Backshell Market Size, Share, Growth Analysis & Forecast to 2034

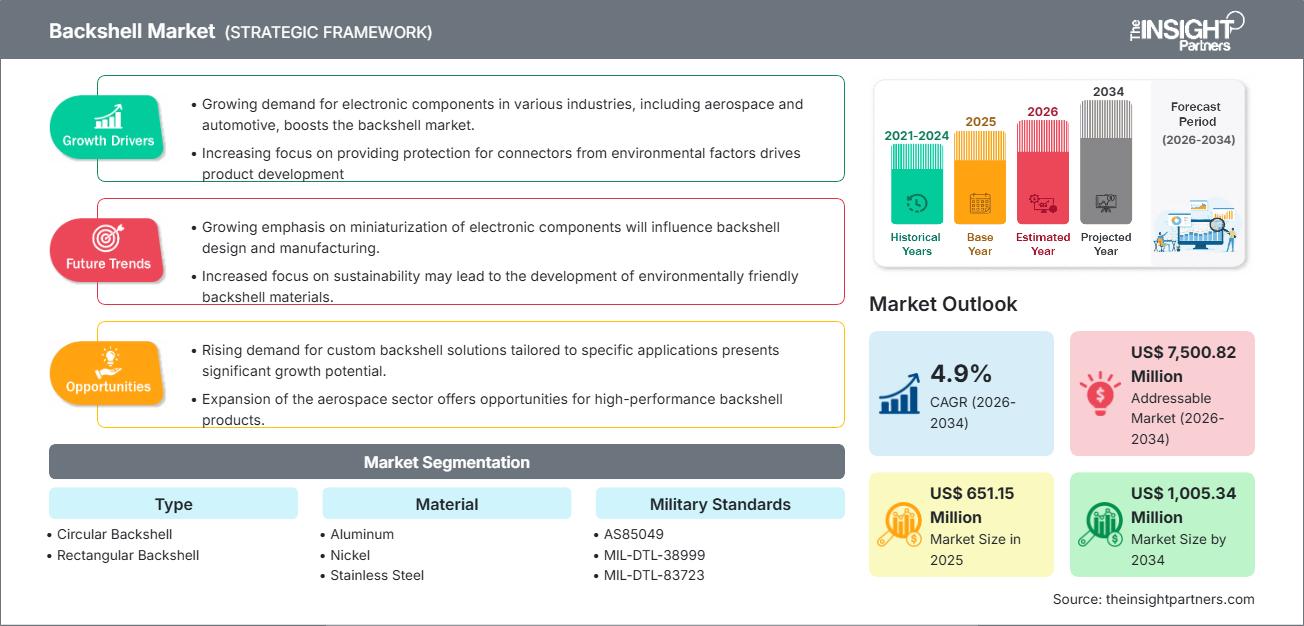

Backshell Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Circular Backshell and Rectangular Backshell), Material (Aluminum, Nickel, Stainless Steel, and Others), Military Standards (AS85049, MIL-DTL-38999, MIL-DTL-83723, MIL-DTL-5015, MIL-DTL-26482, and Others), and Application (Ground, Naval, and Air)

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Mar 2026

- Report Code : TIPRE00024272

- Category : Aerospace and Defense

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

The backshell market size is expected to reach US$1,005.34 million by 2034 from US$651.15 million in 2025. The market is anticipated to register a Compound Annual Growth Rate (CAGR) of 4.9% during the forecast period of 2026–2034.

Backshell Market Analysis

The backshell market analysis indicates consistent and steady growth, mainly driven by large-scale defense modernization programs and increased production of commercial and military aircraft globally. Critical requirements for EMI/RFI protection in sensitive electronic systems operating in harsh environments pave the way for the growth of the market. Besides, increasing regulatory requirements, especially strict military standards such as AS85049, demand the use of high-performance and compliant backshells. The market is also seeing acceleration from the adoption of lightweight composite materials as aerospace and industrial sectors prioritize weight reduction without compromising protection.

Backshell Market Overview

Backshells are essential protective components used in electrical connectors to manage and safeguard the critical point where a cable terminates at a connector plug or receptacle. These components provide strain relief, environmental sealing (against moisture, dust, and fluids), and robust EMI/RFI shielding. They are widely adopted across key sectors, including military, aerospace, and heavy industry, assuring long-term durability and signal integrity while following the most stringent operational standards. The backshell provides great protection against external threats like high levels of vibration, extreme temperatures, and corrosive agents, and is an important component for maintaining system reliability and performance.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONBackshell Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Backshell Market Drivers and Opportunities

Market Drivers:

- Rising Defense Modernization Programs Globally: Increased defense modernization programs worldwide drive interest in several high-reliability, shielded connectors and backshells installed on upgraded military aircraft, naval vessels, and ground vehicles, used to manage complex electronic warfare and communication systems.

