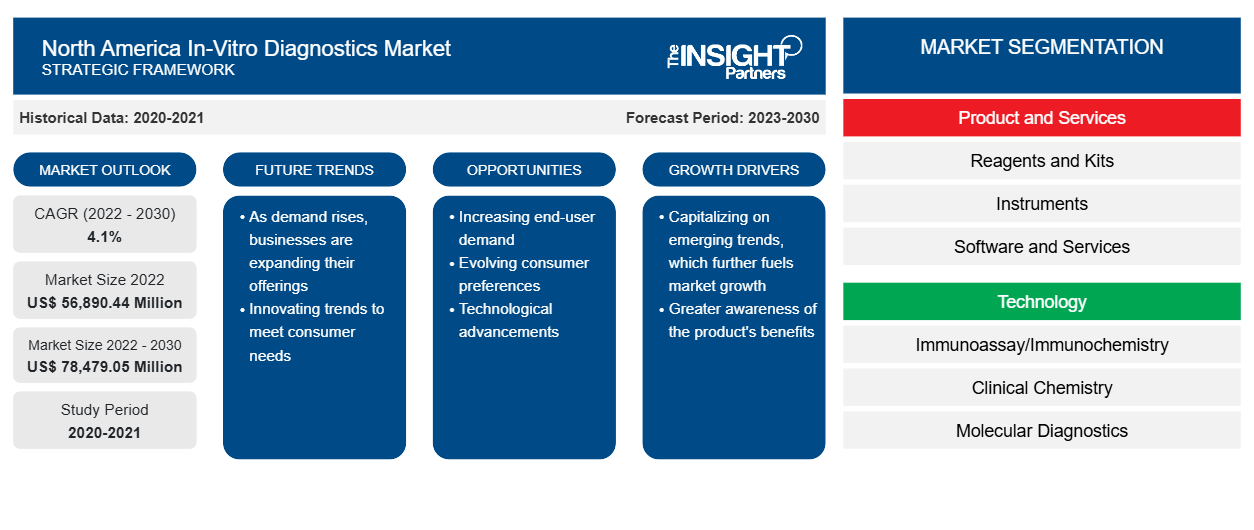

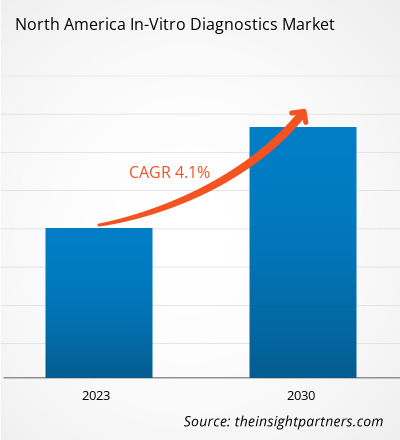

The North America in-vitro diagnostics market is expected to grow from US$ 56,890.44 million in 2022 to US$ 78,479.05 million by 2030; it is estimated to register a CAGR of 4.1% from 2022 to 2030.

Analyst Perspective:

In-vitro diagnostics (IVD) includes instruments, reagents, and software that are used to evaluate specimens such as blood, tissues, urine, stool, and other fluids obtained from the human body to diagnose infections, conditions, and diseases. Additionally, different IVD device types use various techniques, including tissue diagnostics, immunodiagnostics, hematological, and molecular diagnostics. Devices are used in specialized medical facilities since in-vitro diagnostics applications and management require technological competence and knowledge. Factors driving the North America in-vitro diagnostics market are the increasing prevalence of chronic diseases such as tuberculosis (TB), cancer, cardiovascular diseases, and diabetes and the rising incidence of infectious disorders such as gastrointestinal, respiratory, and STDs. Moreover, technological advancements by the players operating in this market will fuel the growth of the market. Combining in vitro diagnostics and artificial intelligence is the beginning of a new era of ‘Smart Diagnostics’. For instance, Hangzhou Zhiwei Information Technology Co. Ltd. has developed an AI bone marrow cell morphology analysis system, Morphogo. The Morphogo system can scan millions of cells in the bone marrow aspirate smears and detect metastatic carcinoma cells.

