Mezcal Market Analysis and Opportunities by 2030

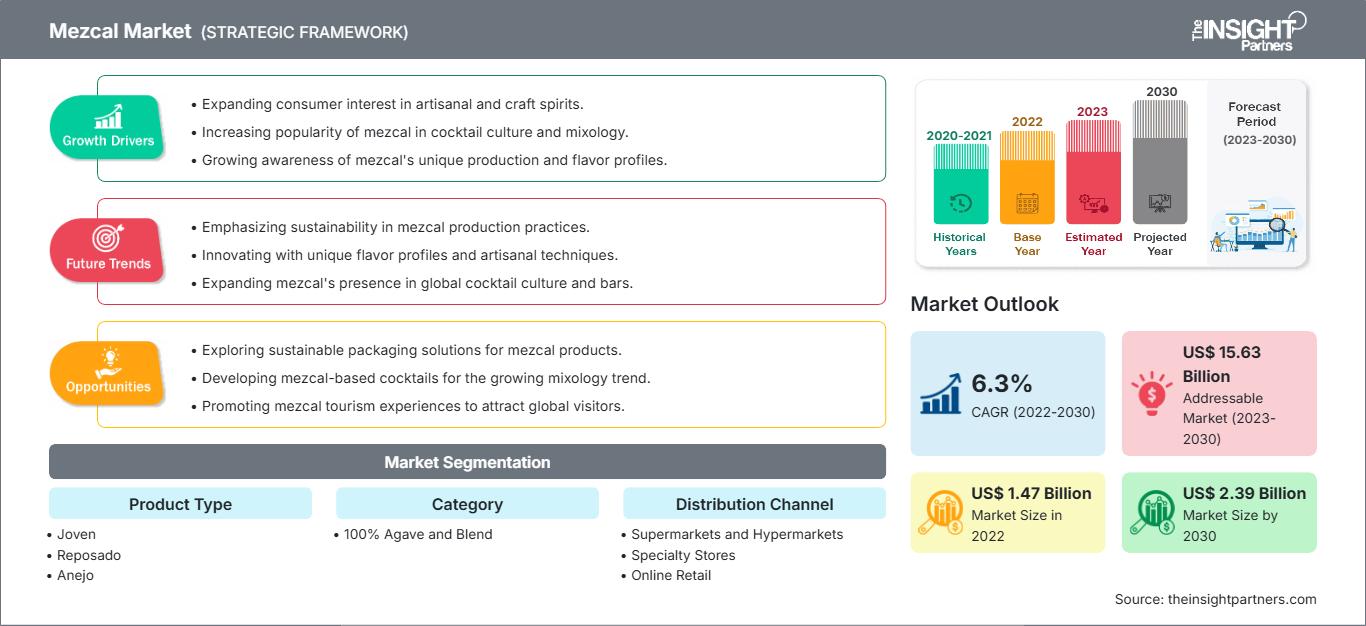

Mezcal Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Product Type (Joven, Reposado, Anejo, and Others), Category (100% Agave and Blend), and Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Retail, and Others)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Oct 2023

- Report Code : TIPRE00007716

- Category : Food and Beverages

- Status : Published

- Available Report Formats :

- No. of Pages : 153

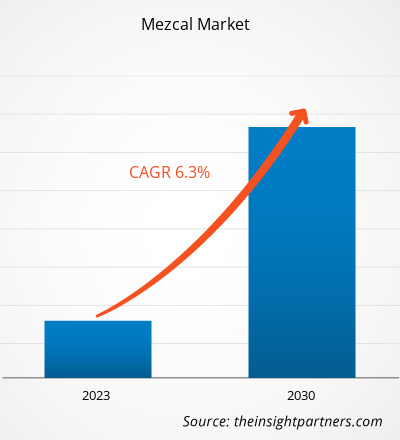

The mezcal market size was valued at US$ 1,469.17 million in 2022 and is expected to reach US$ 2,393.57 million by 2030; it is estimated to register a CAGR of 6.3% from 2022 to 2030.