- Increasing Demand for EMI/RFI Protection: Increasing usage of electronic components and networked systems in aerospace and industrial applications raises the demand for effective shielding solutions, which will help avoid signal degradation and ensure system functionality.

- Growth in Commercial Aviation and Space Exploration: Increasing global air traffic and expanding space programs (both governmental and private) drive demand for durable, lightweight, and high-performance interconnect solutions.

Market Opportunities:

- Development of Lightweight and Corrosion-Resistant Materials: Emphasize advanced composites and special aluminum alloys to realize superior performance, weight savings, and extended service life in extremely harsh or marine environments.

- Integration of Smart Backshells with Sensors: Future opportunities in developing "smart" backshells fitted with miniature sensors for monitoring temperature, vibration, and shield effectiveness will help in predicting maintenance and real-time fault detection.

- Expansion in Emerging Markets: Rapid industrialization and growing defense budgets in countries across Asia-Pacific and the Middle East offer untapped potential for key market players.

Backshell Market Report Segmentation Analysis

The backshell market is comprehensively segmented by type, material, military standard compliance, and end-use application, providing a granular view of market dynamics and growth pockets. Below is the standard segmentation approach used in most industry reports:

By Type:

- Circular Backshell: The segment leads the market share because of the widespread adoption of circular connectors, like MIL-DTL-38999, in aerospace and defense. This provides strong 360-degree shielding and sealing, making it the normal choice when high reliability is at stake.

- Rectangular Backshell: This segment caters to specific industrial and military systems where space and form factor dictate the use of rectangular connectors. Demand is concentrated in specialized equipment and fixed installations.

By Material:

- Aluminium: The most common segment, offering an excellent balance of strength, weight, and cost-effectiveness. Aluminum is widely used across all major applications and is often nickel-plated for corrosion resistance and enhanced conductivity.

- Nickel/Stainless Steel: These materials are preferred for applications requiring superior corrosion resistance, high temperature tolerance, and exceptional durability, such as naval or high-heat engine environments.

- Composite: This material is the fastest-growing segment, driven by the need for significant weight reduction in modern aircraft, offering comparable mechanical performance and shielding when properly metallized.

By Military Standards:

- AS85049

- MIL-DTL-38999

- MIL-DTL-83723

- MIL-DTL-5015

- MIL-DTL-26482

By Application:

- Ground (Vehicles & Equipment): Military ground vehicles, heavy machinery, industrial automation; extremely rugged and sealed backshells that are resistant to extreme shock, vibration, and dust.

- Naval (Marine & Sea): Requires highly specialized, corrosion-resistant stainless steel or marine-grade aluminum backshells due to constant exposure to saltwater and high humidity.

- Air (Aerospace & Aviation): The largest segment, encompassing commercial aircraft, military jets, helicopters, and space vehicles. This application demands extremely lightweight, highly reliable, and EMI-shielded solutions.

By Geography

- North America

- Europe

- Asia-Pacific

- South & Central America

- Middle East & Africa

Backshell Market Regional Insights

The regional trends and factors influencing the Backshell Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Backshell Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Backshell Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 651.15 Million |

| Market Size by 2034 | US$ 1,005.34 Million |

| Global CAGR (2026 - 2034) | 4.9% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Backshell Market Players Density: Understanding Its Impact on Business Dynamics

The Backshell Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Backshell Market top key players overview

Backshell Market Share Analysis by Geography

Asia-Pacific is expected to witness the fastest growth in the coming years. Emerging markets in South & Central America, and the Middle East & Africa, also present many untapped opportunities for backshell component providers to expand. The backshell market shows a different growth trajectory in each region due to factors such as defense spending, aerospace manufacturing activity, industrial automation investment, and adherence to stringent military standards. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds the largest market share due to its advanced defense industry and established commercial aerospace manufacturing base.

- Key Drivers: High R&D spending, widespread adoption of stringent military standards, and ongoing aircraft modernization programs across the U.S. and Canada.

- Trends: Continuous shift toward complex, high-bandwidth interconnect systems that require advanced EMI/RFI shielding technologies and lightweight composite solutions.

2. Europe

- Market Share: Commands a significant share, driven by major regional aerospace players (e.g., Airbus) and robust industrial automation sectors, particularly in Germany and France.

- Key Drivers: Digitization of industrial automation, strong growth in the rail and automotive sectors, and collaborative defense projects requiring standardized components.

- Trends: Increasing focus on miniaturization and high-density connectivity, coupled with regulatory demands for reliable environmental protection across industrial applications.

