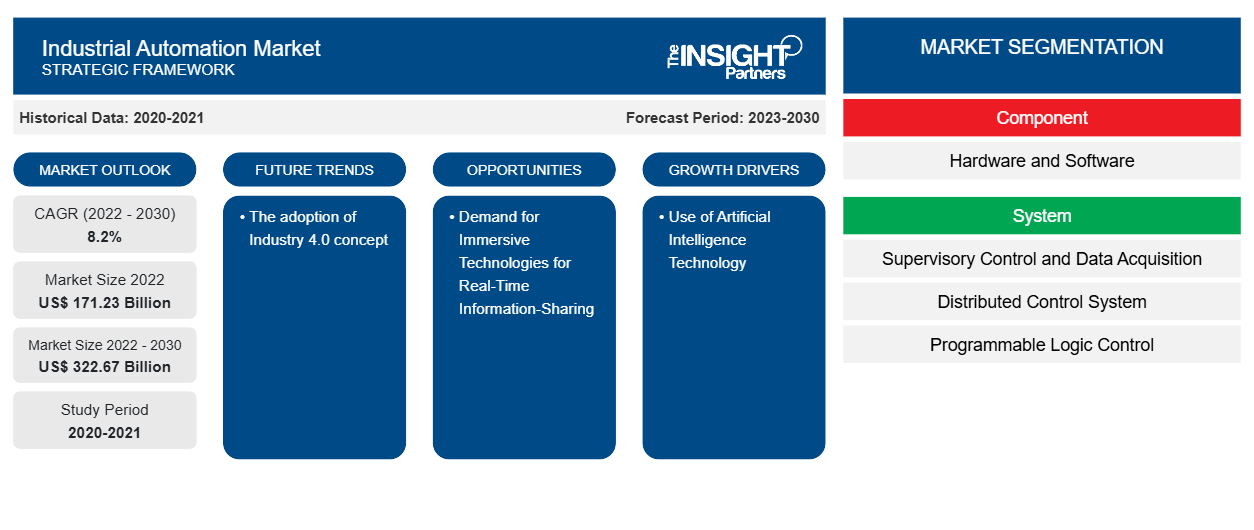

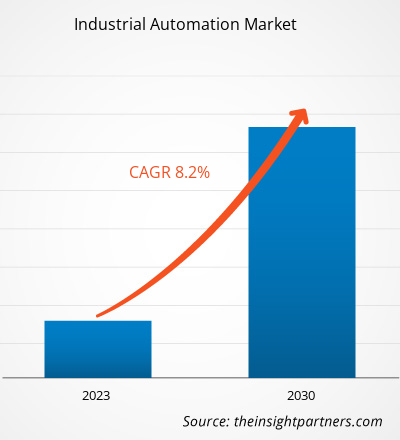

The industrial automation market size is projected to reach US$ 322.67 billion by 2030 from US$ 171.23 billion in 2022. The market is expected to register a CAGR of 8.2% during 2022–2030. The adoption of the Industry 4.0 concept is likely to remain a key trend in the market.

Industrial Automation Market Analysis

In addition to the growing adoption of AI and machine learning, the industrial automation market is being propelled by the increasing convergence of Information Technology (IT) and Operational Technology (OT). This integration is enabling manufacturers to gain greater visibility into operations, improve decision-making, and achieve enhanced control over production processes. Smart sensors, connected devices, and industrial IoT platforms are generating vast amounts of real-time data, which, when analyzed using AI algorithms, support predictive analytics, anomaly detection, and process optimization. Governments in both developed and emerging economies are recognizing the strategic importance of automation in boosting productivity, minimizing human error, and enhancing workplace safety. As a result, several national programs—such as Germany’s Industry 4.0, China’s Made in China 2025, and India’s Make in India initiative—are actively incentivizing investments in automation technologies. Furthermore, the incorporation of machine vision systems with deep learning capabilities is enhancing quality inspection and defect detection across industries such as electronics, automotive, and food & beverage. The growing demand for personalized, high-quality products delivered quickly and cost-effectively is further encouraging businesses to adopt automated and digital manufacturing solutions. As industrial operations become more complex, scalable automation solutions will play a critical role in maintaining competitiveness, agility, and resilience in global markets.

