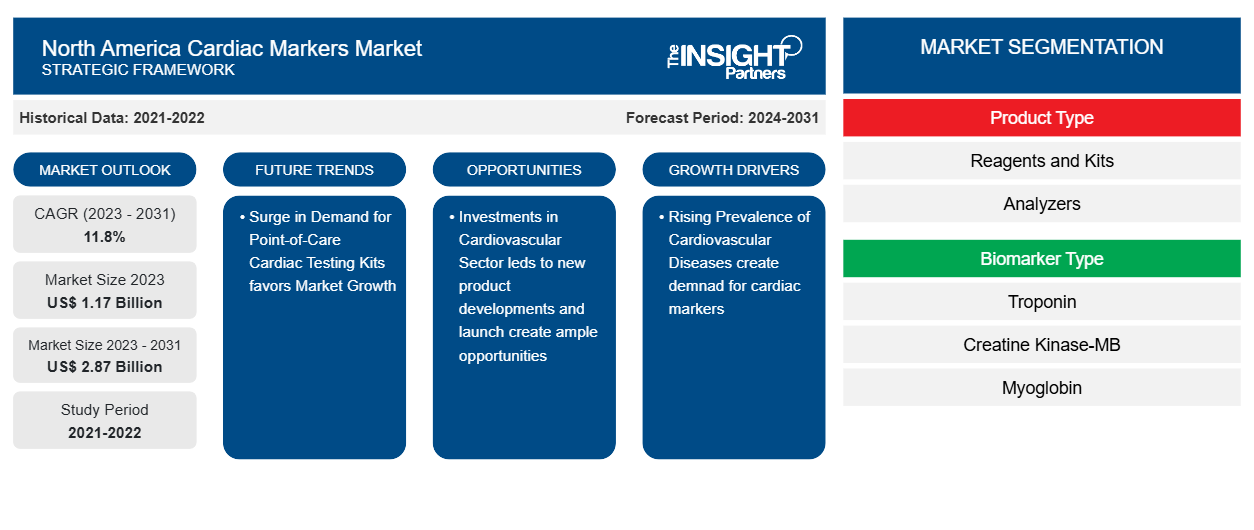

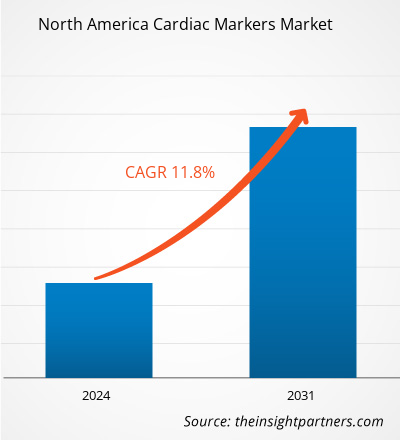

The North America cardiac markers market size is projected to reach US$ 2.87 billion by 2031 from US$ 1.17 billion in 2023. The market is expected to register a CAGR of 11.8% during 2023–2031. The use of exosome biomarkers as a new method for the diagnosis of cardiovascular diseases (CVDs) is likely to remain a key trend in the North America cardiac markers market.

North America Cardiac Markers Market Analysis

An increase in cardiovascular diseases such as heart attacks, strokes, and other heart diseases is a crucial driver for the cardiac markers market. As CVD is one of the leading causes of death in North America, there is an increased desire for early and accurate diagnosis, which can be achieved by cardiac marker testing. Cardiac markers are crucial in determining the severity of heart problems and making treatment recommendations. The development and improvement of point-of-care testing technology have significantly impacted the cardiac marker market.

North America Cardiac Markers Market Overview

Cardiac markers are most commonly used for early detection, diagnosis, and risk stratification of acute coronary syndromes so that healthcare providers can initiate relevant therapies and interventions as quickly as possible. In addition, cardiac markers are critical for monitoring patients with known cardiovascular disease, assessing treatment effectiveness, and guiding therapeutic decisions. Its widespread use in emergency departments, intensive care units, and outpatient settings demonstrates its importance in improving patient outcomes and reducing mortality rates from cardiac events.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America Cardiac Markers Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Cardiac Markers Market Drivers and Opportunities

Surge in Demand for Point-of-Care Cardiac Testing Kits to Favor Market

The clinical advantages of point-of-care (POC) tests include reduced diagnostic time compared to traditional laboratory-based tests. The demand for POC test kits is surging with the increasing prevalence of CVDs, the growing geriatric population, and the ability of POC tests to provide immediate results. Several rapid and novel biomarker tests are being introduced on the back of strong research and development related to cardiovascular conditions. The POC tests can be offered as both qualitative devices and quantitative devices. Qualitative devices only indicate whether the specific biomarker is present in elevated amounts in the sample, whereas quantitative devices provide a numerical value for each biomarker. Quantitative devices are incorporated with one or more cassettes into which the sample is applied and then inserted into a benchtop analyzer to obtain the results. On the other hand, the sample is directly applied to the cassette in qualitative devices, and the results can be read directly. A surge in demand for such POC tests is bolstering the cardiac marker market growth.

