North America Non-Emergency Medical Transportation Market Overview, Growth, Trends, Analysis, Research Report (2025-2031)

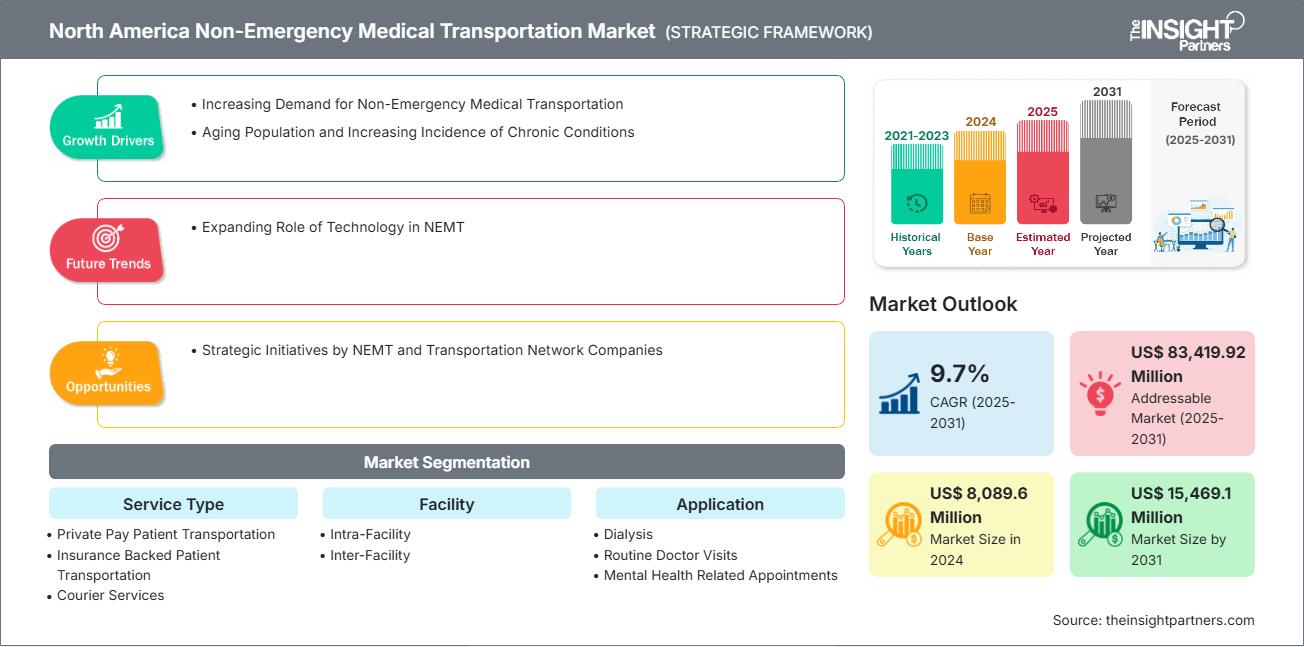

North America Non-Emergency Medical Transportation Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Service Type (Private Pay Patient Transportation, Insurance Backed Patient Transportation, Courier Services, and Others), Facility (Intra-Facility and Inter-Facility), Application (Dialysis, Routine Doctor Visits, Mental Health Related Appointments, Rehabilitation, and Others), and End User (Hospitals and Clinics, Nursing Homes, Homecare Settings, MCO and State Agencies, Healthcare Payers, and Others)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Nov 2025

