North America Courier Express and Parcel Market Developments and Forecast by 2030

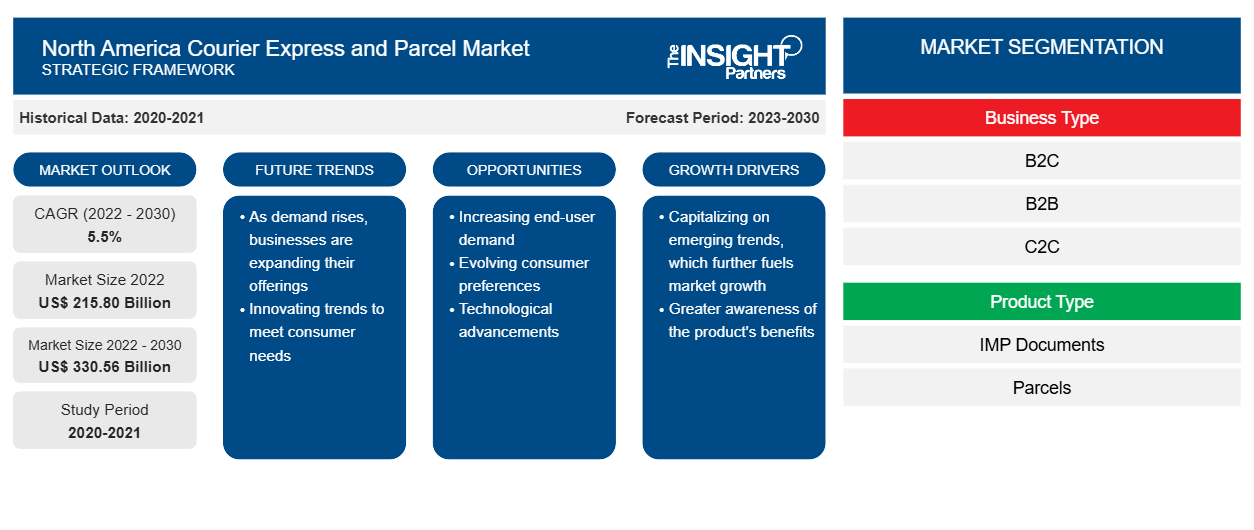

North America Courier Express and Parcel Market Size and Forecast (2020 - 2030), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Business Type (B2C, B2B, and C2C), Product Type (IMP Documents and Parcels), Destination (Domestic and International), Mode of Transport (Groundways, Waterways, and Airways), End User (BFSI, Retail, Manufacturing and Construction, and Others), and Country

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Jan 2024

- Report Code : TIPRE00033415

- Category : Automotive and Transportation

- Status : Published

- Available Report Formats :

- No. of Pages : 244

The North America courier express and parcel market was valued at US$ 215.80 billion in 2022 and is projected to reach US$ 330.56 billion by 2030; it is expected to register a CAGR of 5.5% during 2022–2030.

Analyst Perspective:

The North American courier express and parcel market consists of a sophisticated and dynamic process that is carefully structured to convey goods from warehouses to customers' doorsteps as quickly as possible. Customers including manufacturing, retailers, e-commerce agencies, individuals, and many small and medium-size businesses seek transport facilities to courier their products from one place to another at a faster pace. Orders are often placed through e-commerce platforms or retail shops, sparking a series of cautiously coordinated processes. Retailers process orders and manage inventory in strategically located warehouses, optimizing availability for on-time delivery.

The North america courier express and parcel market ecosystem constitutes a network of diverse stakeholders, technology integrations, logistical infrastructures, and evolving consumer behaviors. The primary stakeholders are e-commerce giants and retailers, then logistics companies come into the picture. These organizations take help from technological companies that offer tools such as route optimization and delivery management. Apart from software companies, many drone manufacturers and service providers play a notable role in the courier express and parcel market.

Market Overview:

Courier express and parcel refers to logistics and postal companies that primarily transport consignments/parcels with comparatively low volume and weight, e.g., letters, small packages, documents, or small items. Parcel shipping measures parcel volume shipments with weights up to 31.5 kg for business-to-business, business-to-consumer, and consumer-to-consumer.

The North America courier express and parcel market is projected to experience significant growth with various driving factors, such as rising e-commerce sales, robust economic expansion, and the escalated need for faster delivery solutions. Also, leading players are investing in technological innovations such as the adoption of electric vehicles and automated sorting systems for parcel deliveries, and growing government initiatives. In December 2023, JD Logistics expanded its express delivery service to countries across North America and Europe. JD Logistics, the logistics arm of Chinese e-commerce giant JD.com, has announced the launch of its international express delivery service. Currently available in Shenzhen and Guangzhou, the expansion will initially cover 23 countries across North America and Europe, facilitating one-way deliveries from China.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONNorth America Courier Express and Parcel Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Increasing E-Commerce Retail Sales with Surge in Internet Users is Driving the North America Courier Express And Parcel Market Growth

The number of internet users across North America reached 439.76 million, and around 90.0% of the people in North America were connected to the Internet in 2023. Currently, 348 million people shop online in North America, and the number of people shopping online is likely to reach 50 million by 2025.

