Molecular Spectroscopy Market Size and Competitive Analysis by 2030

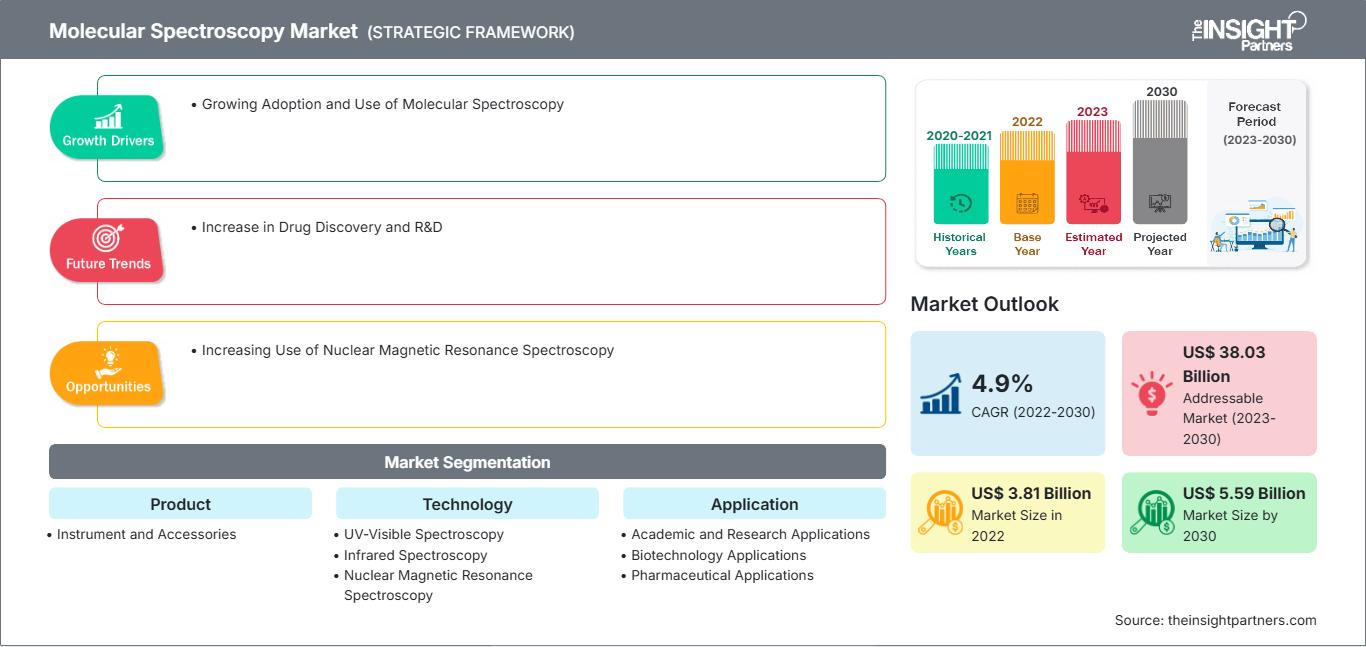

Molecular Spectroscopy Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis By Product (Instrument and Accessories), Technology (UV-Visible Spectroscopy, Infrared Spectroscopy, Nuclear Magnetic Resonance Spectroscopy, Raman Spectroscopy, Near-Infrared Spectroscopy, and Others), Application (Academic and Research Applications, Biotechnology Applications, Pharmaceutical Applications, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Feb 2024

- Report Code : TIPRE00003476

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 196

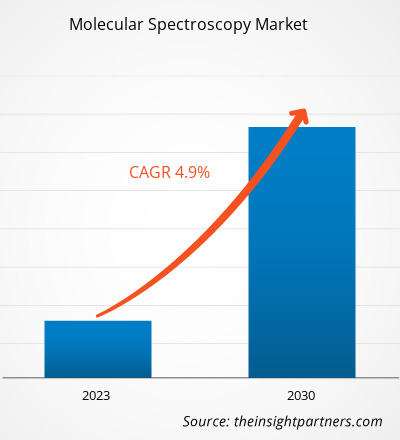

[Research Report] The molecular spectroscopy market is projected to grow from US$ 3,807.30 million in 2022 to US$ 5,586.37 million by 2030; the market is estimated to record a CAGR of 4.9% during 2022–2030.