Industrial Automation Market Overview

Industrial automation replaces human intervention by using control systems such as robots, computers, and information technology to operate various machinery in an industry. Depending on the operations involved, industrial automation control systems are divided into two categories: process plant automation and manufacturing automation. Industrial automation improves product quality, reliability, and production rate while lowering manufacturing and design costs through the use of new, innovative, and integrated technologies and services. They have a variety of characteristics, including high productivity, quality, flexibility, and information correctness, which are projected to promote the use of automation in the industrial sector during the forecast period. Furthermore, the spike in the adoption of automation solutions in oil and gas, manufacturing, chemicals and materials, pharmaceuticals, and other industries is pushing industrial automation.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Industrial Automation Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Industrial Automation Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Industrial Automation Market Drivers and Opportunities

Use of Artificial Intelligence Technology to Favor the Market

Artificial intelligence (AI) is transforming manufacturing in incredible ways. AI enables machines to learn, adapt, and make decisions autonomously. Manufacturers utilize the technology to uncover asset patterns and anomalies to optimize production and save downtime. For example, incorporating AI into industrial robots and drones enhances precision and aids in activities such as inspection, maintenance, and material handling. This decreases the need for human involvement, lowers the danger of accidents, increases maintenance efficiency, and extends equipment life. Moreover, operations technology (OT) engineers who are familiar with operations and equipment are increasingly using sophisticated AI technologies with visual, point-and-click user interfaces (UI). The availability of prebuilt machine learning (ML) apps and industrial demand for automation is fueling the market.

Demand for Immersive Technologies for Real-Time Information-Sharing

Virtual reality (VR) and augmented reality (AR) are immersive technologies that enable real-time information sharing to aid worker training, eliminate human errors, and boost performance. That implies VR and AR may add significant commercial value by improving worker safety, increasing productivity, and reducing downtime. AR can aid industrial enterprises by facilitating return-to-work measures such as remote collaboration, remote assistance, augmented work instructions, and 3D training. AR is also assisting with longer-term, future-of-work strategies aimed at closing the skills gap and driving significant gains. Augmented reality is becoming increasingly important in the workplace.

- Stream Industrial Internet of Things (IIoT) and sensor data to improve condition monitoring, troubleshooting, and repairs.

- View immersive 3D work instructions for assembly, inspection, and maintenance procedures.

- Get step-by-step guidance and on-demand assistance from seasoned professionals.

- Pass comments on the circumstances they observe in the factory or field back into the connected digital thread, enabling closed-loop feedback throughout the company.

- Operators and service technicians use highly demanding augmented reality to streamline operational processes.

Industrial Automation Market Report Segmentation Analysis

Key segments that contributed to the derivation of the industrial automation market analysis are component, system, and end user.

- Based on component, the industrial automation market is divided into hardware and software. The hardware segment held a larger market share in 2022.

- By system, the market is segmented into supervisory control and data acquisition, distributed control systems, programmable logic control, and others. The supervisory control and data acquisition segment is anticipated to expand during the forecast period.

- Based on end users, the market is divided into oil & gas, automotive, food & beverages, chemical & materials, aerospace & defense, and others. The oil & gas segment held the largest market share in 2022.