Market Overview:

In-vitro diagnostics can detect diseases or other conditions and can be used to monitor a person's overall health to help cure, treat, or prevent diseases. Devices can range from simple tests to sophisticated DNA technologies, including reagents, control materials, calibrators, kits, software, and related instruments. In-vitro diagnostics may also be used in precision medicine to identify patients who are likely to benefit from specific treatments or therapies.

The growth of the North America in-vitro diagnostics market is attributed to a few key driving factors such as increasing prevalence of chronic and infectious diseases and rising demand for in-vitro diagnostics during the COVID-19 pandemic. However, stringent regulatory policies and unclear reimbursement scenarios restrict the North America in-vitro diagnostics market growth. In addition, the integration of IVD technologies with digital health solutions is likely to provide opportunities for the market in the coming years.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America In-Vitro Diagnostics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America In-Vitro Diagnostics Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Increasing Prevalence of Chronic and Infectious Diseases Drives North America In-Vitro Diagnostics Market Growth

North America is witnessing exponential increase in prevalence of infectious diseases. These diseases are prominently caused due to pathogenic microorganisms, such as viruses, bacteria, and parasites. Certain factors, such as poor sanitary conditions, lack of public hygiene, massive air pollution, and lack of safe drinking water, are playing a significant role in the increasing prevalence of infectious diseases. For instance, according to the Public Health Agency of Canada, in 2020, a total of 6,736 cases of hepatitis C (acute, chronic, and unspecified combined) were reported.

Moreover, chronic diseases prominently include cancers, chronic respiratory diseases, diabetes, and heart disease. These conditions are accelerating due to biological risk factors, increase in alcoholism, unhealthy diet, physical inactivity, tobacco consumption, and obesity. Chronic conditions are the leading cause of mortality in North America. According to CDC, six in ten Americans live with at least one chronic disease, like heart disease and stroke, cancer, or diabetes. These and other chronic diseases are the leading causes of death and disability in America, and they are also a leading driver of health care costs which was ~ US$4.1 trillion, in 2021. Along with cardiovascular conditions, a higher prevalence of other conditions, such as diabetes, cancer, and obesity, is equally anticipated to boost the growth of the North America in-vitro diagnostics market during the forecast period. According to CDC, heart disease is the leading cause of death for men, women, and people of most racial and ethnic groups in the United States. Moreover, according to the same source, coronary artery disease (CAD) is the most common cause of mortality among adults in the United States, appro 375,476 people died in 2021. Additionally, The Centers for Disease Control and Prevention (CDC) has recently released the 2022 National Diabetes Statistics Report. This report estimated that more than 130 million adults were living with diabetes or prediabetes in the United States. According to a study by National Library of Medicine, in Mexico the prevalence of diabetes mellitus is continusly increasing. In addition, diabetes was the second highest cause of death in Mexico, in 2020 there were 148,437 diabetes-related deaths, and in 2021 there were 184,384 diabetes-related deaths. Certain factors, such as overweight conditions, genetic conditions, aging, and sedentary lifestyle, are further anticipated to boost the prevalence of diabetes in the region. Hence, rising incidence of infectious and chronic diseases, such as cardiovascular diseases, cancer, diabetes, and respiratory conditions, are projected to drive the North America in-vitro diagnostics market as in-vitro diagnostics (IVDs) are tests that can detect disease, conditions and infections.

Segmental Analysis:

The North America in-vitro diagnostics market is segmented on the basis of products and services, technology, application, and end user. Based on products and services, the market is segmented into kits, instruments, and software and services. In 2022, the reagents and kits segment accounted for the largest in-vitro diagnostics market share, and it is anticipated to register the highest CAGR during the forecast period. The increasing cases of viral and fungal infection with inadequate hygienic conditions are promoting the use of reagents. Thus, the players in the market are offering superior quality of molecular reagents and kits for better patient management and care, which is fueling the market growth for the segment.

