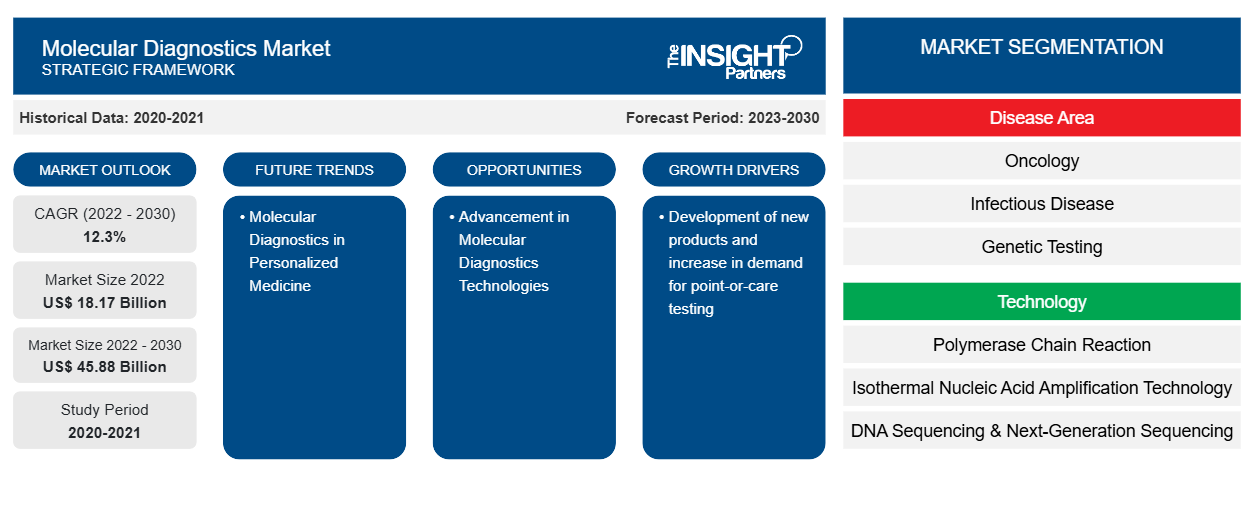

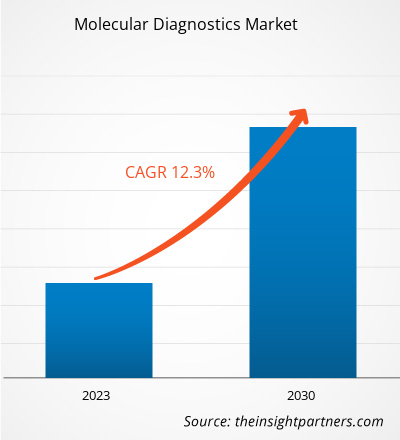

[Research Report] The molecular diagnostics market was valued at US$ 18,173.87 million in 2022 and the molecular diagnostics market size is projected to reach US$ 45,875.65 million by 2030. It is expected to register a CAGR of 12.3% during the forecast period.

Market Insights and Analyst View:

Molecular diagnostics procedures can be employed in the detection of a wide range of conditions such as oncologic diseases, infectious diseases, cardiac diseases, and immune system disorders; they can also be used in genetic testing using genetic material such as DNA and RNA for the diagnosis of different diseases. Development of new products and increase in demand for point-of-care testing and surging prevalence of associated diseases. However, limitations associated with molecular testing hinders the growth of the molecular diagnostics market.

Growth Drivers and Opportunities:

Development of New Products and Increase in Demand for Point-of-Care Testing

Leading medical device manufacturers and other businesses operational in associated markets are actively involved in product innovation and development processes. A few of such important developments in the molecular diagnostics market are mentioned below.

