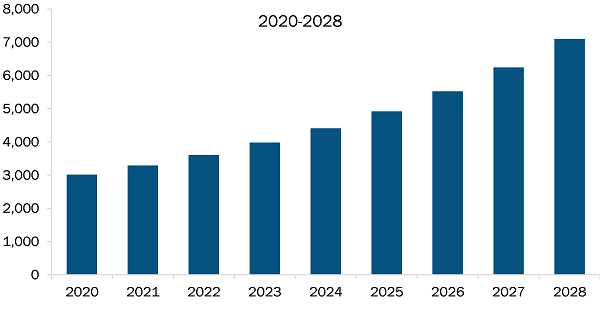

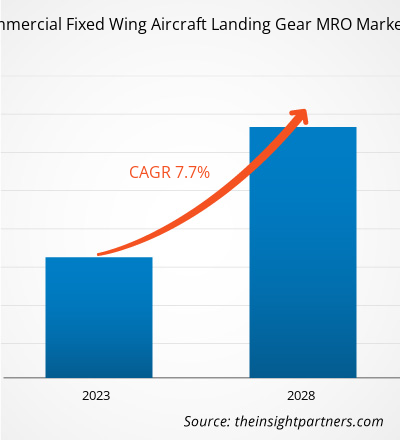

The India commercial fixed wing aircraft landing gear MRO market is expected to grow from US$ 89.04 million in 2022 to US$ 139.22 million by 2028; it is estimated to grow at a CAGR of 7.7% from 2022 to 2028.

India has a limited number of wide body fleet operated by a few airline carriers across the country. The country currently operates 39 wide body aircraft fleet that is expected to witness a growth of more than 8% during the forecast period. The landing gear of wide bodies have more components than narrow body aircraft landing gears. For instance, a narrow body aircraft (e.g., A320 Family and B737 Family) landing gear comprises 2-wheel main landing gear, whereas a wide body aircraft (e.g., B777 series) has multiple axel bogies that can accommodate a higher number of wheels into a main landing gear.

Several airlines in India have been helping to boost the country’s wide body aircraft fleet by introducing a few popular and next generation aircraft models. Until June 2022, Vistara Airlines (Tata SIA Airlines) was the only private airline next to Air India that had been actively operating a fleet of wide body passenger aircraft across the country; however, in July 2022, Jet Airways announced that it will be leasing six B777 wide body jets for operating in the Indian aviation market wherein the active operation date of those aircraft models is not confirmed yet. Similarly, in 2022, Air India announced to resume its long time grounded wide body fleet of another 10 aircraft (six B787-8s and three B777-300ERs) by the end of first quarter 2023. The resuming operations of such aircraft fleet after the COVID-19 pandemic in Indian aviation market is another major trend generating new opportunities for fixed wing wide body aircraft MRO market growth across India. Such factors are generating new market opportunities for market vendors across India and are generating pandemic recovery/profit earning opportunities for India aviation MRO market vendors across the country and thereby expected to drive the commercial fixed wing aircraft landing gear MRO market in the region.

India Commercial Fixed Wing Aircraft Landing Gear : Key Players

Major India commercial fixed wing aircraft landing gear players include Tentacle Aerologistix Pvt Ltd, AI Engineering Services Ltd, AAR Indamer Technics Pvt Ltd, Interglobe Aviation Ltd, Haveus Aerotech India Pvt Ltd, Air Works India (Engineering) Pvt Ltd, Horizon Aerospace Pvt Ltd, and Aerotek Sika Aviation Engineering Pvt Ltd. The rising investment by these companies in product and service enhancements is propelling the market's growth. For instance, in May 2022, Boeing and AI Engineering Services Limited (AIESL) collaborated for the maintenance, repair, and overhaul services of two custom-made B777 aircraft.

India Commercial Fixed Wing Aircraft Landing Gear MRO Market: by Gear Type

Based on gear type, the India commercial fixed wing aircraft landing gear MRO market is segmented into nose gear and main gear. The main gear segment held a larger share in the India commercial fixed wing aircraft landing gear MRO market in 2021. The main gear bears majority of the aircraft loads during takeoff and landing operations. Also, the main landing gears have more weight compared to the nose landing gears. This is due to the main gears are designed to manage the aircraft’s weight and impact during the aircraft landing operations wherein the main landing gears bear around 85% of the aircraft weight, while landing operations compared to nose landing gear that bear only approximately 15% of the aircraft weight during the aircraft take-off or landing operations. The higher weight and load bearing capacity of the main landing gear leads to the requirement of more frequent maintenance and repair checks, which is one of the major factors that boost the growth of India commercial fixed wing aircraft landing gear MRO market size for main gear segment.

Impact of COVID-19 Pandemic on India Commercial Fixed Wing Aircraft Landing Gear MRO Market

The COVID-19 impact has already led to significant losses to the aviation industry vendors. Majority of airliners across India had to cut their costs in each aspect of their business to survive the pandemic during the lockdown and travel restricted period. The COVID-19 outbreak forced the country’s aviation industry into severe downturn that also led to permanent retirement of several old airline fleets before time, postponement of placing new aircraft orders, and grounded aircraft remaining fleet due to flight restriction placed by the Ministry of Civil Aviation of India during the pandemic. This also caused delay and missing out of a few major scheduled periodic maintenances of country’s grounded aircraft fleet for a significant period.

India Commercial Fixed Wing Aircraft Landing Gear MRO Market: Market Initiative

Market initiatives are strategies adopted by companies to expand their footprint worldwide and meet the growing customer demand. The India commercial fixed wing aircraft landing gear MRO market players are mainly focusing on product and service enhancements by integrating advanced features and technologies into their offerings.

- In August 2022, Indigo rapidly expanded its fleet, and to cater to the demands, the company has begun building a Best-in-class Maintenance facility in Bangalore.

- In October 2022, SIKA and Aerotek Aviation Engineering have introduced Aerotek Sika Aviation Engineering, a recently established joint venture that has been set up as a Make in India initiative to provide world-class manufacturing and maintenance, repair, and overhaul services of landing gear for fixed and rotary wing aircraft.

Thus, the abovementioned factors are expected to contribute to the India commercial fixed wing aircraft landing gear MRO market growth.

India Commercial Fixed Wing Aircraft Landing Gear MRO Market Revenue and Forecast to 2028 (US$ Million)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

India Commercial Fixed Wing Aircraft Landing Gear MRO Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 89.04 Million |

| Market Size by 2028 | US$ 139.22 Million |

| Global CAGR (2022 - 2028) | 7.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Gear Type

|

| Regions and Countries Covered | India

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Gear Type, and Activity

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

India

Trends and growth analysis reports related to Aerospace and Defense : READ MORE..

The List of Companies - India Commercial Fixed Wing Aircraft Landing Gear MRO Market

- Tentacle Aerologistix Pvt Ltd

- AI Engineering services Ltd

- AAR Indamer Technics Pvt Ltd

- InterGlobe Aviation Ltd

- Haveus Aerotech India Pvt Ltd

- Air Works India (Engineering) Pvt Ltd

- Horizon Aerospace Pvt Ltd

- Aerotek Sika Aviation Engineering Pvt Ltd

Get Free Sample For

Get Free Sample For