Ceramic Injection Molding Market Growth and Forecast by 2028

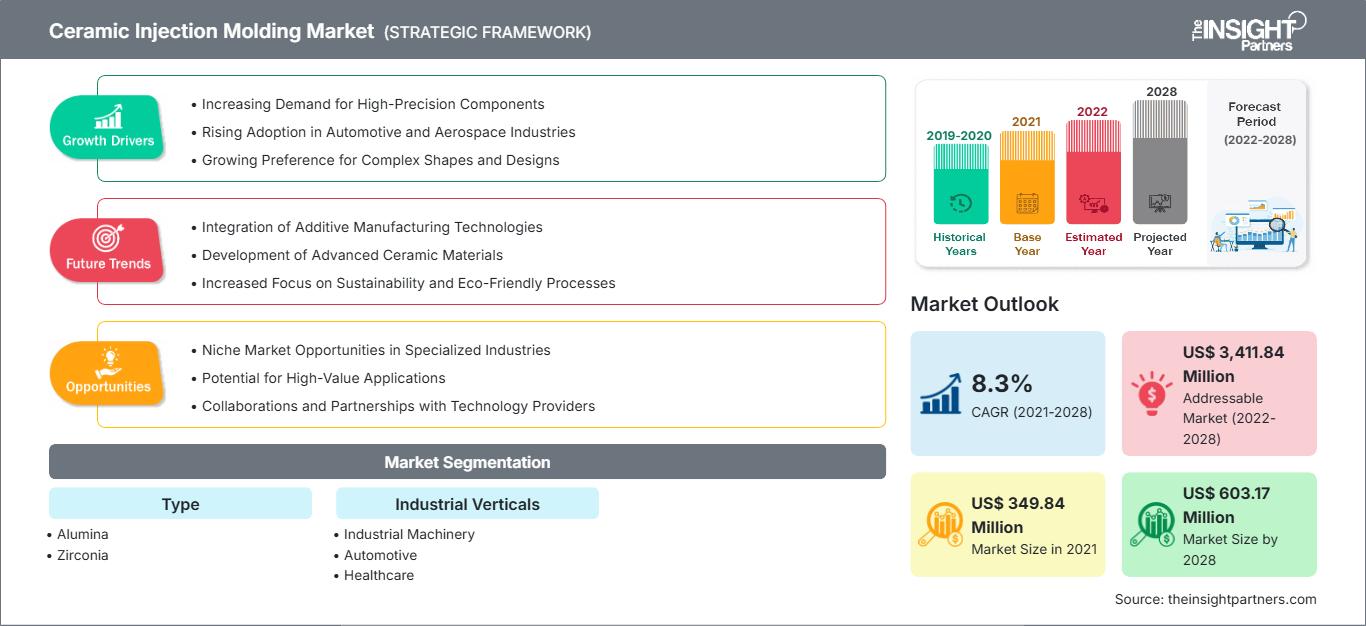

Ceramic Injection Molding Market Forecast to 2028 - Industry Analysis by Type (Alumina, Zirconia, and Others) and Industrial Verticals (Industrial Machinery, Automotive, Healthcare, Electricals and Electronics, Consumer Goods, and Others)

Historic Data: 2019-2020 | Base Year: 2021 | Forecast Period: 2022-2028- Report Date : Dec 2022

- Report Code : TIPRE00007073

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 142

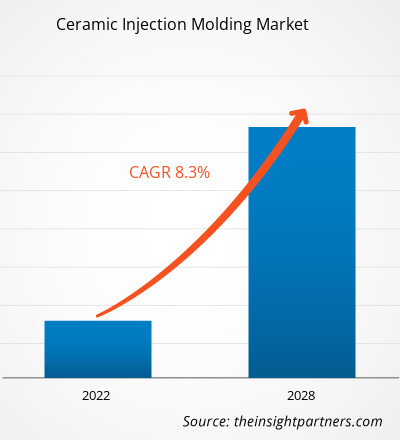

The ceramic injection molding market is projected to reach US$ 603.17 million by 2028 from US$ 349.84 million in 2021. It is expected to register a CAGR of 8.3% from 2022 to 2028.

The demand for ceramic injection molding is growing due to various benefits offered by ceramic injection molding. The increase in application of ceramic injection molding in the automotive & electronics industry in developed and developing regions is expected to provide lucrative opportunities for the market growth. Asia Pacific dominated the market in terms of revenue, and it is also expected to be the fastest-growing region over the forecast period. The alumina segment is dominating the market. The growth of the zirconia segment is expected to positively impact the market growth.

In 2021, Europe held the largest share of the global ceramic injection molding market, and Asia Pacific is estimated to register the fastest CAGR during the forecast period. In 2019, Asia Pacific contributed to the largest share in the global ceramic injection molding market. The growth of the ceramic injection molding market in this region is primarily attributed to the wide availability of ceramic materials such as alumina and zirconia at reduced cost. The expansion in the application of ceramic injection molding in the production of medical instruments and consumer electronics favors its demand in Asia Pacific. The advancements in technologies and rising trend for the use of advanced products boost the demand for ceramic injection molding. Besides all these, the rise in the application of the process in healthcare, industrial machinery, automotive and consumer goods is another factor that provides ample opportunities for the growth of the ceramic injection molding in the region.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONCeramic Injection Molding Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Greater Utilization of Technology by Automotive and Electronics Industry