Month & Year | Description |

July 2021 | Abbott launched its Panbio COVID-19 rapid antigen tests in India. |

July 2021 | Siemens Healthineers commenced the manufacturing of IMDX SARS-CoV2 and other molecular diagnostic kits in its Vadodara (India) facility. |

July 2021 | Bio-Rad Laboratories, Inc. launched Reliance SARS-CoV-2/FluA/FluB RT-PCR Kit for in vitro diagnosis. The kit contains standard and negative molecular controls, along with assay reagents. It is validated to run on Bio-Rad's CFX96 Dx real-time PCR system, in addition to other real-time PCR systems of other manufacturers. |

September 2021 | Chembio Diagnostics, Inc. submitted the Emergency Use Authorization (EUA) application to the Food and Drug Administration (FDA) for its DPP Respiratory Antigen Panel Test System. It is designed to facilitate the simultaneous, discrete, and differential detection of influenza A, influenza B, and SARS-CoV-2 antigens, among others, from a single patient's nasal swab sample. |

September 2021 | Agilent Technologies Inc. signed a worldwide distribution agreement with Visiopharm, which enables Agilent to co-market Visiopharm’s portfolio of CE-IVD marked artificial intelligence (AI)-driven precision pathology software in addition to its own portfolio of automated pathology staining solutions. |

October 2021 | Siemens Healthineers launched the CLINITEST Rapid COVID-19 Test, a rapid antigen test that produces results within 15 minutes. |

December 2020 | Thermo Fisher Scientific acquired Phitonex, Inc., a company based in Durham (North Carolina) that has pioneered a spectral dye platform for high-resolution biology applications designed to accelerate research and development in cell therapy, immuno-oncology, and immunology. Phitonex's product offering would enable Thermo Fisher to offer better flow cytometry and imaging multiplexing capabilities to meet evolving customer needs in protein and cell analysis research. |

Source: The Partners Analysis

Point-of-care testingv is a branch of medicine with a rapidly evolving analytical scope and clinical application. Point-of-care testing solution providers offer products for various evaluations, ranging from blood glucose measurement to viscoelastic coagulation assays. Eliminating the time of transportation and preparation of clinical samples, these tests enable professionals to make clinical decisions about additional testing or therapy in less time. This emerging healthcare solution is being aggressively adopted by patients and healthcare service providers. Point-of-care assays are extensively used in therapeutics, diagnostics, and patient monitoring applications, among others. Moreover, point-of-care products and services help healthcare providers in meeting patients’ demand for at-home medical care. These products and services proved specifically helpful during the COVID-19 pandemic by allowing patients to take tests from their homes instead of traveling to diagnostic or treatment facilities, thereby lowering the risk of infection. Thus, the rising demand for point-of-care testing benefits the molecular diagnostics market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Molecular Diagnostics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Molecular Diagnostics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Advancements in Molecular Diagnostics Technologies

Molecular diagnostic techniques and platforms are being used in all areas of anatomic and clinical pathologies. DNA or RNA sequences that are associated with disease, including single nucleotide polymorphism, deletions, rearrangements, and insertions, can be detected in molecular diagnostic tests. Molecular diagnosis has undergone further improvements after the emergence of COVID-19. Conventionally, CT scans, hematological tests, and RT-PCR were in use for testing. As COVID-19 cases grew rapidly in 2020, the need for rapid, precise testing platforms surged to overcome the disadvantages of conventional testing. Computed tomography (CT), a cost-intensive procedure that may not be available in all hospitals, fails to detect viral infections and other diseases in asymptomatic patients. RT-PCR, which was widely used, was also time-consuming and expensive, and was unable to detect a low viral load during the early stages of infection. Consequently, researchers developed novel approaches to detect SARS-CoV-2, which were faster and more cost effective. Reverse transcription loop-mediated isothermal amplification (RT-LAMP), microarray-based detection, aptamer-based diagnosis, SHERLOCK, SHERLOCKv2, FET Biosensors, cell-based potentiometric diagnosis, and molecular imprinting technology are a few of the examples of novel molecular diagnostics techniques developed for COVID-19 diagnosis. In the last few years, FDA reports have indicated that advancements in molecular testing, antigen-dependent testing, and serological testing have been approved. Collaborative efforts by scientific communities in different countries to manage the COVID-19 pandemic and reduce the extent of mortality have benefited the overall molecular tools and diagnosis landscape, which is likely to create significant opportunities for the molecular diagnostics market in the future.

