Manufacturing Execution System Market Developments and Forecast by 2031

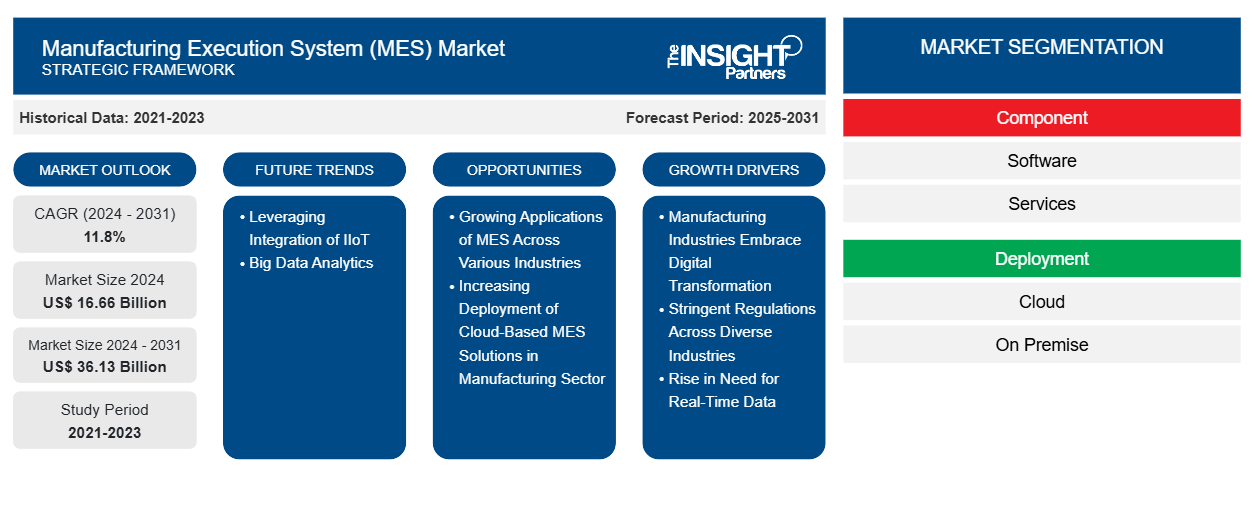

Manufacturing Execution System (MES) Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Software and Services), Services Type (Professional Services and Managed Services), Deployment (Cloud and On-Premise), Organization Size (Large Enterprises and SMEs), License Type (Subscription-Based and Licensed), Sales Channel (Direct Sales and Channel Partners), End User (Discrete Industry and Process Industry), and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Mar 2025

- Report Code : TIPRE00006449

- Category : Technology, Media and Telecommunications

- Status : Published

- Available Report Formats :

- No. of Pages : 549

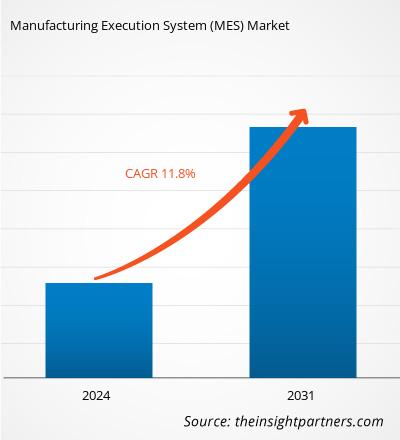

The manufacturing execution system (MES) market size was valued at US$ 16.66 billion in 2024 and is expected to reach US$ 36.13 billion by 2031; it is estimated to register a CAGR of 11.8% during 2024–2031. Leveraging the integration of IIoT and big data analytics is likely to remain a key market trend.

Manufacturing Execution System (MES) Market Analysis

Factors such as manufacturing industries embarking on digital transformation, stringent regulations in various industries, and a growing need for real-time data are driving the growth of the manufacturing execution system (MES) market. The increasing use of MES in various industries and the rise of cloud-based MES solutions in manufacturing are expected to create opportunities for the expansion of the manufacturing execution system (MES) market. Moreover, leveraging the integration of IIoT and big data analytics is expected to set new trends for the manufacturing execution system (MES) market.

