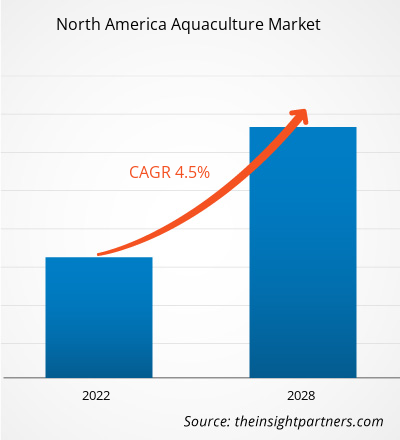

The aquaculture market in North America is expected to grow from US$ 20,110.26 million in 2021 to US$ 27,343.81 million by 2028; it is estimated to grow at a CAGR of 4.5% from 2021 to 2028.

The US, Canada, and Mexico are major economies in North America. Seafood, specifically fish is the part of traditional food in many regions. Also, fish is largely consumed owing to its nutritional benefits and several health benefits. It is considered as a good source of fatty acids, vitamins, minerals, protein, and essential micronutrients. Increase in disposable income and spending power of consumer also upsurge their spending on animal proteins such as seafood as compared to other food categories. Currently, high growth in population and increased popularity of seafood as a healthy source of protein have fueled the growth of aquaculture market. Along with this, the increase in purchasing power of people in developing nations has also supported the market growth. Wild fisheries are not sufficient to meet the North America demand for seafood. Aquaculture is the solution to meet the increasing demand for seafood. Aquaculture is the practice of farming aquatic animals such as fish, crustaceans, mollusks, and others in a controlled environment in man-made tanks and ponds, or water bodies in the coastal areas. It accounts for more than half of the seafood consumption across the world. Overfishing in the oceans has created a need for the development of alternative methods for the production of seafood to feed the planet’s highly growing population. Aquaculture is a sustainable solution over wild fishing to provide future generation with environmentally friendly protein alternatives. It also has reduced greenhouse gas emissions as compared to other types of farming. It is the controlled process of farming of aquatic organisms in inland and coastal areas. Aquaculture is carried out by multinational companies as well as small-scale fisheries. Also, the Food and Agriculture Organization (FAO) has predicted that fish consumption by a human is expected to increase by 50% in the coming 15 years. The rise in the North America fish consumption is driving the growth of the aquaculture market.

The US recorded the highest number of COVID-19 confirmed cases, followed by Mexico and Canada. The crisis adversely affected the aquaculture sector in the region due to supply chain disruptions, the shutdown of manufacturing units, and border restrictions, among others. Disruptions in manufacturing processes and research and development activities restrained new developments in the aquaculture market. However, the situation is far better than the initial pandemic period. The governments announced the relaxation of restrictions, and manufacturers have started their operations with full capacity. Moreover, the demand for packaged seafood products increased significantly across the region, which is expected to provide lucrative opportunities for the North America aquaculture market in the years to come.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the North America aquaculture market. The North America aquaculture market is expected to grow at a good CAGR during the forecast period.

North America AquacultureMarket Revenue and Forecast to 2028 (US$ Million)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Aquaculture Market Segmentation

North America Aquaculture Market – By Product

- Aquatic Plants

- Fish

- Crustaceans

- Mollusca

- Others

North America Aquaculture Market – By Culture Environment

- Fresh Water

- Brackish Water

- Marine Water

North America Aquaculture Market, by Country

- US

- Canada

- Mexico

North America Aquaculture Market - Companies Mentioned

- Bakkafrost

- Blue Ridge Aquaculture, Inc.

- Cermaq Group AS

- Cooke Aquaculture, Inc.

- JBS S.A.

- Leroy Seafood

- Mowi ASA

- Stolt-Nielsen Limited

- Thai Union Group PCL

North America Aquaculture Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 20,110.26 Million |

| Market Size by 2028 | US$ 27,343.81 Million |

| Global CAGR (2021 - 2028) | 4.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Species, Nature, and Culture Environment

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada

Trends and growth analysis reports related to Food and Beverages : READ MORE..

- Bakkafrost

- Blue Ridge Aquaculture, Inc.

- Cermaq Group AS

- Cooke Aquaculture, Inc.

- JBS S.A.

- Leroy Seafood

- Mowi ASA

- Stolt-Nielsen Limited

- Thai Union Group PCL

Get Free Sample For

Get Free Sample For