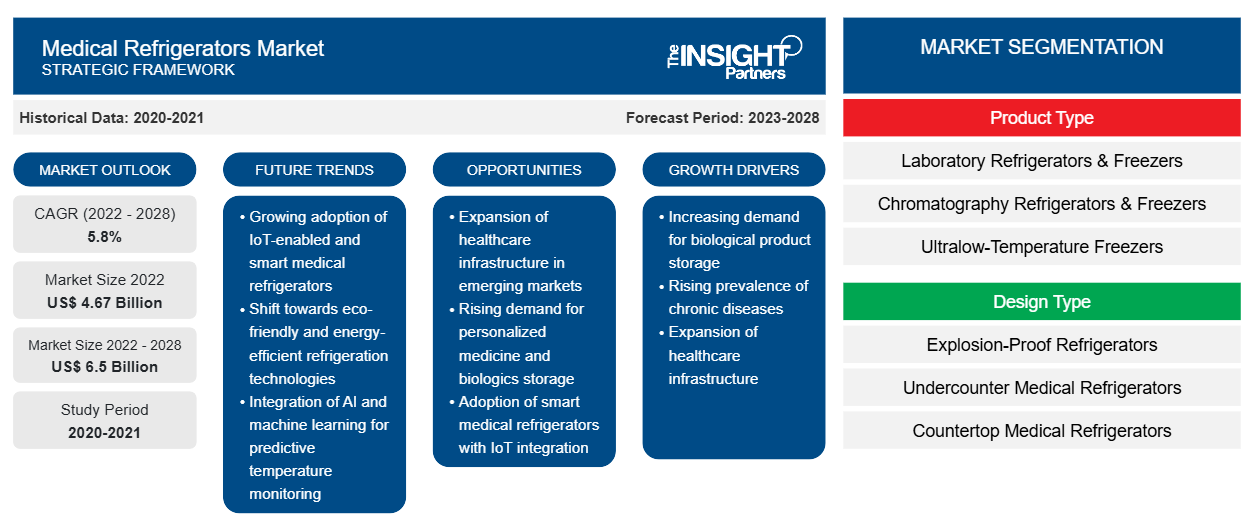

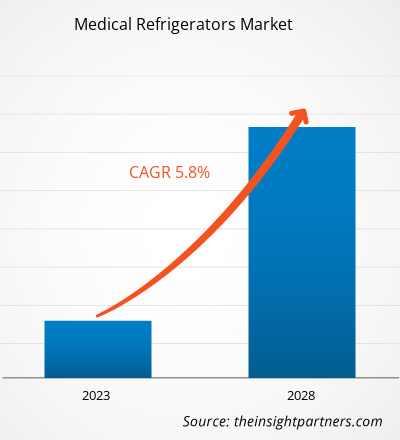

[Research Report] The medical refrigerators market is expected to grow from US$ 4,665.97 million in 2022 to US$ 6,499.18 million by 2028; it is estimated to register a CAGR of 5.8% from 2023 to 2028.

Analyst Perspective:

Medical refrigerators store various biological components such as blood, blood derivatives, biological reagents, vaccines, medicines, and flammable chemicals. The increasing number of medical procedures, combined with the increasing prevalence of problems such as anemia and cancer, is leading to an expansion of blood transfusion methods. The American Red Cross estimates that nearly 13.6 million whole blood and red blood cells are collected annually in the United States. Increasing demand for blood transfusions will drive market growth. The increasing use of these agents to treat severe hypoglycemia has also increased the market demand. The developing countries are striving to introduce new medical cold-chain refrigeration technologies to ensure the safe storage of medicines. In addition, medical refrigerators are also used in the immunohematology department for storing whole blood, blood components, and reagents safely and conveniently.

Market Overview

Medical refrigerators are mainly used in healthcare, where they are used to store various temperature-sensitive products such as vaccines, blood, etc. With the advancement of technology, refrigeration technology has made great strides in meeting the needs of the medical and healthcare industries. Technological advancements have led to improved energy efficiency, improved acoustic properties, and better temperature regulation. These devices have precise cooling techniques, state-of-the-art temperature monitoring software, and remote warning functions. Several manufacturers integrate web-based interfaces and present graphical displays. They also implement low and ultra-low temperature settings and data collection and management systems to increase functionality. The increasing need for medical refrigerators due to increasing cases of chronic diseases, market developments, and technological advancements, among others, are driving the growth of the global medical refrigerators market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Medical Refrigerators Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Medical Refrigerators Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Growth Drivers and Challenges:

