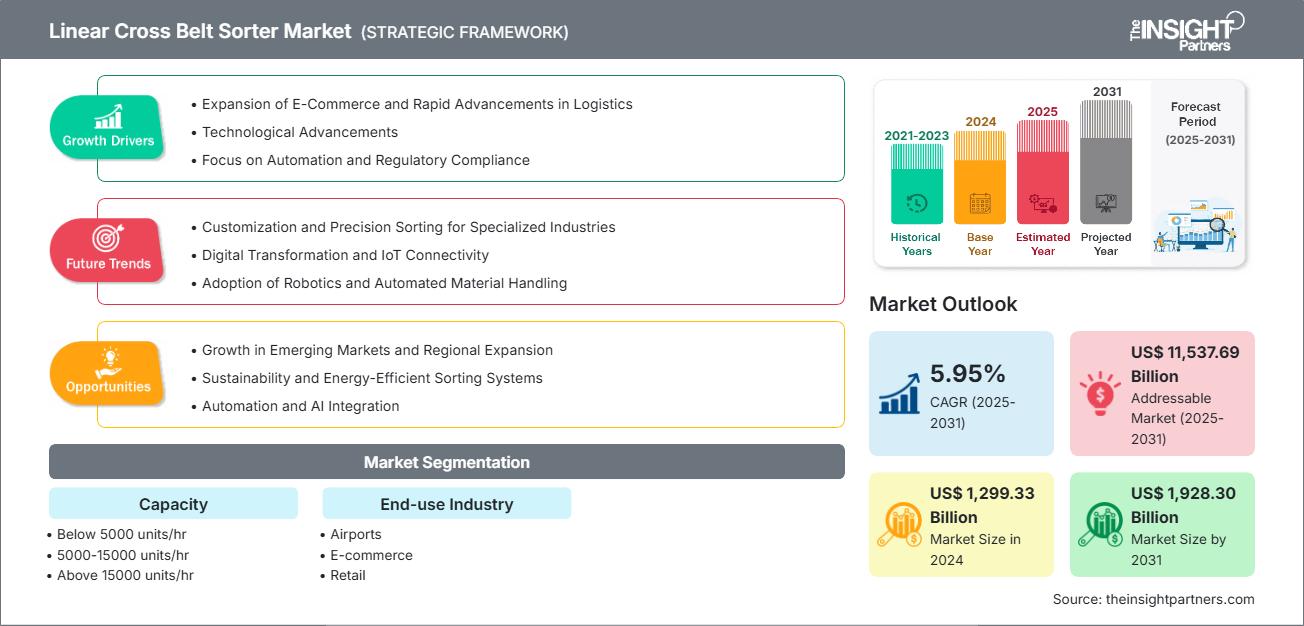

Linear Cross Belt Sorter Market Analysis & Future Trends 2025-2031

Linear Cross Belt Sorter Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Capacity (Below 5000 Units/Hr, 5000-15000 Units/Hr, and Above 15000 Units/Hr), End-Use Industry (Airports, E-Commerce, Retail, and Fashion; Food and Beverages; Manufacturing; Automotive; Logistics; and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Oct 2025

- Report Code : TIPRE00041019

- Category : Manufacturing and Construction

- Status : Published

- Available Report Formats :