Report Segmentation and Scope:

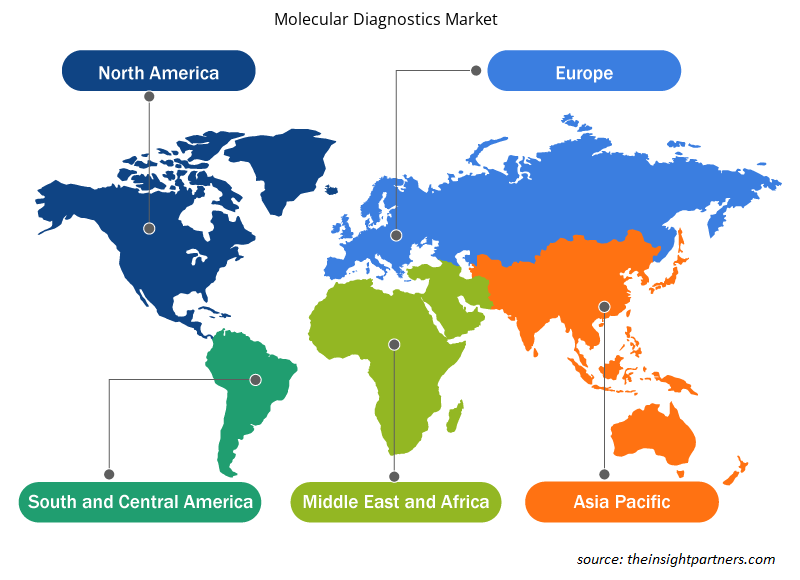

The “Global Molecular Diagnostics Market” is segmented into disease area, technology, product and services, end user, and geography. Based on disease area, the molecular diagnostics market is segmented into oncology, infectious disease, genetic testing, cardiac diseases, immune system disorders, and others. Based on technology, the molecular diagnostics market is segmented into polymerase chain reaction, isothermal nucleic acid amplification technology, DNA sequencing & Next-Generation sequencing, DNA microarrays, in-situ hybridization, and others. Based on product & services, the molecular diagnostics market is segmented into assays & kits, instruments, and services & software. Based on end user, the molecular diagnostics market is segmented into hospitals & clinics, diagnostic laboratories, research & academic institutions, and others. Geographically, the molecular diagnostics market is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Segmental Analysis:

Based on technology, the molecular diagnostics market is segmented into polymerase chain reaction, isothermal nucleic acid amplification technology, DNA sequencing & Next-Generation sequencing, DNA microarrays, in-situ hybridization, and others. The PCR is further sub segmented into RT-PCR, qPCR, Multiplex PCR, and others. The PCR segment held the largest share of the market in 2022, and the same segment is anticipated to register the highest CAGR of 12.7% in the market during the forecast period. PCR is mainly used to make or amplify DNA by copying the nucleic acid strands. Thermal cyclers are employed to denature and anneal DNA strands during amplification, along with reagents such as enzymes, nucleotides, and buffers to build the novel DNA. This technique is widely used in various application such as functional analysis of genes, diagnosis of hereditary, DNA cloning, paternity testing, detection of infectious diseases, and forensic sciences. Polymerase chain reaction has been classified into traditional PCR, real-time PCR, and digital PCR. However, ongoing technological advances and surging demand amid the pandemic will continue to fuel the need for PCR tests in India as well as other Asia Pacific countries. Consistent prevalence of diseases like tuberculosis, Hepatitis, flu, and serious infections will foster PoC molecular diagnostic industry trends. Presently, the outbreak of novel COVID-19 pandemic would create lucrative growth aspects for the market as this approach is highly critical to detect virus in individuals who exhibit no symptoms of signs of disease. PCR’s exquisite sensitivity, relative simplicity, and cost-effectiveness makes PCR stand apart from other nucleic acid amplification techniques, cementing it as a mainstay in molecular laboratories.PCRPCRPCR has become an indispensable tool for various clinical and diagnostic applications or examinations due to continuous research & development on PCR technologies. Therefore, it offers many opportunities for rapid point-of-care diagnostics for various infectious diseases. For instance, F. Hoffmann-La Roche Ltd is continuously working on the advancements of Digital PCR (dPCR) techniques. dPCR has extended its applications to the clinical field and has emerged as an important clinical tool. dPCR offers ultrasensitive and absolute nucleic acid quantification without reference standard. Thus, it offers a broader aspect for standardizing and comparing results between laboratories.During pandemic outbreak, one of the first mover startup, Mylab PathoDetect COVID-19 Qualitative PCR kit was among the first in the country to receive commercial approval from the Central Drugs Standard Control Organisation (CDSCO) last year. Following the approval, Mylab had partnered with biotech giant Serum Institute of India and local firm AP Globale. PCR is further sub-segmented into RT-PCR, qPCR, multiplex PCR and others.

