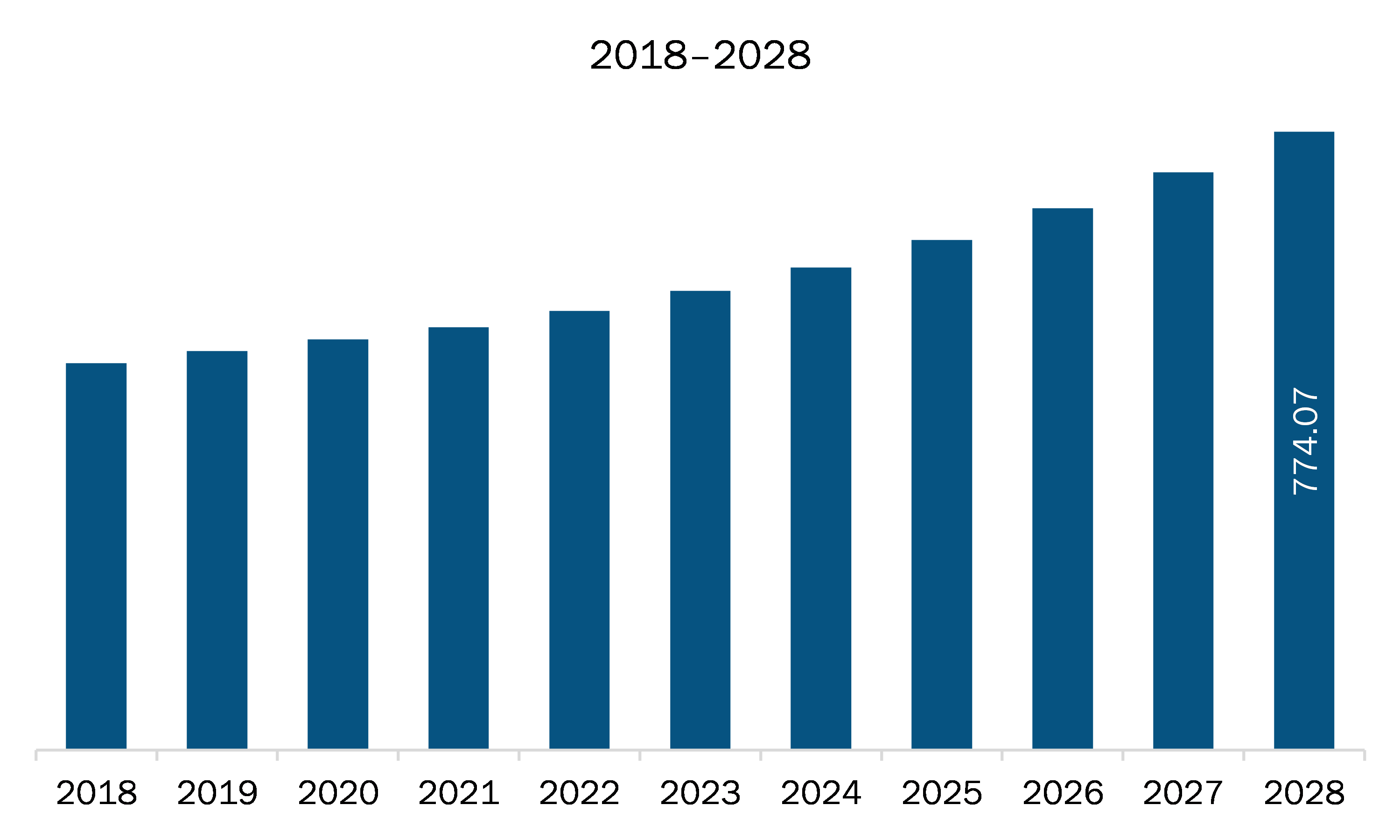

The MEA small caliber ammunition market is expected to grow from US$ 529.60 million in 2021 to US$ 774.07 million by 2028; it is estimated to grow at a CAGR of 5.6% from 2021 to 2028.

The UAE, South Africa, and Saudi Arabia are major economies in MEA region. Escalating adoption of new squad automatic rifle by military forces is expected to drive the MEA small caliber ammunition market. The military forces across MEA region are focusing on adopting revolutionary new bullet designs like the cased-telescoped offering increased lethality but also weight savings for overburdened infantry soldiers. In addition, rapid prototyping has led to the development of new automatic rifles that could replace existing M249. Further, armies across MEA region is planning to move to field a new squad automatic rifle. The new automatic rifle would fire a 6.8 mm round which the service and representatives from industry who are competing for the contract to build it are embracing. The 6.8mm caliber is developed to address the shortcomings of 5.6mm caliber. This is anticipated to fuel the growth of MEA small caliber ammunition market in the near future. Other factor such as mounting demand for small arms ammunition is also expected to escalate the MEA small caliber ammunition market.

In case of COVID-19, MEA is highly affected especially South Africa. The MEA small caliber ammunition market is majorly affected by the disruption in the supply chain. Pertaining to the closure of borders of countries, the supply chain of several small caliber ammunition has been disturbed. The demand for advanced military equipment and products, including rifles and pistols, for strengthening the military troops have weakened during the initial months of COVID-19 virus outbreak. This led the ammunition manufacturers to experience disturbed supply chain of raw materials. This has resulted in a loss of business among the local and international small caliber ammunition manufacturers. Further, several international defense forces rely on sourcing small caliber ammunition from the Israeli, Turkish, and South African manufacturers, however, due to disruption in supply chain and international trades during early days of COVID outbreak, the small caliber ammunition manufacturers faced substantial challenges to generate revenues. This factor has been analyzed to understand and depict the impact of COVID-19 on MEA small caliber ammunition market.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the MEA small caliber ammunition market. The MEA small caliber ammunition market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

MEA Small Caliber Ammunition Market Segmentation

MEA Small Caliber Ammunition Market – By Ammunition Size

- 5.56mm

- 7.62mm

- 9mm

- 12.7mm

- 14.5mm

- 45ACP

- .338mm

- .22LR

- 223 REM

- .308 Winchester

MEA Small Caliber Ammunition Market – By End User

- Military

- Homeland Security

- Law Enforcement Agencies

MEA Small Caliber Ammunition Market – By Gun Type

- Pistols

- Rifles

- Shot Guns

MEA Small Caliber Ammunition Market, by Country

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

MEA Small Caliber Ammunition Market -Companies Mentioned

- BAE Systems Plc

- CBC Global Ammunition

- Denel PMP

- Elbit Systems Ltd.

- FN HERSTAL

- NAMMO AS

- Northrop Grumman Corporation

Middle East & Africa Small Caliber Ammunition Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 529.60 Million |

| Market Size by 2028 | US$ 774.07 Million |

| CAGR (2021 - 2028) | 5.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Ammunition Size

|

| Regions and Countries Covered |

Middle East and Africa

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For