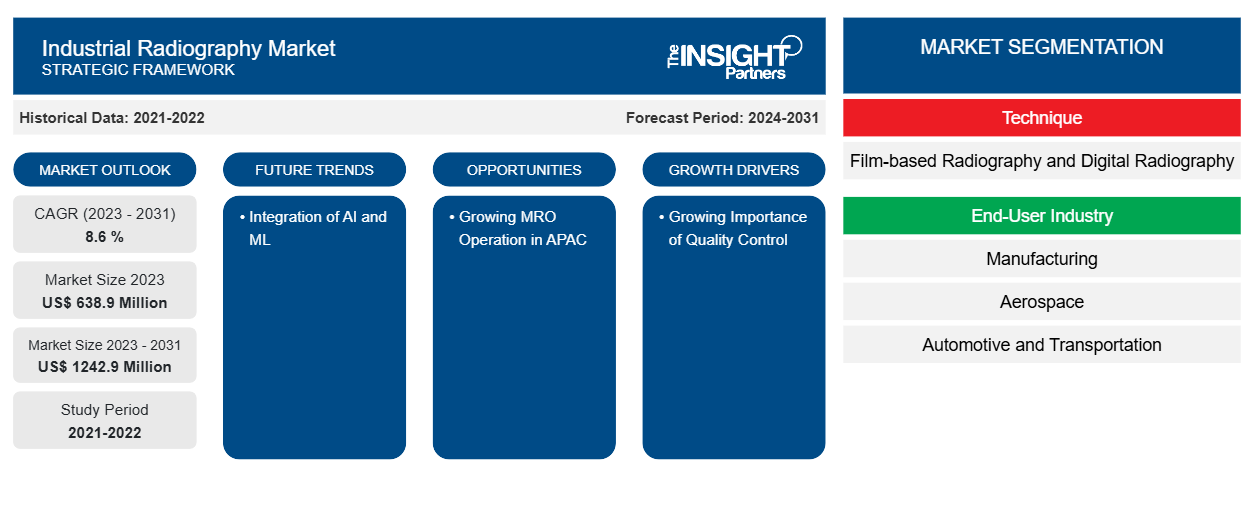

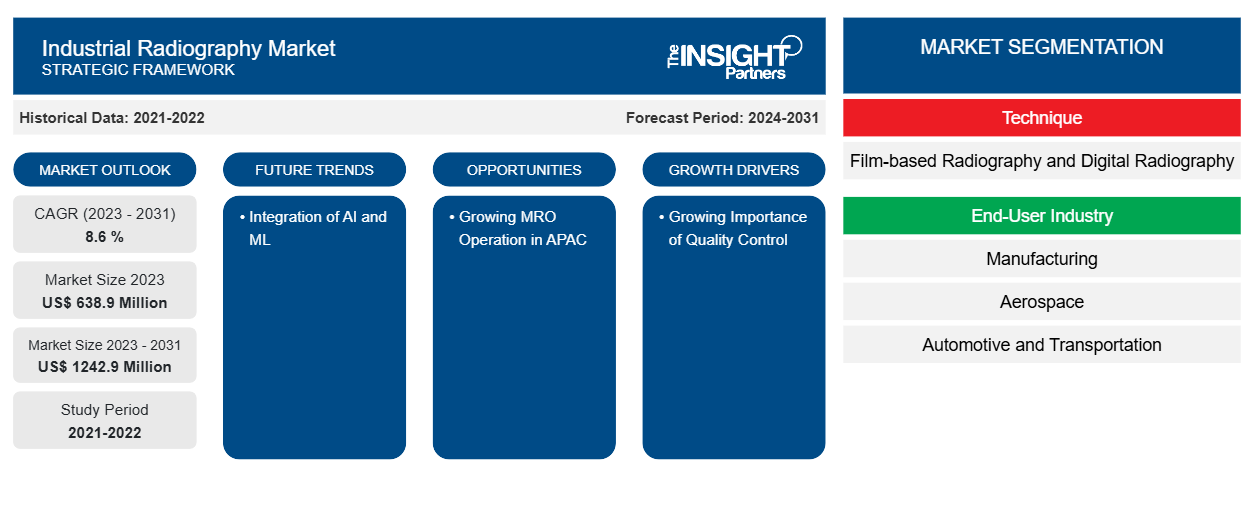

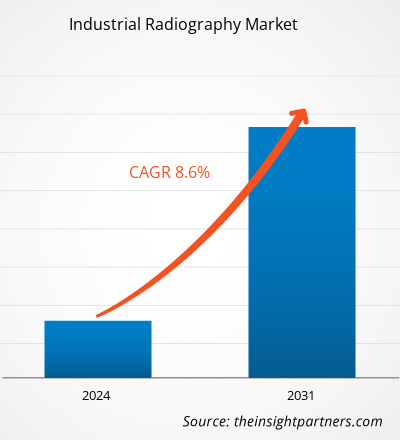

The industrial radiography market size is projected to reach US$ 1242.9 million by 2031 from US$ 638.9 million in 2023. The market is expected to register a CAGR of 8.6 % during 2023–2031. Integration of AI and ML is likely to remain a key trend in the market.

