Molded Foam Market Growth and Analysis by 2030

Molded Foam Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Closed Cell Foam, High Resilience Foam, Integral Skins Foam, Memory Foam, and Others), Form (Rigid Foam and Flexible Foam), Material (Expanded Polystyrene, Polyurethane Foam, Expanded Polyethylene, Expanded Polypropylene, and Others), and Application (Seating and Furniture, Automotive Interior, Bedding and Mattresses, Footwear, and Others)

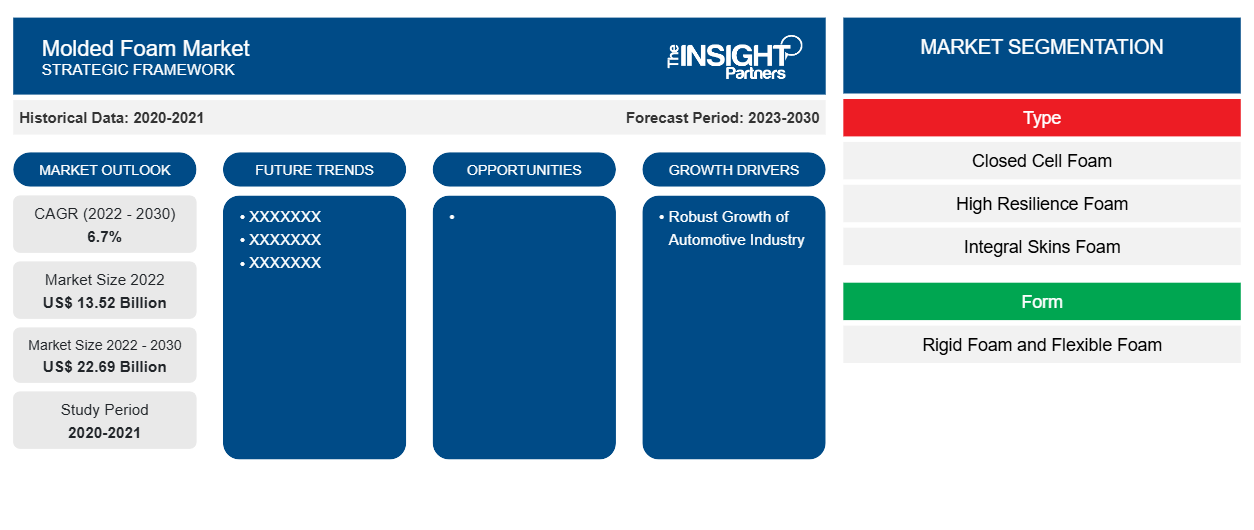

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Sep 2023

- Report Code : TIPRE00030049

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 224

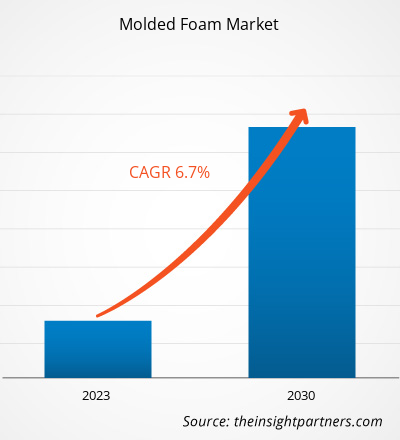

[Research Report] The molded foam market size is expected to grow from US$ 13,524.21 million in 2022 to US$ 22,689.54 million by 2030; it is estimated to register a CAGR of 6.7% from 2022 to 2030.

Market Insights and Analyst View:

The global molded foam market encompasses the production and utilization of foam-based materials such as expanded polystyrene (EPS), polyurethane foam (PU), expanded polyethylene (EPE), etc. across a diverse range of industries. These versatile materials are molded into various shapes and sizes to serve multiple purposes, including protective packaging for fragile items, insulation in construction, manufacturing automotive components, and making comfortable seating and padding in furniture. Over the years, the global molded foam market has reported steady growth due to factors such as the rising demand for lightweight and energy-efficient materials, growing automotive and construction sectors, and increasing emphasis on sustainability. Manufacturers focus on eco-friendly foam production and explore recycling options to align with environmental concerns. Furthermore, advancements in technology and research have led to the development of sophisticated and efficient molded foams, which fuels the molded foam market expansion. This factor is significantly driving the global molded foam market growth.

Growth Drivers and Challenges:

The automotive industry is growing in various countries across the world due to factors such as transition toward electric vehicles, economic growth, increasing population, government support for automotive production, and rising investments in the industry. As per the International Organization of Motor Vehicle Manufacturers, the global sales of passenger cars increased from 53.92 million in 2020 to 57.49 million in 2022. Furthermore, consumers are increasingly enhancing indoor and outdoor spaces and preferring different furniture products. Therefore, there is a high demand for advanced furniture products with appealing designs suitable for gardens, balconies, and outside porches. Also, demand for modular sofas is rising due to their functionality. Old residential building renovation projects and new construction activities have bolstered the demand for furniture products such as tables, chairs, and combination sets. However, the increasing use of plastics has led to extensive plastic waste quantities. A very small percentage of plastic waste is recycled, and the rest goes to landfills or incineration processes. The waste results in deteriorating soil and underground water bodies and causes global warming. Molded foams are made from materials such as expanded polystyrene, polyurethane, expanded polyethylene, expanded polypropylene, and other materials. The adverse effects of plastic use on the environment hinder the demand for molded foam.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONMolded Foam Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “Global Molded Foam Market” is segmented on the basis of type, form, material, and application. Based on type, the molded foam market is segmented into closed cell foam, high resilience foam, integral skins foam, memory foam, and others. Based on form, the molded foam market is bifurcated into rigid foam and flexible foam. Based on material, the molded foam market is segmented into expanded polystyrene, polyurethane foam, expanded polyethylene, expanded polypropylene, and others. Based on application, the molded foam market is segmented into seating and furniture, automotive interior, bedding and mattresses, footwear, and others. Geographically, the market is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

