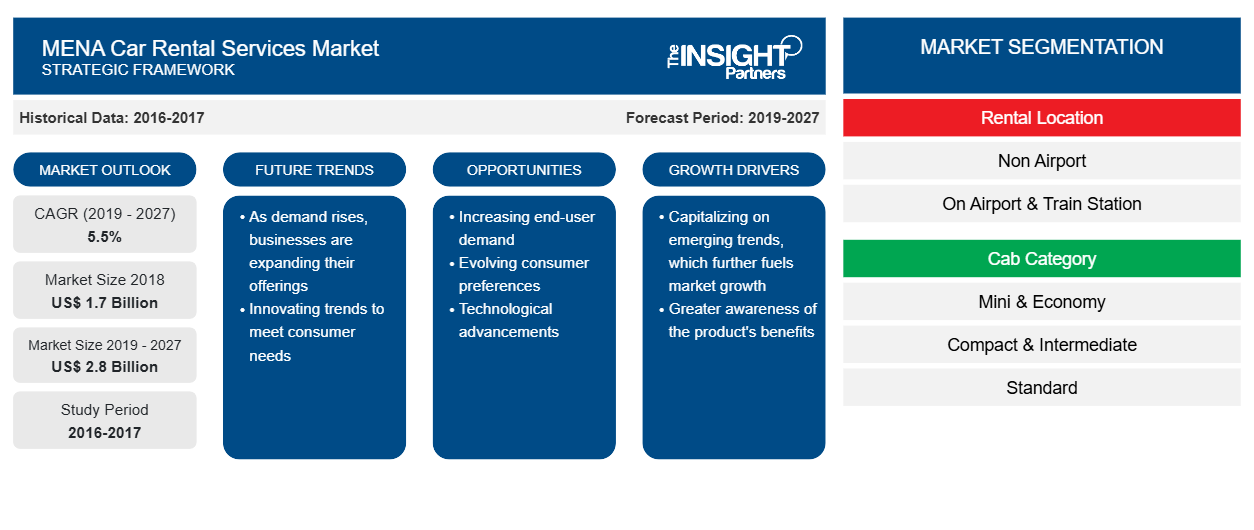

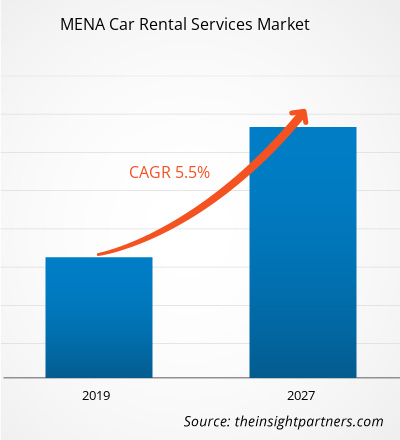

The MENA car rental services market accounted to US$ 1.7 Bn in 2018 and is expected to grow at a CAGR of 5.5% during the forecast period 2019 – 2027, to account to US$ 2.8 Bn by 2027.

Geographically, the MENA car rental services market is segmented into North Africa, Saudi Arabia, UAE, and the Rest of MENA. UAE led the MENA car rental services market in 2018 with a significant market share, as, Dubai is one of the most rapidly emerging business centers across the globe, as well as the attractive infrastructure of the city, is attracting huge tourists to visit the city. Thus, the demand for car rental services in the country is growing at a faster pace. Some of the prominent car rental service provider in the UAE market are Hertz, Europcar, SIXT, Thrifty, and Avis Hala. UAE is followed by Saudi Arabia and the growth is mainly driven by the country’s tourism industry. Moreover, the strong economic support has facilitated the consistent development in the car rental services resulting in significant sources of business for intelligent transportation-related services such as rate comparing tools, 24*7 customer service, and many more. The North African car rental service market is a combination of both leisure and the European customer base of leading car rental brands, which offers enhance the demand for short-term inbound rentals services. The Rest of the MENA market includes countries such as Tunisia, Mauritania, Oman, Qatar, Palestine, Morocco, Egypt, and Libya among others. The growth rate in the countries present in the rest of MENA for the car rental service market is growing at a sluggish rate.