- Report Code : TIPRE00041642

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 185

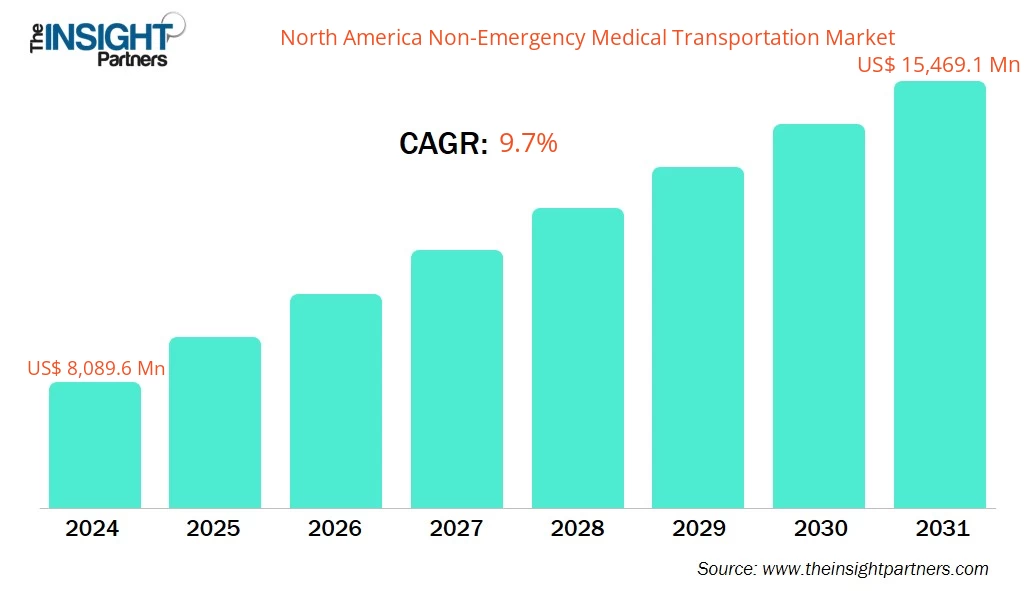

The North America Non-Emergency Medical Transportation Market size is expected to reach US$ 15,469.1 Million by 2031 from US$ 8,089.6 Million in 2024. The market is estimated to record a CAGR of 9.7% from 2025 to 2031.

Executive Summary and North America Non-Emergency Medical Transportation Market Analysis:

The North American non-emergency medical transportation (NEMT) market-covering the U.S., Canada, and Mexico-is witnessing steady expansion as healthcare demands rise alongside an aging population. The growing incidence of chronic illnesses, including diabetes and cardiovascular disorders, continues to drive the need for dependable transport to medical appointments and treatment facilities. The United States remains at the forefront of the non-emergency medical transportation (NEMT) market, driven by its advanced healthcare infrastructure and expanding insurance programs that include transport coverage. In comparison, Canada and Mexico are gradually strengthening their market presence through better healthcare accessibility and policy measures aimed at improving patient mobility. Moreover, the increasing incidence of obesity and disabilities continues to create a higher demand for dependable and medically equipped transportation services.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONNorth America Non-Emergency Medical Transportation Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Non-Emergency Medical Transportation Market Segmentation Analysis:

- By Service Type, the North America Non-Emergency Medical Transportation Market is segmented into Private Pay Patient Transportation, Insurance Backed Patient Transportation, Courier Services, and Others. Private Pay Patient Transportation held the largest share of the market in 2024.

- By Facility, the North America Non-Emergency Medical Transportation Market is segmented into Intra-Facility and Inter-Facility. Inter-Facility held a larger share of the market in 2024.

- By Application, the North America Non-Emergency Medical Transportation Market is segmented into Dialysis, Routine Doctor Visits, Mental Health Related Appointments, Rehabilitation, and Others. Mental Health Related Appointments held the largest share of the market in 2024.

- By End User, the North America Non-Emergency Medical Transportation Market is segmented into Hospitals and Clinics, Nursing Homes, Homecare Settings, MCO and State Agencies, Healthcare Payers, and Others. Hospitals and Clinics held the largest share of the market in 2024.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 8,089.6 Million |

| Market Size by 2031 | US$ 15,469.1 Million |

| CAGR (2025 - 2031) | 9.7% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Service Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

North America Non-Emergency Medical Transportation Market Players Density: Understanding Its Impact on Business Dynamics

The North America Non-Emergency Medical Transportation Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the North America Non-Emergency Medical Transportation Market top key players overview

North America Non-Emergency Medical Transportation Market Outlook

The growing need for Non-Emergency Medical Transportation (NEMT) is propelling market expansion uniquely. Aging populations and chronic illness sufferers increasingly rely on safe, timely rides to routine medical appointments. Many patients face mobility challenges or lack reliable transport, making NEMT essential for maintaining health. Additionally, healthcare systems are prioritizing non-emergency travel to reduce hospital readmissions and improve care continuity. This rising dependence on specialized transport services is driving innovation and investment within the NEMT market. According to the American Hospital Association, each year ~3.6 million individuals in the US do not obtain medical care, due to transportation issues (lack of vehicle access, long distances to healthcare facilities, inadequate public transportation infrastructure, and the cost of transportation). A study by UC Davis Health revealed that ~5.8 million Americans experience missed or delayed medical care each year due to transportation barriers. Transportation is a significant factor contributing to missed medical appointments. A 2019 survey by Kaiser Permanente found that one-third of Americans frequently or occasionally undergo stress due to transportation.