Manufacturing Execution System (MES) Market Overview

A manufacturing execution system (MES) is a comprehensive, dynamic software system that monitors, tracks, documents, and manages the entire manufacturing process, from raw materials to finished products. An MES serves as a functional layer between enterprise resource planning (ERP) and process control systems, providing decision-makers with the data they need to improve plant floor efficiency. MES allows enterprises to track and control the whole manufacturing process, from raw material intake to finished product delivery. This involves handling work orders, checking product quality, monitoring machine performance, and collecting data throughout the production process.

An MES software is used to manage, monitor, and coordinate the real-time physical processes and personnel involved in the conversion of raw materials into intermediate and/or completed commodities. Furthermore, it provides actionable data that assists manufacturing decision-makers in understanding how to optimize plant floor operating conditions in order to increase production output. MES software serves as a bridge between PLM, ERP systems (IT), and machines (OT). This software layer improves the efficiency and quality of the production process, resulting in greater productivity and profitability.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONManufacturing Execution System (MES) Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Manufacturing Execution System (MES) Market Drivers and Opportunities

Stringent Regulations Across Diverse Industries

MES ensures industry compliance through complete traceability and data recording. It records extensive information about the raw ingredients, components, processes, and operators involved in manufacturing. This data enables manufacturers to meet regulatory criteria and maintain high standards. For example, MES can automatically document each stage of the manufacturing process, resulting in an audit trail required for regulatory inspections. It also analyzes quality control parameters in real time to ensure that products fulfill industry standards. If any deviations occur, MES can send alerts and take corrective action to ensure compliance. MES is the backbone of daily operations in the pharmaceutical sector, giving precise and real-time management over all aspects of the manufacturing process. In the pharmaceutical industry, MES facilitates electronic batch records (EBR) in accordance with stringent Good Manufacturing Practice (GMP) criteria. By deploying an EBR system, MES ensures that each production stage is accurately documented, lowering the risk of human mistakes and simplifying daily operations administration. Further, MES in the food and beverages industry meet all legal and sanitary standards, including Hazard Analysis and Critical Control Points (HACCP). MES deployment in the food and beverages industry is best done in stages, commencing with chosen manufacturing lines or areas to minimize disruptions to the manufacturing process. Thus, stringent regulatory standards across various industries drive the manufacturing execution system (MES) market growth.

Growing Applications of MES Across Various Industries

MES solutions can be implemented and modified to meet the specific needs of different industries such as automotive, electronics, and pharmaceutical. At the same time, the fundamental function of an MES remains the same across industries. A manufacturing execution system (MES) solution can help keep pace with an increasingly complex and fast-changing automotive industry and better align manufacturing operations to market needs. An MES uses three key functionalities to accomplish this: operation management, Information management, and integration gateway. Using a MES can help automotive suppliers stay ahead of shifting industry trends. In automotive manufacturing, MES plays a vital role in coordinating complex assembly lines. An MES tracks the progress of vehicles on the assembly line, monitors the availability of components, and synchronizes operations across different workstations. Battery manufacturers can improve quality management by having total traceability from mixing to formulation. Tire manufacturers can maintain efficiency and quality standards while managing complicated tire mixes. An MES can deliver quantifiable improvements in many areas. According to Rockwell Automation, MES can reduce scrap by up to 8%, lead time by up to 45%, cycle time by up to 45%, labor costs by up to 50%, and reject rates by up to 75%. Due to this, it finds application across various industries. Thus, the growing application of MES across various industries is expected to create lucrative opportunities for the growth of the market.

Manufacturing Execution System (MES) Market Report Segmentation Analysis

Key segments that contributed to the derivation of the manufacturing execution system (MES) market analysis are component, deployment, organization size, license type, sales channel, and end user.

- Based on component, the market is segmented into software and service. The service segment is further segmented into professional services and managed services. The software segment dominated the market in 2024.

- In terms of deployment, the market is segmented into on-premise and cloud. The cloud segment is further segmented into private cloud, public cloud, and hybrid cloud. The cloud held the largest market share in 2024.

