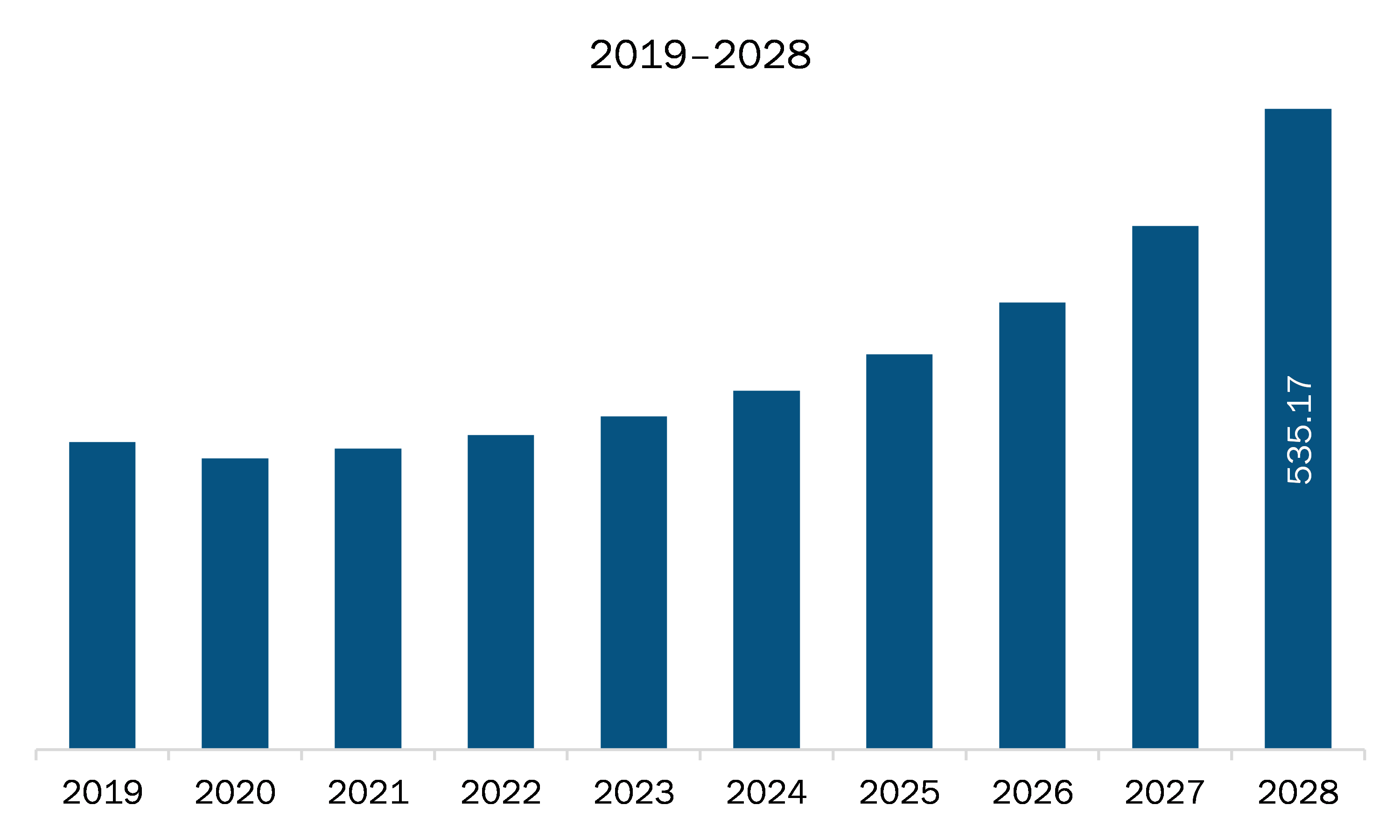

The drone simulator market in North America is expected to reach US$ 535.17 million by 2028 from US$ 251.38 million in 2021; it is estimated to grow at a CAGR of 11.4% from 2021 to 2028.

The US, Canada, and Mexico are major economies in North America. Rising usage of drones in military and commercial purposes is the major factor driving the growth of the North America drone simulator market. Since more than a decade, armed forces from several countries have been using drones. Ground troops are employing small drones regularly. Military spending on unmanned aerial vehicles (UAVs) is rising as a fraction of overall military spending, which is propelling the growth of specialist drone manufacturers and simulator software developers. For instance, the preliminary examination of the Department of Defense's budget request for 2019 revealed that US$ 9.39 billion was invested in drone procurements, research and development initiatives, and manufacturing in United States. The amount is increased by 26% from the amount invested in 2018. In 2019, orders for at least 3,447 new unmanned air, ground, and marine systems were placed, representing a threefold increase over orders placed in 2018. Several drones are being developed specifically for surveillance purposes. Some drones, on the other hand, have been developed for vital missions, such as transporting weapons. Furthermore, drones are employed as loitering weapons. Drones are also employed in real-time to collect data on ongoing and life-threatening military missions using their intelligence, surveillance, and reconnaissance (ISR) capabilities. Hence, the demand for drone simulators is increasing as a result of the factors listed above.

North America is known for the highest rate of adoption of advanced technologies due to favorable government policies to boost innovation and strengthen infrastructure capabilities. As a result, any factor affecting performance of industries in the region hinders its economic growth. Currently, the US is the world's worst-affected country due to the COVID-19 outbreak, which has led governments to impose several limitations on industrial, commercial, and public activities in the country, to control the spread of infection. The led the drone manufacturers and drone MRO service providers witness significant loss during the pandemic. The drone manufacturer’s production volume decreased drastically, thereby hindering the adoption rate of different simulation solution. However, the governments of the US and Canada have maintained their defense spending levels. For instance, the defense spending in the US reached US$ 778 billion in 2020, with a yearly increase on 4.4% which led several drone manufacturers, UGV manufacturers, weapon, and combat system manufacturers to expedite the procurement rate of simulation systems. As a result, the COVID-19 pandemic and its consequences have had a nominal impact on the Drone Simulator market in North America

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the North America drone simulator market. The North America drone simulator market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Drone Simulator Market Segmentation

North America Drone Simulator Market – By Component

- Hardware

- Software

North America Drone Simulator Market – By Simulator Type

- Fixed

- Portable

North America Drone Simulator Market – By Drone Type

- Fixed Wing

- Rotary Wing

North America Drone Simulator Market – By Technology

- Augmented Reality

- Virtual Reality

North America Drone Simulator Market, by Country

- US

- Canada

- Mexico

North America Drone Simulator Market - Companies Mentioned

- BLUEHALO

- CAE Inc.

- General Atomics

- HAVELSAN A.S.

- Israel Aerospace Industries Ltd.

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Quantum3D

- SIMLAT UAS SIMULATION

- SINGAPORE TECHNOLOGIES ELECTRONICS LIMITED

North America Drone Simulator Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 251.38 Million |

| Market Size by 2028 | US$ 535.17 Million |

| CAGR (2021 - 2028) | 11.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For