Contract Logistics Market Growth, Trends & Global Forecast 2025-2031

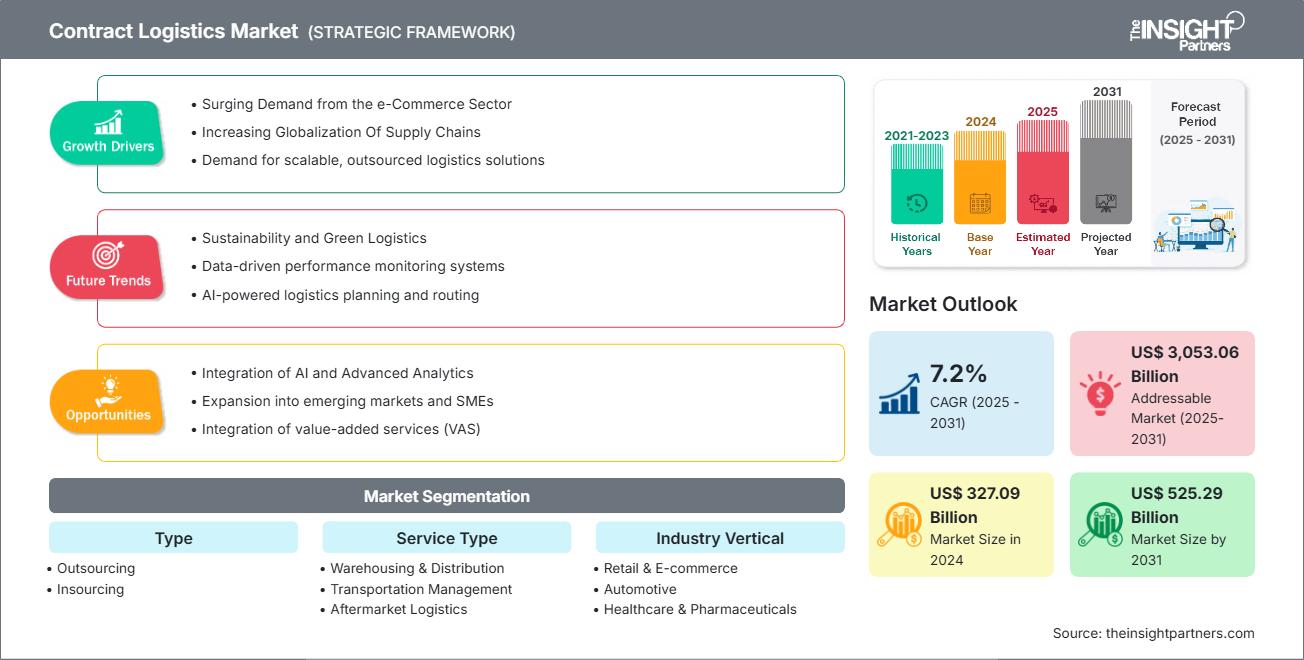

Contract Logistics Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Outsourcing, Insourcing), Service Type (Warehousing and Distribution, Transportation Management, Aftermarket Logistics, Others), End-Users (Retail and E-commerce, Automotive, Industrial and Manufacturing, Pharma and Healthcare, Consumer Goods and Electronics, Aerospace and Defense, Others), and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Aug 2025

- Report Code : TIPEL00002034

- Category : Automotive and Transportation

- Status : Published

- Available Report Formats :

- No. of Pages : 213

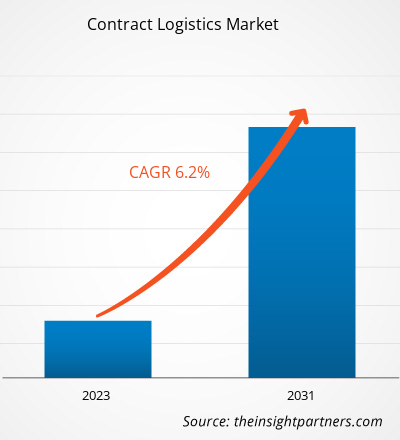

The Contract Logistics Market size is expected to reach US$ 525.29 billion by 2031 from US$ 327.09 billion in 2024. The market is anticipated to register a CAGR of 7.2% during 2025–2031.

