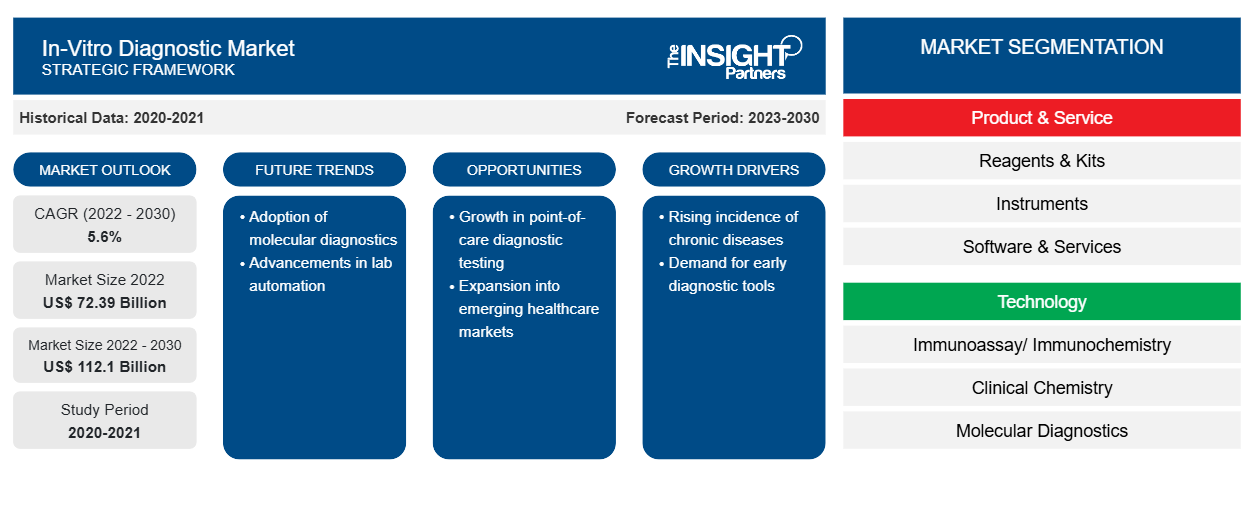

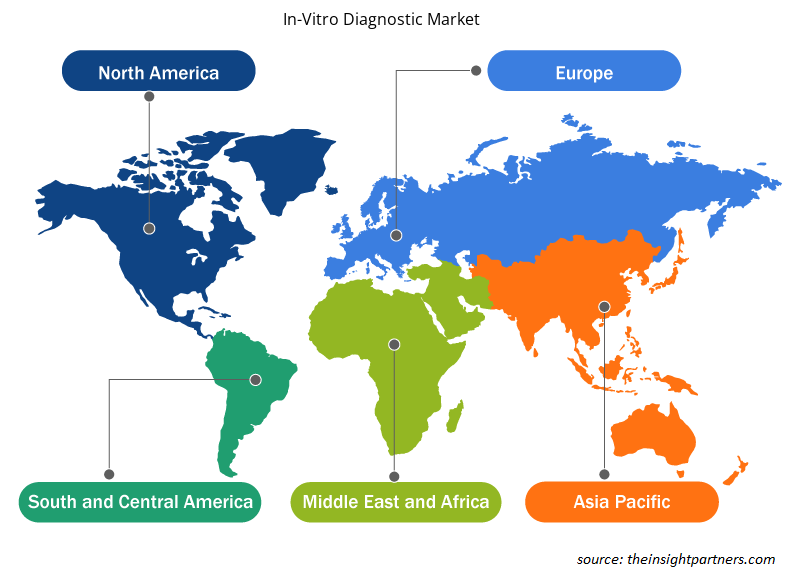

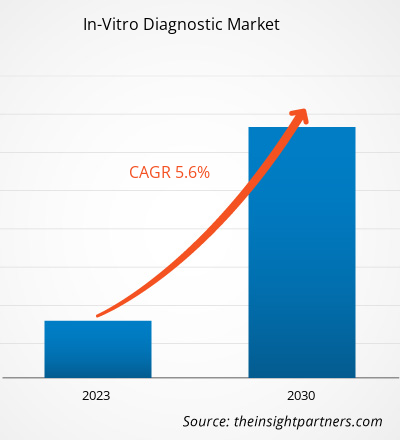

[Research Report] The in-vitro diagnostic market size was valued at US$ 72,393.80 million in 2022 and is expected to reach US$ 1,12,103.51 million by 2030; the market is estimated to register a CAGR of 5.6% from 2022 to 2030