- The manufacturing execution system (MES) market, by organization size, is bifurcated into large enterprises and SMEs. The large enterprises segment dominated the market in 2024.

- Based on license type, the manufacturing execution system (MES) market is segmented into licensed and subscription-based. The subscription-based segment dominated the market in 2024.

- Based on sales channel, the market is categorized into direct sales, channel partners, and third-party providers. The direct sales segment dominated the market in 2024.

- Based on end user, the market is segmented into process industry and discrete industry. The process industry segment is further classified into food and beverages, oil and gas, chemicals, pulp and paper, chemical, energy and power, pharmaceuticals and life sciences, water and wastewater treatment, and others. The discrete industry segment is further segmented into automotive, electronics, semiconductors, aerospace and defense, consumer packaged goods, medical devices, and others. The discrete industry segment dominated the market in 2024.

Manufacturing Execution System (MES) Market Share Analysis by Geography

- The manufacturing execution system (MES) market is segmented into five major regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. North America dominated the manufacturing execution system (MES) market in 2024. Europe is the second-largest contributor to the global manufacturing execution system (MES) market, followed by Asia Pacific.

- The manufacturing execution system (MES) market in North America is segmented into the US, Canada, and Mexico. North America holds a significant manufacturing execution system (MES) market share, driven by the region’s advanced manufacturing base and early adoption of Industry 4.0 technologies. The US, in particular, is home to many MES software vendors, including global leaders such as Rockwell Automation and Honeywell International Inc. MES adoption in North America is prevalent across industries such as automotive, aerospace, pharmaceuticals, and electronics. The growing emphasis on real-time data analytics, production efficiency, and regulatory compliance is propelling the demand for MES solutions. Moreover, the market in North America is witnessing substantial growth as manufacturers and government authorities increasingly recognize the benefits of real-time production monitoring and process optimization. Additionally, government incentives for digital transformation and Industry 4.0 adoption are accelerating the demand for MES systems, further fueling market growth.

Manufacturing Execution System (MES) Market Regional Insights

The regional trends and factors influencing the Manufacturing Execution System (MES) Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Manufacturing Execution System (MES) Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Manufacturing Execution System (MES) Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 16.66 Billion |

| Market Size by 2031 | US$ 36.13 Billion |

| Global CAGR (2024 - 2031) | 11.8% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Manufacturing Execution System (MES) Market Players Density: Understanding Its Impact on Business Dynamics

The Manufacturing Execution System (MES) Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Manufacturing Execution System (MES) Market top key players overview

Manufacturing Execution System (MES) Market News and Recent Developments

The manufacturing execution system (MES) market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the manufacturing execution system (MES) market are listed below:

- Emerson Automation Solutions announced that it expanded its partnership with Informetric Systems Inc. Emerson integrated InfoBatch with the Syncade Manufacturing Execution System. Emerson customers can now aggregate data from Syncade, DeltaV, and third-party databases/historians using the InfoBatch reporting suite.

(Source: Emerson Automation Solutions, Press Release, November 2024)

- GE Digital, an integral part of GE Vernova’s portfolio of energy businesses, announced new enhancements to its cloud-based Manufacturing Execution Systems (MES) software in the Proficy Smart Factory portfolio at the 27th Annual ARC Industry Forum that took place during February 6–9 in Orlando, Florida. Lowering capital expenditures (CAPEX) and operating expenses (OPEX) compared to on-premises implementations, the Proficy Smart Factory cloud MES software can help process, discrete, and mixed-environment manufacturers of any size to reduce total cost of ownership (TCO) up to 30%, decrease maintenance, and improve security.

(Source: GE Digital, Press Release, February 2023)

Manufacturing Execution System (MES) Market Report Coverage and Deliverables

The "Manufacturing Execution System (MES) Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Manufacturing execution system (MES) market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Manufacturing execution system (MES) market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Manufacturing execution system (MES) market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the manufacturing execution system (MES) market

- Detailed company profiles

Frequently Asked Questions

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For