- No. of Pages : 272

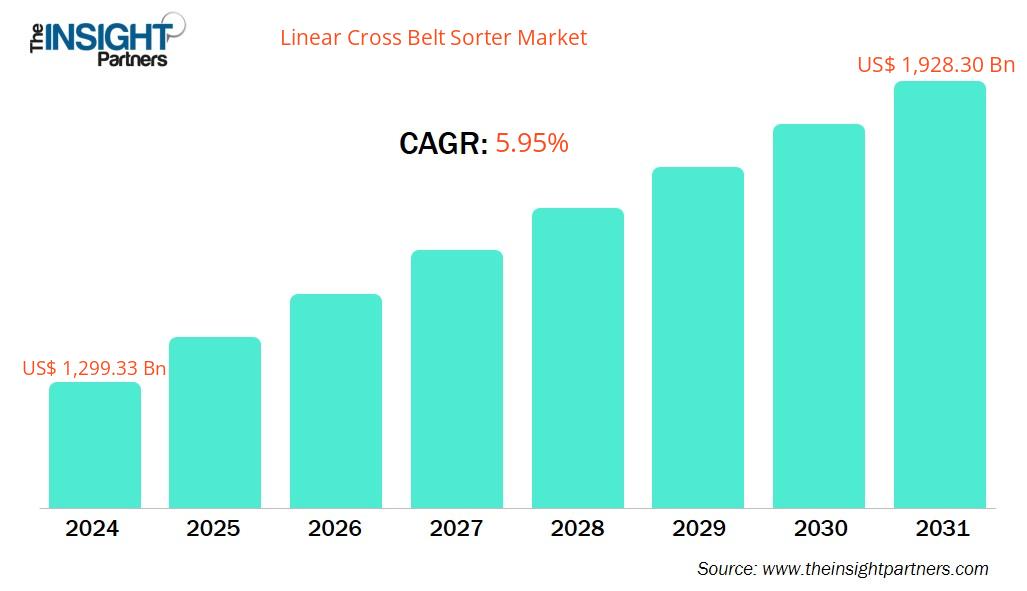

The linear cross belt sorter market size is projected to reach US$ 1,928.30 million by 2031 from US$ 1,299.33 million in 2024. The market is expected to register a CAGR of 5.95% during 2025–2031.

Linear Cross Belt Sorter Market Analysis

The market's growth is driven by the rapid expansion of e-commerce, increased demand for automation trends in supply chains, and the need for efficient warehouse operations. Industries such as logistics, retail, and manufacturing are key users of the linear cross belt sorters. Further, advancements in sorting technology and investments in smart warehouses fuel the growth of the market.

Linear Cross Belt Sorter Market Overview

Linear cross belt sorters are a type of material handling equipment used to sort and distribute a wide variety of products. These sorters transport items on a conveyor belt and then sort them into different chutes or lanes using sensors and diverters. This allows companies to sort and distribute products in a warehouse or distribution center setting quickly and efficiently.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONLinear Cross Belt Sorter Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Linear Cross Belt Sorter Market Drivers and Opportunities

Market Drivers:

- Growth in E‑Commerce: Massive growth in e-commerce is creating tremendous pressure on e-commerce to fulfil a high volume of parcels. Same-day/next-day delivery expectations are forcing automation in sorting, which is driving the market growth.

- Operational Efficiency and Cost Reduction: With rising labor costs, labor shortages, and the desire to reduce manual errors, companies are investing in automated sorting to streamline operations, reduce labor dependency, and improve throughput.

- Growth of Emerging Markets and Infrastructure Investments: Regions such as Asia Pacific and Latin America are investing in logistics infrastructure, warehousing, and modern fulfillment centers; these investments drive the demand for automated sortation systems.

- Supply Chain Complexity: The increasing complexity of supply chains and the growing need for traceability (especially in pharma/food), regulatory standards, batch tracking, etc.) push the adoption of systems that can sort precisely, integrate with warehouse management systems, and maintain data integrity.

- Sustainability and Energy Efficiency: There is growing awareness and increasing regulatory pressure for equipment that consume less energy, reduce waste, and are environmentally friendly. New sorter systems that offer lower energy consumption and are made from materials with a lower environmental impact are becoming more attractive.

Market Opportunities:

- Warehouse Automation and Industry 4.0 Adoption: Companies are investing in automation, such as robotics, IoT, and AI/ML, to streamline logistics operations. Integrating linear cross‑belt sorters with smart monitoring tools, predictive maintenance, and robotics offers better uptime, scalability, and lower labor dependency.

- Technology Innovation: Predictive maintenance using IoT sensors and AI can reduce downtime and maintenance costs. Real‑time decision making: adaptive routing, smarter sorting paths, etc.

- Digital Twins and Simulation‑Based Design: Using digital twins (virtual replicas of physical sorters, warehouses) to test, optimize, and predict performance, before investing in hardware, helps reduce risks, cut costs, and optimize layouts.

- Government Policy and Infrastructure Push: Logistics being granted industry status in various countries (easier financing, subsidies, land, etc.) could lead to more investment in automation (E.g., West Bengal granting industry status to the logistics sector).

- Cold Chain / Temperature Controlled Sortation: Maintaining proper temperature, preventing spoilage, and ensuring hygiene are important for perishables, pharmaceuticals, food products, and similar goods. Sorters designed for cold-chain or climate-controlled environments represent a growing market segment, especially in tropical climates and emerging markets. Key differentiators such as insulation, humidity control, and hygienic surface materials present opportunities for innovation.

