Gas Engine Market Growth and Analysis by 2031

Gas Engine Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Fuel Type (Natural Gas, Special Gas), By Power Output (100-300 kW, 300-500 kW, 0.5-1 MW, 1-2 MW, 2-5 MW, 5-10 MW, 10-15 MW), By End-User (Remote (Mining, Drilling, Others), Mid-Stream Oil and Gas, Heavy Industries (Chemicals, Paper, Metals, Food and Beverages, Others) Light Manufacturing, Utilities (Grid, IPP, Others), Biogas, Datacenters, MUSH, Commercial), and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : May 2025

- Report Code : TIPRE00015324

- Category : Energy and Power

- Status : Published

- Available Report Formats :

- No. of Pages : 545

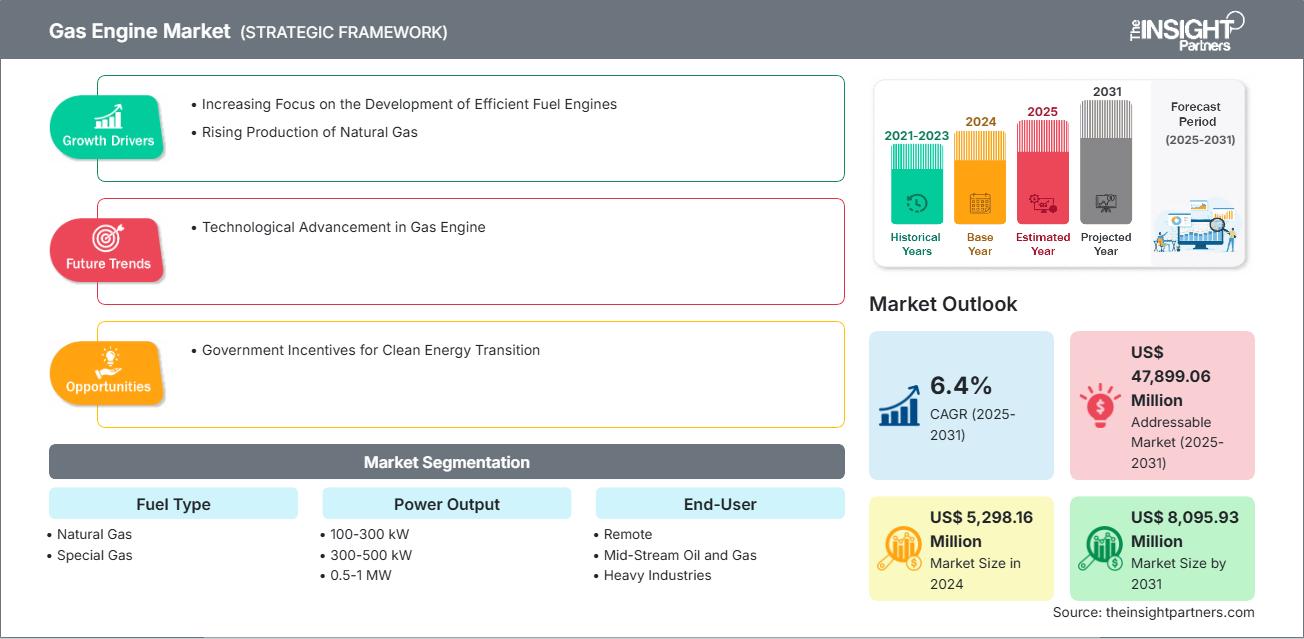

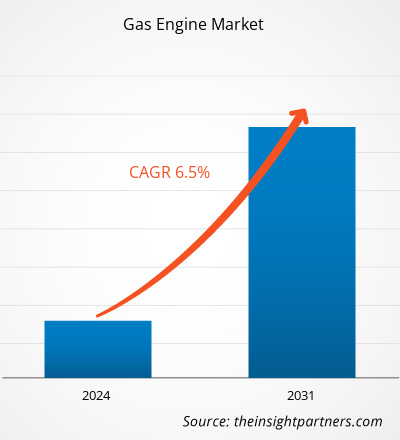

The gas engine market size is expected to reach US$ 8,095.93 million by 2031 from US$ 5,298.16 million in 2024. The market is estimated to register a CAGR of 6.4% during 2025–2031. The rising energy demand worldwide is likely to bring new trends to the market in the coming years.