Market Insights and Analyst View:

In-vitro diagnostics includes laboratory testing and medical devices used to analyze biological samples, such as urine, blood, or tissues, obtained from a human body. These tests play a vital role in monitoring and diagnosing various medical conditions. The increasing prevalence of chronic diseases, technological advancements, and the growing geriatric population are the noteworthy factors driving the in-vitro diagnostics market growth. Advancements in molecular diagnostics empower efforts made by research groups and healthcare workforces across the world to improve personalized treatment plans based on the genetic makeup of individuals. Growth opportunities in developing regions due to progressing infrastructure and health-related awareness can also be associated with the projected growth of the in-vitro diagnostics market during 2022–2030.

Growth Drivers:

According to CDC data, coronary artery disease (CAD) is the most common cause of adult mortality. Approximately 375,476 people died due to CAD in 2021. Estimates published in the 2022 National Diabetes Statistics Report by the World Health Organization state that ~422 million people worldwide have diabetes, the majority of which are living in low- and middle-income countries. Moreover, 1.5 million deaths are directly related to diabetes each year. Overweight, genetic conditions, aging, sedentary lifestyle, etc., are boosting the prevalence of diabetes. According to estimations published in a Cancer Research UK report, ~18.1 million new cancer cases were reported worldwide in 2020, and the number is expected to increase to 28 million by 2040. Hence, the rising prevalence of infectious and chronic diseases such as cardiovascular diseases, cancer, diabetes, and respiratory conditions drives the growth of the in-vitro diagnostics market.

IVD is used in clinical, laboratory, and outpatient settings with the aim specifically to help in the detection of diseases and, consequently, aid in the selection of appropriate treatment protocols. The integration of IVD technologies with digital health solutions is gaining traction globally. Data analytics, artificial Intelligence, and remote monitoring enhance the value of diagnostic tests, leading to better patient management and outcomes. IVD technologies integrated with digital health solutions can be incorporated into clinical decision support systems. As recognized by the WHO, digital health solutions could help detect diseases. Artificial intelligence health bots and similar other emerging solutions may present opportunities for patient care and address challenges such as high cost and time requirements. In diagnostics based on genomic testing, deep learning can identify cancer cells, determine their type, and predict what mutations may occur in a tumor from images of a specific sample. Artificial intelligence and machine learning (AI/ML) in in-vitro diagnostics are revolutionizing medical device development. These modern diagnostic systems facilitate diagnosis based on digital image analysis, thereby improving healthcare decision-making. Smart diagnostics are extremely scalable IVD solutions that use artificial intelligence to perform better than lab-based diagnostics at a fraction of the price. Additionally, this type of diagnostics can derive emergent features through unique chemical and biological signature detection and analysis. Thus, the integration of IVD with digital health technologies is likely to offer lucrative opportunities to the in-vitro diagnostics market in the coming years.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

In-Vitro Diagnostic Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

In-Vitro Diagnostic Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The global in-vitro diagnostics market is segmented into product & service, technology, and application. Based on product & service, the market is categorized into reagents & kits, instruments, and software & services. In terms of technology, the in-vitro diagnostics market is segmented into immunoassay/immunochemistry, clinical chemistry, molecular diagnostics, microbiology, blood glucose self-monitoring, coagulation and hemostasis, hematology, urinalysis, and others. The in-vitro diagnostics market, by application, is fragmented into infectious diseases, diabetes, oncology, cardiology, autoimmune diseases, nephrology, and others. The in-vitro diagnostic market, by end user, is segmented into hospitals, laboratories, home care, and others. The in-vitro diagnostics market, based on geography, is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Spain, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and Rest of the Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Segmental Analysis:

