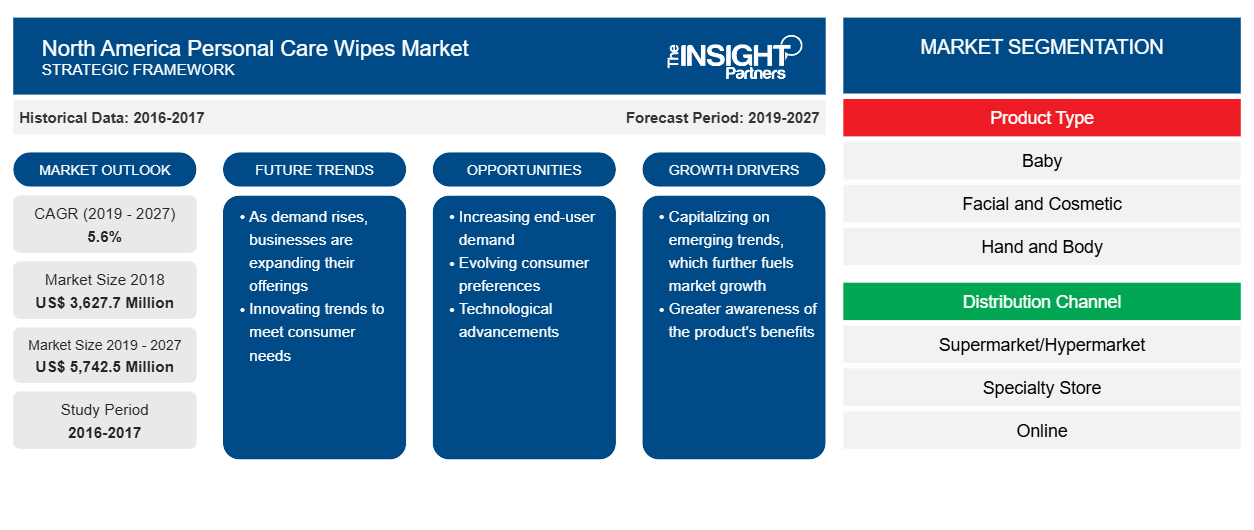

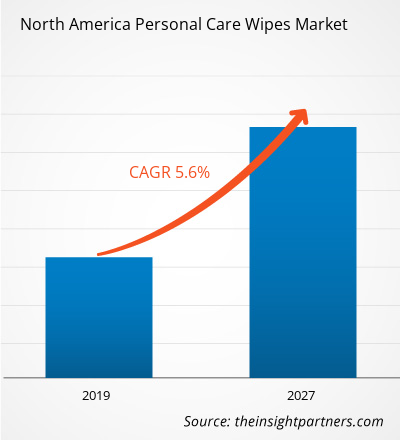

The North American personal care wipes market was valued at US$ 3,627.7 million in 2018 and is projected to reach US$ 5,742.5 million by 2027; it is expected to grow at a CAGR of 5.6% from 2019 to 2027.

Wipe is a small moist cloth that is used for cleaning surfaces. Various types of personal care wipes are commercially available such as baby personal care wipes, makeup removal personal care wipes, cooling personal care wipes, perfume personal care wipes, body personal care wipes, medical personal care wipes, general cleaning personal care wipes, intimate personal care wipes, nail polish removal personal care wipes, and antibacterial personal care wipes. These personal care wipes are subjected to light rubbing or friction to remove dirt or liquid from the surface. The key advantage of personal care wipes is convenience. Using personal care wipes is quicker and easier than the alternative of dispensing a liquid and using another cloth or paper towel to clean or remove dust.

The US contributed to the largest share in the North American personal care wipes market. The growth of the personal care wipes market in this region is primarily attributed to the rising demand for personal care wipes among various end-users. Additionally, the demand for personal care products such as baby personal care wipes, hand and body wipes, and facial care wipes is increasing in developed countries such as the US and Canada due to rising concern of health and hygiene among the consumers. Moreover, surging demand for natural, chemical-free, and biodegradable personal care wipes is further projected to propel the demand for personal care wipes in the region. The region also has the presence of major personal care wipes manufacturers, such as Procter & Gamble, Rockline Industries, Johnson & Johnson, and Edgewell Personal Care.