Linear Cross Belt Sorter Market Report Segmentation Analysis

The linear cross belt sorter market is divided into different segments to give a clearer view of how it works, its growth potential, and the latest trends. Below is the standard segmentation approach used in most industry reports:

By Capacity:

- Below 5000 Units/Hr: Linear cross belt sorting with this capacity caters principally to small-to-medium scale operations across diverse industries. It focuses on cost-effective yet reliable sorting solutions.

- 5000–15000 Units/Hr: Demand is high because it can effectively support mid- to high-level volume operations. Specific systems can provide speed, accuracy, and scalability, which are helpful for e-commerce, retail, and third-party logistics providers.

- Above 15000 Units/Hr: This segment caters to high-throughput environments, including large-scale e-commerce hubs and automated distribution centers.

By End-User Industry:

- Airports

- E-Commerce, Retail, and Fashion

- Food and Beverages

- Manufacturing

- Automotive

- Logistics

- Others

Each sector has specific logistics and warehousing requirements. It influences cross belt sorter adoption and functionality preferences.

By Geography:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

The linear cross belt sorter market in Asia Pacific is expected to witness the fastest growth. The need for faster order fulfilment, the booming e-commerce ecosystem, and investment in the booming e-commerce ecosystem are the factors likely to drive the market.

Linear Cross Belt Sorter Market Regional InsightsThe regional trends and factors influencing the Linear Cross Belt Sorter Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Linear Cross Belt Sorter Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Linear Cross Belt Sorter Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 1,299.33 Million |

| Market Size by 2031 | US$ 1,928.30 Million |

| Global CAGR (2025 - 2031) | 5.95% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Capacity

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Linear Cross Belt Sorter Market Players Density: Understanding Its Impact on Business Dynamics

The Linear Cross Belt Sorter Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Linear Cross Belt Sorter Market top key players overview

Linear Cross Belt Sorter Market Share Analysis by Geography

The Asia Pacific market is expected to grow the fastest in the next few years. Emerging markets in South & Central America and the Middle East and Africa also have many untapped opportunities for linear cross belt sorter providers to expand.

The linear cross belt sorter market grows differently in each region due to factors such as varying levels of industrial automation, e-commerce penetration, labor costs, infrastructure development, and investment in warehouse modernization. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds a significant portion of the global market

-

Key Drivers:

- Demand for warehouse automation in e-commerce

- The growth in online shopping is forcing retailers and logistics companies to adopt automated sorting systems to meet high-speed order fulfillment demands. Automated sorting systems such as linear cross belt sorters enable warehouses and distribution centers to handle large order volumes efficiently, decreasing processing times and errors.

- Labor shortages driving investment in automated sorting solutions

- Strong presence of major logistics and tech companies

- Trends: Integration of AI and IoT in sorting systems

2. Europe

- Market Share: Substantial share due to early adoption of digital commerce

-

Key Drivers:

- Strict labor laws encouraging automation

- Strict regulations on working hours and labor conditions are pushing companies toward automation in order to reduce dependence on manual labor and improve productivity. Automated sorting systems help businesses comply while enhancing productivity and consistency.

- Focus on sustainable and energy-efficient warehouse operations

- Demand for precise, high-speed sorting in fashion and pharmaceuticals

- Trends: Investments in smart warehousing solutions

3. Asia Pacific

- Market Share: Fastest-growing region with a rising market share every year

-

Key Drivers:

- Rapid e-commerce growth in China, India, and Southeast Asia

- China, India, and Southeast Asia are witnessing rapid growth in online shopping. This surge fuels the need for scalable, high-speed sorting solutions to manage increasing parcel volumes efficiently across fulfillment networks.

- Growing investments in smart warehousing and logistics infrastructure

- Increasing manufacturing output and export activities

- Trends: Adoption of low-cost, high-efficiency sortation systems

4. South and Central America

- Market Share: Growing market with steady progress

-

Key Drivers:

- Gradual digital transformation in supply chain and logistics

- Growing intra-regional trade and distribution networks

- Increasing trade within South and Central America is fueling the need for efficient logistics infrastructure. More sorting and distribution capabilities are necessary to increase the speed of delivery and service standards across the region.