Contract Logistics Market Analysis

The contract logistics market is propelled by several key drivers, including the rapid growth of e-commerce, increasing demand for efficient supply chain solutions, and globalization of trade, which necessitates sophisticated logistics networks. Technological advancements, such as automation, IoT, and AI, enable greater visibility, speed, and accuracy in logistics operations, creating significant growth opportunities. Additionally, businesses increasingly focus on sustainability, prompting logistics providers to adopt green initiatives and expand market potential.

Contract Logistics Market Overview

Contract Logistics refers to outsourcing logistics and supply chain management services to third-party providers who manage warehousing, transportation, inventory control, and distribution on behalf of their clients. This arrangement allows businesses to focus on their core competencies while benefiting from cost efficiencies, improved scalability, and access to advanced logistics technologies and expertise. Common applications of contract logistics include order fulfillment, freight forwarding, reverse logistics, and inventory management across retail, manufacturing, automotive, pharmaceuticals, and e-commerce. Types of contract logistics services vary from simple transportation and warehousing solutions to integrated end-to-end supply chain management, including value-added services such as packaging, assembly, and customized distribution.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONContract Logistics Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Contract Logistics Market Drivers and Opportunities

Market Drivers:

- Surging Demand from the e-Commerce Sector: The rapid expansion of e-commerce is significantly fueling the growth of the contract logistics market. As more consumers shift to online shopping, businesses are facing rising demands for faster, more efficient delivery and fulfillment services. This surge has pushed companies to outsource their logistics operations to third-party providers that specialize in managing supply chains, warehousing, transportation, and last-mile delivery. The e-commerce expansion across the globe. For example, in 2023, the Indian e-commerce landscape witnessed significant developments. The Open Network for Digital Commerce (ONDC) recorded nearly 1.2 million transactions during Diwali week in November, reflecting a surge in digital commerce activities. By December 2023, ONDC achieved 5.5 million transactions in a month, with 2.1 million in the retail category, indicating a growing adoption of digital platforms.

- Increasing Globalization Of Supply Chains: The expanding globalization of supply chains is a key factor fueling the growth of the contract logistics market. As companies increasingly source raw materials and manufacture products across multiple countries, the complexity of managing these dispersed operations rises significantly. This growing interconnection between global markets demands more efficient, flexible, and specialized logistics solutions. Contract logistics providers play a critical role in helping businesses navigate the challenges associated with international transportation, customs regulations, and diverse distribution networks. In June 2023, the US Department of Commerce initiated its Advisory Committee on Supply Chain Competitiveness (ACSCC), bringing together officials and industry leaders to discuss coordination on cross-border logistics, diversification of sourcing, and infrastructure gaps—all critical factors amplifying reliance on outsourced logistics capacity.

Market Opportunities:

- Sustainability and Green Logistics: Sustainability and green logistics create significant opportunities in the contract logistics market by aligning supply chain operations with environmental and social governance (ESG) objectives. As companies worldwide face increasing pressure to lower their carbon footprints and adopt environmentally responsible practices, contract logistics providers create innovative solutions that enhance operational efficiency while reducing environmental impact. These green logistics strategies focus on minimizing emissions, streamlining transportation routes, improving warehouse energy efficiency, and integrating renewable energy sources. By embracing these practices, businesses contribute to global sustainability goals and strengthen their long-term resilience and competitiveness.

Contract Logistics Market Report Segmentation Analysis

The contract logistics market is categorized into distinct segments to provide a comprehensive understanding of its structure, growth prospects, and emerging trends. Below is the standard segmentation approach used in most industry reports:

By Type:

- Outsourcing: Outsourcing in contract logistics refers to companies delegating their supply chain and logistics operations, such as warehousing, transportation, inventory management, and order fulfilment, to third-party logistics (3PL) providers. This segment held the largest contract logistics market share in 2024.

- Insourcing: Insourcing in contract logistics involves shifting previously outsourced logistics operations back in-house to improve control, efficiency, and service customization. This trend is gaining traction as companies seek greater flexibility amid global supply chain disruptions.