Market Insights and Analyst View:

The molecular spectroscopy market forecast can help stakeholders in this marketplace plan their growth strategies.

Factors such as the growing adoption and use of molecular spectroscopy and the rapid growth of the pharmaceutical industry propel the molecular spectroscopy market growth. However, a shortage of technically skilled personnel and high maintenance and installation costs impede the growth of the market.

Growth Drivers:

Rapid Growth of Pharmaceutical Industry Drives Molecular Spectroscopy Market

The pharmaceutical industry has experienced growth at an unprecedented pace over the recent years and is slated to propel further in the upcoming years. The Pharmaceutical Research and Manufacturers Association (PhRMA) states that the US firms conduct over half the world’s R&D in pharmaceuticals (US$ 75 billion) and hold the highest number of patents in new medicines. Besides developed economies, rapid growth has been witnessed in the research environment in emerging economies such as Brazil, China, and India.

The growth of the pharmaceutical industry has also been crucial in increasing the demand for molecular spectroscopy. Molecular spectroscopy techniques, including infrared spectroscopy, UV-visible spectroscopy, and mass spectrometry, are among the most important tools for pharmaceutical research and development. The significant expansion of the pharmaceutical industry in recent years, primarily due to the COVID-19 outbreak, has positively impacted the molecular spectroscopy market size.

The main applications of molecular spectroscopy in the pharmaceutical industry are for analyzing molecular bond strengths, identifying individual bonds and specific atoms within a molecule, obtaining clues to the particular orientation of a molecule, and analyzing pharmacological purity. The need for molecular spectroscopy is increasing significantly as pharmaceutical companies expand their research and development activities related to drug discovery and development. For example, Raman spectroscopy is used to study structural activities and interactions to improve reaction conditions and formulation screening and identify constraints such as polymorph and scale medical compounds from discovery to development.

Thus, the factors mentioned above are increasing the demand for molecular spectroscopy for the large-scale production of various therapeutics, facilitating the molecular spectroscopy market share expansion.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONMolecular Spectroscopy Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “molecular spectroscopy market analysis” has been carried out by considering the following segments: product, technology, and application.

Segmental Analysis:

By technology, the molecular spectroscopy market is segmented into UV-visible, infrared, nuclear magnetic resonance, Raman, near-infrared, and others. The UV-visible spectroscopy segment held the largest market share in 2022. The nuclear magnetic resonance spectroscopy segment is anticipated to register the highest CAGR of 6.0% during the forecast period.

Ultraviolet-visible (UV-Vis) spectroscopy is a procedure that measures the number of separate wavelengths of UV or visible light that is absorbed by or transmitted through a sample compared to a reference or blank sample. UV-Vis spectroscopy is a widely used method in various areas of science, ranging from bacterial cultivation, drug identification, and nucleic acid purity testing and quantification to quality control in the beverage industry and chemical research.

Nuclear magnetic resonance (NMR) spectroscopy is an analytical chemistry procedure used for quality control and research to reveal a sample’s content, purity, and molecular structure. Besides molecular structure, NMR spectroscopy can determine phase changes, conformational and configuration changes, solubility, and diffusion potential. NMR spectroscopy has been widely used in the pharmaceutical industry for over a quarter of a century to determine the structure of chemical samples. Nowadays, NMR is increasingly being used to solve biological problems. The technologies used range from bioliquid NMR to in vivo NMR spectroscopy of perfused organs and whole animals to MRI of whole animals and humans.