Market Insights

The high cost of car ownership as compared to car rental

The car rental industry has been experiencing noteworthy changes pertaining to technological advances along with the significant changes in customer behavior and preference. Technological advancements allow car rental service providers to introduce innovative products and services to meet the continuously evolving customer needs. The consumer behavior toward the use of cars has been shifting over the past few years through car rental and car-sharing services. This transformation has accompanied the supply as well as the expansion of several services conventionally offered by companies that focus all their activities on the mobility market, including car rental companies.

Integration of technology-driven solutions to offer better customer services

Several car rental companies are focusing on offering advanced technology-driven solutions to their customers with intent to offer improved customer service as well as to distinguish their services from those offered by their competitors. In October 2019, Enterprise Holdings introduced Entegral, an integrated software solution capable of simplifying the post-accident process; this product enabled service providers to get customers on their way, back into their cars.

Rental Location Insights

The non-airport segment led the MENA car rental services market, by rental location, with a share of 62.42% in 2018; it is anticipated to continue its dominance during the forecast period, growing at a CAGR of 5.7% of the MENA car rental services market during the forecast period. The non-airport rental location provides various types of advantages such as it offers customers a suitable and geographically wide-ranging network of car rental locations, and it contributes to higher vehicle use as a result of the longer average rental periods related to non-airport business.

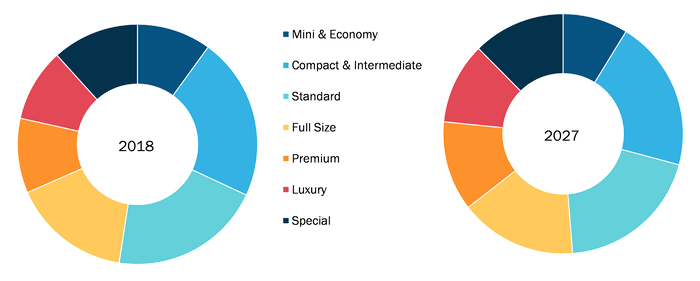

Car Category Insights

The car rental services market by car category was led by a compact & intermediate segment which held a market share of 21.95% in 2018. . A compact car offers much more interior space for passengers, along with trunk space. Small compact cars are an appropriate choice for extra storage space as well as ease of travel. Moreover, the intermediate car category can accommodate four adults and one child, along with space for two checked size baggage and one cabin size baggage.

Customer Type Insights

B2B segment led the MENA car rental services market with a market share of 51.14% in 2018. As B2B Companies across the region provide unique opportunities with the innovative technology in car rental services for executives and corporate travelers. Several companies have gained substantial share in the car rental services market by gaining large corporate contracts that could considerably impact the margins of the rental players.

Rest of MENA Car Rental Services Market by Car Category

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

MENA Car Rental Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

MENA Car Rental Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Some of the market Initiatives were observed to be the most adopted strategy in the MENA car rental services market. Few of the recent market initiatives are listed below:

MENA CAR RENTAL SERVICES MARKET SEGMENTATION

MENA Car Rental Services Market - By Rental Location

- Non-Airport

- On Airport & Train Station

MENA Car Rental Services Market - By Cab Category

- Mini & Economy

- Compact & Intermediate

- Standard

- Full Size

- Premium

- Luxury

- Special

MENA Car Rental Services Market - By Customer Type

- B2B

- B2C

MENA Car Rental Services Market - By Country

- North Africa

- Saudi Arabia

- UAE

- Rest of MENA

MENA Car Rental Services Market - Company Profiles

- ALAMO (Al Tayer Motors LLC)

- Avis Budget Group, Inc.

- Europcar Mobility Group S.A.

- Auto Europe

- Budget Rent a Car System, Inc.

- Enterprise Holdings Inc.

- Expedia Group

- The Hertz Corporation

- SIXT SE

- Rhino Car Hire

MENA Car Rental Services Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 1.7 Billion |

| Market Size by 2027 | US$ 2.8 Billion |

| Global CAGR (2019 - 2027) | 5.5% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Rental Location

|

| Regions and Countries Covered | MENA

|

| Market leaders and key company profiles |

|

MENA Car Rental Services Market Players Density: Understanding Its Impact on Business Dynamics

The MENA Car Rental Services Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the MENA Car Rental Services Market top key players overview

Frequently Asked Questions

What are reasons behind MENA car rental services industry growth?

What are market opportunities for MENA car rental services Market?

Which vehicle segment holds the major share in MENA car rental services market based on car category?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For