Industrial Explosives Market Growth and Forecast by 2031

Industrial Explosives Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (High Explosives, Blasting Agents, and Low Explosives), Application (Mining, Construction, and Others), and Geography

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Report Date : Aug 2024

- Report Code : TIPRE00004231

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 155

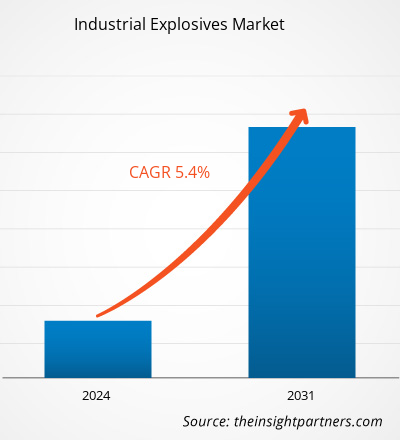

The industrial explosives market size is projected to reach US$ 35.77 billion by 2031 from US$ 23.51 billion in 2023. The market is expected to register a CAGR of 5.4% during 2023–2031. Research and development of environment-friendly explosives are likely to set trends in the market during the forecast period.

Industrial Explosives Market Analysis

In the past few years, there has been a significant rise in mining activities and large-scale metal mining operations. These operations often require substantial quantities of explosives for various applications such as rock fragmentation, overburden removal, and access to mineral deposits. With the growing demand for metals, mining companies increasingly focus on improving safety measures and operational efficiency. This includes advancing mining explosive technologies and formulations that can optimize blasting operations. Industrial explosives with better fragmentation capabilities, reduced vibrations, and improved safety features can help increase productivity and minimize environmental impacts. The growing mining industry, coupled with rising innovations in the industrial explosives market, is expected to favor the market growth.

Industrial Explosives Market Overview

The mining industry operates in a complex network of national, regional, and local regulatory frameworks. Navigating these regulatory requirements can be time-consuming and resource-intensive for mining companies. In addition, obtaining permits for mining operations can be a lengthy and bureaucratic procedure in many countries. The use of industrial explosives has its challenges and risks, as safety is a paramount aspect of consideration. In order to mitigate the risks of handling explosives, stringent regulations and standards govern the use of explosives. Governments of various countries implement rigorous explosive safety standards such as adherence to specific production processes, utilization of advanced safety technologies, and safety management systems. The growing environmental awareness, stringent regulations, and the need for sustainable practices in various applications such as mining, construction, and avalanche control are fostering the research on several environment-friendly explosives. Environment-friendly explosives or green explosives are developed to minimize their environmental impact while maintaining or improving performance and safety.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONIndustrial Explosives Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Industrial Explosives Market Drivers and Opportunities

Surge in Government Support for Infrastructure Development to Favor Market

Industrial explosives play a major role in infrastructure development, providing an efficient and cost-effective means for large-scale excavation and demolition. Their applications span from the construction of roads, dams, tunnels, and other civil engineering projects. The utilization of industrial explosives allows for the rapid breaking of rock and other hard materials, which is essential for creating foundations and facilitating the extraction of resources. In May 2023, South Korea and Saudi Arabia signed two memorandums of understanding with an aim to enhance business opportunities in the transport and logistics industries, including public transport, air transport, roads, ports, railways, and logistics. Thus, the surge in government support for infrastructure development fuels the market growth.

Utilization of Explosives for Avalanche Control

Avalanche mitigation or avalanche blasting is achieved for the protection of human lives, infrastructure, and recreational areas from the destructive force of avalanches. The utilization of industrial explosives for avalanche control presents a significant opportunity to enhance safety and accessibility in hilly and mountain regions. Critical infrastructure such as roads, railways, and communication lines often traverse avalanche-prone areas. The utilization of explosives for avalanche control helps protect the infrastructure from damage. The costs for repairs and maintenance are minimized by reducing the risks of large avalanches. In remote or high-risk areas, helicopters are used to deliver explosives, which further allows rapid deployment and precise targeting of unstable snowpacks.

Industrial Explosives Market Report Segmentation Analysis

Key segments that contributed to the derivation of the industrial explosives market analysis are type and application.

- Based on type, the industrial explosives market is segmented into high explosives, blasting agents, and low explosives. The blasting agents segment held the largest share of the market in 2023.

- Based on application, the industrial explosives market is segmented into mining, construction, and others. The mining segment dominated the market in 2023.

Industrial Explosives Market Share Analysis by Geography

The geographic scope of the industrial explosives market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Asia Pacific dominated the industrial explosives market. According to the report published by the US Geological Survey in 2022, China is the producer of 16 critical minerals out of 25 listed minerals. According to research conducted by the Norwegian Institute of International Affairs in 2022, Central Asia recorded a presence of 38.6% of global manganese ore reserves, 30.07% of chromium, 20% of lead, 12.6% of zinc, 8.7% of titanium, 5.8% of aluminum, and 5.3% of copper. China's well-established mining infrastructure and expertise in rare earth metal extraction enable efficient extraction of scandium-containing ores, ensuring a steady supply to meet domestic and global demand. China, Tajikistan, Australia, Vietnam, and other countries account for major antimony mine production and reserves worldwide. In July 2024, Koh Samui municipality (Thailand) suspended a Chinese-owned luxury resort project on Koh Samui due to permit issues, resulting in possible demolition. Therefore, growth in mining and demolition operations bolsters the demand for industrial explosives in Asia Pacific.

Industrial Explosives Market Regional Insights

The regional trends and factors influencing the Industrial Explosives Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Industrial Explosives Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Industrial Explosives Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 23.51 Billion |

| Market Size by 2031 | US$ 35.77 Billion |

| Global CAGR (2023 - 2031) | 5.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Industrial Explosives Market Players Density: Understanding Its Impact on Business Dynamics

The Industrial Explosives Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Industrial Explosives Market top key players overview

Industrial Explosives Market News and Recent Developments

The industrial explosives market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the industrial explosives market are listed below:

- Dyno Nobel and a Saudi investment company announce entry into a non-binding MOU for the development of an ammonium nitrate plant in Saudi Arabia. (Source: Dyno Nobel, Press Release, January 2024)

- Enaex SA and NYK Bulk & Projects Carriers Ltd, a member of the NYK Group, signed a memorandum of understanding (MoU) to jointly research the feasibility of supplying low-carbon ammonia to ammonia-fueled ships. (Source: Enaex SA, Press Release, February 2024)

Industrial Explosives Market Report Coverage and Deliverables

The "Industrial Explosives Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Industrial explosives market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Industrial explosives market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces analysis and SWOT analysis

- Industrial explosives market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the industrial explosives market

- Detailed company profiles

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For