Market Insights and Analyst View

Mezcal is a distinctive Mexican spirit made from agave plants, primarily in the Oaxaca region. Unlike tequila, which is a type of mezcal made exclusively from blue agave, mezcal can be produced from various agave species, giving it a broader range of flavors and aromas. The surge in demand for mezcal can be attributed to its artisanal production methods, unique smoky flavor, and the growing appreciation for craft spirits. Consumers are increasingly seeking authenticity and diversity in their drinking experiences, which has led to mezcal gaining popularity among adventurous spirits enthusiasts and mixologists alike. Its cultural heritage and traditional production techniques have also contributed to its appeal, making it a sought-after choice for those looking to explore the rich world of agave-based spirits.

Growth Drivers and Challenges

The rising demand for luxury and premium beverages has emerged as a driving force for the Mezcal. One significant catalyst for this trend is the increase in the disposable income of consumers. As people's earnings have grown, they are more inclined to allocate a portion of their budget to indulging in high-end spirits such as Mezcal. This has opened up opportunities for premium Mezcal brands to thrive as consumers seek distinctive, elevated drinking experiences. Additionally, the influence of millennials cannot be understated. This demographic cohort has shown a particular penchant for spending on high-end beverages, driven by a desire for quality, authenticity, and unique flavor profiles. Mezcal aligns perfectly with these preferences, offering a handcrafted and artisanal product that resonates with the millennial demographic, contributing significantly to the surge in demand.Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONMezcal Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

The evolution of consumer preferences plays a pivotal role in driving the mezcal market. Modern consumers increasingly seek unique and sophisticated spirits that go beyond ordinary mixes. With its intricate production process, smoky notes, and distinct flavors, Mezcal aligns well with this shift. It has become a symbol of refined taste and has gained a reputation as a premium beverage choice, attracting discerning consumers looking for a more elevated drinking experience. The burgeoning cocktail culture contributes to Mezcal's ascent in the luxury beverage market. Mixologists and bartenders have embraced Mezcal as a versatile and premium ingredient for crafting unique and innovative cocktails. Its smoky and complex flavors add depth and character to drinks, making it a sought-after choice in upscale bars and restaurants. This has heightened Mezcal's visibility and spurred consumer interest in recreating these upscale cocktail experiences at home, further driving demand.

Effective marketing strategies and distinctive packaging have amplified the perception of Mezcal as a luxury product. Premium Mezcal brands have invested in sophisticated branding highlighting the product's artisanal origins, emphasizing its exclusivity. This marketing approach has attracted consumers looking for status symbols and unique gifting options, bolstering the demand for Mezcal in the luxury spirits market. Moreover, the rising global interest in authentic, craft, and heritage products has worked in Mezcal’s favor. Consumers—particularly millennials and Gen Z—are placing higher value on traceability, artisanal craftsmanship, and sustainability in their purchase decisions. Mezcal's small-batch production, deep-rooted cultural heritage, and ties to local agave-farming communities position it as a spirit that resonates with ethically-minded consumers. As a result, it not only serves as a premium beverage but also represents a lifestyle choice centered around cultural appreciation and conscious consumption.

The growing presence of Mezcal in international markets, supported by expanding distribution channels and increasing participation in global spirits exhibitions and competitions, continues to elevate brand recognition and reinforce its premium image. Thus, a dynamic shift in consumer preferences serves as a pivotal growth catalyst for the Mezcal market.

However, there are strict regulations that govern Mezcal production, labeling, and certification in Mexico. The Denomination of Origin for Mezcal, which protects Mezcal's geographical origin and traditional production methods, imposes a set of rules that can be burdensome for producers. For instance, to be labeled as "Mezcal," the spirit must be made from specific varieties of agave plants, primarily found in some areas of Mexico, and produced using traditional methods. The traditional method includes cooking in earthen pits or clay ovens, milling by hand, fermentation in stone or organic pits, and distillation with direct fire under copper or clay pots. Meeting these requirements can be costly or time-consuming, limiting the ability of smaller producers to enter the market and compete effectively.