Based on disease area, the molecular diagnostics market is segmented into oncology, infectious disease, genetic testing, cardiac diseases, immune system disorders, and others. The infectious disease segment held the largest market share in 2022. However, oncology segment is anticipated to register the highest CAGR of 12.6% during the forecast period. Oncology molecular diagnostics are tests that expose inherited material, proteins, associated molecules and assess metabolic functions, drug metabolism, and disease induction grounded on DNA, RNA, and proteins that deliver oncological information. As stated by World Health Organization (WHO), cancer reckoned for roughly 10 million demises in 2020. Furthermore, as per the 2021 statistics by the American Cancer Society, by 2040, the global burden of carcinoma is anticipated to raise to 27.5 million fresh cases and 16.3 million cancer deceases. Such like high figures denote that the evaluated rising frequency of cancer is chipping into the accelerating requirement for primitive diagnosis and preventive cure. There are numerous methods to diagnose carcinoma comprehending PCR, INAAT, and NGS etc. Among all the conception of PCR (polymerase chain reaction) led to an enormous advancement in clinical DNA testing. PCR-based methodologies demand straightforward instrumentation and infrastructure, exploit only minute quantities of biological material and are extensively harmonious with clinical routine.

Although the cost of PCR is lofty, most accurate real-time PCR approach (with more than 99% accuracy) is the one substantially used in numerous developed countries including Korea, while developing countries substantially exploit the conventional PCR (more than 90% accuracy), which is affordable than real-time PCR. Because of the high prices of the other options, underdeveloped countries generally use Rapid PCR (60 – 70% accuracy). Within the field of oncology molecular diagnostics, NGS is another technology flaunting the loftiest rate of growth. Numerous companies are working intensely to make economic use of this technology. For instance, in April 2021, Illumina Inc. blazoned its partnership with Kartos Therapeutics to co-develop an NGS- Based TP53 Companion Diagnostic, which aided to reduce the costs associated with storing and managing of genomic data.

Based on product & services, the molecular diagnostics market is segmented into assays & kits, instruments, and services & software. The assays & kits segment held the largest share of the market in 2022, and it is anticipated to register the highest CAGR in the market during the forecast period. Molecular Diagnostics assays are among the widely used technique for analysis. Various types of assays such as rapid molecular assays, reverse transcription-polymerase chain reaction (RT-PCR), antigens, and others are used to identify and analyse various diseases such as influenza COVID 19, tuberculosis, and others. As part of product innovation and business strategies, the market players offer diagnostic kits for different test kits. The regional players are actively involved in business development related to the segment. For instance, In September 2021, Mylab Discovery Solutions acquired a majority stake in Sanskritech, developer of a platform Swayam a point of care testing system that can perform about 70 tests on the point. Moreover, in the COVID19 pandemic, various global market players offer their kits through their regional business divisions. Based on the above factors, the segment is expected to contribute remarkably during the forecast period.

Based on end user, the molecular diagnostics market is segmented into hospitals & clinics, diagnostic laboratories, research & academic institutions, and others. In 2022, the diagnostic laboratories segment held the largest share of the market. Moreover, the segment is also expected to witness growth in its demand at a fastest CAGR of 12.7% during 2022 to 2030, owing to the rise in the detection and diagnosis of various medical conditions across the regions. Diagnostic laboratories are the primary uses for molecular diagnostics products and services. It has well-established facilities as per the regulatory requirements. The laboratories use all possible molecular diagnostic products and services. The sample collected from the patients is analyzed and studied using different instruments, reagents, methods, and technologies. The labs provide services to hospitals, clinics, at-home care, and others. The increasing prevalence of chronic diseases, infectious diseases, outsourcing the molecular diagnostics activities by individual researchers are among the factors supporting the segment growth during the forecast period.

