ISDN Modem Market Size, Share, Trends, and Future Outlook 2034

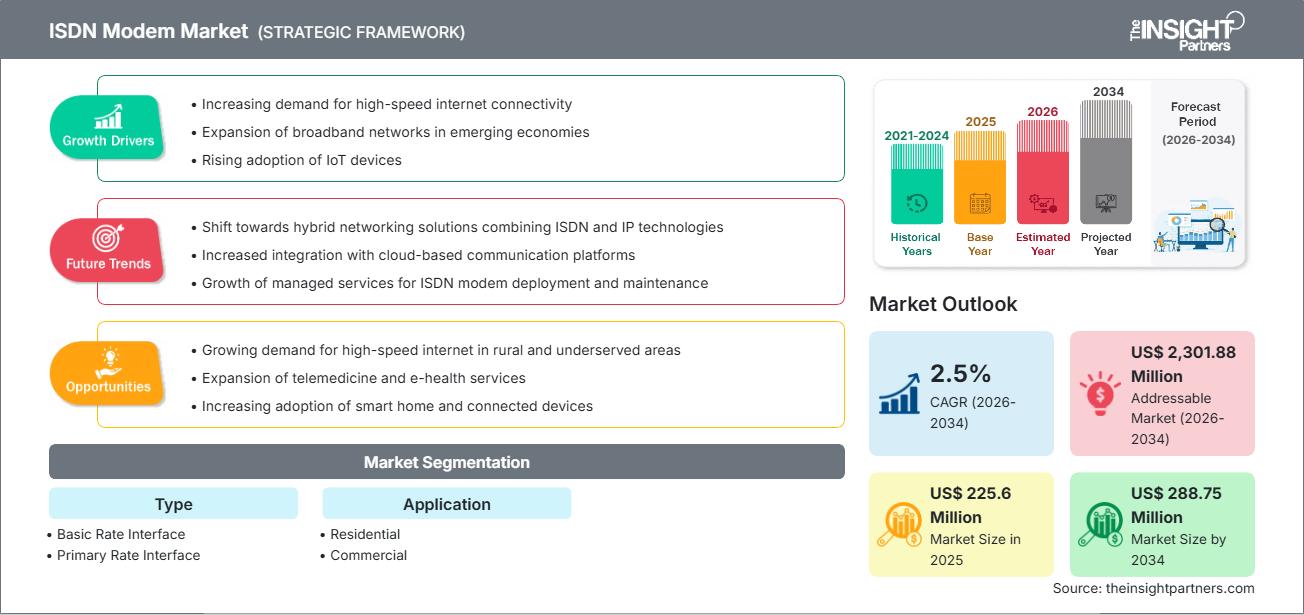

ISDN Modem Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type [Basic Rate Interface (BRI) and Primary Rate Interface (PRI)] and Application (Residential and Commercial)

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Apr 2026

- Report Code : TIPRE00016015

- Category : Electronics and Semiconductor

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

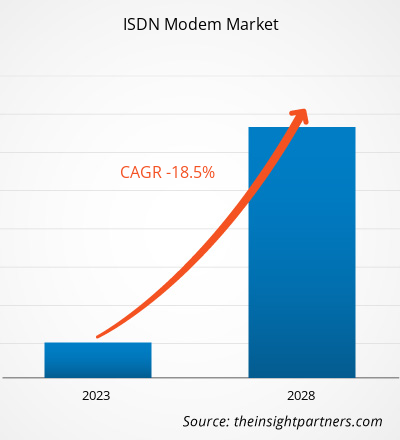

The ISDN modem market is expected to go from US$ 225.6 million in 2025 to US$ 288.75 million by 2034, representing a CAGR of 2.5% during the forecast period.

ISDN Modem Market Analysis

The forecast for the ISDN modem market indicates a contraction, driven primarily by the rapid shift from legacy ISDN infrastructures to IP-based communication technologies and broadband. However, there remains a niche demand for ISDN modems in certain regions and use cases, especially as a backup for legacy telephony infrastructure, in underdeveloped markets, or among businesses that continue to rely on ISDN-based voice or data lines for reliability and security.

Declining tape of ISDN infrastructure modernization and replacement, combined with cost pressures to maintain older networks, firmly push the market downward. That said, some players continue to innovate with ISDN modems featuring hybrid compatibility, modular design, and efficient energy profiles to serve the shrinking but persistent base.

ISDN Modem Market Overview

Integrated Services Digital Network (ISDN) modems are communication devices that enable digital transmission of voice, video, and data over traditional telephone copper lines. They support B‑channels for data/voice and a D‑channel for signaling, typically providing up to 128 kbps throughput for BRI (Basic Rate Interface). ISDN modems have historically been important for multi-line voice, data applications, secure telephony, and structured enterprise communication. As carriers and enterprises transition to VoIP and broadband, ISDN modems remain relevant chiefly in legacy systems, backup lines, and specific regulated environments.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONISDN Modem Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

ISDN Modem Market Drivers and Opportunities

Market Drivers:

- Legacy Infrastructure Dependence: Some organizations and telecom networks continue to rely on ISDN for reliability and multi-line, low-latency connectivity.