- Government incentives for industrial automation in select countries

- Trends: Rise of localized e-commerce platforms

5. Middle East and Africa

- Market Share: Although small, but growing quickly

-

Key Drivers:

- Growing investment in logistics hubs, especially in the Gulf Cooperation Council

- The Middle East, especially the Gulf region, is rapidly developing logistics hubs to become global trade gateways. These hubs require sophisticated automated sortation systems to efficiently process large cargo volumes and support economic diversification plans.

- Modernization of infrastructure to support economic diversification

- Increasing retail and e-commerce penetration

- Trends: Emergence of smart logistics parks

Linear Cross Belt Sorter Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is intense due to the presence of established players such as FORTNA Inc. (USA); Gosunm Intelligent Industry Co., Ltd. (China); Falcon Autotech Pvt Ltd. (India); Hangzhou ConfirmWare Technology Co., Ltd. (China); Suzhou Pairs Kee Automation Equipment Co., Ltd. (China); Fives SAS (France); Bastian Solutions LLC (USA); BEUMER Group GmbH & Co. KG (Germany); Okura Yusoki Co., Ltd. (Japan), and GINFON Group (China).

This high level of competition urges companies to stand out by offering:

- Advanced security features

- Customizable and scalable solutions tailored to the diverse industry

- Competitive pricing models

- Comprehensive after-sales support and service

Opportunities and Strategic Moves

- Manufacturers and system integrators are increasingly collaborating with e‑commerce logistics players and third‑party logistics (3PLs) to co‑deploy solutions optimized for high parcel volumes.

- Some vendors are bundling maintenance, software upgrades, and monitoring services (via IoT) as part of the package, moving toward outcome‑based or performance‑based contracts.

- Energy-efficient and eco-friendly sorting systems align with global sustainability goals and regulations.

Other companies analyzed during the course of research:

- Muvro Technologies

- GBI Intralogistics Solutions

- Wayzim Technology Co., Ltd.

- Gosunm Intelligent Industry Co., Ltd.

- Better Convey Automatic Equipment Co., Ltd.

- ZedSort (Muvro Technologies)

- GreyOrange

- Intralox

- Dematic

- Vanderlande

- Siemens Logistics

- Beumer Group

- Interroll

- Swisslog

Linear Cross Belt Sorter Market News and Recent Developments

- Falcon Autotech selected by DTDC Express Ltd for sorter technology Falcon Autotech, a leading supplier of intralogistics automation solutions, has been selected by DTDC Express Ltd, one of India’s leading integrated express logistics companies, to automate its parcel sorting operations at its super hub of 175,000 sq ft in Chennai, Tamil Nadu. Using its cross-belt sorter technology, Falcon has designed DTDC's parcel sorting system, which can handle 9,000 parcels per hour, operate in a 24/7 environment, and can be expanded to cater to future growth.

- Fives announced a new strategic partnership with Agito Fives, a global leader in high-speed sortation technology, announced a new strategic partnership with Agito, a trusted automation solutions provider for the parcel and logistics sector. This collaboration marks an important step in Fives' expansion across the Asia-Pacific (APAC) region, with a particular focus on Australia and New Zealand.

- Major Merger and Acquisition: The BEUMER Group announced the acquisition of Hendrik Group Inc The BEUMER Group announced that it had acquired one of the leading companies for air-supported belt conveyors, The Hendrik Group Inc. Through this acquisition, BEUMER Group is expanding its portfolio in the field of bulk material transport.

Linear Cross Belt Sorter Market Report Coverage and Deliverables

The "Linear Cross Belt Sorter Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Linear cross belt sorter market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Linear cross belt sorter market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Linear cross belt sorter market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the linear cross belt sorter market

- Detailed company profiles

Frequently Asked Questions

Nivedita is an accomplished research professional with over 9 years of experience in Market Research and Business Consulting. Currently serving as a Project Manager in the ICT domain at The Insight Partners, she brings deep expertise in managing and executing Syndicated, Custom, Subscription-based, and Consulting research assignments across diverse technology sectors.

With a proven track record of delivering data-driven analysis and actionable insights, Nivedita has been a key contributor to several critical projects. Her work involves end-to-end project execution—right from understanding client objectives, analyzing market trends, to deriving strategic recommendations. She has collaborated extensively with leading ICT companies, helping them identify market opportunities and navigate industry shifts.

Nivedita holds an MBA in Management from IMS, Dehradun. Prior to joining The Insight Partners, she gained valuable experience at MarketsandMarkets and Future Market Insights in Pune, where she held various research roles and built a strong foundation in industry analysis and client engagement.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For