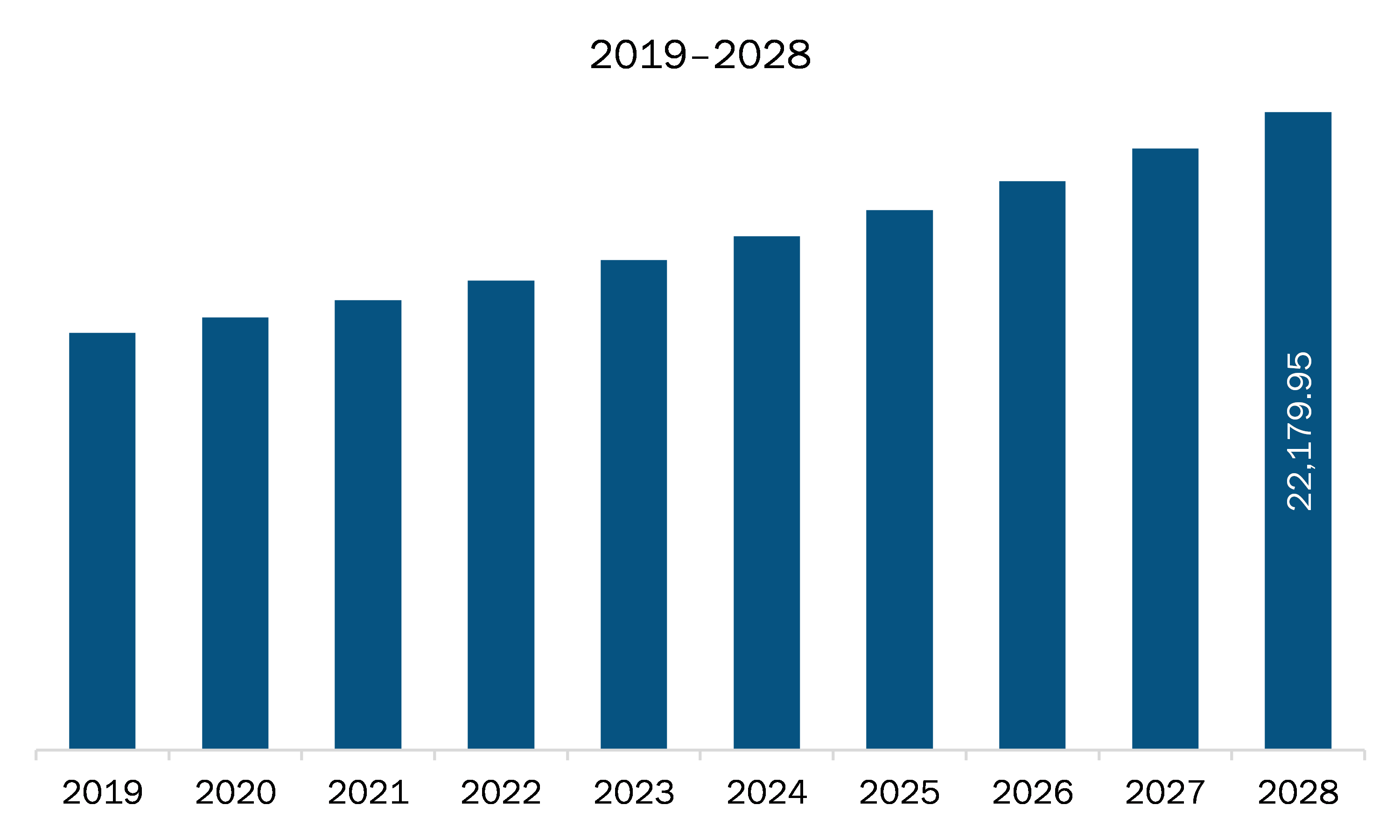

The North America adhesive tapes market is expected to grow from US$ 15,649.30 million in 2021 to US$ 22,179.95 million by 2028; it is estimated to grow at a CAGR of 5.1% from 2021 to 2028.

The US, Canada, and Mexico are economies in North America. Extensive range of applications of adhesive tapes is expected to fuel the market growth. Adhesive tapes are material and adhesive film combinations used to bond or join objects instead of using screws, fasteners, or welding. The tape can protect the surface by not requiring fasteners or screws to protect the surface, thereby making it useful for various applications such as packaging, healthcare, automotive, electrical and electronics, building and construction, and others adhesive tapes are ideal for automated product production. Liquid adhesives are messy and time-consuming because they must be sprayed or rolled on the surface before bonding. Adhesive tapes have major applications in industries, such as packaging, healthcare, automotive, electrical and electronics, and building and construction. The growth of the market is mainly attributed to the widespread use of tapes in various applications such as packaging, healthcare, automotive, electrical and electronics, building and construction, and others. The rising use of flatter and microelectronic devices increases the use of adhesive tapes in the electrical and electronic industries. In addition, it is used in the healthcare industry for wound dressings, surgeries, splints, ostomy seals, and secure IV lines coupled with the increasing aging population and the growing incidence of chronic diseases. In the healthcare industry, the tape is used in surgical containers, monitoring electrodes, and other medical equipment, as well as wound care applications. The health market continues to grow due to innovative products. Additionally, in the building and construction industry, adhesive tapes are used in commercial, industrial, and residential buildings for wall coverings or decorative trims, bonding and mounting components on windows and doors, protective bumper rails to walls and furniture, and panels to frames, due to the growing adoption of such products for protection and bonding. Such a wide application scope of adhesive tapes drives the growth of the North America adhesive tapes market.In North America, the US recorded the highest COVID-19 confirmed cases than Canada and Mexico. The COVID-19 pandemic is negatively impacting the chemical & materials industry in the region as the crisis is restricting the supply and distribution chain. The unavailability of raw materials due to lockdown in many raw material supplying countries has halted the production. There is a mixed impact of the pandemic on the adhesives tape market. Various industries, such as automobiles, construction, electronics and electrical, experienced sharp declines amid the pandemic. However, the healthcare industry has grown since the outbreak due to excessive demand for PPE kits and medical equipment. With the state of economic recovery, several industrial sectors and economies are strategically planning to invest in the healthcare sector. This is expected to provide an impetus to the market growth in the coming years.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the North America adhesive tapes market. The North America adhesive tapes market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Adhesive Tapes Market Segmentation

North America Adhesive Tapes Market – By Resin Type

- Acrylic

- Rubber

- Silicone

- Others

North America Adhesive Tapes Market – By Technology

- Water-Based Adhesive Tapes

- Solvent-Based Adhesive Tapes

- Hot-Melt- Based Adhesive Tapes

North America Adhesive Tapes Market – By Tape Backing Material

- Polypropylene (PP)

- Paper

- Polyvinyl Chloride (PVC)

- Others

North America Adhesive Tapes Market – ByApplication

- Packaging

- Healthcare

- Automotive

- Electrical and Electronics

- Building and Construction

- Others

North America Adhesive Tapes Market, by Country

- US

- Canada

- Mexico

North America Adhesive Tapes Market - Companies Mentioned

- 3M

- Avery Dennison Corporation

- Berry Global Inc.

- Intertape Polymer Group

- LINTEC Corporation

- Lohmann GmbH & Co.KG

- Nitto Denko Corporation

- Rogers Corporation

- Scapa

- tesa SE

North America Adhesive Tapes Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 15,649.30 Million |

| Market Size by 2028 | US$ 22,179.95 Million |

| CAGR (2021 - 2028) | 5.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Resin Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For