Based on products & services, the in-vitro diagnostic market is segmented into reagents & kits, instruments, and software & services. In 2022, the reagents & kits segment held the largest share of the market due to the popularity of self-test kits and POC devices. The projected growth of the market for reagents and kits is attributed to the tremendous popularity of self-test kits and POC devices, and a rise in availability and adoption automated instruments that simplify jobs and provide accurate results. The increasing cases of viral and fungal infections with inadequate hygienic conditions promote reagent use. Reagents and kits, in addition to other consumables, are frequently used in research processes. In-vitro diagnostics tests are performed on urine, blood, stool, and tissue samples to diagnose various conditions, from mild infections to life-threatening diseases such as cancer. Abbott, F. Hoffmann-La Roche Ltd, and Bio-Rad Laboratories, Inc. are among the key companies offering kits and reagents. Governments implemented mass screening programs during the COVID-19 outbreak, which propelled the in-vitro diagnostics market growth. In 2020, Abbott Laboratories ramped up its production of COVID-19 test kits, including a new tool that could enable mass COVID-19 screening.

The in-vitro diagnostic market is segmented based on application into infectious disease, diabetes, oncology, cardiology, autoimmune disease, nephrology, and others. In 2022, the infectious disease segment held the largest share of the market. The same segment is expected to register the highest CAGR in the market during 2022-2030.

Based on technology, the in-vitro diagnostics market is segmented into immunoassay/immunochemistry, clinical chemistry, molecular diagnostics, microbiology, blood glucose self-monitoring, coagulation and hemostasis, hematology, urinalysis, and others. In 2022, the immunoassay/ immunochemistry segment held the largest share of the market. However, the molecular diagnostics segment is expected to register the fastest CAGR during 2022–2030 owing to the launch of novel products and continuous technological evolution. Moreover, COVID-19 has positively impacted immunoassay and molecular diagnostics.

The In-vitro diagnostics market, based on end user, is segmented into hospitals, laboratories, home care, and others. In 2022, the hospitals segment held the largest market share. Additionally, the continued expansion of healthcare infrastructure would lead to improvements in current hospital facilities, which is likely to trigger the demand for IVD tests performed in these facilities. The growing number of hospital admissions, coupled with the spur in the prevalence of chronic diseases, is expected to fuel the growth of the in-vitro diagnostics market for the hospital segment during 2022–2030. Developing countries are witnessing a huge demand for advanced hospital settings to cope with the increasing patient pool and rising public health concerns. Thus, a growing number of hospitals are anticipated to boost the adoption of in-vitro diagnostics due to its superior benefits. Furthermore, benefits provided by hospitals, such as proper patient-centric care and availability of reimbursement facilities fuel the market growth of this segment.