Industrial Radiography Market Analysis

In industrial radiography, inspectors analyze the interior structure of materials and components using ionizing radiation such as X-rays or gamma rays. This allows one to disclose hidden defects, measure thickness, and check the integrity of various constructions while causing no damage. Further, increasing maintenance, repair and operations are driving the growth of the market.

Industrial Radiography Market Overview

Industrial radiography is a nondestructive testing modality that uses ionizing radiation to inspect materials and components with the purpose of detecting and measuring faults and degradation in material qualities that might cause the breakdown of engineering structures. Manufacturers utilize industrial radiography to detect fractures or faults in materials. Industrial radiography mostly employs x-ray and gamma radiation to reveal faults that cannot be noticed with the naked eye. Industrial radiography is a nondestructive type of physical testing. This form of radiography employs ionizing radiation emitted from a radioactive source under regulated conditions to detect or determine the interior structure of an object without causing any harm to its outward morphology. As a result, it can be used to obtain a clear understanding of the constituents or components of the thing or product under study.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Industrial Radiography Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Industrial Radiography Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Industrial Radiography Market Drivers and Opportunities

Growing Importance of Quality Control to Favor Market

Quality Control Inspectors of industrial radiography evaluate the overall quality of radiographic images and inspection methods. They guarantee that inspections satisfy industry standards and that equipment works properly. Industrial radiography is primarily used to detect internal flaws in materials and structures, such as cracks, voids, inclusions, and discontinuities. It ensures the structural integrity and safety of numerous system components. Industrial radiography is used to evaluate materials such as metals, polymers, composites, and ceramics. Welds, pipelines, castings, forgings, aviation components, and other items are all commonly inspected.

Growing MRO Operation in APAC

India's MRO demand is expected to expand faster than the global average, creating opportunities for domestic and foreign investors, OEMs, and top MROs. Investors, both domestic and foreign, might participate. Further, the home to the largest MRO base in Asia high concentration of aerospace industry presence of big industry players such as Rolls Royce and Airbus are the reasons for growing MRO Operations in Asia. MRO is a vital component of many industries. The following industries make heavy use of MRO practices: Manufacturing businesses rely extensively on maintenance and repair activities for manufacturing equipment, machinery, and tools. This encompasses automobiles, airplanes, electronics, consumer goods, and other industries. The transportation business, which includes airlines, trains, shipping, and logistics, relies on MRO techniques to maintain their car, airplane, locomotive, and shipping container fleets.

Industrial Radiography Market Report Segmentation Analysis

Key segments that contributed to the derivation of the industrial radiography market analysis are technique and end-user industry.

- Based on the technique, the industrial radiography market is segmented into film-based radiography and digital radiography.

- Based on the end-user industry, the industrial radiography market is segmented into manufacturing, aerospace, automotive and transportation, power generation, petrochemical and gas, and others.

