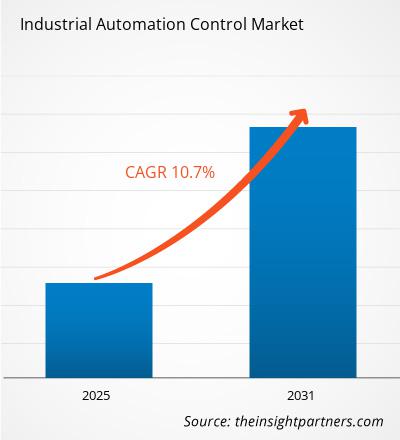

The industrial automation control market size is expected to reach US$ 391.63 billion by 2031 from US$ 193.22 billion in 2024. The market is anticipated to register a CAGR of 10.7% during 2025–2031. The integration of artificial intelligence (AI) and machine learning (ML) is likely to bring new trends to the market in the coming years.

Industrial Automation Control Market Analysis

Automation in manufacturing spans a range of applications, from controlling assembly lines and packaging processes to overseeing complex tasks such as precision machining or chemical production. With real-time data collection and analysis, automated systems can detect faults, predict maintenance needs, and optimize workflows, leading to fewer breakdowns and downtime. This results in a more agile production environment, capable of responding quickly to market changes or consumer demand. By reducing human error and enhancing operational oversight, Industrial automation control also plays a critical role in improving workplace safety. For businesses, it can lead to significant cost savings, faster production cycles, and the ability to scale operations more effectively. As industries continue to embrace automation technologies, they can achieve higher levels of competitiveness and innovation, positioning themselves for long-term growth and success in an increasingly digital and globalized market.

Industrial Automation Control Market Overview

Industrial automation control refers to the use of advanced technologies and control systems, such as computers, robots, and information systems, to manage and monitor industrial processes and machinery. The goal of Industrial automation control is to improve efficiency, productivity, and safety by reducing human intervention in manufacturing operations. In business, industrial automation control streamlines production by automating repetitive and time-consuming tasks, enabling faster, more accurate, and consistent outputs. Through automation, businesses can enhance operational efficiency, reduce the risk of errors, and minimize labor costs, all while maintaining high levels of product quality. These systems often integrate sensors, robotics, and artificial intelligence (AI) to monitor and control production lines in real time, making adjustments to improve performance and reduce waste.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

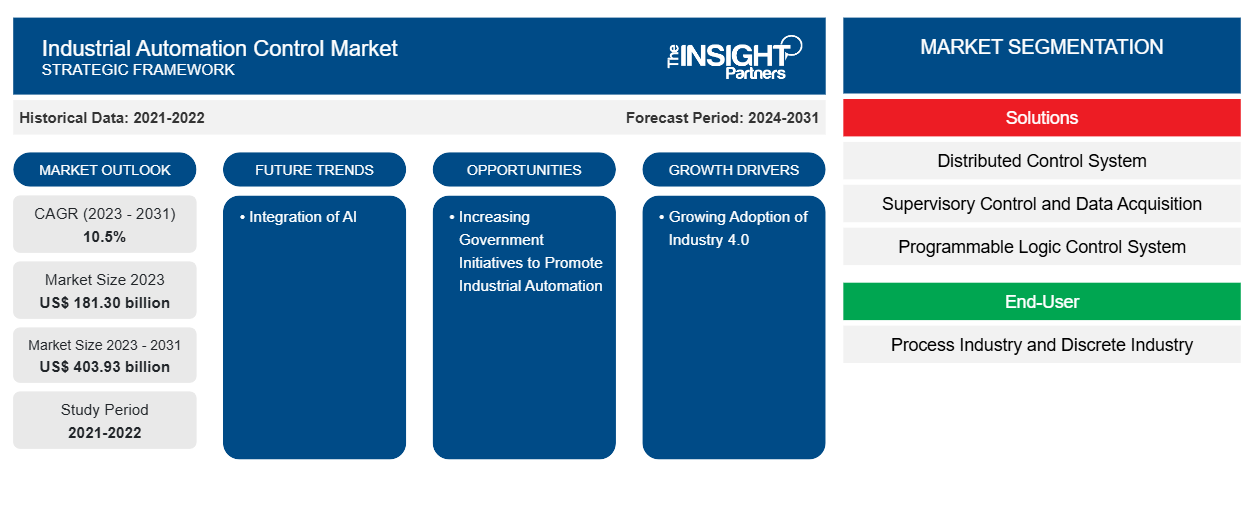

Industrial Automation Control Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Industrial Automation Control Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Industrial Automation Control Market Drivers and Opportunities

Widespread Adoption of Industrial Automation Control in Diverse Industries

The penetration of industrial automation control is gaining pace in industries other than automotive. In the recent past, the non-automotive industries were very underpenetrated in comparison to the automotive industry. With the increasing functionality of equipment such as industrial robots, it is anticipated that the non-automotive industries will further accelerate the adoption of industrial automation control.