By Service Type:

- Warehousing and Distribution: Warehousing and distribution are core components of contract logistics, enabling businesses to streamline their supply chains through efficient inventory management and timely product movement. This segment held the largest contract logistics market share in 2024.

- Transportation Management: Transportation Management is a core component of contract logistics, ensuring the efficient, timely, and cost-effective movement of goods across supply chains. It involves route planning, carrier selection, freight auditing, shipment tracking, and performance optimization.

- Aftermarket Logistics: Aftermarket Logistics in contract logistics focuses on the movement, management, and value addition involved with spare parts, returns, repairs, recycling, or refurbishment after initial product sale.

- Others: In the contract logistics market, the other service category encompasses critical value-added solutions such as packaging, labelling, and freight forwarding.

By Industry Vertical:

- Retail & E-commerce

- Automotive

- Healthcare & Pharmaceutical

- Consumer Goods & Electronics

- Industrial & Manufcaturing

- Aerospace & Defense

- Others

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

The contract logistics market in Asia Pacific is expected to witness the fastest growth. The expanding cross-border e-commerce sector primarily drives this growth.

Contract Logistics

Contract Logistics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 327.09 Billion |

| Market Size by 2031 | US$ 525.29 Billion |

| Global CAGR (2025 - 2031) | 7.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Contract Logistics Market Players Density: Understanding Its Impact on Business Dynamics

The Contract Logistics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Contract Logistics Market Share Analysis by Geography

Asia Pacific is expected to grow the fastest in the next few years. Emerging markets in South & Central America, the Middle East & Africa also have many untapped opportunities for contract logistics providers to expand.

The contract logistics market grows differently in each region owing to the rise of the e-commerce industry and the growing trade between various countries. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds a significant portion of the global market

-

Key Drivers:

- Rapid online retail expansion is demanding efficient fulfillment and last-mile logistics.

- Integration of automation, robotics, and warehouse management systems.

- Companies are increasingly outsourcing logistics to focus on core business operations.

- Trends: Rise of 3PL & 4PL partnerships for end-to-end supply chain visibility and agility.

2. Europe

- Market Share: Substantial share owing to early, stringent EU regulations

-

Key Drivers:

- High demand for coordinated and compliant logistics across multiple countries.

- Pressure to reduce emissions and adopt green logistics solutions.

- Strong demand for specialized logistics services.

- Trends: Electrification of transport fleets and use of sustainable packaging in warehousing.

3. Asia Pacific

- Market Share: Fastest-growing region with dominant market share

-

Key Drivers:

- High production volumes require scalable logistics solutions.

- Growing E-commerce Ecosystem, particularly in India, China, and Southeast Asia.

- Major investments in ports, highways, and logistics parks.

- Trends: Surge in demand for omni-channel logistics to support hybrid retail models.

4. Middle East and Africa

- Market Share: Although small, it is growing quickly

-

Key Drivers:

- Increased logistics demand from non-oil sectors such as retail and healthcare.

- Growth of regional hubs such as the UAE, Saudi Arabia, and Egypt.

- Simplified regulations to attract global logistics players.

- Trends: Emergence of logistics hubs aligned with mega-projects (e.g., NEOM, DP World expansions).

5. South & Central America

- Market Share: Growing Market with steady progress

-

Key Drivers:

- Increased intra-regional commerce in Mercosur and Pacific Alliance countries.

- Demand for Cold Chain Logistics.

- Urbanization and Retail Growth.

- Trends: Increased digitalization of logistics through mobile platforms and fleet tracking systems.

Contract Logistics Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is intense due to the presence of major global players such as DHL Supply Chain, XPO Logistics, DB Schenker, and Kuehne + Nagel. Additionally, regional and specialized providers such as FedEx (North America), CEVA Logistics (France), and Nippon Express (Japan) further diversify the competitive landscape.

This high level of competition urges companies to stand out by offering:

- Integrated supply chain solutions (e.g., warehousing, last-mile delivery, inventory management)

- Investments in automation and robotics for warehouse operations

- Development of sector-specific expertise (e.g., pharmaceuticals, automotive, e-commerce)

- Deployment of advanced technologies such as IoT, AI, and real-time visibility platforms.