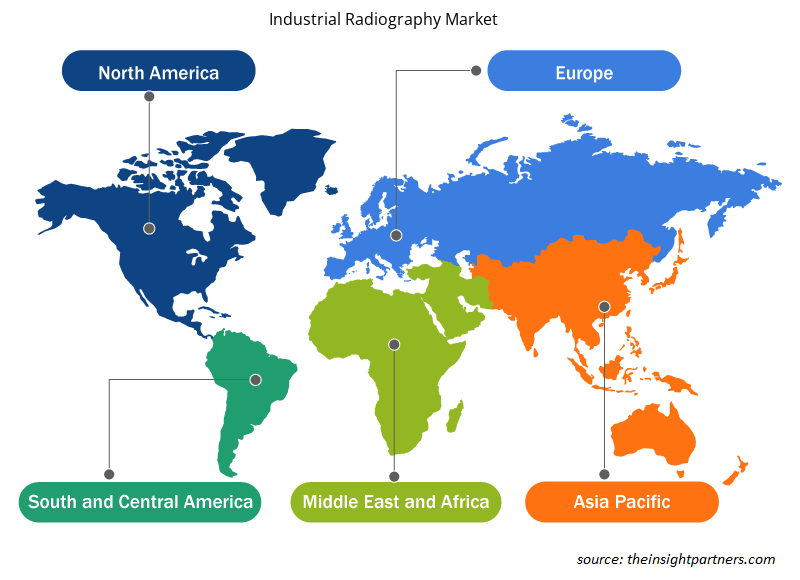

Industrial Radiography Market Share Analysis by Geography

The geographic scope of the industrial radiography market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America. The industrial radiography market in North America is segmented into the US, Canada, and Mexico. North America has developed the aerospace & defense industry meteorology automotive vehicle production. The region has various renowned automotive manufacturers such as Ford, Hona, Toyota, Tesla, and others. The industrial radiography primary aim is to detect internal defects in materials and structures such as cracks, voids, inclusions, and discontinuities. Manufacturers use it to detect products for cracks or faults.

Industrial Radiography Market Regional Insights

The regional trends and factors influencing the Industrial Radiography Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Industrial Radiography Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Industrial Radiography Market

Industrial Radiography Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 638.9 Million |

| Market Size by 2031 | US$ 1242.9 Million |

| Global CAGR (2023 - 2031) | 8.6 % |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Technique

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

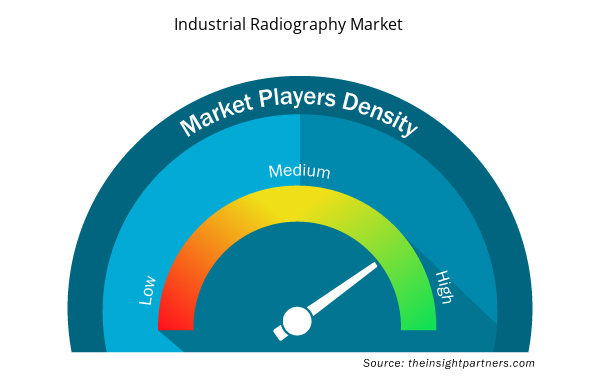

Industrial Radiography Market Players Density: Understanding Its Impact on Business Dynamics

The Industrial Radiography Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Industrial Radiography Market are:

- 3DX-RAY

- Anritsu

- Comet Group

- Fujifilm Corporation

- GENERAL ELECTRIC

- METTLER TOLEDO

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Industrial Radiography Market top key players overview

Industrial Radiography Market News and Recent Developments

The industrial radiography market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the industrial radiography market are listed below:

- The Royal Air Force has awarded 3DX-Ray a contract to supply three ThreatScan-LSC Portable X-ray Scanning Systems (RAF). The ThreatScan-LSCs will replace existing systems, and this is 3DX-first Ray's contract with the RAF.

(Source: 3DX-RAY, January 2021)

- Teledyne Industrial X-Ray Solutions, a provider of high-performance X-ray imaging, introduced a new product line of high-speed, high-performance industrial dynamic detectors based on our innovative radiation-hard IGZO sensor technology. The Rad-Xcam 1717, 1723 and 3030 detectors are designed to address the demanding needs of Industrial inspection, biomedical and scientific applications, providing compelling integration cost advantages. (Source: Teledyne., July 2023)

Industrial Radiography Market Report Coverage and Deliverables

The “Industrial Radiography Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Industrial radiography market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Industrial radiography market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Industrial radiography market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the industrial radiography market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Technique ; End-User Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

What is the expected CAGR of the industrial radiography market?

The market is expected to register a CAGR of 8.6 % during 2023–2031.

What would be the estimated value of the industrial radiography market by 2031?

The global industrial radiography market is expected to reach US$ 1242.9 million by 2031.

What are the future trends of the industrial radiography market?

Integration of AI and ML to play a significant role in the global industrial radiography market in the coming years.

Which are the leading players operating in the industrial radiography market?

The leading players operating in the global industrial radiography market are 3DX-RAY, Anritsu, Comet Group, Fujifilm Corporation, GENERAL ELECTRIC, Mettler Toledo, Nikon Corporation, Novo Dr Ltd, Shimadzu Corporation, and ZEISS International.

What are the driving factors impacting the industrial radiography market?

The growing importance of quality control is the major factors that propel the global industrial radiography market.

Which region dominated the industrial radiography market in 2023?

North America dominated the industrial radiography market in 2023.

Get Free Sample For

Get Free Sample For