Liquid Biopsy Market Analysis, Size, and Share by 2031

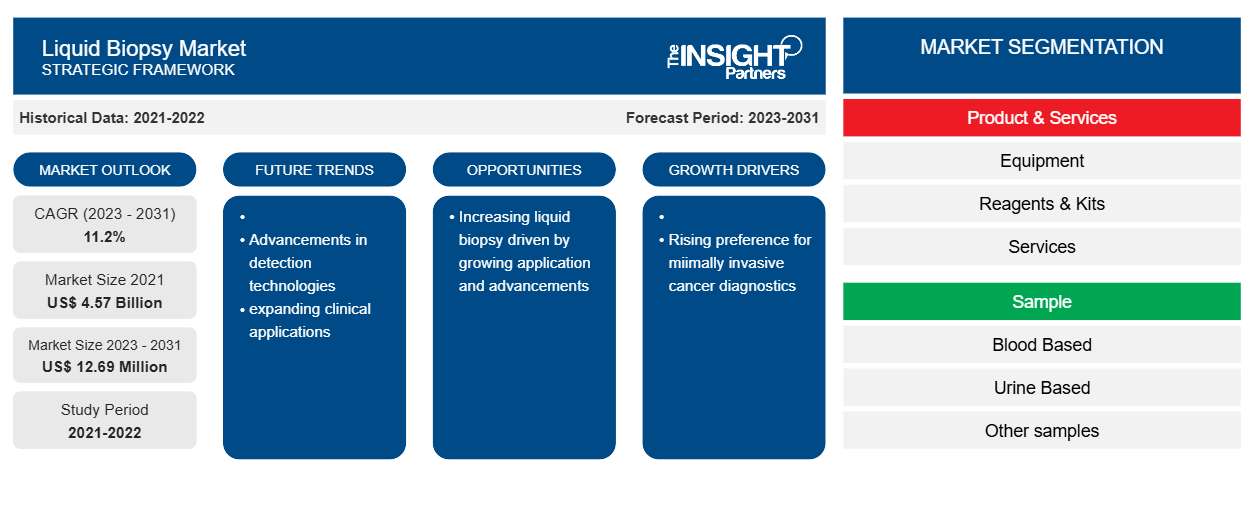

Liquid Biopsy Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product & Services (Reagents & Kits, Equipment, and Services), Application (Noninvasive Prenatal Testing (NIPT), Oncology, Transplant Diagnostics, and Other Applications), Sample (Blood Based, Urine Based, and Other samples), Circulating Biomarker (Exosomes, Circulating Tumor Cells (CTC), and Free Nucleic Acid), End User (Academic & Research Institutes, Hospitals, Reference Laboratories, and Other End Users), and Geography

Historic Data: 2021-2022 | Base Year: 2021 | Forecast Period: 2023-2031- Report Date : Mar 2026

- Report Code : TIPRE00003996

- Category : Life Sciences

- Status : Data Released

- Available Report Formats :

- No. of Pages : 150

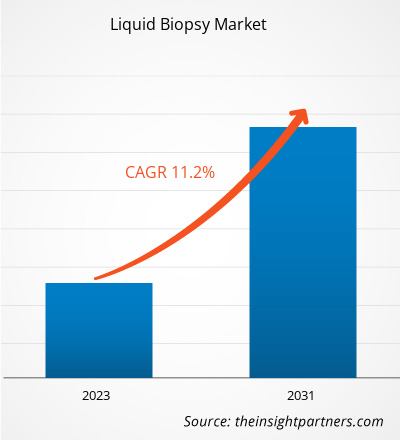

The Liquid Biopsy Market Size was estimated to be US$ 4.57 billion in 2021 and US$ XX billion in 2023 and is expected to reach US$ 12.69 million by 2031; it is estimated to record a CAGR of 11.2% till 2031. Consistent launch of new products is likely to remain a key Liquid Biopsy Market trends.

Liquid Biopsy Market Analysis

Liquid biopsy is a type of diagnostic test that can identify various types of cancer without being invasive. The growing prevalence of cancer among the population is leading to the growth of the liquid biopsy market across the world. For instance, As per the World Health Organization (WHO), in 2022, ~20 million new cancer cases and 9.7 million deaths caused by cancer were reported worldwide. Additionally, the latest estimates from WHO’s Global Cancer Observatory indicated that in 2022, 10 different types of cancer accounted for approximately two-thirds of new cancer cases and deaths worldwide. Among these, lung cancer was the most commonly occurring cancer globally, accounting for 2.5 million new cases and 12.4% of the total new cases. Female breast cancer ranked 2nd with 2.3 million cases and 11.6% of the total new cases, followed by colorectal cancer, accounting for 9.6% of the total new cases. Prostate cancer ranked fourth with 1.5 million cases, and stomach cancer ranked fifth with 970,000 cases. Thus, there is largest potential market for liquid biopsy is as a screening tool for testing asymptomatic individuals for various types of cancer. Hence, increasing demand for Liquid biopsies driving the liquid biopsy market growth.