Opportunities and Strategic Moves

- Implementing AI, IoT, and automation in warehousing and inventory management improves efficiency and reduces human error.

- Data analytics and machine learning are leveraged for demand forecasting, network optimization, and predictive maintenance.

Major Companies operating in the Contract Logistics Market are:

- Deutsche Post AG (Germany)

- FedEx Corp (US)

- GXO Logistics Inc. (US)

- United Parcel Service Inc (US)

- Nippon Express Co Ltd (Japan)

- GEODIS SA (France)

- Ryder System Inc (US)

- CMA CGM SA (France)

- DSV AS (Denmark)

- Kuehne + Nagel International AG (Switzerland)

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analysed during the course of research:

- Expeditors International

- C.H. Robinson Worldwide

- Rhenus Logistics

- Penske Logistics

- Fiege Logistik

- Toll Global Logistics

- APL Logistics

- GAC (Gulf Agency Company)

- Yusen Logistics

- Bolloré Logistics

- SF Holding (SF Express)

- Dachser

- Raben Group

- cargo-partner

- Andreani Grupo

- Warehouse Services Inc.

- NFI

- Lineage Logistics

- TVS Supply Chain Solutions

- Aramex

- Toll Group

- Delhivery

- GlobalTranz

- Gebrüder Weiss

- CMA CGM (contract logistics arm)

- MSC (Mediterranean Shipping Company)

- Wincanton plc

- CJ Logistics

Contract Logistics Market News and Recent Developments

- DHL Group has signed a Memorandum of Understanding (MoU) with Temu, April 2025 - DHL Group has signed a Memorandum of Understanding (MoU) with the e-commerce marketplace Temu to deepen their cooperation and to expand their successful partnership. The agreement aims to enhance collaboration to better support local small and medium-sized enterprises (SMEs) in established markets as well as in growth markets, such as Eastern Europe and the Middle East.

- GXO Logistics, Inc. Expands its partnership with Revelyst, April 2025 - GXO Logistics, Inc.(NYSE: GXO), the world's largest pure-play contract logistics provider, announced the renewal and expansion of its partnership with Revelyst, a collective of brands that design and manufacture performance gear and precision technologies to fuel outdoor experiences. GXO will continue managing B2B and B2C logistics services, including picking, packing, and managing returns from its Eindhoven warehouse.

Contract Logistics Market Report Coverage and Deliverables

The "Contract Logistics Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Contract logistics market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Contract logistics market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Contract logistics market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the contract logistics market

- Detailed company profiles

Frequently Asked Questions

1. Integration with AI and Machine Learning

2. Digitalization and Automation

3. E-commerce Fulfillment Focus

4. Sustainability and Green Logistics

5. Integrated Supply Chain Services

1. Predictive Demand and Inventory Management: AI and ML algorithms analyze historical data, market trends, and real-time demand signals to accurately forecast inventory needs. This reduces overstocking, minimizes stockouts, and optimizes warehouse space—leading to better customer satisfaction and cost control.

2. Route Optimization and Fleet Management: AI-driven route optimization tools help logistics providers determine the most efficient delivery paths by analyzing traffic patterns, weather conditions, fuel costs, and delivery schedules. This leads to faster deliveries, lower fuel consumption, and fewer delays—key advantages in last-mile logistics.

1. Variable Transportation Expenses: Fluctuating transportation costs are significantly restraining the growth of the contract logistics market by increasing operational uncertainties and reducing profit margins. Transportation forms a core component of contract logistics, involving the movement of goods across various stages of the supply chain.

1. Surging Demand from the e-Commerce Sector: The rapid expansion of e-commerce is significantly fueling the growth of the contract logistics market. As more consumers shift to online shopping, businesses are facing rising demands for faster, more efficient delivery and fulfillment services.

2. Increasing Globalization of Supply Chains: The expanding globalization of supply chains is a key factor fueling the growth of the contract logistics market. As companies increasingly source raw materials and manufacture products across multiple countries, the complexity of managing these dispersed operations rises significantly.

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For