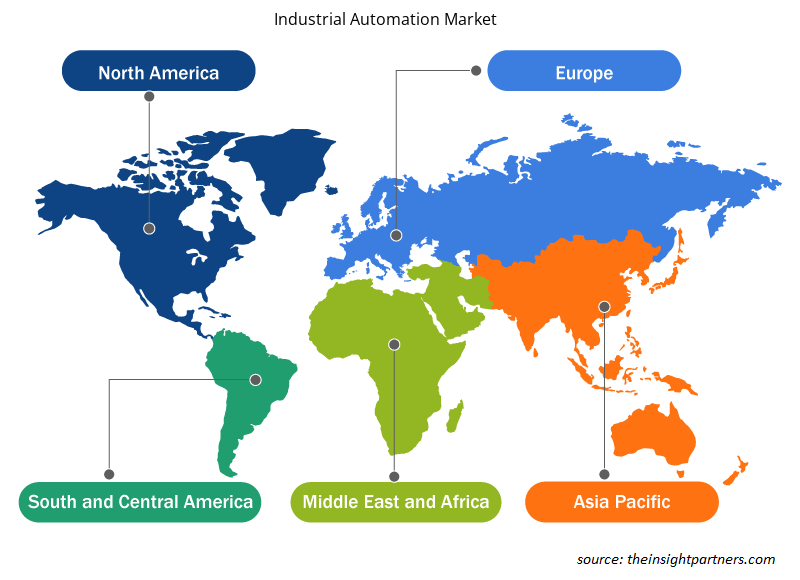

Industrial Automation Market Share Analysis by Geography

The geographic scope of the industrial automation market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The market in Asia Pacific is projected to expand during the forecast period due to the presence of key players. Omron Corporation, Mitsubishi Electric Corporation, Hitachi Ltd., and others are offering their customers technologically advanced factory automation products that improve their operational efficiencies. Expanding industries and increasing adoption of industrial automation technologies are boosting the market.

Industrial Automation Market Regional Insights

The regional trends and factors influencing the Industrial Automation Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Industrial Automation Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Industrial Automation Market

Industrial Automation Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 171.23 Billion |

| Market Size by 2030 | US$ 322.67 Billion |

| Global CAGR (2022 - 2030) | 8.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Industrial Automation Market Players Density: Understanding Its Impact on Business Dynamics

The Industrial Automation Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Industrial Automation Market are:

- ABB Ltd.

- Bosch Rexroth AG

- Emerson Electric Co.

- Hitachi Ltd.

- Honeywell International, Inc.

- Mitsubishi Electric Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Industrial Automation Market top key players overview

Industrial Automation Market News and Recent Developments

The industrial automation market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the industrial automation market are listed below:

- In 2023, Emerson Electric's acquisition of National Instruments for US$ 8.2 billion in April 2023 marked a strategic move to fortify its presence in industrial automation. The deal aligned with Emerson's pursuit of testing and measurement growth, tapping into National Instruments' software-driven automated systems to deliver enhanced profitability and industry diversification. This step reflected the surge in demand for advanced automation solutions. (Source: Emerson Electric Co., Company Website, October 2023)

- ABB India secured a significant contract for the electrification and automation of ArcelorMittal Nippon Steel India's advanced cold rolling mill in Hazira. ABB's technology aimed to enhance energy efficiency, zinc consumption optimization, and corrosion resistance, aligning with AM/NS India's sustainability goals. This collaboration showcased industrial automation's transformative potential. (Source: ABB Ltd, Company Website, June 2023)

Industrial Automation Market Report Coverage and Deliverables

The “Industrial Automation Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Industrial automation market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Industrial automation market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Industrial automation market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the industrial automation market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Artificial Intelligence in Healthcare Diagnosis Market

- Workwear Market

- Formwork System Market

- Authentication and Brand Protection Market

- Medical and Research Grade Collagen Market

- Quantitative Structure-Activity Relationship (QSAR) Market

- Flexible Garden Hoses Market

- Cell Line Development Market

- Enteral Nutrition Market

- Visualization and 3D Rendering Software Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, System, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

What are the future trends of the industrial automation market?

The integration of new technologies such as IoT, AI, cloud, and others to play a significant role in the global industrial automation market in the coming years.

What are the driving factors impacting the industrial automation market?

The rising adoption of industrial automation solutions among industries is the major factors that propel the global industrial automation market.

Which region dominated the industrial automation market in 2022?

Asia Pacific dominated the industrial automation market in 2022.

What is the expected CAGR of the industrial automation market?

The global industrial automation market is estimated to register a CAGR of 8.2% during the forecast period 2022–2030.

Which are the leading players operating in the industrial automation market?

The key players holding majority shares in the global industrial automation market are ABB Ltd., Bosch Rexroth AG, Emerson Electric Co., Hitachi Ltd., Honeywell International, Inc., Mitsubishi Electric Corporation, Omron Corporation, Rockwell Automation, Inc., Schneider Electric SE, and Siemens AG.

What would be the estimated value of the industrial automation market by 2030?

The global industrial automation market is expected to reach US$ 322.67 billion by 2030.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Industrial Automation Market

- ABB Ltd

- Bosch Rexroth AG

- Emerson Electric Co

- Hitachi Ltd

- Honeywell International Inc

- Mitsubishi Electric Corp

- OMRON Corp

- Rockwell Automation Inc

- Schneider Electric SE

- Siemens AG

Get Free Sample For

Get Free Sample For