Blood and blood components perform many vital functions in the body. Consequently, severe blood loss could result in life-threatening conditions such as hypovolemic/hemorrhagic shock, which require immediate blood transfusion to prevent organ failure and death. Blood transfusion is one of the important steps in many surgical procedures, as well as in chemotherapy, stem cell therapy, and organ transplantation procedures; it is also employed in the treatment of acute and chronic diseases caused by deficiencies or defects in plasma proteins or cellular blood components, to avoid complications such as life-threatening bleeding or to improve the quality of life. For instance, as per the data provided by WHO, anemia affects ~25% of the population, i.e., ~1.6 billion people, worldwide; the prevalence of the condition is highest, i.e., 47.4%, among toddlers and children of preschool age. The National Hemophilia Foundation estimates that more than 400,000 people worldwide are affected by hemophilia. According to the American National Red Cross 2023 data findings, 13.6 million units of whole and red blood cells are collected annually in the US. In the US, ~29,000 units of red blood cells, 6,500 units of plasma, and ~5,000 units of platelets are required daily. Thus, the increasing demand for safe blood and blood components for transfusion has encouraged the manufacturing or development of various types of blood bank freezers; it has also triggered the adoption of ULT freezers for secure storage due to the strict guidelines imposed by the WHO for the storage of blood samples, which is contributing to the medical refrigerators market growth.

The healthcare sector is witnessing technological developments that accelerate the adoption and acceptance of medical refrigerators. As a result, the companies focus on manufacturing energy-efficient natural refrigerants and inverter compressors to reduce power consumption effectively through slow-speed rotation control. Biological research specimens must be stored below -80°C, i.e., at ultralow temperature (ULT) values. The ULT feature provides an alternative to standard compressor-based cooling technology that keeps improving as the understanding of it grows. Further, innovative products by Haier Biomedical, such as smart frequency conversion technology, boast an unparalleled energy consumption of just 8.2 Kwhr/day with a unit capacity of 829 L/29.2 ft3. Similarly, other technologies, such as unique default passwords for smart freezers, solid-state cooling, 2D barcode systems, shared freezers, and mobile lab freezers, are gathering significant attention.

Further, many new hospitals are implementing various strategies to reduce capital investments. Procuring refurbished or refurbished existing equipment is one way to address the high demand for affordable and reliable products. Not only small hospitals with limited budgets but also some leading medical institutes demand refurbished medical imaging equipment. Moreover, refurbished medical devices are cost-effective, and budget constraints at many levels, mainly in the healthcare sectors in cost-sensitive countries, compel medical institutes to opt for these devices. Many original manufacturers and standalone refurbishments have established a separate second-hand market flourishing in India. However, domestic manufacturers have raised several issues, demanding a total ban on such devices. Major manufacturers in the medical refrigerators market do not offer refurbished freezers, which is hampering their market performance. Thus, the growing consumer preference for refurbished equipment is hindering the market proliferation to a certain extent.

Report Segmentation and Scope:

The “Global Medical Refrigerator Market” is segmented based on product type, design type, door type, temperature control range, volume, and end user. Based on product type, the medical refrigerators market is segmented into laboratory refrigerators and freezers, chromatography refrigerators and freezers, ultra-low-temperature freezers, blood bank refrigerators and plasma freezers, cryogenic storage systems, pharmacy refrigerators and freezers, enzyme refrigerators and freezers, hospital refrigerators and freezers, shock freezers, and others. Based on design type, the medical refrigerators market is segmented into explosion-proof refrigerators, under-counter medical refrigerators, countertop medical refrigerators, and flammable material storage refrigerators. Based on temperature control range, the medical refrigerators market is segmented into between −1 and −50°C, between 2°C and 8°C, between −51 and −150°C, and below −151°C. Based on end users, the medical refrigerators market is segmented into hospitals, pharmacies, medical laboratories, blood banks, pharmaceutical companies, research institutes, and diagnostic centers. Based on geography is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Spain, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

Based on product type, the medical refrigerators market is segmented into laboratory refrigerators and freezers, chromatography refrigerators and freezers, ultra-low-temperature freezers, blood bank refrigerators and plasma freezers, cryogenic storage systems, pharmacy refrigerators and freezers, enzyme refrigerators and freezers, hospital refrigerators and freezers, shock freezers, and others. The blood bank refrigerators and plasma freezers segment held the largest share of the market. The increasing prevalence of different diseases and rise in road accidents, underlining the need to maintain adequate stock in blood banks and organize blood donation camps, are boosting the segment's market growth. Further, the same segment is expected to grow at the highest CAGR during 2022–2030.

Based on design type, the medical refrigerators market is segmented into explosion-proof refrigerators, under-counter medical refrigerators, countertop medical refrigerators, and flammable material storage refrigerators. The countertop medical refrigerators segment held the largest share of the market. However, the under-counter medical refrigerators segment is estimated to register the highest CAGR in the market during 2022-2030. The market growth for the countertop medical refrigerators segment is due to their compact size and ability to fit in smaller spaces such as small research labs, clinics, and remotely located healthcare facilities.