Liquid Biopsy Market Overview

Global liquid biopsy market is segmented by region into North America, Asia Pacific, Europe, South & Central America, and Middle East & Africa. The North American region dominates the liquid biopsy market with the largest share. The US held the largest market for liquid biopsy market in North America and is expected to grow due to factors such as propelling number of cancer cases, growing developments for liquid biopsy by the companies and others.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONLiquid Biopsy Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Liquid Biopsy Market Drivers and Opportunities

Rising preference for minimally invasive cancer diagnostics to Favor Market

There is a growing preference for minimally or noninvasive tests among patients for diagnostic purposes. Early cancer detection, tumor monitoring throughout treatment, recurrence monitoring, and mutation detection are possible using liquid biopsy, which uses a noninvasive method. Patients tend to prefer minimally invasive procedures as they involve the use of advanced instruments that allow for more intricate work to be performed with less pain, lower risk, and minimal scarring. In recent times, there has been considerable interest in circulating tumor cell diagnostics and liquid biopsy as a non-invasive substitute for tissue biopsy in cancer patients. The adoption of liquid biopsy will be facilitated by advancements in minimally invasive cancer detection technologies. The market growth will be influenced by increasing demand for non-invasive diagnostic tools and laboratory acceptance of CTCs tests and liquid biopsy.

A liquid biopsy is a simple and non-invasive alternative to surgical biopsies that enables medical professionals to gather various information about tumors from a blood sample. Blood tests are painless, non-invasive, and bear no risks, which significantly cuts down the cost and time to diagnose a problem. Moreover, CTCs, exosomes, cfDNAs, and microvesicles can be detected in a blood sample, making blood-based liquid biopsies more popular. Therefore, the rising demand for minimally invasive diagnostic tests is driving the market growth.

Increasing Liquid Biopsy Due to Growing Application and Advancements – An Opportunity

According to the College of American Pathologists, ctDNA testing is likely to expand in clinical care. Due to continued research on circulating tumor DNA (ctDNA)/RNA, CTCs, and extracellular vesicles, the images of tumor status with increased resolution can be obtained through liquid biopsies. The uses of liquid biopsy range from monitoring cancer growth to detecting genetic mutations, identifying signs of relapse, and predicting sensitivity to immunotherapy. The advantages of liquid biopsies and technological improvements will continue to expand their applicability and utility in monitoring patients for relapse and determining the best treatments. The growing applications are likely to offer significant opportunity for the growth of the market.

Liquid Biopsy Market Report Segmentation Analysis

Key segments that contributed to the derivation of the liquid biopsy market analysis are product& services, sample, circulating biomarker, application, and end user.

- Based on product & services, the liquid biopsy market is segmented into equipment, reagents & kits, and services. The reagents & kits segment held a largest market share in 2023.

- By sample, the market is segmented into segmented into urine based, blood based, and other samples. The blood based segment held the largest share of the market in 2023.

- By circulating biomarker, the market is segmented into exosomes, free nucleic acid, and circulating tumor cells (CTC). The circulating tumor cells (CTC) segment held the largest share of the market in 2023.

- By application, the market is segmented into oncology, transplant diagnostics, noninvasive prenatal testing (NIPT), and other applications. The oncology segment held the largest share of the market in 2023.

- By end user, the market is segmented into hospitals, reference laboratories, academic & research institutes, and other end users. The hospitals segment held the largest share of the market in 2023.

Liquid Biopsy Market Share Analysis by Geography

The geographic scope of the Liquid Biopsy Market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

North America has dominated the liquid biopsy market. In North America, the US is the largest market for liquid biopsy. The growth of liquid biopsy market is primarily driven by growing prevalence of cancer, high R&D spending for new diagnostics and presence of major market players in the US are going to proliferate the growth of liquid biopsy market in this country. Every year, the American Cancer Society predicts the number of new cancer cases and deaths in the US. According to their projections, in 2023, there were 1,958,310 new cancer cases in the US. Further, Asia Pacific is anticipated to grow with the highest CAGR in the coming years.

Liquid Biopsy Market Regional InsightsThe regional trends and factors influencing the Liquid Biopsy Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Liquid Biopsy Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Liquid Biopsy Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 4.57 Billion |

| Market Size by 2031 | US$ 12.69 Million |

| Global CAGR (2023 - 2031) | 11.2% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Product & Services

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Liquid Biopsy Market Players Density: Understanding Its Impact on Business Dynamics

The Liquid Biopsy Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Liquid Biopsy Market top key players overview

Liquid Biopsy Market News and Recent Developments

The Liquid Biopsy Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for liquid biopsy:

- In February 2024, Twist Bioscience Corporation launched the cfDNA Library Preparation Kit to facilitate liquid biopsy research using its silicon platform. (Source: Twist Bioscience Corporation, 2024)

- In September 2023, Pillar Biosciences, a provider in decision medicine, globally launched oncoReveal Core LBx, a next-generation sequencing (NGS) kit designed to enable laboratories with a solution for liquid biopsy-based pan-cancer tumor profiling. (Source: Pillar Biosciences, 2023)

- In July 2022, BillionToOne, Inc., a next-generation molecular diagnostics company, launched its first oncology liquid biopsy products - Northstar Select and Northstar Response. These products are currently available for research use with select academic cancer centers. (Source: BillionToOne, Inc., 2022)

Liquid Biopsy Market Report Coverage and Deliverables

The “Liquid Biopsy Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For