Reagents and kits, in addition to other consumables, are frequently used in research processes. In-vitro diagnostics (IVDs) tests are performed on urine, blood, stool, and tissue samples to diagnose various conditions from mild infections to life-threatening diseases, such as cancer. Abbott; F. Hoffmann-La Roche Ltd; Bio-Rad Laboratories, Inc.; and other manufacturers offer kits and reagents. The governments implemented mass screening programs during the COVID-19 outbreak, which propelled the North America in-vitro diagnostics market growth. In 2020, Abbott Laboratories ramped up its production of COVID-19 test kits, including a new tool that could enable mass COVID-19 screening.

By technology, the North America in-vitro diagnostics market is segmented into immunoassay/immunochemistry, clinical chemistry, molecular diagnostics, microbiology, blood glucose self-monitoring, coagulation and hemostasis, hematology, urinalysis, and others. Based on application, the market is segmented into infectious disease, diabetes, oncology, cardiology, autoimmune disease, nephrology, and others. In terms of end user, the North America in-vitro diagnostics market is segmented into hospitals, laboratories, homecare, and others. This report offers insights and in-depth analysis of the market, emphasizing parameters such as market trends and market dynamics along with the competitive analysis of the leading market players.

Country Analysis:

The US held the largest share of the North America in-vitro diagnostics market. Chronic diseases such as cancer and cardiovascular diseases are the major causes of disability and death in the US. Per the National Center for Chronic Disease Prevention and Health Promotion, 6 in 10 people in the country have at least one chronic disease. According to the Centers for Disease Control and Prevention (CDC), in 2021, ~18.2 million adults aged 20 and above had coronary artery disease (CAD) in the US. Heart disease is the leading cause of death among people in the country. Additionally, the American Hospital Association estimates ~133 million people have at least one chronic disease, and that number is expected to reach 170 million by 2030. The high incidence of chronic diseases results in a huge demand for diagnostic procedures, which, in turn, drives the in-vitro diagnostics market in the US. Growing emphasis on preventive care coupled with enhanced access to healthcare facilities would further boost the market growth in the coming years.

Key Player Analysis:

The North America in-vitro diagnostics market majorly consists of players such as Abbott Laboratories, F. Hoffmann-La Roche Ltd, Danaher Corp, Siemens AG, Sysmex Corp, Thermo Fisher Scientific Inc, Becton Dickinson and Co, bioMerieux SA, Bio-Rad Laboratories Inc, and Qiagen NV. Among the players in the North America in-vitro diagnostics market, F. Hoffmann-La Roche Ltd and Abbott Laboratories are the top two players owing to the diversified product portfolio offered. F. Hoffmann-La Roche Ltd is a biotech company that provides in-vitro diagnostics and is a supplier of solutions for diseases area. The company specializes in medicines for oncology, virology, inflammation, metabolism, CNS, clinical chemistry, immunology, urinalysis, blood screening, genetics, infectious diseases, and microbiology. It also specializes in tissue-based cancer diagnostics, vitro diagnostics, and diabetes management. F. Hoffmann-La Roche Ltd provides its products and services to commercial laboratories, hospitals, researchers, healthcare professionals, and pharmacists. As of December 31, 2022, 29 billion tests were conducted with Roche Diagnostics products; 14.2 million patients were treated with Roche medicines; and had 20 manufacturing sites in pharmaceuticals and diagnostics worldwide. F. Hoffmann-La Roche Ltd conducts its business in two segments: diagnostics and pharmaceuticals. Diagnostics provides immunodiagnostics, cardiac tests, clinical chemistry, custom biotech, PCR tests, pathogen monitoring and detection, sexual health, donor screening, genomics, companion diagnostics, and tissue biopsies.

Recent Developments:

Inorganic strategies such as mergers and acquisitions, partnerships, collaborations, and joint ventures and organic strategies such as product launch, product approval, and expansion are highly adopted by companies in the North America in-vitro diagnostics market. A few recent key market developments are listed below:

- In April 2023, Thermo Fisher Scientific entered into a strategic partnership with ALPCO-GeneProof, a global leader in diagnostics, to broaden its CE-IVD molecular assay portfolio. The partnership combines the strengths of ALPCO-GeneProof’s expertise in molecular diagnostics with Thermo Fisher’s robust supply chain and support systems. The portfolio to be delivered by Thermo Fisher is comprised of 37 CE-IVD molecular diagnostic assays from ALPCO-GeneProof's portfolio, built on its innovative “one workflow” technology allowing for ease of use and compatibility with a wide range of qPCR instruments.