Based on temperature control range, the medical refrigerators market is divided into between −1 and −50°C, between 2°C and 8°C, between −51 and −150°C, and below −151°C. The between −1°C and −50°C segment led the market in 2022 with the highest market share and is expected to retain its dominance during 2022-2030.

Based on end users, the medical refrigerators market is segmented into hospitals and pharmacies, medical laboratories, blood banks, pharmaceutical companies, research institutes, diagnostic centers, and others. The blood banks segment held the largest share of the market in 2022, and it is further anticipated to register the highest CAGR. The increasing prevalence of hematologic diseases and the rise in accident cases drive the market growth for the blood banks segment.

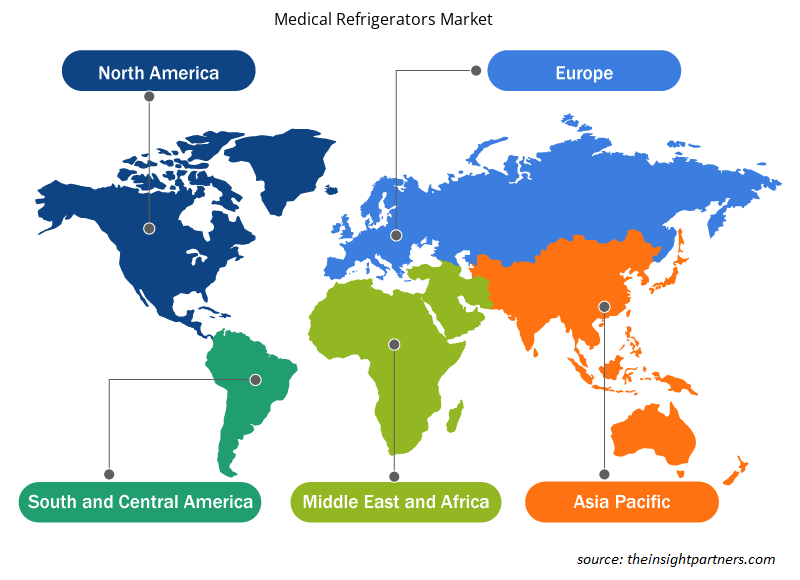

Regional Analysis:

Based on geography, the global medical refrigerator market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. In 2022, North America held the largest global medical refrigerator market share. The US medical refrigerator market was the leading in the North American region. The market's growth is attributed to increased R&D spending, and developments in the pharmaceutical and biotechnology sectors are credited for the region's rapid growth. Additionally, rising cancer rates in the US and increasing adoption of biomedical refrigerators and freezers will drive the market. In addition, the number of blood banks, pharmacies, and diagnostic laboratories is growing rapidly across the country owing to significant market players in the US.

Asia Pacific is expected to witness a high CAGR in the global medical refrigerator market due to increasing technological development and awareness about people's health and hygiene. Due to cheap and skilled labor in Asia Pacific, it is the fastest growing segment, and several companies are relocating their manufacturing facilities there. Due to the increasing use of medical refrigerators, the market is expected to grow rapidly in India and China. Further, government initiatives to increase the number of blood samples collected are also increasing. In India, the National AIDS Control Organization (NACO) and the National Blood Transfusion Council (NBTC) help in promoting voluntary blood donation. The demand for medical refrigerators is expected to grow with the number of blood units collected. The market is expected to grow as investments and funding to improve healthcare facilities and infrastructure increase.

Medical Refrigerators Market Regional Insights

The regional trends and factors influencing the Medical Refrigerators Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Medical Refrigerators Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Medical Refrigerators Market

Medical Refrigerators Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 4.67 Billion |

| Market Size by 2028 | US$ 6.5 Billion |

| Global CAGR (2022 - 2028) | 5.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Medical Refrigerators Market Players Density: Understanding Its Impact on Business Dynamics

The Medical Refrigerators Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Medical Refrigerators Market are:

- THERMO FISHER SCIENTIFIC INC.

- Philipp Kirsch GmbH

- Godrej & Boyce Manufacturing Company Limited

- Haier Group Corporation

- Blue Star Limited

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Medical Refrigerators Market top key players overview

Industry Developments and Future Opportunities:

Various initiatives taken by top medical refrigerator companies operating in the global medical refrigerator market are listed below:

- In March 2022, B Medical Systems announced that the company's Ultra-Low Freezer U201 had received WHO PQS prequalification.

- In January 2022, B Medical Systems announced its plan to open a new manufacturing facility in India to meet the increasing demand for medical cold chain products, including vaccine refrigerators, in the country.

- In December 2020, Tobin Scientific and PHCbi collaborated on a regional COVID-19 vaccine distribution solution to address the need for ultra-low temperature requirements.