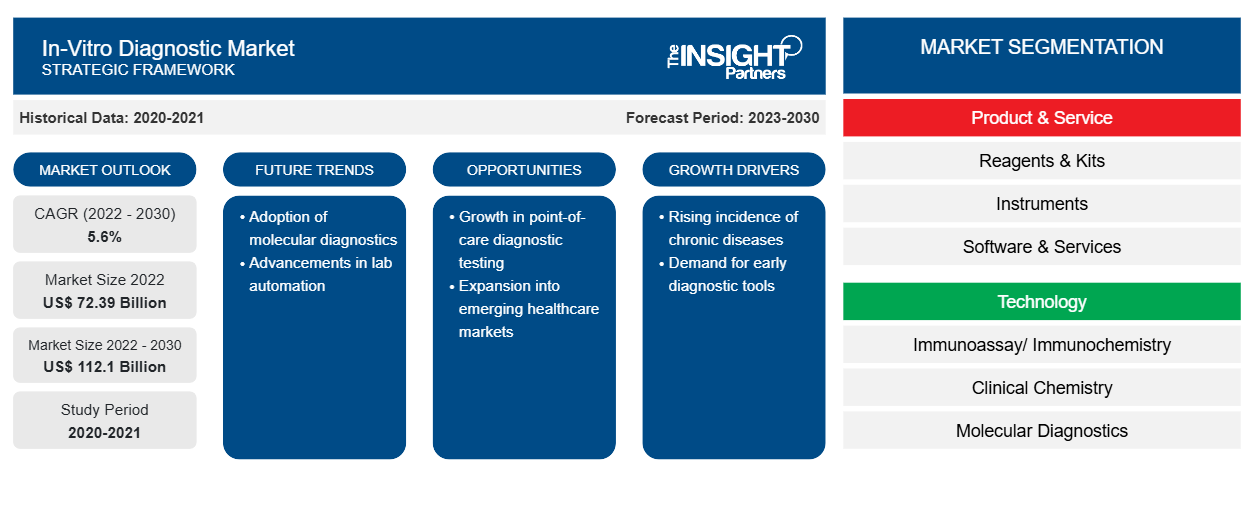

Regional Analysis:

Based on geography, the in-vitro diagnostic market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. The market in North America has been analyzed with a prime focus on three major countries—the US, Canada, and Mexico. The US held the largest share of the North American in-vitro diagnostics market in 2022. It is estimated to hold the largest share in the in-vitro diagnostic market in North America during the forecast period. The market growth in this country is ascribed to the increasing prevalence of chronic and infectious diseases, focus on efficient disease diagnosis, and a higher need for advanced healthcare systems. Chronic diseases such as cancer and cardiovascular disease are the major causes of disabilities and death in the US. As per the National Center for Chronic Disease Prevention and Health Promotion, 6 in 10 people in the country have at least 1 chronic disease. In 2021, ~18.2 million adults aged 20 and above had coronary artery disease (CAD) in the US, as per the report by the Centers for Disease Control and Prevention (CDC). CAD is the leading cause of death among people in the country.

The American Hospital Association also estimates ~133 million people have at least 1 chronic disease, and the number is expected to reach 170 million by 2030. The high incidence of chronic diseases results in a huge demand for diagnostic procedures, which, in turn, drives the in-vitro diagnostics market in the US. Growing emphasis on preventive care and enhanced access to healthcare facilities would further boost the market growth in the coming years.

In-Vitro Diagnostic Market Opportunity:

IVD is used in clinical, laboratory, and outpatient settings with the aim specifically to help detect diseases and, consequently, aid in selecting appropriate treatment protocols. The integration of IVD technologies with digital health solutions is gaining traction globally. Data analytics, artificial intelligence, and remote monitoring enhance the value of diagnostic tests, leading to better patient management and outcomes. IVD technologies integrated with digital health solutions can be incorporated into clinical decision support systems. As recognized by the WHO, digital health solutions could help detect diseases. Artificial intelligence health bots and similar emerging solutions may present opportunities for patient care and address challenges such as high cost and time requirements. In diagnostics based on genomic testing, deep learning can identify cancer cells, determine their type, and predict what mutations may occur in a tumor from images of a specific sample. Machine learning and artificial intelligence in in-vitro diagnostics are revolutionizing medical device development. These modern diagnostic systems facilitate diagnosis based on digital image analysis, improving healthcare decision-making. Smart diagnostics are extremely scalable IVD solutions that use artificial intelligence to perform better than lab-based diagnostics at a fraction of the price. Additionally, this type of diagnostics can derive emergent features through unique chemical and biological signature detection and analysis. Thus, integrating IVD with digital health technologies is likely to offer lucrative opportunities to the in-vitro diagnostics market in the coming years.