3. Asia-Pacific

- Market Share: Expected to be the fastest-growing region during the forecast period, owing to rapid industrialization and escalating defense budgets.

- Key Drivers: Significant government investment in domestic defense manufacturing (e.g., China, India), rapid growth in electronics manufacturing, and commercial fleet expansion.

- Trends: Adoption of Western military standards and a surge in demand for cost-effective, yet high-quality, backshell solutions to support new production lines.

4. South & Central America

- Market Share: Represents an emerging market with gradual growth.

- Key Drivers: Expansion of industrial sectors (mining, oil & gas) and increasing investments in telecommunications infrastructure, requiring reliable connectivity components.

- Trends: Cloud-based, cost-effective industrial connectors and backshells are gaining traction, primarily among small-to-medium-sized industrial providers.

5. Middle East & Africa

- Market Share: A developing market with strong growth potential due to rising military infrastructure spending.

- Key Drivers: Strategic national e-health and infrastructure initiatives, along with healthcare infrastructure expansion.

- Trends: Implementation of specialized, rugged backshells to withstand the extreme temperatures and harsh desert environments typical of regional military and energy applications.

Backshell Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

The backshell market is highly competitive, characterized by the presence of large multinational corporations and specialized, niche manufacturers. This landscape is largely driven by the highly critical and technical nature of ensuring signal integrity, environmental sealing, and EMI/RFI shielding in demanding applications like aerospace and defense.

Competition is intensifying due to the presence of major players specializing in complete interconnect solutions, such as Amphenol Corporation and TE Connectivity, alongside specialized component manufacturers such as Glenair, Inc., which supply core, high-reliability backshell products.

This competitive environment pushes vendors to differentiate through:

- Seamless Integration: Developing backshells that offer faster assembly, guaranteed fit, and robust integration with specific, high-demand connector series (e.g., D38999).

- Material Innovation: Investing in lightweight composite and advanced thermoplastic solutions for weight-sensitive applications in modern aircraft and defense platforms.

- Customization and Compliance: Offering highly customized solutions and maintaining strict, updated compliance with evolving military and aerospace specifications (e.g., AS85049) to ensure global regulatory acceptance.

- Thermal and Environmental Management: Specializing in designs that enhance thermal dissipation and provide superior sealing against extreme temperatures, pressure, and corrosive fluids.

Opportunities and Strategic Moves

- Partner with Aircraft and Defense Primes: Collaborate with major OEMs (Original Equipment Manufacturers) to co-develop next-generation interconnect architectures and backshell designs optimized for new platforms.

- Incorporate Advanced Shielding Technologies: Integrate specialized coatings and materials for enhanced EMI/RFI mitigation across wider frequency ranges, addressing the complexity of modern digital systems.

Major Companies operating in the Backshell Market are:

- Amphenol Corporation

- TE Connectivity

- Glenair, Inc.

- Collins Aerospace

- Curtiss-Wright Corporation

- Souriau Sunbank (Eaton)

- PEI-Genesis

- Isodyne Inc.

- Arrow Electronics

Disclaimer: The companies listed above are not ranked in any particular order.

Backshell Market News and Recent Developments

- Amphenol Corporation launched AlumaLite backshells : Amphenol Corporation introduced its AlumaLite backshell series, delivering up to 50% weight savings compared to traditional designs. These backshells offer superior EMI shielding and corrosion resistance, targeting aerospace and defense applications.

- TE Connectivity expands AMPSEAL 16 backshell portfolio : TE Connectivity announced new AMPSEAL 16 backshell variants, including 90° and 180° configurations with UL94 V‑0 flame rating. The company also unveiled Tinel‑Lock swept elbow backshells, reducing weight by 20% for aerospace and military connectors.

- Glenair emphasizes rapid delivery of MIL‑Spec backshells : Glenair highlighted its extensive catalog of AS85049-compliant backshells, offering same-day availability for circular and rectangular connectors. The company promotes QT Series banding backshells for quick installation and enhanced EMI protection.

- Collins Aerospace signs predictive maintenance deal with Qatar Airways : Collins Aerospace partnered with Qatar Airways on the deployment of its Ascentia analytics solution across Boeing 787 fleets, further showing its commitment to advanced aerospace systems and reliability solutions.

- Curtiss-Wright secures defense contracts and boosts guidance : Curtiss-Wright announced multiple defense contracts, including turret drive stabilization systems for XM30 combat vehicles and encrypted flight recorders for Bell Textron MV‑75 aircraft. The company also raised its full-year financial outlook.

Backshell Market Report Coverage and Deliverables

The "Backshell Market Size and Forecast (2021–2034)" report provides a detailed analysis of the market covering below areas:

- Backshell Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Backshell Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

Backshell Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments - Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Backshell Market

- Detailed company profiles

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For