- In June 2020, Dulas acquired Polestar, a UK-based company that pioneered the innovative use of solar, hydro, and wind energy and state-of-the-art healthcare refrigerators for vaccine storage. Polestar is a UK-based company that produces industrial and medical refrigeration equipment.

- In April 2020, Thermo Fisher Scientific signed a partnership agreement with DKSH to distribute its Revco RDE Series Ultra Low Temperature (ULT) freezers. This agreement was mainly focused on the clinical sector.

- In December 2020, Follett LLC announced the expansion of its manufacturing facilities in Forks Township. Adding US$12 million and 90,000 sq. ft would bring the total manufacturing and office space under the roof to ~250,000 sq. ft. The expansion and related investments were completed by mid-2021.

Competitive Landscape and Key Companies:

Some of the prominent medical refrigerator companies operating in the market include Thermo Fisher Scientific Inc.; Philipp Kirsch GmbH, Godrej & Boyce Manufacturing Company Limited, Haier Group Corporation, Blue Star Limited, Helmer Scientific Inc.; Vestfrost Solutions, PHC Holdings Corporation, FOLLETT LLC, Lec Medical, amongst others. The company focuses on new product launches and geographical expansions to meet the growing global demand and increase its product range in specialty portfolios. Their widespread global presence allows them to serve many customers and increase their market share.

Frequently Asked Questions

Which are the top companies that hold the market share in medical refrigerators market?

Thermo Fisher Scientific Inc. and PHC Holdings Corporation are the top two companies that hold huge market shares in the medical refrigerators market.

Which product type led the medical refrigerators market?

The laboratory refrigerators and freezers segment held the largest share of the market in the global medical refrigerators market and held the largest market share of 41.00% in 2022.

Who are the key players in the medical refrigerators market?

The medical refrigerators market majorly consists of the players such Thermo Fisher Scientific Inc., Philipp Kirsch GmbH, Godrej & Boyce Manufacturing Company Limited, Haier Group Corporation, Blue Star Limited, Helmer Scientific Inc., Vestfrost Solutions, PHC Holdings Corporation, FOLLETT LLC, and Lec Medical among others.

What is the market CAGR value of medical refrigerators market during forecast period?

The CAGR value of the medical refrigerators market during the forecasted period of 2023-2028 is 5.8%.

What are the driving factors for the medical refrigerators market across the globe?

Key factors that are driving the growth of this market are increasing demand for blood and blood components, technological advancements in medical refrigerators, and growing R&D activities to introduce new drug compounds are expected to boost the market growth for the medical refrigerators over the years.

Which design type held the largest share in the medical refrigerators market?

The countertop medical refrigerators segment dominated the global medical refrigerators market and accounted for the largest market share of 47.31% in 2022.

What are medical refrigerators?

Medical refrigerators are used to store vaccines, pharmaceuticals, chemotherapeutics, blood, plasma, and other samples that require tight temperature control. These are more reliable products for the storage of medicinal products as they emit less heat and less sound into the room. Rising occurrence of hematological disorders and an increment in the number of accidents have increased the requirement for plasma for employment in plasma fractionation operations. In return, this requirement has led to an increase in requirements for plasma freezers and refrigerators at the blood bank. These features are boosting demand for blood bank development worldwide. Thus, driving demand for medical refrigerators for pharmaceutical and laboratory use.

Which temperature control range held the largest share in the medical refrigerators market?

The between -1 to -50°C segment dominated the global medical refrigerators market and held the largest market share of 38.91% in 2022.

Which end-user held the largest share in the medical refrigerators market?

The hospitals and pharmacies segment dominated the global medical refrigerators market and held the largest market share of 41.16% in 2022.

Which region is expected to witness significant demand for medical refrigerators market in the coming years?

Global medical refrigerators market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa and South & Central America. In North America, the U.S. is the largest market for medical refrigerators. The region is expected to witness a consistent growth owing to factors such as rising research activities for the treatment of diseases, increasing occurrence of chronic and infectious diseases, and the replacement of older medical refrigerators with newer and more advanced energy-efficient cold storage device. The Asia Pacific region is expected to account for the fastest growth in the medical refrigerators market. In India and China, the market is expected to grow rapidly owing to factors such as the research activities & pharmaceutical manufacturing and increasing investments by leading players and respective government agencies in emerging APAC countries.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Medical Refrigerators

- THERMO FISHER SCIENTIFIC INC.

- Philipp Kirsch GmbH

- Godrej & Boyce Manufacturing Company Limited

- Haier Group Corporation

- Blue Star Limited

- Helmer Scientific Inc.

- Vestfrost Solutions

- PHC Holdings Corporation

- FOLLETT LLC

- Lec Medical

Get Free Sample For

Get Free Sample For