Gas Engine Market Analysis

Increasing focus on the development of efficient fuel engines is one of the key factors driving the growth of the global gas engine market. In addition, rising product of natural gas and exploration and production activities across the globe is anticipated to further boost the demand for gas engines during the analyzed timeframe. Moreover, growing government incentives for clean energy transition across the globe is further projected to create opportunities for the key players operating in market.

Gas Engine Market Overview

The gas engine manufacturing industry is evolving with innovations in natural gas engine offerings to support emission targets. The rising demand for low-emission, fuel-efficient engines to reduce air pollution and the advent of special gas engines in the manufacturing, utilities, and remote generation application sectors propel the gas engine market growth. Also, biogas-powered engines with improved electric efficiency and low emissions are creating substantial growth opportunities for the market players. The gas engine manufacturers are focusing on offering advanced products to address the rising demand for high power outputs, meeting diesel engine standards. Major heavy industries, remote power plants, and manufacturing companies are selecting high-power gas engines due to enhanced electric efficiency and reduced fuel costs. The use of natural gas in gas engine combustion technology can resolve the emission problems, along with assisting customers in meeting new regulatory norms. There is an increase in the adoption of gas engines in South America, Africa, and Asia, while North America and Europe are focusing on adopting solar and wind energy during the forecast period. The increasing adoption of natural gas for power generation in commercial, industrial, and construction sectors is supporting the gas engine market growth.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONGas Engine Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Gas Engine Market Drivers and Opportunities

Increasing Focus on Development of Efficient Fuel Engines

Several governments are imposing regulations to control the emissions of diesel and petrol engines, compelling engine manufacturers to opt for alternative fuel solutions such as natural gas. Gas engines release less emissions as compared to other types of engine to generate a sufficient amount of power. The emission monitoring and regulatory bodies are imposing stringent regulations on the use of diesel engines and generators. Various industries are deploying gas engines and generators for power generation to meet these regulatory standards.

Cummins Inc. and Liberty Energy Inc. announced the launch of the industry’s first natural gas variable-speed, large-displacement engine to power Liberty’s digiPrime hydraulic fracturing platform, set for deployment in the first half of 2025. This follows the strategic partnership between the two companies in June 2024, aimed at jointly developing innovative technology for the completions and services market. The Cummins HSK78G natural gas engine, initially introduced in March 2019 as part of a fixed-speed generator set for the power generation sector, has demonstrated exceptional reliability in providing consistent power across varying natural gas sources and operational environments. The recent advancements in Liberty’s digiPrime platform utilize the HSK78G engine and enhance its response time and load acceptance. This collaboration highlights a significant step in the ongoing growth of the gas engine market, which continues to innovate in areas of efficiency and operational performance, particularly within sectors such as hydraulic fracturing and energy production. Thus, the rise in the development of efficient fuel engines, owing to stringent regulations related to gas engines, is propelling the market growth.

Government Incentives for Clean Energy Transition

Governments are increasingly supporting the transition to cleaner energy sources as part of their broader environmental sustainability goals. This is crucial for the global push for decarbonization and the reduction of greenhouse gas emissions. Various incentives, subsidies, and tax breaks are provided by the governments to encourage the adoption of cleaner and more energy-efficient technologies. Gas engines, being a cleaner alternative to coal and oil, are well-positioned to benefit from these supportive policies. For instance, the growing emphasis on clean, energy-efficient solutions in transportation has led to the development of several government grant programs aimed at supporting the transition of transit fleets to sustainable technologies. The Federal Transit Administration (FTA) has played a significant role through its Low-No Emission and Bus Facilities Grants. These grants are specifically designed to aid transit agencies in transitioning their fleets to cleaner, more energy-efficient alternatives such as renewable natural gas (RNG). Since 2022, the FTA has awarded over US$ 500 million to fund various natural gas projects, significantly offsetting capital expenditures for agencies and facilitating the adoption of clean energy technologies. These federal grants, particularly in the transportation sector, promote the use of natural gas-powered buses and vehicles, which are increasingly viewed as a viable and environmentally friendly alternative to diesel and gasoline-powered options.