Ceramic injection molding is highly exploited by industries such as automotive, electronics, and consumer goods. Ceramic injection molding technology can produce highly accurate, complex ceramic components and parts for electronics, mobile phones, and consumer goods industries. For the past few years, the production of portable computing devices, cellular phones, gaming systems, and other personal electronic devices has increased exponentially. Hence, the rise in the adoption of these products drives the expansion of the ceramic injection molding industry. Rapid urbanization has further lead to the rise in the adoption of mobile phones, electronic items, vehicles, and others. The tremendous growth of the automobile industry combined with huge production demand for this technology is stimulating a positive impact. The demand for molded miniature products is escalating in the automotive sector, attributed to their high strength and complexity in their structures. Complex and vital components in electronic systems, engines, and locking mechanisms are usually manufactured by injection molding processes, which is a considerable driver to expanding the ceramic injection molding market. Technical ceramics function efficiently under extreme conditions such as high temperatures, corrosive atmospheres, and abrasive conditions. Also, advanced ceramics integrate with excellent mechanical characteristics with a low specific weight. Owing to this property of advanced ceramics, they are considered lightweight construction materials and thus find applications in moving aeronautics and automotive components and engine components. Further, rising disposable income and enhancing living standards in the developing regions are assisting the growth of these end-user industries, eventually amplifying the market growth.

Type-Based Insights

Based on type, the ceramic injection molding market is categorized into alumina, zirconia, and others. The alumina segment held the largest share in the market in 2021. The zirconia segment is expected to register the highest CAGR during the forecast period. Zirconium oxide also known as zirconia refers to a white crystalline oxide of zirconium. Mineral baddeleyite is the most natural occurring form of zirconia that bears a monoclinic crystalline structure. Ceramic powder of zirconia is widely used in injection molding. Zirconia possesses greater thermal expansion capacity as compared to alumina. It is biocompatible and has high chemical inertness, high fracture resistance and low thermal conductivity. Zirconia powder is employed in the production of dental implants through injection molding. The production of ceramic injection molding parts using yttrium oxide stabilized tetragonal zirconia appears to be feasible. The strength and variability of yttrium oxide stabilized tetragonal zirconia parts is usually more as compared to other conventional parts. Mullite zirconia is identified as a potential material for high temperature structural industry verticals owing to its high thermal shock resistance, high temperature strength, and low coefficient thermal expansion. The zirconia powder used in injection molding possesses the ability to fabricate the complex shapes that are made from the mullite zirconia composites. The zirconia powder is mainly used in the injection molding of optical fibers ferrules and wire bond nozzles. The zirconia-toughened alumina ceramics serve as interesting materials for biomedical and engineering industry verticals due to hardness, high strength and abrasion resistance. For this reason, the ceramic injection molding appears to be an attractive option for producing zirconia-toughened alumina. Zirconia is mainly used in industry verticals where alumina strength is considered to be insufficient.

Category Insights

Industrial Vertical-Based Insights

Based on industrial verticals, the ceramic injection molding market is segmented into industrial machinery, automotive, healthcare, electricals and electronics, consumer goods, and others. The healthcare segment accounted for the largest market share in 2020. The use of ceramic injection molding in dental implants, tweezers, endoscopic tools, and other applications supports the market for ceramic injection molding in the healthcare industry. The oxides of zirconia and alumina are used in the fabrication of numerous appliances, which further drives the demand for ceramic injection molding in the healthcare industry. The ability of ceramic injection molding process to modulate the roughness and surface quality of the components used in healthcare applications support the growth of the market. The growing healthcare industry is yet another factor that provides lucrative opportunities for the development of this segment. Further, the formation of micro-ceramic injection molding parts and their application in various products used in healthcare industry boost the growth of the healthcare segment in the ceramic injection molding market.

The major players operating in the ceramic injection molding market include AMT Pte. Ltd.; Arburg GmbH + Ko. KG.; Ceramco, Inc.; CoorsTek, Inc.; Indo MIM; KLAGER; Micro; Morgan Advanced Materials; Nishimura; Advanced Ceramics, Co. Ltd.; and OECHSLER AG. These companies are emphasizing on new product launches and geographical expansions to meet the growing consumer demand worldwide. They have a widespread global presence, which provides them to serve a large set of customers worldwide and subsequently increases their market share. These market players focus heavily on new product launches and regional expansions to increase their product range in specialty portfolios.

Ceramic Injection Molding Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 349.84 Million |

| Market Size by 2028 | US$ 603.17 Million |

| Global CAGR (2021 - 2028) | 8.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Ceramic Injection Molding Market Players Density: Understanding Its Impact on Business Dynamics

The Ceramic Injection Molding Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Report Spotlights

- Progressive industry trends in the ceramic injection molding market to help companies develop effective long-term strategies

- Business growth strategies adopted by the ceramic injection molding market players in developed and developing countries

- Quantitative analysis of the market from 2019 to 2028

- Estimation of global demand for ceramic injection molded products

- Porter’s Five Forces analysis to illustrate the efficacy of buyers and suppliers in the ceramic injection molding market

- Recent developments to understand the competitive market scenario

- Market trends and outlook, as well as factors driving and restraining the growth of the ceramic injection molding market

- Assistance in the decision-making process by highlighting market strategies that underpin commercial interest

- Size of the ceramic injection molding market at various nodes

- A detailed overview and ceramic injection molding industry dynamics

- Size of the ceramic injection molding market in various regions with promising growth opportunities

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For