In-Vitro Diagnostics In-Vitro Diagnostic Market Regional Insights

The regional trends and factors influencing the In-Vitro Diagnostic Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses In-Vitro Diagnostic Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for In-Vitro Diagnostic Market

In-Vitro Diagnostic Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 72.39 Billion |

| Market Size by 2030 | US$ 112.1 Billion |

| Global CAGR (2022 - 2030) | 5.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product & Service

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

In-Vitro Diagnostic Market Players Density: Understanding Its Impact on Business Dynamics

The In-Vitro Diagnostic Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the In-Vitro Diagnostic Market are:

- Abbott Laboratories

- F. Hoffmann-La Roche Ltd

- Danaher Corp

- Siemens AG

- Sysmex Corp

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the In-Vitro Diagnostic Market top key players overview

Competitive Landscape and Key Companies:

A few of the prominent in-vitro diagnostic manufacturers operating in the global in-vitro diagnostic market are Abbott Laboratories, F. Hoffmann-La Roche Ltd, Danaher Corp, Siemens AG, Sysmex Corp, Thermo Fisher Scientific Inc, Becton Dickinson and Co, bioMerieux SA, Bio-Rad Laboratories Inc, Qiagen NV. These companies focus on new technologies, advancements in existing products, and geographic expansions to meet the increasing consumer demand worldwide and growing their product range in specialty portfolios. For instance, in October 2020, Abbott signed a non-exclusive royalty-bearing license agreement with Quanterix Corporation. Under the agreement, Abbott has gained access to Quanterix’s portfolio of bead-based technology patents for in vitro diagnostic (IVD) applications. In addition, Quanterix received an initial license fee, regulatory and launch milestones, milestone fees subject to achievements associated with Abbott’s future developments, and royalties on the sale of licensed products.

Frequently Asked Questions

What is in-vitro diagnostics?

In vitro diagnostics (IVD) are tests done on samples such as blood or tissues that have been taken from the human body. In-vitro diagnostics are specialized to detect diseases or other conditions that can be used to monitor a person's overall health to help cure, treat, or prevent diseases. Additionally, in-vitro diagnostics may also be utilized for precision medicine to identify patients who are likely to benefit from specific treatments or therapies. Therefore, these in-vitro diagnostics can include next-generation sequencing tests that scan a person's DNA to detect genomic variations.

What is the market CAGR value of in-vitro diagnostics market during forecast period?

The CAGR value of the in-vitro diagnostics market during the forecasted period of 2022-2030 is 5.6%.

What are the driving factors for the in-vitro diagnostics market across the globe?

Key factors that are driving the growth of this market are increasing prevalence of chronic diseases, technological advancements, and the growing geriatric population are expected to boost the market growth for the in-vitro diagnostics over the years.

Which products & services segment leads the in-vitro diagnostics market?

The reagent & kits segment held the largest share of the market in the global in-vitro diagnostics market and held the largest market share of 79.00% in 2022.

Which are the top companies that hold the market share in in-vitro diagnostics market?

Abbott and F.Hoffman-La-Roche are the top two companies that hold huge market shares in the in-vitro diagnostics market.

Which application held the largest share in the in-vitro diagnostics market?

The infectious diseases segment dominated the global in-vitro diagnostics market and held the largest market share of 39.8% in 2022.

Which region is expected to witness significant demand for in-vitro diagnostics market in the coming years?

Global in-vitro diagnostics market is segmented by region into North America, Europe, Asia Pacific, the Middle East & Africa and South & Central America. Europe held the largest market share of the in-vitro diagnostics market in 2022. With several European market players focusing on research and development activities in the field of imaging technology, the regional market for in-vitro diagnostics market is likely to propel in Europe region during the forecast period.

Who are the key players in the in-vitro diagnostics market?

The in-vitro diagnostics market majorly consists of the players such Abbott Laboratories, F. Hoffmann-La Roche Ltd, Danaher Corp, Siemens AG, Sysmex Corp, Thermo Fisher Scientific Inc, Becton Dickinson and Co, bioMerieux SA, Bio-Rad Laboratories Inc, and Qiagen NV.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - In-Vitro Diagnostics Market

- Abbott Laboratories

- F. Hoffmann-La Roche Ltd

- Danaher Corp

- Siemens AG

- Sysmex Corp

- Thermo Fisher Scientific Inc

- Becton Dickinson and Co

- bioMerieux SA

- Bio-Rad Laboratories Inc

- Qiagen NV

Get Free Sample For

Get Free Sample For