The molecular spectroscopy market, by product, is divided into instruments and accessories. The instrument segment held a larger market share in 2022 and is anticipated to register a higher CAGR of 5.1% during the forecast period. Spectrometers can be divided into three main types based on operating principles: dispersive, filter-based, and Fourier transform instruments. Fourier transform spectrometers (FTS or FT spectrometers) have replaced dispersive instruments in many infrared and near-infrared applications over the past few decades. The interferometer is the heart of every Fourier transforms spectrometer. The current generation FT spectrometers use various interferometer designs.

The molecular spectroscopy market, by application, is categorized into academic and research applications, biotechnology applications, pharmaceutical applications, and others. The academic and research applications segment held the largest market share in 2022 and is anticipated to register the highest CAGR of 5.4% during the forecast period. Academic and research institutes are pivotal contributors to the molecular spectroscopy market, especially those working in biotechnology, cell culture, and regenerative medicine. These institutions serve as critical testing and validation centers, meticulously assessing the biocompatibility and scalability of various products.

Research and development organizations are engaged in the processes and activities to innovate, introduce new products and technologies, and provide services in the molecular spectroscopy market. Research and development is also important to accelerate product introductions. The growth of research and development organizations is majorly attributed to the increasing adoption of bioreactors for research and innovation processes. Additionally, the research institutes invest heavily to boost the bioprocesses, leading to market growth.

Emerging Trends in Drug Discovery to Accelerate Molecular Spectroscopy Market Expansion

The demand for and use of molecular spectroscopy increased significantly during the COVID-19 pandemic. In July 2022, Bruker PhenoRisk launched PACS RuO, a research-only NMR test for molecular phenonomic research on blood samples from “long COVID-19” patients. The PhenoRisk PACS RuO test holds promise for exploring early-stage risk factors, monitoring longitudinal recovery, and prospective secondary organ damage in cardiovascular disease, type II diabetes, inflammation, and renal dysfunction.

In addition, molecular spectroscopy plays a crucial role in drug discovery and development. Raman spectroscopy has proven to be one of the most powerful analytical techniques for drug discovery and pharmaceutical development. In September 2020, an American Chinese biotech company, Xtalpi, raised US$ 319 million in funding to further develop its intelligent digital drug discovery and development platform (ID4), which includes solid shape selection, predicting small molecule candidate properties, and other services. Thus, advancements in drug discovery will likely bring new molecular spectroscopy market trends in the coming years.

Regional Analysis:

Geographically, the global molecular spectroscopy market report is segmented into North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In 2022, North America held the largest molecular spectroscopy market share. The market growth in this region is driven by the increasing number of product launches by biotechnology and biopharmaceutical companies and the presence of key market players. In addition, extensive R&D by various pharmaceutical and biotechnology companies and academic & research institutes is expected to stimulate the North America molecular spectroscopy market growth.

The US is the largest contributor to the market in North America. It is mainly driven by the growing biopharmaceutical sector, characterized by technological advancements, and increasing flexibility. According to the International Trade Administration (ITA), the US is the global biopharmaceutical leader in R&D. Major developments in new biologics owing to the growing number of new molecular entities (NMEs) approved by regulatory authorities and several market players offering new products help in creating new market trends. According to Chemical & Engineering News, a growing number of NMEs are approved by the US Food and Drug Administration (FDA) every year. Furthermore, increasing R&D investments by US-based pharmaceutical and biotechnology companies to improve outcomes of clinical trials and ensure patient safety stimulate market growth.

In Canada, the presence of many pharmaceutical companies offering innovative products in the global market strengthens the growth of the molecular spectroscopy market. A few examples of such players operating in Canada are Amgen, Xenon Pharmaceuticals, Zymeworks, Gilead Sciences, Abbott, Alphora Research, Amgen, Apotex, Astellas, Merck, AbbVie, Bristol-Myers Squibb, Caprion Biosciences, Charles River Laboratories, GlaxoSmithKline, Pharma, AstraZeneca, Baxter, Bayer, and Cipher Pharmaceuticals.