Investments in Cardiovascular Medicine

With the burgeoning incidence of cardiovascular diseases, the demand for advanced diagnostics and treatments has increased significantly in North America, compelling companies to invest in their cardiology R&D capabilities. Investors are also considering forming partnerships in this discipline of medicine, which offer lucrative opportunities for market growth. A few of the recent initiatives by investors in the cardiology segment are mentioned below:

- US Heart and Vascular, a portfolio company of Ares Management, announced a partnership with Houston-based Willowbrook Cardiovascular Associates in 2022. In 2023, the company also partnered with Orion Medical, strengthening its presence in Houston.

- In 2023, Lee Equity Partners announced the launch of the new Cardiovascular Logistics platform in collaboration with the Cardiovascular Institute of the South (CIS), which is a large independent cardiovascular practice.

- In Q4 of 2022, Cardiovascular Associates of America, a Webster Equity Partners portfolio company, announced a partnership with the Chicago Cardiology Institute, The Heart House of New Jersey, the Cardiovascular Institute of New England, and Southwest Cardiovascular Associates.

Such investments and partnerships by investors and companies involved in the CVD segment create lucrative opportunities for the North America cardiac marker market growth.

North America Cardiac Markers Market Report Segmentation Analysis

Key segments that contributed to the derivation of the cardiac markers market analysis are product type, biomarker type, indication, and end user.

- Based on product type, the North America cardiac markers market is segmented into reagents and kits, and analyzers. The analyzers segment held a larger share in 2023. The reagents and kits segment is expected to register a higher CAGR during 2023–2031.

- Based on biomarker type, the North America cardiac markers market is divided into troponin, creatine kinase-MB, myoglobin, B-type natriuretic peptide, and others. The troponin segment held the largest market share in 2023 and is estimated to register the highest CAGR in the market during 2023–2031.

- By indication, the market is segmented into congestive heart failure, myocardial infraction, acute coronary syndrome, and others. The congestive heart failure segment held the largest share of the market in 2023. The acute coronary syndrome segment is estimated to register the highest CAGR during 2023–2031.

- In terms of end user, the North America cardiac markers market is divided into hospitals, diagnostic laboratories, point-of-care testing facilities, and others. The hospitals segment held the largest market share in 2023. The diagnostic laboratories segment is estimated to register the highest CAGR in the market during 2023–2031.

North America Cardiac Markers Market Share Analysis by Region

The regional scope of the North America cardiac markers market report is mainly divided into three countries: US, Canada, and Mexico.

The market growth in North America is due to the developed healthcare system and the high acceptance of cardiac markers for diagnosing and predicting diseases. The growing geriatric population needs biomarker testing for detecting conditions such as acute myocardial infarction, thereby driving demand for testing products. The presence of key players such as Quidel Corporation and Danaher Corporation is another factor contributing to the growth of the North America cardiac markers market. The World Health Organization (WHO) states that ~77 million adults over the age of 18 have type 2 diabetes, including 25 million prediabetes, which increases the possibility of CVDs and puts additional pressure on the healthcare system. Furthermore, well-planned business strategies by market players in this region to develop innovative cardiac biomarker tests are expected to contribute to the market growth in this region.

North America Cardiac Markers Market Report Scope| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1.17 Billion |

| Market Size by 2031 | US$ 2.87 Billion |

| CAGR (2023 - 2031) | 11.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

North America Cardiac Markers Market Players Density: Understanding Its Impact on Business Dynamics

The North America Cardiac Markers Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the North America Cardiac Markers Market top key players overview

North America Cardiac Markers Market News and Recent Developments

The North America cardiac markers market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the North America cardiac markers market are listed below:

- Hytest Ltd expanded into North America with a subsidiary, Hytest North America. The company will launch local operations to better serve customers and meet growing demands. With a local team in the US, the company will strive to enhance accessibility to products and services, ensuring a smoother experience for valued customers in North America. (Source: Hytest Ltd, Press Release, 2024)

- Hytest Ltd announced the launch of the latest troponin product, the recombinant chimeric human Cardiac Troponin binary Complex (Cat. # 8IFC20). This unique complex features the most stable part of cTnI (fragment 28-110) linked with TnC by a 20-aar flexible linker of the cTn I – C complex. (Source: Hytest Ltd, Press Release, 2023)

- Abbott announced that the US Food and Drug Administration (FDA) approved an expanded indication for the company's CardioMEMS HF System to support caring for more people with heart failure. With the expanded indication, an additional 1.2 million US patients can now benefit from advanced monitoring with the CardioMEMS sensor, which marks a significant increase over the current addressable population. The sensor provides an early warning system, enabling doctors to protect against worsening heart failure. (Source: Abbott Laboratories, Press Release, 2022)

North America Cardiac Markers Market Report Coverage and Deliverables

The “North America Cardiac Markers Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering the following areas:

- North America cardiac markers market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- North America cardiac markers market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- North America cardiac markers market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the North America cardiac markers market

- Detailed company profiles

Frequently Asked Questions

What is cardiac marker?

Who are the major players in the cardiac marker market?

Which country is dominated the cardiac marker market?

Which biomarker type segment is dominating the cardiac marker market?

Which product type segment is dominating the cardiac marker market?

Which indication segment is dominating the cardiac marker market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For