Another regulatory challenge relates to certification and labeling. Producers must adhere to rigorous quality standards and undergo certification processes to carry the official "Mezcal" label. This can be a barrier for smaller, local producers who may not have the resources to navigate these bureaucratic procedures or invest in the necessary equipment and facilities. Furthermore, strict rules about labeling and advertising include specifying the type of agave used, the region of production, and the distillation process. Any deviations from these rules can lead to legal issues, making it essential for producers to comply meticulously. These regulatory constraints can restrict market entry, hinder innovation, and create compliance costs, particularly for small Mezcal producers.

Report Segmentation and Scope

The global mezcal market is segmented on the basis of product type, category, distribution channel, and geography. Based on product type, the market is categorized into joven, reposado, anejo, and others. By category, the market is bifurcated into 100% agave and blend. By distribution channel, the market is categorized into supermarkets and hypermarkets, specialty stores, online retail, and others. By geography, the global mezcal market is broadly segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America.

Segmental Analysis

Based on product type, the market is categorized into joven, reposado, anejo, and others. The reposado segment is expected to register the highest CAGR during 2022–2030. Reposado, which translates to "rested" in Spanish, represents a middle ground between the youthful boldness of joven and the aged complexity of anejo mezcal. It undergoes a relatively short aging process of two months to one year in oak barrels. This aging imparts a mellower character to the spirit, smoothing out some of the agave's sharper edges. While retaining the core agave flavors, reposado mezcal develops additional nuances, such as hints of vanilla, caramel, and wood. Its surging demand is due to its ability to balance the unaged vibrancy of joven and the refined complexity of anejo, making it a preferred choice for those seeking a smoother and more approachable mezcal experience.

Regional Analysis

The mezcal market is segmented into five key regions: North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. North America dominated the global mezcal market, and the regional market accounted for US$ 612.20 million in 2022. Europe is a second major contributor, holding more than 29% share of the global market. Asia Pacific is expected to register a considerable CAGR of over 7% during 2022–2030. Mezcal is gaining popularity among consumers in Asian countries such as China, India, Japan, and Australia. This consumer shift toward mezcal is mainly attributed to rising health concerns. The rising preference for luxurious alcoholic beverages has increased the demand for mezcal, which is anticipated to propel the market growth in APAC.Mezcal

Mezcal Market Regional InsightsThe regional trends influencing the Mezcal Market have been analyzed across key geographies.

Mezcal Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1.47 Billion |

| Market Size by 2030 | US$ 2.39 Billion |

| Global CAGR (2022 - 2030) | 6.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Mezcal Market Players Density: Understanding Its Impact on Business Dynamics

The Mezcal Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

COVID-19 Pandemic Impact

The COVID-19 pandemic initially hindered the global mezcal market due to the shutdown of manufacturing units, shortage of labor, disruption of supply chains, and financial instability. The disruption of various industries due to the economic slowdown caused by the COVID-19 outbreak restrained the mezcal supply. Various liquor stores were closed. However, businesses started gaining ground as previously imposed limitations were eased across various countries. Moreover, the introduction of COVID-19 vaccines by governments of different countries eased the situation, leading to a rise in business activities worldwide. Several markets, including the mezcal market, reported growth after the ease of lockdowns and movement restrictions.

Competitive Landscape and Key Companies

Casa Agave Ltd, Quiquiriqui Mezcal Ltd, Davide Campari Milano NV, Gente de Mezcal SA de CV, Bacardi-Martini BV, Diageo Plc, Pernod Ricard SA, Meanwhile Drinks Ltd, Proximo Spirits Inc, and Madre Mezcal Inc are among the prominent players operating in the global mezcal market.

Frequently Asked Questions

Another avenue of innovation involves the aging process. Mezcal aging can occur in various containers, such as oak barrels, glass, or clay pots. Producers experiment with different aging periods and container types to impart unique flavors and aromas. For instance, extended aging in oak barrels can introduce hints of vanilla and caramel, enhancing the complexity of the final product. This approach mirrors the techniques often seen in the whiskey and wine industries, offering a bridge for consumers transitioning from those spirits to Mezcal.

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For