The biopharmaceutical sector is vital in Canada’s health research and innovation ecosystem. Also, extensive R&D activities by pharmaceutical companies through partnerships trigger additional investments in small and medium-sized enterprises (SMEs) and venture funds. Also, the growing number of contract research organizations and contract manufacturing organizations (CROs and CMOs) serving Canadian and international clients increases the scope of the pharmaceutical sector in Canada, thus positively influencing market growth. In August 2021, the Canadian government announced an agreement with leading COVID-19 vaccine developer—Moderna, Inc.—to build an mRNA vaccine facility in Canada. The goals of the recently announced biomanufacturing and life science strategy were aligned with Moderna’s efforts to establish an mRNA vaccine manufacturing facility in Canada. The move will enhance Canada’s industrial capability and boost the biomanufacturing and life sciences industry.

Molecular Spectroscopy Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 3.81 Billion |

| Market Size by 2030 | US$ 5.59 Billion |

| Global CAGR (2022 - 2030) | 4.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Molecular Spectroscopy Market Players Density: Understanding Its Impact on Business Dynamics

The Molecular Spectroscopy Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Industry Developments and Future Opportunities:

A few strategic developments by leading players operating in the molecular spectroscopy market are listed below:

- In March 2023, NJ Biopharmaceuticals LLC and JEOL Ltd. announced their collaboration to bring innovative drug discovery platform solutions using JEOL’s 800 MHz NMR. NJ Bio contributed its expertise in antibody-drug conjugates, oligonucleotide conjugates, and other chemistries to develop platform solutions for its drug discovery clients—in particular, a platform for using NMR-derived structural information to optimize Targeted Protein Degraders (TPDs).

- In December 2023, NMR spectroscopy solutions for life and materials research were primarily provided by Bruker Corporation, which announced the successful installation of a 1.2 GHz NMR system at the Ohio State University’s National Gateway Ultrahigh Field NMR Center. Modern equipment that makes it possible to conduct high-resolution liquid and solid-state NMR studies is the 1.2 GHz AVANCE NMR spectrometer. Researchers at Ohio State and around the US will use it to investigate biological molecules’ structure and dynamics as well as cutting-edge materials, like those used in batteries, to better understand the underlying causes of illnesses such as cancer, heart disease, viral infections, and Alzheimer’s disease.

- In December 2023, Shimadzu Corp, a leading manufacturer of precision instruments, measuring instruments, and medical equipment, released the IRSpirit-X series of Fourier transform infrared (FTIR) spectrophotometers, including the IRSpirit-LX, IRSpirit-TX, and IRSpirit-ZX. The entry-level IRSpirit-LX and the IRSpirit-TX have the highest sensitivity for a small FTIR*3, and the IRSpirit-ZX has a capacity for stable measurements in high-temperature and high-humidity regions due to more moisture-resistant components.

- In December 2023, Shimadzu Corp launched the GCMS-QP2050 quadrupole gas chromatograph mass spectrometer. Gas chromatograph mass spectrometers (GC-MS) analyze the type and amount of chemicals in a sample by splitting it at the atomic and molecular levels. GC-MS systems are used to test pesticides and other controlled environmental contaminants, as well as for quality control and commercial development of food and chemical products.

Competitive Landscape and Key Companies:

Bruker Corporation, Jasco Corp, Shimadzu Corp, JEOL Ltd, Teledyne Princeton Instruments Inc, Agilent Technologies Inc, Oxford Instruments Plc, Ostec Instruments, Revvity Inc, Merck KGaA, Silios Technologies SA, Thermo Fisher Scientific Inc, and Horiba Ltd are among the prominent companies profiled in the molecular spectroscopy market report. These companies focus on developing new technologies, upgrading existing products, and expanding their geographic presence to meet the growing consumer demand worldwide.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For