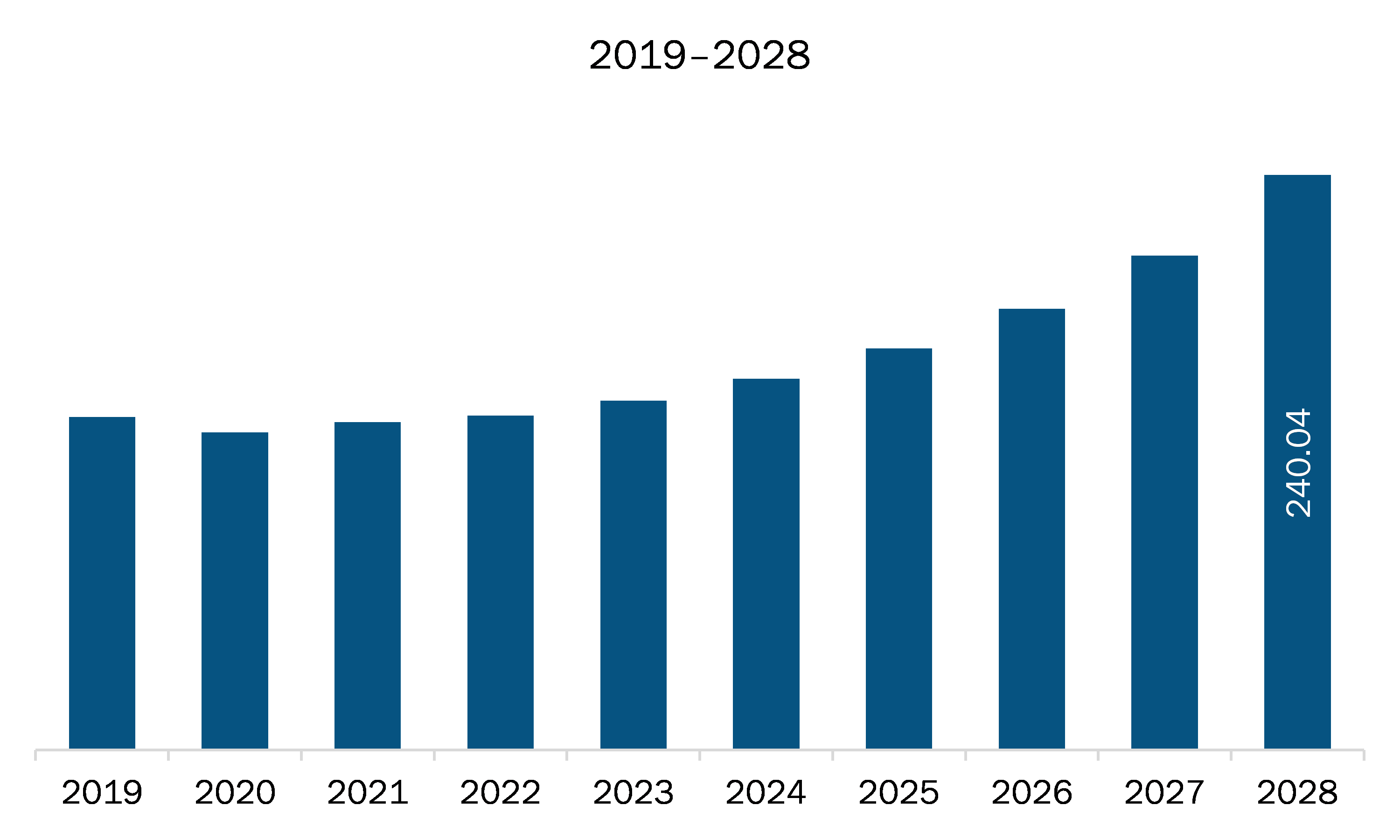

The recovered carbon black market in MEA is expected to grow from US$ 136.88 million in 2021 to US$ 240.04 million by 2028; it is estimated to grow at a CAGR of 8.4% from 2021 to 2028.

Saudi Arabia, South Africa, and UAE are economies in MEA. Waste tires are becoming a major environmental, economic, and technical challenge due to their high content of combustible components and potential to offer valuable materials as well as energy resources. In recent years, a variety of waste tire management methods have been adopted and applied around the world, including other important alternative methods for end of life tire management defined in 3R: reduction, reuse, and recycling to minimize damage, which is a serious threat to the natural environment and the humans. The European Union collects ~3.4 million tons of used tires every year. The tire industry is the largest consumer of virgin carbon black in the EU as it consumes ~1.8 million tons of the same annually, accounting for ~73% of total demand. The production of 1 ton of carbon black requires 1.5–2.0 tons of oil and releases ~2.5–3 tons of CO2. In addition to petroleum, natural gas, and steel, recycled carbon black is used as a key material in the production of tires, conveyor belts, and rubber parts; it is also being used in the production of paints in some cases. By reusing tires, it is possible to reduce CO2 emissions, thereby aiding in waste tire management. Thus, emphasis on waste tire management is giving rise to several key trends that are bound to impact the recovered carbon black market growth in the coming years.

In the MEA region, the worst affected countries are Turkey, South Africa, Iraq, and Israel with a high number of COVID-19 confirmed cases and deaths. According to International Finance Corporation, the COVID-19 pandemic has a severe impact upon the economy of the Middle East and Africa, which has led to a decline in oil production, tourism, and remittances. The confinement measures implemented for sanitary purposes in the region have led to a standstill of several activity across diverse economic sectors. The MEA region comprises of many growing economies, which are prospective markets for recovered carbon black vendors. The pandemic has significantly slowed down the growth of recovered carbon black market in the region.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the recovered carbon black market. The MEA recovered carbon black market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

MEA Recovered Carbon Black Market Segmentation

MEA Recovered Carbon Black Market – By Application

- Tire

- Non-Tire Rubber

- Plastics

- Others

MEA Recovered Carbon Black Market- By Country

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

MEA Recovered Carbon Black Market-Companies Mentioned

- Bolder Industries

- ENRESTEC

- Pyrolyx AG

- SR2O Holdings, LLC

Middle East and Africa Recovered Carbon Black Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 136.88 Million |

| Market Size by 2028 | US$ 240.04 Million |

| CAGR (2021 - 2028) | 8.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Application

|

| Regions and Countries Covered |

Middle East and Africa

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For