Regional Analysis:

Geographically, the molecular diagnostics market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. The North America regional market is expected to grow at a CAGR of 12.5% during the forecast period. The same region held the largest share in 2022 and is expected to continue a similar trend during the forecast period.

The increasing adoption of technologically advanced products, rise in research & development activities, presence of large healthcare businesses, and growing use of molecular diagnostics are among the key factors propelling the growth of the molecular diagnostics market in this region. The US held the largest share of the North America molecular diagnostics market in 2022.

The US holds the largest share of the molecular diagnostics market. Market growth in this country is primarily driven by the increasing prevalence of chronic kidney disorders (CKD), rising geriatric population, and a growing number of product launches by key players. Aging is a prominent risk factor responsible for renal diseases. According to a study published by the Population Reference Bureau in 2020, the population of individuals of age 65 years was 55 million in the US in 2020, which is expected to reach 95 million by 2060. Regulatory agencies in the US are devising favourable policies for the development of point-of-care (POC) products for the diagnosis and treatment of various indications. For instance, in March 2021, the US Food Drug Administration (FDA) authorized the first point of care testing of Chlamydia and Gonorrhea Test by the usage of Binx Health IO CT/NG Assay for point-of-care settings such as community-based clinics, urgent care settings, and outpatient healthcare facilities. In May 2022, BD (Becton and Dickinson), one of the leading global medical technology companies, announced the launch of its new, fully automated, high-throughput infectious disease molecular diagnostics platform in the US. The new BD COR MX instrument, with the 510(k) clearance from the FDA, is a new analytical instrument option for the BD COR platform. The BD CTGCTV2 molecular assay, the first test available on the new system, a single test that detects the three most prevalent non-viral sexually transmitted infections (STIs)—Chlamydia trachomatis (CT), Neisseria gonorrhoeae (GC), and Trichomonas vaginalis (TV).

The growth of the market in Asia Pacific is attributed to rising geriatric population, increasing cancer cases, growing technological advancements, and increasing number of startups, biotechnology, and biopharmaceutical companies are driving the molecular diagnostics market in this region. Moreover, the rise in research activities in the region and the presence of associations or organizations enhancing the quality of care in cancer contribute to the molecular diagnostics market growth.

Molecular Diagnostics Market Regional Insights

The regional trends and factors influencing the Molecular Diagnostics Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Molecular Diagnostics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Molecular Diagnostics Market

Molecular Diagnostics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 18.17 Billion |

| Market Size by 2030 | US$ 45.88 Billion |

| Global CAGR (2022 - 2030) | 12.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Disease Area

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Molecular Diagnostics Market Players Density: Understanding Its Impact on Business Dynamics

The Molecular Diagnostics Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Molecular Diagnostics Market are:

- Abbott Laboratories

- Agilent Technologies Inc.

- Thermo Fisher Scientific Inc

- F. Hoffman-La Roche Ltd.

- Qiagen NV

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Molecular Diagnostics Market top key players overview

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global molecular diagnostics market are listed below:

- In April 2023, QIAGEN launched QIAstat-Dx in Japan with respiratory panel for syndromic testing. Japan to become the latest of more than 100 countries where QIAstat-Dx is available for molecular testing in diagnosing over 20 respiratory diseases from one patient sample.

- In April 2023, Novartis Malaysia extended the Molecular Diagnosis Program for aBC patients with PIK3CA Gene. This will create the accessibility of PIK3CA testing, realizing the significant impact of early diagnosis and intervention on advanced breast cancer (aBC) patient’s quality of life.

- In January 2023, Agilent to Collaborate with Quest Diagnostics to Extend Access to the Agilent Resolution ctDx FIRST Liquid Biopsy Test. The agreement between Quest and Agilent will enable broad adoption for ctDx FIRST, a single-site premarket approved (ssPMA) test performed at the Resolution Bioscience CLIA laboratory in Washington.