Since 1965, Medicaid has had a non-emergency medical transportation (NEMT) benefit, and people covered by Medicaid are provided with transportation services as an essential benefit. As per the Medicaid Enrollment and Unwinding Tracker, ~94 million individuals in total were enrolled in Medicaid till April 2023. The KFF Medicaid Budget Survey anticipated an 8.2% increase in healthcare membership in 2021 in the US, primarily driven by the COVID-19 crisis and elevated unemployment rate. As more people gain access to Medicaid, there is a direct increase in demand for NEMT services. The need and demand for NEMT services increase with the increase in healthcare enrollment and eligibility.

Most of the states in the US have transitioned to deliver NEMT through NEMT brokers or managed care organizations (MCOs). In many states, the brokers or MCOs receive a per capita payment to oversee the NEMT services, while other states, including Nevada, Arizona, and Vermont, deliver NEMT on a fee-for-service basis through local service providers. The Children's Health Insurance Program (CHIP) offers health coverage to eligible children via Medicaid and separate CHIP programs. CHIP is administered by states in accordance with federal requirements and jointly funded by state and federal governments. Therefore, with an increase in such initiatives by governments, the demand for NEMT is increasing, thereby driving market growth.

North America Non-Emergency Medical Transportation Market Country Insights

By country, the North America Non-Emergency Medical Transportation Market is segmented into the United States, Canada, and Mexico. The United States held the largest share in 2024.

The growth of the non-emergency medical transportation market is attributed to increasing prevalence of various diseases, expanding insurance coverage for non-emergency medical transportation (NEMT), and high state-wise rate of reimbursement for these services as administrative or medical expenses. In addition, a shift towards patient-centered care, heightened awareness of NEMT, and technological advancements are some of the factors supporting the growth of the market. Chronic illnesses, old age, disabilities, injuries and obesity are just a few of the many reasons Americans rely on non-emergency medical transportation services. The pandemic generated an enormous need for reliable car transportation to get to appointments, essential doctor visits, and daily treatments. In addition, the increase in the number of senior citizens is contributing to the growth of the non-emergency medical transportation market in the country. Additionally, Companies operating in the market are adopting organic and inorganic development strategies for market expansion. Below are a few instances of the same:

- Coastal Medical Transportation Systems (CMTS), a privately owned medical transportation company based in Massachusetts, acquired Transformative Healthcare's medical transportation division in September 2022. This division included LifeLine Ambulance Service and Fallon Ambulance Service. As a result of this acquisition, CMTS became one of the largest ambulance networks in the state, both in terms of the number of patients served and the geographic area covered.

- In September 2022, Baystate Wing Hospital partnered with Quaboag Connector to provide transportation services for healthcare in Massachusetts. This curb-to-curb service offers Non-Emergency Medical Transportation (NEMT), allowing patients to request rides to and from medical appointments at Baystate Wing Hospital facilities.

North America Non-Emergency Medical Transportation Market Company Profiles

Some of the key players operating in the market include AMR, ABC Non-Emergency Medical Transportation, LLC, MTM, Inc., Xpress Transportation, CJ Medical Transportation, VERIDA, Elite Medical Transport, Acadian Ambulance Service, Crothall Healthcare, ModivCare, Ride Health, Roundtrip, Transdev, One Call, Medical Answering Services, LLC, Abba Medical Transportation, LLC, Able Medical Transportation, Inc., Life Ride, Stellar Transport, and Mobility Transportation Services, Inc.

These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

North America Non-Emergency Medical Transportation Market Research Methodology

The following methodology has been followed for the collection and analysis of data presented in this report:

Secondary Research

The research process begins with comprehensive secondary research, utilizing internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

- Company websites, annual reports, financial statements, broker analyses, and investor presentations

- Industry trade journals and other relevant publications

- Government documents, statistical databases, and market reports

- News articles, press releases, and webcasts specific to companies operating in the market

Note:

All financial data included in the Company Profiles section has been standardized to US$. For companies reporting in other currencies, figures have been converted to US$ using the relevant exchange rates for the corresponding year.Primary Research

The Insight Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis and gain valuable insights. These research interviews are designed to:

- Validate and refine findings from secondary research

- Enhance the expertise and market understanding of the analysis team

- Gain insights into market size, trends, growth patterns, competitive dynamics, and future prospects

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

- Industry stakeholders: Vice Presidents, Business Development Managers, Market Intelligence Managers, and National Sales Managers

- External experts: Valuation specialists, research analysts, and key opinion leaders with industry-specific expertise

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For