- Demand for Backup Connectivity: In regions or businesses where broadband is less reliable or unavailable, ISDN lines serve as a fallback or redundancy option.

- Regulated & Secure Communications: ISDN's circuit-based communication can be perceived as more secure or deterministic in some regulated sectors, which sustains a niche use case.

Market Opportunities:

- Hybrid Systems Development: There may be opportunities for ISDN modem vendors to design hybrid modems that interface with both ISDN and IP networks, catering to organizations that are slowly migrating.

- Emerging Markets & Rural Use: In developing regions or rural areas where newer broadband infrastructure is still rolling out, ISDN lines may persist, opening a window for modem vendors to serve these legacy installations.

- IoT & Industrial Use Cases: Some IoT or industrial applications that demand stable, low‑rate, circuit-switched connections could leverage ISDN in specialized deployments.

ISDN Modem Market Report Segmentation Analysis

In typical market research reports (similar to The Insight Partners’ structure), the ISDN modem market can be segmented as follows:

By Type:

- Basic Rate Interface (BRI)

- Primary Rate Interface (PRI)

By Application:

- Residential use

- Commercial / Enterprise use

By Geography:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South & Central America

ISDN Modem Market Regional Insights

The regional trends and factors influencing the ISDN Modem Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses ISDN Modem Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

ISDN Modem Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 225.6 Million |

| Market Size by 2034 | US$ 288.75 Million |

| Global CAGR (2026 - 2034) | 2.5% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

ISDN Modem Market Players Density: Understanding Its Impact on Business Dynamics

The ISDN Modem Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the ISDN Modem Market top key players overview

ISDN Modem Market Share Analysis by Geography

Here’s a hypothetical or inferred regional breakdown and key trends:

-

North America

- Likely holds a significant share owing to historical ISDN infrastructure and business continuity demands.

- Some enterprises and call centers use ISDN for legacy voice and data lines.

-

Europe

- Moderate share, with regulatory and legacy infrastructure still sustaining demand in certain sectors.

- Possible emphasis on hybrid ISDN–IP deployments.

-

Asia Pacific

- Smaller but relevant share, especially in regions where IP infrastructure is still proliferating or legacy telco lines persist.

- Opportunity in rural or developing markets.

-

Middle East & Africa, South & Central America

- Emerging niche for ISDN modems in legacy telecom systems.

- Lower overall volumes but strategic importance for backup line providers or small business use.

ISDN Modem Market Players Density: Understanding Its Impact on Business Dynamics

The ISDN modem market is increasingly niche and legacy, but competition still exists:

- Strategic Differentiators:

- Hybrid ISDN/IP compatibility

- Modular, energy-efficient designs

- Low maintenance, secure legacy connectivity

- Competition Impact:

- Declining market volume encourages consolidation or specialization.

- Vendors may partner with telecom operators in markets where legacy ISDN lines remain.

- Some are focusing on advanced ISDN modems for specialized or industrial use rather than mass telecom.

Opportunities / Strategic Moves for Players:

- Develop cost‑effective BRI/PRI modems with backup‑line appeal.

- Promote modular hybrid devices for enterprises migrating to VoIP but retaining ISDN lines for redundancy.

- Explore emerging markets where ISDN infrastructure is still functional but under‑monetized.

Major Key Players of the market:

- Ekinops

- TERRATEL

- Patton LLC

- A TLC S.r.l.

- Epygi Technologies LLC

- Polycom

- Xiamen Yeastar Information Technology Co., Ltd.

- HypermediaS

- Aristel Networks

Other companies analysed during the time of research:

- Adtran, Inc.

- DrayTek Corp.

- U.S. Robotics

- AVM GmbH

- Fritz!Box series (by AVM)

- Black Box Network Services, Inc.

- MultiTech Systems, Inc.

- Westermo Network Technologies AB

- 2NTelekomünikasyone a.s.

- Belkin International, Inc.

ISDN Modem Market News and Recent Developments

- Some modem manufacturers continue to innovate: for instance, hybrid modems combining ISDN and IP functionalities, or energy-efficient ISDN models, to serve the legacy niche.

- There is limited but persistent demand in regions with underdeveloped broadband or in businesses that rely on ISDN for redundant voice/data channels.

ISDN Modem Market Report Coverage and Deliverables

The hypothetical “ISDN Modem Market Size and Forecast (2021–2034)” report by The Insight Partners would include:

- Forecasts of market size at global, regional, and country levels, across all key segments.

- In-depth analysis of market trends, dynamics (drivers, restraints, and opportunities).

- PEST and SWOT analysis to help understand macro-political, economic, social, and sectoral forces.

- Competitive landscape: company profiles, market concentration, heat-map analysis.

- Recent developments and strategic moves by major players.

Frequently Asked Questions

2. High maintenance cost of legacy lines

3. Declining telecom support for ISDN services

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For