Apart from industries, the penetration is also increasing among countries. Developed markets, including China, the US, and Japan, have higher penetration; however, there is still a lot of opportunity available for the industrial market to grow further, even in the developed markets. For instance, in 2023, China accounted for 35% of gross production, which is nearly triple the gross production of the US and comes in second at 12%. The prospect of further installations is remarkable in many of these countries, particularly in the non-automotive industry. This growth is attributed to the necessary modernization and transformation required in these markets. These statistics are promising for manufacturers as it signifies the huge scope for further increase in adoption.

Rise in Government Support

The importance of government and policymakers in promoting industrial automation control has significantly increased as industries globally strive to improve efficiency and streamline manufacturing processes. As industrial automation control plays a pivotal role in driving the Fourth Industrial Revolution, governments and policymakers need to establish the appropriate support mechanisms and regulatory frameworks to foster its widespread adoption and growth. For instance, in India, the government has implemented several measures to strengthen the smart manufacturing sector, one of the key initiatives being the Production Linked Incentive (PLI) scheme. Launched in 2020, the PLI scheme targets 14 sectors, including automobiles, pharmaceuticals, textiles, food processing, and white goods, as part of a broader strategy to promote domestic manufacturing. The scheme is designed to encourage companies to adopt smart manufacturing practices by offering financial incentives to those that produce goods locally and meet specific investment, sales, and export criteria. This initiative aims to enhance the competitiveness of these companies and, in turn, elevate the overall value of India's manufacturing sector.

Similarly, in the US, in 2023, the Department of Energy (DoE) announced a US$ 22 million initiative to support 12 state-run programs to expedite the adoption of smart manufacturing at small- and medium-sized facilities. This initiative, funded by the President's Bipartisan Infrastructure Law, intends to enhance access to smart manufacturing technologies and high-performance computing within the US manufacturing sector. Furthermore, in August 2023, The Advanced Robotics for Manufacturing (ARM) Institute shortlisted eight new short-cycle technology projects and plans to award a total contribution of approximately US$ 3.26 million for funding through its 23-01 Technology Project Call. Such initiatives are expected to offer a significant opportunity to boost the smart manufacturing sector, thereby fueling the industrial automation control market growth.

Industrial Automation Control Market Report Segmentation Analysis

Key segments that contributed to the derivation of the industrial automation control market analysis are system and end user.

- Based on system, the industrial automation control market is segmented into SCADA, DCS, PLC, PLM, and others. The SCADA segment dominated the market in 2024.

- Based on end user, the industrial automation control market is bifurcated into process industry and discrete industry. The discrete industry segment dominated the market in 2024.

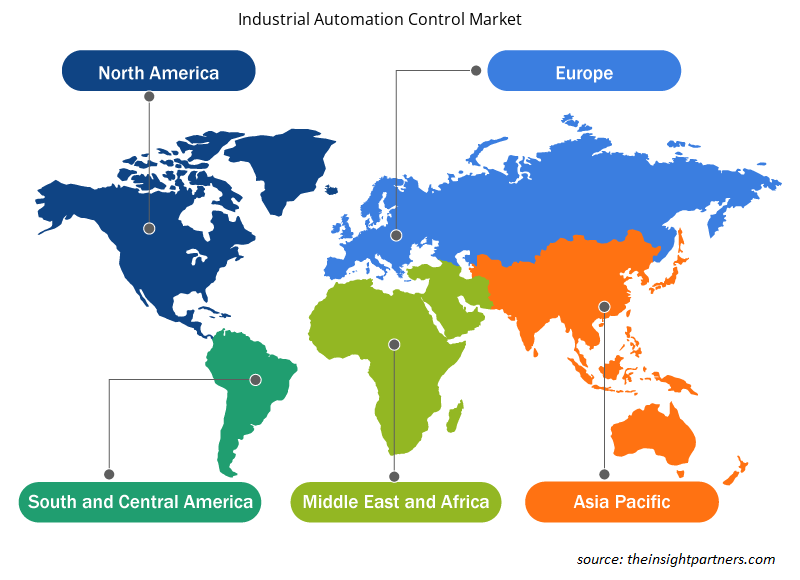

Industrial Automation Control Market Share Analysis by Geography

The industrial automation control market is segmented into five major regions: North America, Europe, Asia Pacific, Middle East & Africa (MEA), and South America. North America dominated the market in 2024.

Across North America, technological advancements have fostered highly competitive markets, positioning the region as a hub for innovation and economic strength. Companies in the region are consistently optimizing their business processes to meet the rising demand for high-quality products and services in the most efficient manner.

