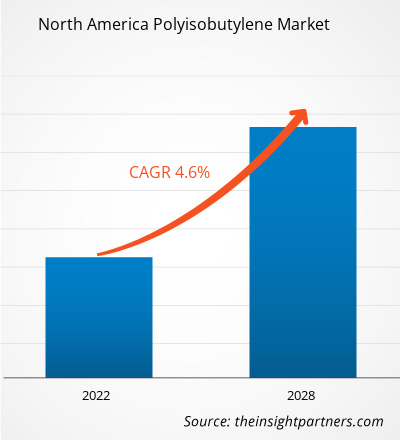

The North America polyisobutylene market is expected to reach US$ 1,290.0 million by 2028 from US$ 943.2 million in 2021. The market is estimated to grow at a CAGR of 4.6% from 2021 to 2028.

The automotive industry has been the key market for several types of fuel additives for many years. The share for automobiles has continuously been higher than that of the other fuel additives market segment due to the lack of efficient fossil fuel alternatives and an increasing middle-class economy. The relative importance of aviation for fuel additives has boosted in recent years, ultimately mounting the demand for polyisobutylene. Moreover, increasing use of polyisobutylene-based butyl rubber in developing automobile parts including gaskets, hosepipes, and window strips due to superior thermal stability, flexibility, and improved oxidation resistance is expected to fuel the demand in automotive sector over the forecast period.

The U.S has the highest number of confirmed cases of coronavirus, as, compared to Canada and Mexico. This is likely to impact the chemical and materials industry in the region as, due to the COVID-19 outbreak, the supply chain is likely to get affected. In addition, the overall manufacturing processes, research, and development activities will also impact market growth.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the polyisobutylene market. The North America polyisobutylene market is expected to grow at a good CAGR during the forecast period.

North America Polyisobutylene Market Revenue and Forecast to 2028 (US$ Million)

North America Polyisobutylene Market Segmentation

By Molecular Weight

- Low

- Medium

- High

By Product

- Conventional PIB

- Highly Reactive PIB

By Application

- Tires

- Industrial Lubes and Lube Additives

- Fuel Additives

- Adhesives and Sealants

- Other Application

By End User

- Industrial

- Food

- Others

By Country

- North America

- US

- Canada

- Mexico

Companies Mentioned

- BASF SE

- Braskem S.A.

- Daelim Industrial Petrochemical Division

- Ineos AG

- Infineum International Limited

- The Lubrizol Corporation

- TPC Group

North America Polyisobutylene Report Scope

Report Attribute

Details

Market size in 2021

US$ 943.2 Million

Market Size by 2028

US$ 1,290.0 Million

Global CAGR (2021 - 2028)

4.6%

Historical Data

2019-2020

Forecast period

2022-2028

Segments Covered

By Molecular Weight - Low

- Medium

- High

By Product - Conventional PIB

- Highly Reactive PIB

By Application - Tires

- Industrial Lubes and Lube Additives

- Fuel Additives

- Adhesives and Sealants

By End User Industry - Industrial

- Food

Regions and Countries Covered

North America - US

- Canada

- Mexico

Market leaders and key company profiles

BASF SE

Braskem S.A.

Daelim Industrial Petrochemical Division

Ineos AG

Infineum International Limited

The Lubrizol Corporation

TPC Group

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 943.2 Million |

| Market Size by 2028 | US$ 1,290.0 Million |

| Global CAGR (2021 - 2028) | 4.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Molecular Weight

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Molecular Weight, Product, Application, and End Use

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

- BASF SE

- Braskem S.A.

- Daelim Industrial Petrochemical Division

- Ineos AG

- Infineum International Limited

- The Lubrizol Corporation

- TPC Group

Get Free Sample For

Get Free Sample For