Based on type, the molded foam market is segmented into closed cell foam, high resilience foam, integral skins foam, memory foam, and others. The closed cell foam segment held the largest market share in 2022. Closed-cell foam is a versatile material used in various industries due to its unique properties. It consists of tiny, sealed air bubbles within its structure that create a closed cell structure. Closed cell foam is non-water-resistant, floatable, and has excellent tensile strength. Based on form, the molded foam market is segmented into rigid foam and flexible foam. The flexible foam segment held a larger market share in 2022. Flexible foam provides a plush and cushioned feel, making it a popular choice for upholstered furniture, seating cushions, and bedding products such as pillows and mattress toppers. In addition, flexible foam offers excellent shock absorption and impact resistance. This property is valuable in applications where safety and protection are essential, such as automotive seating and helmet liners. Based on material, the molded foam market is segmented into expanded polystyrene, polyurethane foam, expanded polyethylene, expanded polypropylene, and others. The molded foam market share of the polyurethane foam segment was notable in 2022. Polyurethane is a closed-cell foam commonly used for molded foam products due to its versatility, durability, and cost-effectiveness. Polyurethane foam is available in various densities, allowing customization to meet specific comfort and support requirements. This makes it ideal for applications such as mattresses, upholstery, seating cushions, and pillows, where user comfort is a priority. Based on application, the molded foam market is segmented into seating and furniture, automotive interior, bedding and mattresses, footwear, and others. The molded foam market share of the bedding and mattresses segment was notable in 2022. Molded foam plays a crucial role in bedding and mattresses, enhancing comfort, support, and overall sleep quality. Molded foam mattresses offer excellent support and pressure relief as they contour the body's shape. This ensures that users experience comfortable and restful sleep by minimizing pressure points and promoting proper spinal alignment.

Regional Analysis:

The molded foam market is segmented into five key regions—North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. Asia Pacific dominated the global molded foam market, and the regional market accounted for ∼US$ 5,000 million in 2022. North America is also a major contributor, holding a significant global molded foam market share. The North America market is expected to reach over US$ 6,000 million by 2030. Europe is expected to register a considerable CAGR of around 7% from 2022 to 2030. The Asia Pacific molded foam market, by country, is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. The market is driven by growing demand for molded foam by the automotives, furniture, and packaging industries. China dominates the regional market, followed by countries such as Japan, India, Vietnam, and South Korea. Commercial places and residential units are among the major end users of molded foam in these countries. The burgeoning furniture industry is poised to catalyze the molded foam market growth in Asia Pacific. The quest for comfort and aesthetics is paramount in the modern furniture landscape. Consumers are increasingly looking for furniture that enhances the visual appeal of their living spaces and offers unparalleled comfort.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the molded foam market are listed below:

- In August 2022, the Carpenter Co opened a new showroom in Las Vegas. The showroom provides various products, including polyester products, pet beds, carpet cushions, direct-to-consumer programs, and decorative pillows.

- In July 2021, the Vita Group acquired Technical Foam Services (TFS). TFS brought enhanced technical foam conversion capacity and capability to The Vita Group.

Molded Foam

Molded Foam Market Regional InsightsThe regional trends and factors influencing the Molded Foam Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Molded Foam Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Molded Foam Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 13.52 Billion |

| Market Size by 2030 | US$ 22.69 Billion |

| Global CAGR (2022 - 2030) | 6.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Molded Foam Market Players Density: Understanding Its Impact on Business Dynamics

The Molded Foam Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

COVID-19 Pandemic Impact:

The COVID-19 pandemic adversely affected almost all industries in various countries. Lockdowns, business shutdowns, and travel restrictions in North America, Europe, Asia Pacific (APAC), South & Central America (SAM), and the Middle East & Africa (MEA) hampered the growth of several industries, including the chemicals & materials industry. The shutdown of manufacturing units disturbed global supply chains, manufacturing activities, delivery schedules, and essential and nonessential product sales. Various companies reported delays in product deliveries and a slump in their product sales in 2020. Due to the pandemic-induced economic recession, consumers became cautious and selective in purchasing decisions. Consumers significantly reduced nonessential purchases due to lower incomes and uncertain earning prospects, especially in developing regions. Many molded foam manufacturers reported declining profits due to reduced consumer demand during the initial phase of the pandemic. However, by the end of 2021, many countries were fully vaccinated, and governments announced relaxation in certain regulations, including lockdowns and travel bans. There has been increase in disposable income within the population, due to which the focus on purchasing new furnitures and renovation has increased, which increased the demand for molded foam. All these factors positively impacted the growth of the molded foam market across different regions.

Competitive Landscape and Key Companies:

Superlon Baltic UAB, Carpenter Co, Intex Technologies LLC, Sheela Foam Ltd, Vita (Holdings) Ltd, Sinomax Group Ltd, International Industries LLC, Pomona Quality Foam LLC, Woodbridge Foam Corp, and CT Formpolster GmbH are among the prominent players operating in the global molded foam market. These players offer high-quality molded foam and cater to many consumers across the world.

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For