- In February 2023, Becton, Dickinson and Company received EUA from FDA for a new molecular diagnostic combination test for SARS-CoV-2, Influenza A + B, and Respiratory Syncytial Virus (RSV) to help combat illness in the current and future respiratory virus seasons. The test helps eliminate the need for multiple tests or doctor visits and assists clinicians in implementing the right treatment plan quickly.

- In January 2023, QIAGEN launched EZ2 Connect MDx for use in diagnostic laboratories, making the IVD platform for automated sample processing available for widescale use. The device carries the EU’s CE-IVD compliance marking for IVD for the European Union and other countries that accept this designation. It is also available in the US, Canada, and other countries.

North America In-Vitro Diagnostics Market Regional Insights

The regional trends and factors influencing the North America In-Vitro Diagnostics Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses North America In-Vitro Diagnostics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for North America In-Vitro Diagnostics Market

North America In-Vitro Diagnostics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 56,890.44 Million |

| Market Size by 2030 | US$ 78,479.05 Million |

| Global CAGR (2022 - 2030) | 4.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product and Services

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

North America In-Vitro Diagnostics Market Players Density: Understanding Its Impact on Business Dynamics

The North America In-Vitro Diagnostics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the North America In-Vitro Diagnostics Market are:

- Abbott Laboratories

- F. Hoffmann-La Roche Ltd

- Danaher Corp

- Siemens AG

- Sysmex Corp

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the North America In-Vitro Diagnostics Market top key players overview

Frequently Asked Questions

Which segment is dominating the North America in-vitro diagnostics market?

The North America in-vitro diagnostics market, based on technology, is segmented into immunoassay/immunochemistry, clinical chemistry, molecular diagnostics, microbiology, blood glucose self-monitoring, coagulation and hemostasis, hematology, urinalysis, and others. The immunoassay/immunochemistry segment held the largest market share in 2022. However, the molecular diagnostics segment is anticipated to register the highest CAGR during the forecast period.

What was the estimated North America in-vitro diagnostics market size in 2022?

The North America in-vitro diagnostics market was valued at US$ 56,890.44 million in 2022.

What are the growth estimates for the North America in-vitro diagnostics market till 2028?

The North America in-vitro diagnostics market is expected to be valued at US$ 78,479.05 million in 2028.

Who are the major players in the North America in-vitro diagnostics market?

The North America in-vitro diagnostics market majorly consists of the players such as Abbott Laboratories, F. Hoffmann-La Roche Ltd, Danaher Corp, Siemens AG, Sysmex Corp, Thermo Fisher Scientific Inc, Becton Dickinson and Co, bioMerieux SA, Bio-Rad Laboratories Inc, and Qiagen NV.

What is the in-vitro diagnostics market?

In-vitro diagnostics can detect diseases or other conditions and can be used to monitor a person's overall health to help cure, treat, or prevent diseases. Devices can range from simple tests to sophisticated DNA technology which include reagents, control materials, calibrators, kits, software, and related instruments. In-vitro diagnostics may also be used in precision medicine to identify patients who are likely to benefit from specific treatments or therapies.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

I wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA, MANAGING DIRECTOR, PineCrest Healthcare Ltd.The Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

Yukihiko Adachi CEO, Deep Blue, LLC.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Strategic Planning

- Investment Justification

- Identifying Emerging Markets

- Enhancing Marketing Strategies

- Boosting Operational Efficiency

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - North America In-Vitro Diagnostics Market

- Abbott Laboratories

- F. Hoffmann-La Roche Ltd

- Danaher Corp

- Siemens AG

- Sysmex Corp

- Thermo Fisher Scientific Inc

- Becton Dickinson and Co

- bioMerieux SA

- Bio-Rad Laboratories Inc

- Qiagen NV

Get Free Sample For

Get Free Sample For