Various initiatives are being implemented by global companies to further drive the growth of the industrial automation control market. For instance, in December 2024, ONDEX Automation ("ONDEX" or the "Company") announced that it had completed a partnership with Automation & Control Inc. ("ACI"), a Moorestown, NJ-based leader in control systems and industrial automation services. This strategic partnership marks a significant milestone in ONDEX Automation's mission to deliver innovative automation solutions to its North American manufacturing customers. Backed by Shore Capital Partners, a Chicago-based private equity firm, ONDEX Automation is building a leading system integrator to serve the needs of its North American manufacturing customers. ONDEX is actively pursuing additional opportunities to partner with factory automation system integrators who bring a diverse range of capabilities, experienced engineering talent, and a shared commitment to innovation and excellence. Key players in the North America industrial automation control market include Rockwell Automation Inc., ABB Ltd., and Mitsubishi Electric Corporation. These companies are driving innovation and shaping the future of industrial automation in the region.

Industrial Automation Control Market Regional Insights

The regional trends and factors influencing the Industrial Automation Control Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Industrial Automation Control Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Industrial Automation Control Market

Industrial Automation Control Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 193.22 Billion |

| Market Size by 2031 | US$ 391.63 Billion |

| Global CAGR (2025 - 2031) | 10.7% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By System

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

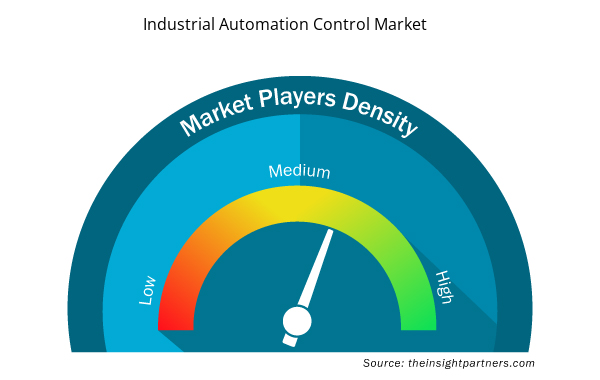

Industrial Automation Control Market Players Density: Understanding Its Impact on Business Dynamics

The Industrial Automation Control Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Industrial Automation Control Market are:

- ABB Ltd

- Honeywell International Inc.

- Siemens AG

- Emerson Electric Co.

- Bosch Rexroth AG

- General Electric Company

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Industrial Automation Control Market top key players overview

Industrial Automation Control Market News and Recent Developments

The industrial automation control market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the industrial automation control market are listed below:

- Bosch Rexroth is expanding its BODAS ecosystem in the field of automation with two new solutions: The Collision Avoidance System enables effective collision prevention through precise object detection and person detection using radar, ultrasound, and smart cameras.

(Source: Bosch Rexroth, Press Release, 2025)

- ABB has launched the ABB Ability Symphony Plus SDe Series, a portfolio of hardware products that help modernize existing process control system installations with minimal risk and disruption to plant operations. The new series enables plant operators in industries such as power, water, oil and gas, pharmaceuticals, and pulp and paper to upgrade installed control systems to the latest technologies, driving efficiency and productivity improvements.

(Source: ABB, Press Release, 2024)

Industrial Automation Control Market Report Coverage and Deliverables

The "Industrial Automation Control Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Industrial automation control market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Industrial automation control market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Industrial automation control market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the industrial automation control market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- High Speed Cable Market

- Transdermal Drug Delivery System Market

- Medical and Research Grade Collagen Market

- Artificial Intelligence in Healthcare Diagnosis Market

- Public Key Infrastructure Market

- Europe Surety Market

- Electronic Shelf Label Market

- Smart Grid Sensors Market

- Enteral Nutrition Market

- Customer Care BPO Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Solutions ; and End-User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Frequently Asked Questions

Which are the leading players operating in the Industrial Automation Control Market?

Honeywell, Omron Corp, Schneider Electric SE, Siemens AG, ABB Ltd are major players in the market.

What would be the estimated value of the Industrial Automation Control Market by 2031?

The market is expected to reach a value of US$ 391.63 billion by 2031.

What is the expected CAGR of the Industrial Automation Control Market?

The market is anticipated to expand at a CAGR of 10.7% during 2025-2031.

What are the driving factors impacting the Industrial Automation Control Market?

Rapid Expansion of manufacturing Industry, Widespread adoption of industrial automation control in diverse industries, and constant rise in labor costs and need for accuracy in production are driving the market growth.

What are the future trends of the Industrial Automation Control Market?

Integration of Artificial Intelligence (AI) and Machine Learning (ML) is a key trend in the market.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Industrial Automation Control Market

- ABB Ltd

- Honeywell International Inc.

- Siemens AG

- Emerson Electric Co.

- Bosch Rexroth AG

- General Electric Company

- Hitachi, Ltd.

- Koyo Electronics Industries Co., Ltd.

- Mitsubishi Heavy Industries, Ltd.

- Omron Corporation

- Rockwell Automation

- Yokogawa Electric Corp.

Get Free Sample For

Get Free Sample For