The growing number of online shoppers with the surge in Internet users in North American countries such as the US, Canada, and Mexico is the major factor driving the growth of courier express and parcel market. During the COVID-19 pandemic, there was a massive increase in online orders that subsequently propelled the demand for parcel shipping. The volume of parcel shipments in the US increased by 64% between 2014 and 2022, i.e., from 13.2 billion to 21.2 billion parcels. Revenues from retail e-commerce increased at higher rates in the US between 2017 and 2022. Retail e-commerce sales increased from US$ 459 billion in 2017 to almost US$ 905 billion in 2022. The popularity of retail e-commerce is a major factor driving the North America courier express and parcel market growth.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Segmental Analysis:

Based on business type, the North America courier express and parcel market share is segmented into B2C, B2B, and C2C. Among these, B2C held the largest share in 2022, primarily owing to rising online shopping trends with the surge in demand from e-commerce. More than 70% of North Americans shopped online. In 2022, there were ~268 million digital buyers in the US, expected to reach 285 million by 2025. These B2C customers are expected to offer significant opportunities for various e-commerce companies. Whole Foods, Nike, and Petco connect with each customer.

Business to consumers (B2C) refers to selling goods directly from the firms to consumers who are the end users of that product or service. B2C companies are firms that sell directly to consumers without any mediators. Major B2C companies include Amazon.com, Meta, eBay, Netflix, and The New York Times Co. Increasing e-commerce sales in North America owing to rising consumer preference toward online shopping is the major factor driving the courier express and parcel market for the B2C segment. According to the US Department of Commerce, e-commerce sales in the US reached ~US$ 1.03 trillion in 2022 and increased from US$ 960.44 billion in 2021. Thus, the remarkable e-commerce product or service growth propels the courier express and parcel market for the B2C segment.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Regional Analysis:

The north america courier express and parcel market share is growing at a moderate pace with the increasing adoption of automation and advanced technologies for parcel deliveries. In April 2021, Amazon.com, Inc. expanded its investment in building a fulfillment center in Fort Wayne (Indiana, US). In addition, key players are launching additional shipping routes to improve efficiency and provide last-mile deliveries.

In November 2023, UPS launched large-scale picking automation at its Kentucky warehouse, US. UPS Supply Chain Solutions Inc. announced a new agreement with Geek+ (a developer of autonomous mobile robots). The company’s warehouse is situated near Louisville (Kentucky, US). The company has planned an investment of around US$ 79 million to adopt this Pop-Pick solution, with over 700 robots set to be deployed at the US$ 79 million (£63m) facility, which is named the ‘Velocity’ warehouse.

In May 2023, Instacart (a grocery technology company in North America) announced its partnership with PetSmart (a pet retailer) to offer same-day delivery from the Instacart Application. The company has nearly 1,500 PetSmart stores across the US to offer same-day delivery from its 150 PetSmart stores across Canada.

Thus, the expansion of such facilities and rising partnerships between retailers and delivery companies are likely to stir the growth of the North American courier express and parcel market during the forecast period. The North America courier express and parcel market has been segmented into 3 major countries: the US, Canada, and Mexico.

Key Player Analysis:

United Parcel Service Inc, Purolator Inc, TForce Logistics LLC, Lone Star Overnight LLC, Amazon.com Inc, Deutsche Post AG, Intelcom Courrier Canada Inc, Updater Services Ltd., Better Trucks Inc, OnTrac Logistics Inc, Canada Post Corp, Canpar Express Inc, General Logistics Systems BV, FedEx Corp, and, Pitney Bowes Inc are the prominent courier express and parcel market players in the market.

Recent Developments in North America Courier Express and Parcel Market

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the North America courier express and parcel market. The market initiative is a strategy adopted by companies to expand their footprint across the world and to meet the growing customer demand. The market courier express and parcel market players present in the market are mainly focusing on product and service enhancements by integrating advanced features and technologies into their offerings. A few recent developments by key players in the North America courier express and parcel market are listed below:

Year |

News |

|

April-2021 |

Lone Star Overnight, a regional parcel delivery company, announced that it will incorporate Saturdays into its normal delivery schedule starting May 1, 2021. LSO will also deliver B2C e-commerce packages as part of its normal service at no additional charge. |

North America Courier Express and Parcel Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 215.80 Billion |

| Market Size by 2030 | US$ 330.56 Billion |

| CAGR (2022 - 2030) | 5.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Business Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For