In December 2019, an outbreak of COVID-19 began in Wuhan (China), and since then it has spread across the globe at a fast pace. The US, Spain. Russia, India, China, Italy, France, and Germany, are amongst the worst affected countries in terms of positive cases, and reported deaths as of March 2020. According to the latest WHO figures updated on May 25, 2020, there are ~5 307 298 confirmed cases and 342 070 total deaths globally. The COVID-19 has affected economies and industries in various countries due to lockdowns, travel bans, and business shutdowns. Consumer good industry is one of the major industries facing serious disruptions such as supply chain breaks, technology events cancellations, and office shutdowns as a result of this outbreak.China is known as a global hub of manufacturing and the largest raw material supplier for various industries. The overall market breakdown due to COVID-19 is also affecting the growth of the personal care wipes market due to shutting down of factories, obstacle in supply chain, and downturn in world economy.

North American Personal Care Wipes Market

Market Insights

Growth of Personal Care Industry

High disposable income and rising purchasing power are the factors enabling consumers to spend more on personal care products. Also, the growth of personal industries in developed and developing regions propels the demand for personal care products such as skin care, sanitizing, and others. Moreover, rising concerns related to personal hygiene and increasing influence of social media and other promotional media have increased consumer awareness about health and hygiene products. This has significantly driven the demand for personal care products such as skin and personal care wipes. Personal care wipes are mainly used to maintain skin health and personal hygiene. Apart from maintaining personal and household hygiene, wet tissues and wipes exhibit antibacterial, exfoliating, and moisturizing properties. This has propelled the demand for wipes among health-conscious consumers. To capitalize on the surging demand, key wipe manufacturers are introducing personal care wipes for both male and female skin types. These factors boost the demand for personal care wipes in North American. The rapid growth of the personal care industry provides opportunities for wipe manufacturers to innovate their product offerings and packaging. This has further led to the introduction of innovative and upgraded products in the market and has helped leading producers to build brand appeal and loyalty among consumers. For instance, Johnson and Johnson's under the brand name Clean and Clear, offers multipurpose wet facial wipes for purposes such as makeup removal, cleansing, moisturization, and maintaining skin softness. This has led to an increase in the demand for multi-functional wet wipes, which would in turn drive the growth of the personal care wipes market during the forecast period.

Product Type Market Insights

Based on product type, the North American personal care wipes market has been segmented into baby, facial and cosmetic, hand and body, flushable, and others. In 2018, the baby personal care wipes segment dominated the personal care wipes market. An increasing rate of childbirth, rising population of working women, coupled with modernization in healthcare practices, are the key factors propelling the demand for baby personal care wipes in North American. The shift toward healthy lifestyle and rising focus on sanitation and well-being of babies has further driven the demand for antibacterial wipes for personal care applications.

North American Personal Care Wipes Market, by Product Type – 2018 and 2027

Distribution Channel Market Insights

Based on distribution channel, the North American personal care wipesmarketis segmented into supermarkets and hypermarkets, convenience stores, online, and other distribution channel.The supermarket and hypermarket segment held the largest share in the North American personal care wipes market in 2018. The presence of a strong network of supermarkets and hypermarkets in developed countries has propelled the sales of personal care wipes through personal care wipes over the past few years. Hypermarkets and supermarkets are self-help stores that provide a wide range of personal care wipes products such as baby personal care wipes, facial personal care wipes, disinfectant personal care wipes, and household personal care wipes. These products are placed in an organized way in different sections and shelves to attract customers. These types of stores offer an extensive choice of wipe products to consumers from different brands in one place at affordable prices compared to other distribution channels. This factor has led to increased sales of wipe products through supermarkets and hypermarkets.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America Personal Care Wipes Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Several strategic initiatives are commonly adopted by companies to expand their footprint worldwide. Diamond wipes International Inc., Body Wipes Company, Procter & Gamble, and among others are the market players implementing these strategies to enlarge the customer base and gain significant market share in North American, which in turn permits to maintain their brand name in the North American personal care wipes market.

North American Personal Care Wipes Market – By Product Type

- Baby

- Facial and Cosmetic

- Hand and Body

- Flushable

- Others

North American Personal Care Wipes Market – By Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Store

- Online

- Commercial and Industrial

- Others

Company Profiles

- Body Wipe Company

- Diamond Wipes International

- Edgewell Personal Care

- Johnson and Johnson

- Kimberly Clark Corporation

- La Fresh

- Nice-Pak Products, Inc.

- Procter & Gamble

- Rockline Industries

- Unicharm International

North America Personal Care Wipes Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 3,627.7 Million |

| Market Size by 2027 | US$ 5,742.5 Million |

| CAGR (2019 - 2027) | 5.6% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

North America Personal Care Wipes Market Players Density: Understanding Its Impact on Business Dynamics

The North America Personal Care Wipes Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the North America Personal Care Wipes Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For