- In February 2023, Siemens Healthineers announced a multi-year partnership with Unilabs. This partnership will improve the patient care and also installation of various instruments by Siemens.

COVID-19 Impact:

Before the COVID-19 pandemic, molecular diagnostics market was experiencing a steady increase in demand before the COVID-19 pandemic. Technological advancements, like a polymerase chain reaction (PCR), and others, the rising application of molecular diagnostics were growing before pandemic.

During pandemic, the spread of the pandemic coupled with uncertainty around economic recovery has affected the pharmaceutical industry in the region. This economic impact is expected to have negative effect on the investments in research and development. Some key players in the molecular diagnostics provided best postop operative care to their cancer patient while protecting health care professionals and other patients. Abbott has received Emergency Use Authorization (EUA) for a point-of-care test that can provide results in minutes. Thus, increased production by the companies has resulted in profits, and the outbreak of COVID-19 has shown a positive impact on market growth.

Competitive Landscape and Key Companies:

Some of the prominent players operating in the global molecular diagnostics market are Abbott Laboratories, Agilent Technologies Inc., Thermo Fisher Scientific Inc, F. Hoffman-La Roche Ltd., Qiagen NV, bioMerieux SA, Illumnia Inc., Danaher, Siemens Healthineers AG, Novartis AG, and TBG Diagnostics Limited. These companies focus on new product launches and geographical expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. They have a widespread global presence, which provides them to serve a large set of customers and subsequently increases their market share. The report offers trend analysis of the molecular diagnostics market emphasizing various parameters such as technological advancements, market dynamics, and competitive landscape analysis of leading market players across the globe.

Frequently Asked Questions

What are the driving factors for the molecular diagnostics market across the globe?

Development of new products and increase in demand for point-of-care testing and surging prevalence of associated diseases. are the key driving factors behind the market development.

Which type segment led molecular diagnostics market?

Based on disease area, the molecular diagnostics market is segmented into oncology, infectious disease, genetic testing, cardiac diseases, immune system disorders, and others. The infectious disease segment held the largest market share in 2022. However, oncology segment is anticipated to register the highest CAGR during the forecast period.

What is the regional market scenario of the molecular diagnostics market?

Global molecular diagnostics market is segmented by region into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. North America is likely to continue its dominance in the molecular diagnostics market during 2022–2030. The US holds the largest share of the market in North America and is expected to continue this trend during the forecast period.

What is meant by the molecular diagnostics market?

Molecular diagnostics procedures can be employed in the detection of a wide range of conditions such as oncologic diseases, infectious diseases, cardiac diseases, and immune system disorders; they can also be used in genetic testing using genetic material such as DNA and RNA for the diagnosis of different diseases.

Who are the key players in the molecular diagnostics market?

Companies operating in the market are Abbott Laboratories, Agilent Technologies Inc., Thermo Fisher Scientific Inc, F. Hoffman-La Roche Ltd., Qiagen NV, bioMerieux SA, Illumnia Inc., Danaher, Siemens Healthineers AG, Novartis AG, and TBG Diagnostics Limited.

Which technology segment held the largest revenue (US$ Mn) in the molecular diagnostics market?

Based on technology, the molecular diagnostics market is segmented into polymerase chain reaction, isothermal nucleic acid amplification technology, DNA sequencing & Next-Generation sequencing, DNA microarrays, in-situ hybridization, and others. The PCR is further sub segmented into RT-PCR, qPCR, Multiplex PCR, and others. The PCR segment held the largest share of the market in 2022, and the same segment is anticipated to register the highest CAGR during the forecast period.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Molecular Diagnostics Market

- Abbott Laboratories

- Agilent Technologies Inc.

- Thermo Fisher Scientific Inc

- F. Hoffman-La Roche Ltd.

- Qiagen NV

- bioMerieux SA

- Illumnia Inc.

- Danaher

- Siemens Healthineers AG

- Novartis AG

- TBG Diagnostics Limited

Get Free Sample For

Get Free Sample For