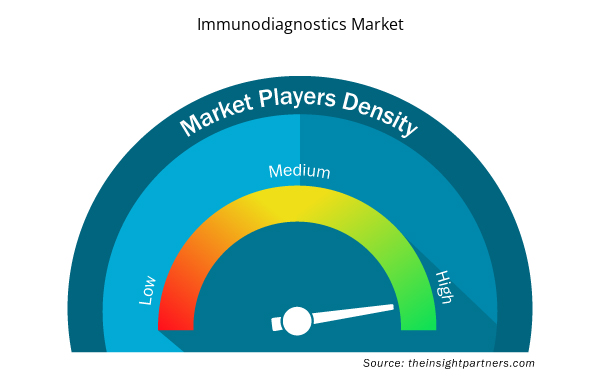

Immunodiagnostics Market Players Density: Understanding Its Impact on Business Dynamics

The Immunodiagnostics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Immunodiagnostics Market are:

- Abbott Laboratories

- F. Hoffmann-La Roche Ltd

- DiaSorin SpA

- Danaher Corporation

- Thermo Fisher Scientific Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Immunodiagnostics Market top key players overview

Key Player Analysis:

The immunodiagnostics market majorly consists of players such as Abbott Laboratories, F. Hoffmann-La Roche Ltd, DiaSorin SpA, Danaher Corp, Thermo Fisher Scientific Inc, PerkinElmer Inc, Shenzhen Mindray Bio-Medical Electronics Co Ltd, bioMerieux SA, Svar Life Science AB, and Siemens Healthineers AG.

Abbott Laboratories and F. Hoffmann-La Roche Ltd are the top two players in the immunodiagnostics market. The companies have been implementing various strategies that have helped the growth of the company and in turn have brought about various changes in the market. The companies have utilized organic strategies such as launches, expansion, and product approvals. On the flip side, inorganic strategies, such as product launches, partnerships, and collaborations, were widely seen in the immunodiagnostics market.

Recent Developments:

Inorganic and organic strategies are highly adopted by companies in the immunodiagnostics market. A few recent key market developments are listed below:

- In April 2023, Thermo Fisher Scientific announced a partnership with ALPCO-GeneProof, a global leader in diagnostics. The partnership has helped in bringing TaqPath Menu | GeneProof PCR kits into the market.

- In July 2022, Abbott Diagnostics announced its participation in American Association for Clinical Chemistry (AACC) 2022. In the exhibition, the company demonstrated its diagnostics systems and analyzers.

- In May 2023, Thermo Fisher Scientific announced that the US FDA had cleared its immunoassays, B·R·A·H·M·S PlGF plus KRYPTOR and B·R·A·H·M·S sFlt-1 KRYPTOR novel biomarkers. These immunoassays assess risks and clinical management of preeclampsia, a severe pregnancy complication.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Clinical Indication, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Which segment by type led the immunodiagnostics market?

The enzyme-linked immunosorbent assays (ELISA) segment held the largest share of the market in 2022. Whereas the chemiluminescence immunoassays (CLIA) segment is estimated to register the highest CAGR in the market during the forecast period.

What are the growth estimates for the immunodiagnostics market till 2028?

The immunodiagnostics market is expected to be valued at US$ 34,487.80 million in 2030.

What is the estimated immunodiagnostics market size in 2022?

The immunodiagnostics market is estimated to be valued at US$ 19,218.89 million in 2022.

What is the market CAGR value of the immunodiagnostics market during the forecast period?

The CAGR value of the immunodiagnostics market during the forecasted period of 2022-2028 is 7.6%.

Which region is projected to be the fastest-growing region in the global immunodiagnostics market?

The Asia Pacific is expected to be the fastest-growing region in the immunodiagnostics market over the forecast period due to the infectious diseases and the growing use of point-of-care immunodiagnostics, and developments by market players offering immunodiagnostics.

Who are the major players in the immunodiagnostics market across the globe?

The immunodiagnostics market majorly consists of the players, such as Abbott Laboratories, F. Hoffmann-La Roche Ltd, DiaSorin SpA, Danaher Corp, Thermo Fisher Scientific Inc, PerkinElmer Inc, Shenzhen Mindray Bio-Medical Electronics Co Ltd, bioMerieux SA, Svar Life Science AB, and Siemens Healthineers AG.

What are the driving factors for the global immunodiagnostics market across the world?

The factors that are driving the growth of the immunodiagnostics market are the rising prevalence of infectious diseases and the growing use of point-of-care immunodiagnostics.

What are Immunodiagnostics?

Immunodiagnostics is referred as a diagnostic methodology that primarily uses antigen-antibody reaction as its primary means of detection. Antibodies specific for a desired antigen can be conjugated with a radiolabel, fluorescent label, or color-forming enzyme and are used as a probe to detect it. The speed, accuracy and simplicity of such tests has led to the development of rapid techniques for the diagnosis of disease, microbes and even illegal drugs in vivo.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Immunodiagnostics Market

- Abbott Laboratories

- F. Hoffmann-La Roche Ltd

- DiaSorin SpA

- Danaher Corporation

- Thermo Fisher Scientific Inc

- PerkinElmer Inc

- Shenzhen Mindray Bio-Medical Electronics Co Ltd

- bioMerieux SA

- Svar Life Science AB

- Siemens Healthineers AG.

Get Free Sample For

Get Free Sample For