Gas Engine Market Report Segmentation Analysis

Key segments that contributed to the derivation of the gas engine market analysis are fuel type, power output, end user, and application.

- In terms of fuel type, the market is categorized into natural gas and special gas. The natural gas segment dominated the gas engine market share in 2024.

- By power type, the market is categorized into 100–300 kW, 300–500 kW, 0.5–1 MW, 1–2 MW, 2–5 MW, 5–10 MW, and 10–15 MW. The 5–10 MW segment dominated the market in 2024.

- Based on end user, the market is divided into remote power generation, midstream oil and gas, heavy industries, light manufacturing, utilities, biogas, data centers, MUSH, and commercial. The heavy industries segment dominated the market in 2024.

Gas Engine Market Share Analysis by Geography

The gas engine market is segmented into five major regions: North America, Europe, Asia Pacific (APAC), the Middle East and Africa (MEA), and South and Central America (SAM). Europe dominated the market in 2024, followed by Asia Pacific and North America.

The gas engine market in Europe is segmented into Germany, France, the UK, Russia, and Italy. Europe has been a leader in the adoption of renewable energy solutions, and the shift toward cleaner energy sources is significantly boosting the gas engine market. Countries such as Germany, Italy, and the UK are transitioning to more sustainable energy solutions, integrating natural gas and hydrogen as part of their green energy strategies. MWM’s recent launch of the TCG 3020 series engine, capable of using a hydrogen admixture, reflects the continent’s focus on hydrogen and natural gas as future energy sources. Additionally, the UK’s commitment to carbon neutrality by 2050 and its investments in gas engine technology demonstrate the growing demand for energy-efficient, low-emission technologies. The European Union’s ambitious targets for reducing emissions by 2030 further fuel the demand for natural gas engines in power generation, transportation, and industrial applications.

Gas Engine Market Regional Insights

The regional trends and factors influencing the Gas Engine Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Gas Engine Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Gas Engine Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 5,298.16 Million |

| Market Size by 2031 | US$ 8,095.93 Million |

| Global CAGR (2025 - 2031) | 6.4% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Fuel Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Gas Engine Market Players Density: Understanding Its Impact on Business Dynamics

The Gas Engine Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Gas Engine Market top key players overview

Gas Engine Market News and Recent Developments

The gas engine market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the gas engine market are listed below:

- INNIO Group announces its newest Waukesha VHP P9390X engine upgrade designed for simpler operation and increased reliability. The VHP P9390X upgrade offers operators the latest engine technology, extending the life of the equipment by 60% while lowering downtime and reducing emissions across various operating conditions. (Source: INNIO Group, Press Release, September 2024)

- Mitsubishi Heavy Industries Engine & Turbocharger, Ltd. (MHIET), a part of Mitsubishi Heavy Industries (MHI) Group, launched SGP M2000, a new natural gas engine cogeneration system with a generation output of 2,000 kW. The new package encloses a 16-cylinder natural gas-fired engine, modeled G16NB, that boasts an electrical efficiency of 44.3%, the highest level in the world for a 2,000 kW-class engine and makes a cogeneration system in compact packaging. (Source: Mitsubishi Heavy Industries, Press Release, March 2023)

Gas Engine Market Report Coverage and Deliverables

The "Gas Engine Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Gas engine market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Gas engine market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Gas engine market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the gas engine market

- Detailed company profiles

Frequently Asked Questions

Nivedita is an accomplished research professional with over 9 years of experience in Market Research and Business Consulting. Currently serving as a Project Manager in the ICT domain at The Insight Partners, she brings deep expertise in managing and executing Syndicated, Custom, Subscription-based, and Consulting research assignments across diverse technology sectors.

With a proven track record of delivering data-driven analysis and actionable insights, Nivedita has been a key contributor to several critical projects. Her work involves end-to-end project execution—right from understanding client objectives, analyzing market trends, to deriving strategic recommendations. She has collaborated extensively with leading ICT companies, helping them identify market opportunities and navigate industry shifts.

Nivedita holds an MBA in Management from IMS, Dehradun. Prior to joining The Insight Partners, she gained valuable experience at MarketsandMarkets and Future Market Insights in Pune, where she held various research roles and built a strong foundation in industry analysis and client engagement.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For